How to buy "big tech" without breaking the bank

Global X ETFs

Technology stocks, especially the world’s biggest, are too expensive for Australian investors, so you’re better off sticking to ASX-listed firms, right? Not necessarily, when you consider that just nine stocks comprise more than half the total market cap weight of the top 100 stocks on the NASDAQ.

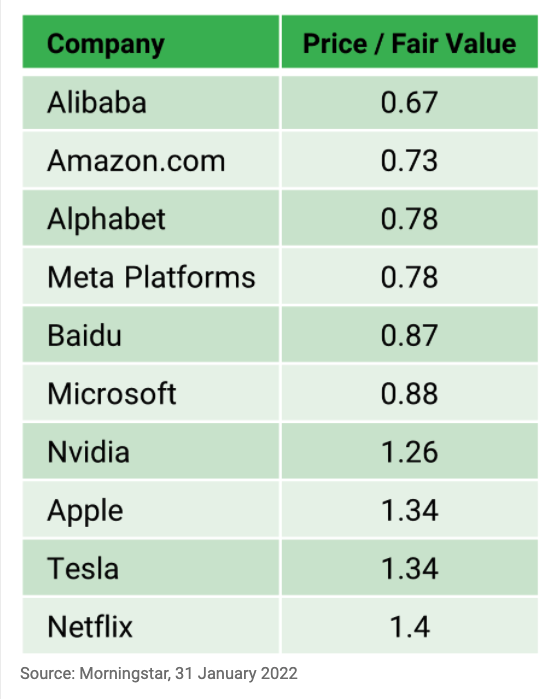

Though a few of them have taken a bath in recent months – we’ve all heard about the recent share price falls of Netflix, Alphabet and others of the FANG+ cohort – the broadly held view remains positive. And contrary to the common view that they’re pricey, Morningstar research suggests most of these stocks are currently undervalued.

We’re not shy about the fact there is going to be short- to medium-term volatility in many of these companies because we’re seeing a lot of noise around inflation, interest rates and how the Fed will respond. But in the long term, these companies have very strong earnings

Apple is one example, its earnings growth of around 12% pales slightly alongside other high-growth tech names that are delivering 20% or more.

But think of the base on which it’s getting that 12% It’s massive and these are still very strong companies. You’ve always got to consider the context.

And in the longer term, it may make more sense to consider the likes of Apple and Microsoft as Value rather than Growth stocks.

Microsoft made its way into the index of ETF Securities Australia FANG+ (ASX: FANG) after a recent rebalance. This is because of its growing dominance in cloud computing, despite being traditionally known as a software company.

The numbers paint an appealing picture. The price-to-earnings ratio – a metric commonly referred to (rightly or wrongly) as a gauge of a stock’s relative cost – of the NASDAQ 100 Index is 26.4. The collective PE multiple for the above 10 stocks is only slightly higher at 27.9.

Which is the cheapest? Alibaba presents the best value. Trading at US$126 a share as of the NYSE’s close on Tuesday 15 February, the wide moat company (a Morningstar measure of competitive advantage) is currently trading around 35% below what the research house thinks it’s worth.

There’s been plenty of optimism around local success stories such as Atlassian, Afterpay, Canva and others that have become (almost) household names. But the volume of Australian startups has been in decline since 2017, according to data from PitchBook.

Registrations under Australia’s Early Stage Venture Capital program peaked in 2017, with no registrations last year. Along similar lines, a Startup Muster survey published in 2018 showed a 12% year-on-year drop, as reported by the Australian Financial Review.

How to get global tech exposure

So, getting access to companies that have chosen to IPO on exchanges further afield than the ASX probably makes even more sense now. But how?

Australians are notoriously home-biased share market investors but ETFs may provide a more efficient way to buy global stocks. Obviously, a global mindset provides access to a far broader range of companies, especially in the technology space.

There are many reasons why many technology start-ups don’t restrict themselves to Australia, which it’s only a very small part of the global market.

“The US has always been the place to go when you’re considering tech innovation or disruption and historically, it’s been very hard for Australian startup tech companies to list on the ASX and they’re potentially missing out on a lot of opportunities they’d get overseas.”

Is FANG+ too concentrated?

I acknowledge the traditional view that ETFs are broadly diversified vehicles. But I also emphasise that index investing is no longer about just buying “the market” but also zooming in on sectors, themes and strategies.

You could take a single stock approach and choose which company to own and how much weight. Or you could invest in an active manager. But these are big risks because, as we’ve seen, many active managers have failed to outperform.

Would you like to invest in the FANG ETF?

ETFS FANG+ ETF (ASX Code: FANG) offers investors exposure to highly traded next-generation technology and tech-enabled companies. FANG provides concentrated exposure to global innovation leaders. Find out how to invest here.