How to profit from tax

Companies in the IPO phase are often mispriced at issue. They are rarely independently researched, there is often little knowledge of the business, finances and management, and there is certainly no efficient pricing history. These factors all contribute to market inefficiencies which can be a real source of opportunity (and, of course, risk).

I like to think of an attractive IPO like a cool new laneway bar that has just opened, but that nobody yet knows about and that is offering a nightly 2-for-1 happy hour to drum up new business. You get to enjoy it before everybody hears about it, and before there is a line out the front, a $10 cover charge, and all the drink prices have gone up by 25%!

Plenty of reasons to like Kelly Partners

Like the cool new bar, the wider market is likewise yet to catch on to accounting practice business, Kelly Partners Group (KPG). This stock came to our attention during its IPO roadshow back in May 2017. There were plenty of reasons for us to be attracted to the story.

It was a small raise, just $7.3m and a modest market capitalisation of less than $50m. Importantly the company’s founder and MD, Brett Kelly, kept his shareholding, comprising over 50% of the company’s shares.

This type of issue size is typically overlooked by the broader investment market leading to possible mispricing. KPG had consolidated 16 accounting practices into an established and profitable corporate with growing brand recognition, particularly in NSW. With an established back office and proven business model, KPG had, and continues to have, the opportunity to bring more practices, both established and greenfields, under its banner.

While one might feel the urge to flee when the words ‘accounting practice’ are mentioned, please stick with me here... With the current state of markets, I think it’s fair to say that everyone is looking for a defensive sector. Well, what could be better in these turbulent times than investing in one of the two certainties in life, TAX!

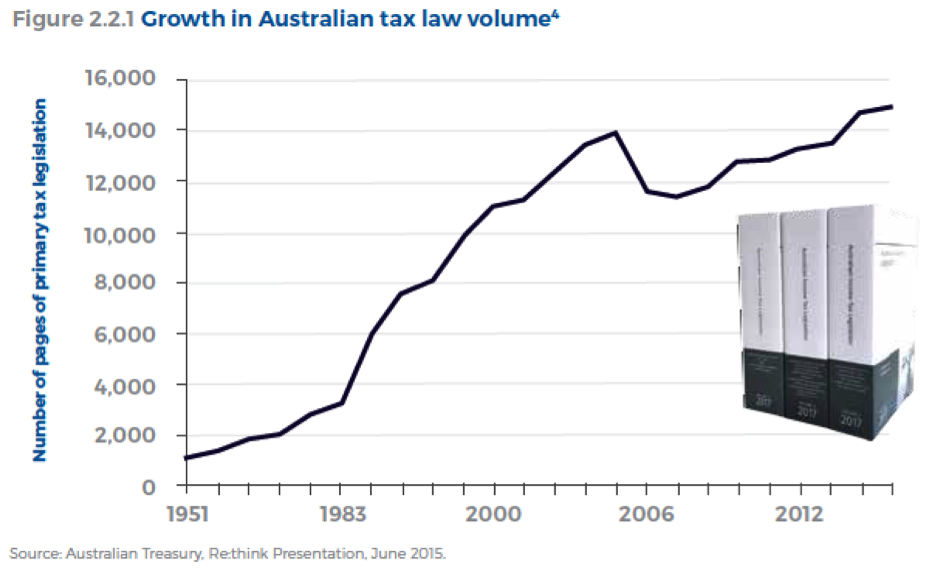

The reality is that the Australian Tax Act is not getting any simpler, citizens will always look to reduce their tax bill as much as possible, and governments will continue to capture as much tax as they can. In the foreseeable future, this is simply not likely to be an industry in decline.

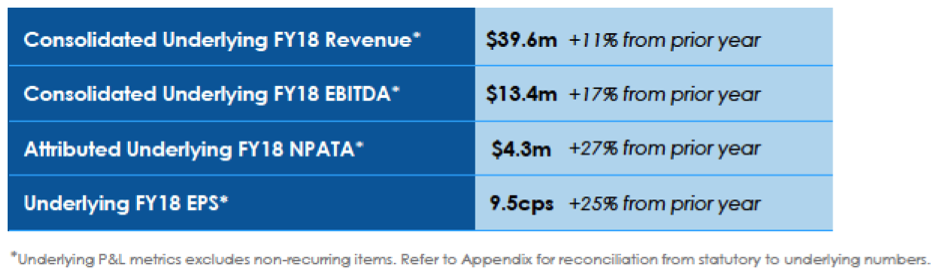

What’s more, a consolidation model like KPG has decent underlying growth with EPS growth in FY18 of 25%. Of course, this gets harder as the business grows but KPG is a tiny player in a huge market with ample opportunity for growth many years into the future. FY19 looks to be off to a strong start with two additional acquisitions in NSW announced already along with a new office in Melbourne.

For those that like regular cash flow, KPG pays quarterly dividends, currently 1cps fully franked. And it trades on, what we think, is a highly attractive PE of just 11x FY19.

Given such attractive metrics, from the current share price circa $1.25, we comfortably see upside of 50% or more in the near-term for this defensive growth business.

1 topic

1 stock mentioned