How are the various emerging market economies handling Covid-19?

Throughout Covid-19, much of the attention from a humanitarian and economic perspective has been on advanced economies. Emerging markets are only mentioned in passing when, for example, Brazil and India climb the rankings of countries with the highest number of infections.

But emerging markets aren’t homogenous and responses to the pandemic have varied significantly. In this Collections piece, we ask emerging markets managers Rasmus Nemmoe, FSSA Investment Managers; John Malloy, Jr, RWC Partners; and Alex Duffy, Fidelity Investments to explain the state of play in developing economies.

North versus South

Rasmus Nemmoe, FSSA Investment Managers

Similar to the rest of the world, the impact has clearly been negative with some variation from country to country. Generally speaking, Asia and more specifically North Asia (China, Taiwan and South Korea) have done relatively better if measured by mortality rates and overall economic impact. On the other hand, Latin America has done relatively worse and has suffered from high mortality rates and significant impairments to overall economic activity.

While some of this is down to differences in resources and the ability to implement rigid testing regimes (Taiwan and South Korea for instance are already wealthy countries and really not emerging any longer), the reality is also that Brazil and Mexico (which are some of the hardest-hit countries) have made some clear errors in their response to the virus which have amplified the blow.

Stringent lockdown policies allow for gradual reopening

John Malloy, Jr, RWC Partners

From our analysis of Covid-19 and its effects on emerging markets, the differing responses from governments and authorities around the world suggest that comparison is a difficult task due to varying levels of stimulus, testing and technology among others. Partially due to prior experience and superior levels of technology, North Asian markets have dealt with the pandemic well. China, Vietnam, South Korea and Taiwan managed to put in place stringent lockdown policies within the first few weeks of their own Covid-19 outbreaks, before gradually opening up as cases and deaths started to flatline. Any further outbreaks have been dealt with aggressively which has kept cases and deaths contained thus far.

Macroeconomic data is encouraging with industrial production, exports and Purchasing Managers’ Index (PMI) all trending higher.

Other Asian markets such as India implemented stringent lockdown policies, causing extreme economic weakness in Q2 2020. While cases continue to rise, they are clearly flatlining and the government has pledged significant support to combat the effects of the pandemic. Additionally, President Modi has seen his ‘Make in India’ world tour pay off with Google, Amazon, Facebook and countless private equity firms investing billions dollars into the country this year.

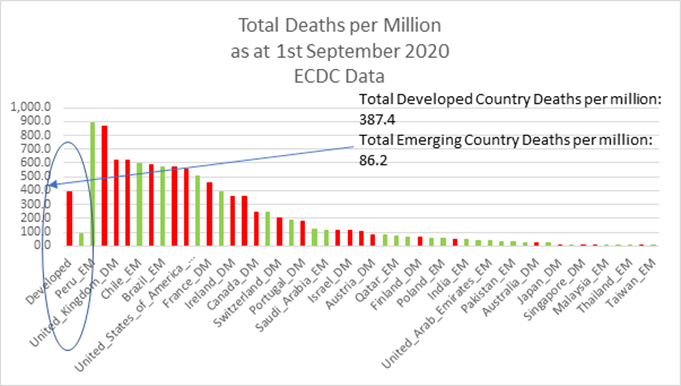

Chart 1: Developed Markets Deaths per Million Greater than Emerging Markets

Source: RWC Partners

Although President Bolsonaro has been subject to media attacks, cases and deaths in Brazil have started to flatline. Furthermore, Brazil’s Central Bank has cut the SELIC rate to the lowest in the country’s history (2.25%). Economic indicators such as industrial production and retail sales have re-bounded partially due to the government’s support mechanisms. Although Russia has been hit hard by the effects of Covid-19, accommodative monetary policy has also given significant support to the economy. Energy markets continue to trend towards normalisation which has resulted in a recovery in Brent Crude oil to US$40 per barrel. The country has significant foreign exchange reserves to help counter any further deterioration in its fiscal revenue.

What is abundantly clear from the chart is that deaths per million in emerging markets are far fewer than in developed markets. This is due, in part, to the demographic dividend of emerging markets with younger populations. On average, around 10% of the total population is above the age 65 in emerging markets compared to 20% for developed markets.

Regional dislocation but expect rebound in 2021

Alex Duffy, Fidelity International

It is undeniable that the coronavirus pandemic will have a long-lasting impact on economies and companies worldwide. And while markets face further headwinds, emerging market growth is expected to suffer less in 2020 and we believe will experience a better rebound in 2021 than the developed world. Emerging market countries were broadly in a relatively strong position entering the coronavirus pandemic and their respective fiscal, monetary and financial responses show signs of progress. Higher foreign currency reserves and floating exchange rates will also provide buffers.

However, not all emerging markets will emerge on an equal footing from the crisis and there are already signs of regional dislocation.

North Asia, led by China, has staged a sharp rebound vis-à-vis South Asia whilst in Latin America many countries are still behind the curve in controlling the outbreak and government capacity is limited to compensate for the economic impact.

Against this backdrop, selectivity remains paramount and we continue to focus on identifying high quality names that are well equipped, with strong balance sheet and corporate governance structures, to navigate these market conditions. Diversification is also a key consideration in the portfolio construction and process, and we believe our investment approach can limit the risk of the portfolio being impacted by a single event.

Conclusion

Emerging-market stocks and currencies have virtually erased their losses as a result of Covid-19 in 2020 although the virus is still a significant challenge in many countries. While data from Asia, the region first affected by the Covid-19 pandemic, suggests steady improvement is taking place, the severity of the virus in Latin America means recovery will take far longer.

4 topics

2 contributors mentioned