How to invest for a consistent retirement income

Reece Birtles, Chief Investment Officer for Martin Currie Australia, believes investors selecting for retirement income need to follow a very specific approach covering valuation of long-term cashflows, along with careful diversification through concentration limits. He argues that investors should promote quality in their search rather than simply looking for the highest dividend payers.

“It's reasonably well known that the highest dividend paying stocks in the market, the highest dividend yield stocks, are more likely to have their dividend cut over time. We find the best way to avoid those companies that have their dividend cut is to avoid low quality companies.”

In this edition of Fund in Focus, we look at the unique challenges of investing in retirement and taking a different approach to identifying income stocks to ensure a stable, consistent income for life.

Edited transcript

Hello, my name's Reece Birtles. I'm Chief Investment Officer for Martin Currie Australia, and I'm here today to talk to you about the Martin Currie Equity Income Fund.

We designed the Martin Currie Equity Income Fund for Australian retirees. Going back into the 2000s, my parents, as well as some other investment team members' parents hit retirement. And what we saw was that for them, the retirement problem is very different than what typical active products provide to them at that time.

For the retiree, they tend to be looking for a high growing and stable income stream to cover their cost of living. Whereas most products have been designed for accumulation, which is to maximise your wealth by the time you're 65 given your risk profile.

When we came to design this product for equity income, we wanted to take some unique characteristics into account.

- We wanted a high level of income that was above the typical draw down rate that a retiree would have, in order for them to focus on the more stable income and focus less on the more uncertain capital return;

- We wanted to take into account their unique situation of franking credits and the tax refund available for low tax payers; and

- We wanted the income stream to grow over time better than inflation, which really required us to look at the concentration risk, the sustainability of dividends and the franking credit availabilities of each individual stocks when we are building the portfolio.

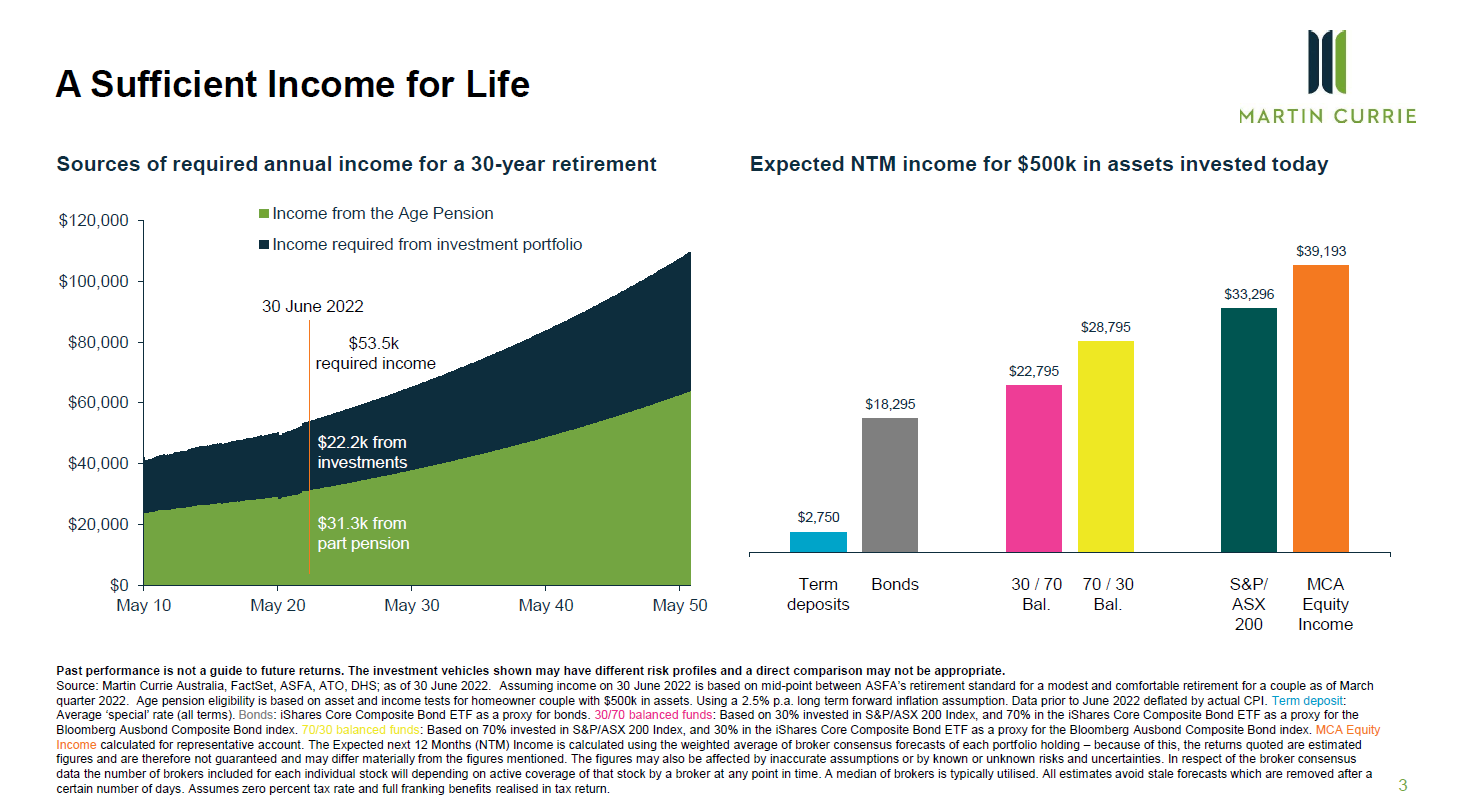

Looking at the problem of what we call the sufficient income for life

When a retiree reaches retirement, they still have a good 20 years left and they need their portfolio to generate a level of income to match their cost of living.

Based on ASFA data, a typical retiree looks for about $53,000 of income per annum, and they might get about $30,000 from their government pension. So, what that means is that your investment portfolio needs to generate around $22,000 per year of income from a typical balance of $500,000.

When we look at the products available in the Australian market, based on current interest rate structures from term deposits, fixed income, the typical balanced fund income requirements, it's quite clear that it's very hard to achieve that level of income to match the retiree's needs. We can build an equity income product that benefits from high dividend paying companies in Australia, as well as franking credits, which provide one of the few free lunches for retirees with the tax credit for a 0% taxpayer, in order to produce a high income stream that is really suited to provide that sufficient income for life.

When we look at this high, and stable, and growing income stream that is required for retirees, what we want to do is ensure that it's stable over time. And to do that, we've built our own portfolio construction approach, where we look at the maximum concentration of individual stocks.

We look at the quality of the companies, and the diversification in order to provide a more reliable and high income stream than alternative products. What we're trying to do is not just produce a percentage yield as typical high dividend products do. When we look at high dividend index style products, they tend to have very high concentration risk, they can have very high turnover, and they can chase companies that are paying excessive dividends at the current point in time. This causes them to turn capital into income, and that can impair the long term income stream that a product generates.

Our approach is relatively low turnover, really focused on growing income streams in order to provide that stable and growing income that matches the retiree's needs and is well in excess of alternative propositions.

Four key aspects to identifying stocks for retirement income

Martin Currie Australia has a well proven investment approach. Our 18 member investment team focuses on four key aspects when looking at each individual stock.

Secondly, the quality of the business, which is the business strengths or the moat that a company has as well as its management capability, stewardship and governance practises. The direction of earnings, whether they're improving or deteriorating.

Quality is really important to us for an equity income strategy

So we screen out companies on a five quality rating based on our internal analysis, where one quality companies are the best. We're very selective in where we might own four quality names. And this really allows us to void those dividend trap stocks.

Whilst we may not own the very highest yield stocks in the market, it ensures we're getting the companies that have the ability to grow over time.

They're less likely to do a rights issue that is dilutive. They're less likely to have business threats from new entrants, or competition or commoditization. And they also tend to have better governance characteristics and sustainability characteristics such as carbon profile compared to the rest of the market.

Portfolio construction makes a difference

Then we also think import portfolio construction is really important to equity income.

When we look at the makeup of the Australian market, we can see that about 7 stocks dominate the total dividend yield of the ASX 200. We think the high concentration that the index has, in particular names like BHP (ASX: BHP) and the large banks, just create excessive risk if something negative was to happen to one of those stocks. For example, commodity prices falling in the case of BHP or Rio Tinto (ASX: RIO), or if there was a credit cycle for the banks. We don't want that excessive concentration.

Instead, our approach is to have a maximum of 5% allocation in a starting position, and a maximum of 6% overall to anyone's stock. And we diversify our positions across about 45 stocks in the portfolio. So what it means is that the sources of the income return, the expected yield of the fund is in excess of 7%. That diversity is very high and reduces the risk that we have dividend cuts from any one stock.

Secondly, we also limit our concentration to any economic sector to a maximum of 22%. This is to avoid that concentration, for example, to banks or to miners.

The other key feature in looking at sector allocation is our very strong exposure to inflation protection in this type of product. The dividend stream has grown strongly since the COVID recovery and in this more inflationary environment.

We have high allocations to sectors like real assets that have great pricing power for inflation, as well as high quality companies like the supermarkets and strong businesses like Medibank (ASX: MPL).

These have a very good ability to raise prices in an inflationary environment. In addition, we hold some of the financial names that benefit from higher interest rates and strong pricing power.

Turning to the portfolio top 10 stocks

When we turn to the top 10 stocks in the portfolio, what we can see is that there is a significant diversification of those names.

No holding is more than 4.7% currently.

You can also see that each of the top 10 holdings has an attractive franked dividend yield on a forward-looking basis. You'll see that the names in the portfolio are reasonably well-known Australian companies with very strong market positions. And this reflects our focus on quality and safety of their dividend-paying power.

So for example, Medibank has a dominant market position within the Australian private health insurance industry, with very strong competitive advantages in terms of its cost of doing business compared to competitors and strong customer proposition.

You can also see names like Aurizon (ASX: AZJ) in the real asset space that benefits from rising interest rates in terms of the returns they're allowed to earn on their regulated asset base, that will drive higher revenue and dividends in a higher inflationary period. As well as quality companies, such as Coles (ASX: COL) that can pass on cost increases to consumers, given its very strong market position and low cost of doing business.

As an investor in this portfolio, you are going to receive more of your return in terms of annual income that can be used to cover the cost of living. And that income is more stable than capital returns. Clearly share market volatility is relatively high, with variance in share prices around 15 to 20% per annum. Whereas the variability in the income stream tends to be less than 10% per annum.

This makes the portfolio well suited to retirees who have a higher draw down rate, but at the same time, still want exposure to gross assets where that income can grow over time.

Who we are

Martin Currie Australia is a specialist investment manager of Franklin Templeton.

We benefit from the significant resources of Franklin Templeton globally. And we have a very strong track record in Australian equities across our full range of active products, including value, income, real assets and a sustainability product. We've invested in the Australian market for over 40 years, and we have a highly experienced team with a very strong tenure, where the majority of our efforts are focused on stock fundamental analysis in order to pick the right companies for our investee's portfolios.

The Martin Currie Australia Equity Income Fund

In conclusion, looking at the Martin Currie Australia Equity Income Fund, we believe it is one of the very few true retirement income strategies for Australian retirees.

It has that income-focused return profile. It is clearly aligned with our investment philosophy of a sufficient income for life. Clearly, our approach is quite differentiated in the sense that it is benchmark unaware. So it looks very different from other products that haven't been designed for this specific purpose. And we have a very strong approach to environmental, social and governance practices with strong engagement with companies and incorporation of ESG issues in our decision-making framework.

Learn more

The Martin Currie Equity Income Fund is designed for investors looking for a high, stable and growing income stream, with lower volatility than the broader equity market. For further information, please visit our website or our fund profile below.

3 topics

5 stocks mentioned

1 fund mentioned

2 contributors mentioned