How insider ownership can thrash the market

Investsmart

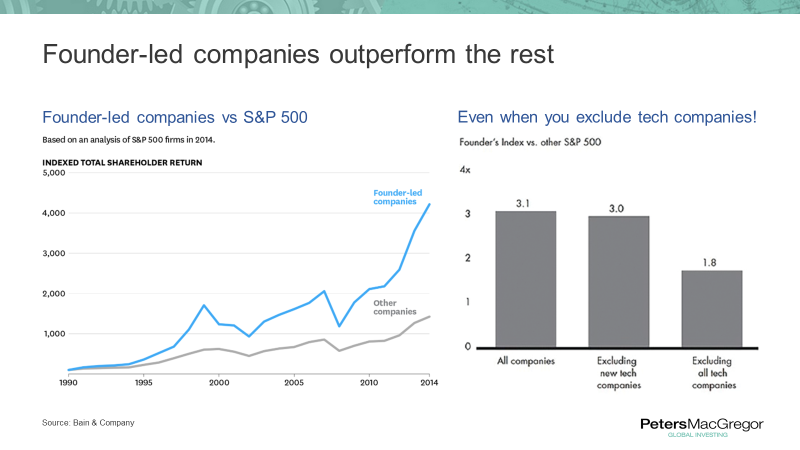

Research shows that founder-led companies outperform. While that might not be surprising given the recent share price performance of US tech titans such as Amazon, Alphabet, Netflix and Facebook, which are led by their founders, research shows that this phenomenon isn’t limited to the technology sector (see charts below).

No guarantees

Investing in businesses with large inside ownership is no guarantee of high returns, but the successful operators have common traits.

First, they think long term. After investigating stocks in the S&P500, Ronald Anderson and David Reeb discovered that founding shareholders are more likely to invest in long-term projects and think harder about succession planning.

This contrasts with typical corporate behaviour, or the ‘institutional imperative’ as Warren Buffett calls it, where executives favour high immediate earnings and share buybacks over long term investments to maximise bonuses at the expense of the long-term health of the business.

Inside-owners are often more entrepreneurial and aren’t afraid to do something different if it makes financial sense. They’re also smart about acquisitions. They don’t bet the company and are typically buying valuable assets in downturns while their contemporaries are busy fortifying their balance sheets.

According to research by von Lilienfeld-Toal and Ruenz, ‘The acquisition activity of firms with high ownership is significantly lower than that of low ownership firms… Overall, these findings suggest that high ownership firms engage less in empire building’. A study by Bain & company a couple of years examined the performance of founder led companies v S&P 500 index and the results were compelling (see charts above).

Though owner-managers are more interested in increasing profits than owning marquee businesses for bragging rights, they aren’t usually driven by greed. Charles Schwab, who founded stock brokerage company Charles Schwab Corporation, explains why this unique group often keeps working decades after they became wealthy.

‘The man who does not work for the love of work, but only for money, is likely to neither make money nor find much fun in life.’

In short, they work because they enjoy it. Let’s now examine two owner-managers that feature in our portfolio and one great Australian success story.

Tony Brown

Tony Brown is the founder of four-wheel drive accessories business ARB Corporation. Brown grew so tired of parts and accessories on his four-wheel drive breaking under duress that he decided to manufacture his own, including bull bars, old man emu shockers and air lockers, among many others.

If you’d bought shares at one dollar in 1999, not only would your investment have multiplied by 22 times since then, but you would’ve collected almost $7 in dividends. ARB has regularly paid special dividends as well, showing that the company has not only dominated its niche but is also shareholder friendly.

You’ll often discover rare traits shared among owner-led businesses. One example is having net cash on the balance sheet. As Brown is interested in managing ARB for the long term, and because there is no risk of ARB being taken over due to the high family insider ownership, Brown takes no risk with the company’s finances. That means the company is never under financial stress, even during a recession, and it makes the company’s ungeared historical return on equity of over 20% even more impressive.

Even if you had of paid the highest price for ARB prior to the GFC, you still would’ve earned an annualised return of well over 20%. It proves that even in expensive markets like today’s, you can still find value in good businesses if you’re prepared to own them over long periods.

John Malone

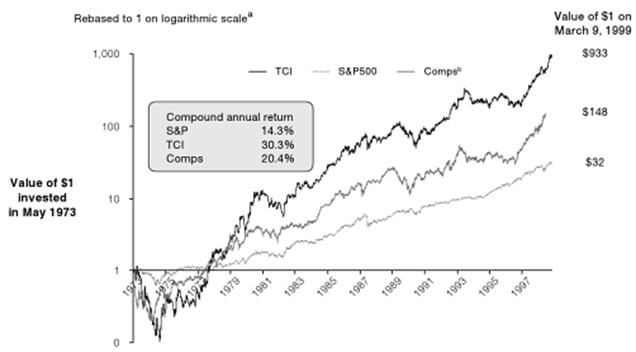

John Malone is the doyen of the US cable TV industry and the lead protagonist in the book Cable Cowboy. He produced 30% annualised returns as CEO of TCI between 1973 and 1999 (twice that of the S&P500 – see Figure 2 below) before selling the company at the height of the tech boom to AT&T.

Figure 2. TCI returned 30% p.a. between 1973-1999

Source: Center for Research in Security Prices (CRSP) and TCI annual reports

From the ashes of the tech wreck that followed, Malone emerged with a large stake in Liberty Media, which spawned numerous companies with interests in cable TV content and distribution, satellite radio and broadband internet, just to name a few.

We own several Liberty names with businesses diversified by industry and geography. They don’t typically screen well due to a host of factors. Management focuses on maximising free cashflow to buy back shares rather than reporting high current profits that attract high taxes, for example, which depresses return on equity even though the company produces high cash returns on investment.

As complications like this keep most investors away despite management’s remarkable track record, we’ve no problem taking advantage of the discounts overlooked by others.

Paul Saville

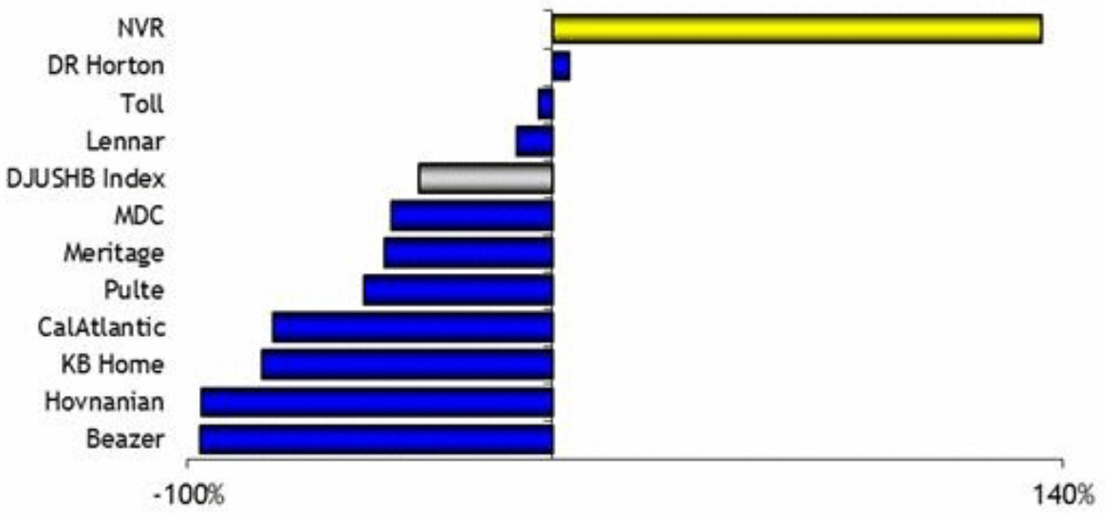

Paul Saville watched the original incarnation of homebuilder NVR go broke before becoming CEO in 2005. Unlike virtually every other listed homebuilder on the planet, he learned from the experience and constructed a way to protect NVR from recessions.

Instead of dangerously leveraging the balance sheet to accumulate land for development, NVR lays down 10% of the purchase price for an option on future development. This means the balance sheet isn’t highly geared, allowing the company to buy back 75% of its shares on issue over the past 20 years. That’s a remarkable feat for any company, yet alone a home builder.

In 2009 NVR was the only listed US homebuilder to make a profit and post respectable shareholder returns through the GFC (see Figure 3). With US housing stock now reaching record lows, interest rates still low and the millennial population – the country’s largest ever – reaching a median age that suggests they’ll soon start having families of their own, the company is well placed to benefit from an increase in homebuilding. If housing doesn’t pick up, we expect the company to buy back plenty more shares.

Figure 3. NVR 10-year total shareholder return vs competitors as at 31 December 2015

Source: NVR annual reports

In an environment where revenue growth is harder to come by, we believe entrepreneurial managers are worth their weight in gold, as they adapt to keep their businesses growing. Our job is to keep partnering with these talented individuals so that your savings continue to grow alongside theirs.

Futher insights

For more information on how our approach to Global Investing finds value in world-class businesses not typically held in the broad indexes, which currently offer more risk than return, visit our website

Disclosure: Peters MacGregor Capital Management Limited holds a financial interest in JD.com and NVR through various mandates where it acts as investment manager.

3 topics

1 stock mentioned

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder

Expertise

Nathan has over 20 years' investment experience. Before joining Peters MacGregor, he worked for 9 years at Intelligent Investor, including 4 years as a Portfolio Manager. Nathan is a CFA charterholder