How to tame a Grizzly (FANG'ed) Bear

Bear markets can be pretty frightening, no matter how seasoned the investor. However, there are a couple of useful tools and principles that can help us navigate them. In this wire, we apply these to the US technology majors - the so-called "FANG" stocks.

The beauty of "time in the market" is that you build up some healthy scar tissue. Having been savaged a few times by bear markets, I have become more sanguine about market panics, and a great deal more focused about what to do in the midst of them. They are a necessary part of the market cycle, and a good time in which to take stock of your portfolio. Not so much what to sell, as what to buy. As the legendary investor John Templeton once said:

The time of maximum pessimism is the best time to buy, and the time of maximum optimism is the best time to sell

Great advice, so long as you have some dry powder to deploy in the smoke of battle.

Having cash is handy, and we would all like to have more when we need it. In general, it is a good idea to approach bear markets with a very healthy respect for liquidity. What tends to happen, as we have seen these last six weeks, is that the stocks that run hottest in the bull market tend to be dumped in a panic. Selling out of smaller capitalization companies, and more speculative profit less firms is good preparation. Absent that, liquidating the weaker firms early is generally a good policy. Later in bear markets this becomes harder to do.

Those who have margin accounts need to be very careful to monitor their gearing levels. The general rule for US account holders is that the Federal Reserve imposes a 1:1 gearing limit for most investors. However, your brokerage will likely have additional limits that are usually expressed as a "percentage of equity" that counts towards your margin buffer. Once your available margin falls to zero, you will very likely receive the dreaded margin call.

Margin calls are dreadful if you come unprepared. You must provide additional liquidity on very short notice. This means injecting new cash into your account, or forced liquidation. Of course, you could sell some of your holdings, and very often this is the right action. However, it is far far better to do that early, rather than late, in the bear market development.

What happens to most novice investors is that they find themselves holding a host of illiquid speculative companies, late in the bull market, and are reluctant to take losses and sell them. Do not feel embarrassed to fess up in the privacy of your own bathroom, look in the mirror, and see the self who always moves opposite to you.

Make friends with "mirror you" and sell those losers that are sinking you.

Mirror you is your best friend in any bear market. If you consider always the merits of behaving opposite to your current instincts, you are more likely to make good decisions. This is all about letting go of the sense of "self blame" we feel when we get an investment wrong.

Mirror you is all powerful. In a bear market, mirror you often comes out on top

This can be confusing at first, but I find it a good way to make up mind.

Other tricks, that may seem a little "childish" can also be helpful. Print out charts of the stocks that are causing you the most anguish. Stick them on the wall and look at from a distance. Gaze at them as you might if you were three years old. Ask yourself this question:

Does it look like it is going up or does it look like it is going down?

Now, repeat the same exercise as mirror you. This is easy. Turn the chart upside down.

This may seem pretty strange, at first, because we are used to making decisions with the left brain faculties of logic and reason. However, you will find, I think, that bear markets will very much surface your emotional side. This is governed by the right brain.

The thing about the right brain is that thinks visually, has a major role to play in our emotional reasoning, and is quite comfortable with mirror imaging. What you want to do with these very simple exercises is to help your right and left brain get comfortable on the one problem.

These silly little games of staring at charts right side up, and upside down, from a distance and then verbalizing the very simple question:

Is that stock a buy or a sell?

will get you into the right frame of mind for both sides of your brain to work together.

I know it sounds silly, but I have been doing this for over 25 years, and it works for me.

What I find is that my biggest problem in making good decisions in a bear market is that the world has generally changed in some ways, but not in all ways. The dominant centers for the typical financial decision maker are left-brain rational. These will help you stay the course during a well-established bull market. You all know the narrative, right?

However, once the economic and market cycle turns we are twixt narratives. You can be sure there will be a new one along, but you can't be sure which of the old ones will survive. The good news is that Mother Nature equipped our minds with emotional intelligence. That horrible feeling in your stomach is a warning that something is not quite right.

Bear markets engage our fight or flight reflex which makes us anxious

The rational mind is very uncomfortable with such gut wrenching emotion because it signals danger and risk. However, the problem of finance is that we have nothing to run away from. The only actions we have, are to buy, sell, or do nothing.

Everybody knows the simple answer to such blind panic: sell everything!

However, it is best not to do that. Treat the emotion as a signal that something has to change in our assumptions about the world. It is a message to the brain to change something.

How then can we relate this to the simplistic chart flipping exercises I mentioned earlier?

Really, in my experience, it comes down to this.

When you are in a bear market the first and best question to answer is this:

What do I really want to keep owning on the other side of this mess?

Once you have decided that, you know what you need to think about selling. Importantly, you don't want to come out of the bear market owning a bunch of speculative stocks that you, me, anybody, might have thought would "change the world" but are now facing bankruptcy.

You don't want the wanna be change the world walking dead to change your world in such a way that you have no cash left to buy anything that is a sound investment.

So, that bad stuff really has to go.

Now you have a simpler problem. You know you need to sell some things, but the market is not playing ball. Every time you most want to sell, is when everybody else is selling. This is really the main problem to solve in a bear market.

You have decided which stuff should go but when do you sell it?

There are other related problems, like which thing to sell first.

Obviously, you want to sell it for the best price you can, but who knows what that is?

Here it is helpful to remember that we are all of us playing the same game. Whenever it is obvious what needs to be sold, the market will be cautious to avoid showing that.

Bear markets have a habit of creeping up on us. Everything is calm, and stocks look quiet, with maybe a mild downtrend, and then, wham, everything goes down all at once. Fundamentals may actually look fine, but stocks are sold regardless. This is not crazy, a good stock may well be widely owned by investors with over-leveraged margin accounts. Very often these are sold because the investor simply cannot sell the other stocks that they borrowed against.

Think about this different question:

If I knew what investors paid for their stock then I would know where liquidation risk is highest, because that is where leveraged traders have the most risk.

This may not, at first, be obvious but you have probably thought about it for houses. Suppose everyone in your street had negative equity, then fire sales would be quite likely. They would be even more likely if a recession hit and folks lost their jobs.

It is the same with stocks. Wherever the typical investor is nursing steep paper losses you will find a concentration of liquidation risk for them to meet their obligations. The flip side to that is the human behavior. If you hold a good stock, that remains liquid, and has paper profits, I bet you are more likely, without deeper thought, to choose that to sell, than the passion play which is underwater by 50% from what you paid, but is certain to "change the world".

Wrong answer, and we all know it.

Sell the junk to meet your obligations!

Now that we know what we all know, the question is how to turn that set of observations into some kind of investment strategy to better cope with bear markets:

- Sort your portfolio into the keepers and the weepers

- Sell what weepers you can into the quiet markets to eliminate any excess leverage

- Respond to bear market rallies by selling weaker stocks into any strength to gain cash

Aside from the exercises I mentioned earlier, a great tool that I employ in bear markets is the average cost of entry estimator that I described in an earlier wire, The savvy yabby (or, how I “know” when to adjust iron ore exposures).

This is a simple calculation I run to work out roughly where the "break even" line lies between the typical investor being in profit or loss on their stock holdings.

The reasoning should now be clear. Just as I implored you to consider what "mirror you" would do when faced with a buy-sell decision, this tool can help us work our which corners of the market have investors with good stocks to sell to fund losers, and losers they won't sell.

That seems a bit cruel in a way. Really we are trying to spy on the misery of other investors so that we can better understand why good stuff is sinking along with bad stuff. However, you, me, anybody, who is in the investment game is not running a charity. In the melee of a full market panic, you don' t want to be crushed in the stampede for the exits.

Let's do this now for the major US technology firms:

- FB.OQ Meta Platforms (Facebook)

- AMZN.OQ Amazon

- NFLX.OQ Netflix

- GOOG.OQ Alphabet (Google)

- AAPL.OQ Apple

- MSFT.OQ Microsoft

These used to be called the "FANG" stocks after the first letters of the first four, but then the names changed, and folks realized that Apple and Microsoft were good businesses.

Maybe now they are the MMAAAN stocks? Whatever...

Let's have a look and see who might be keepers and who look like weepers.

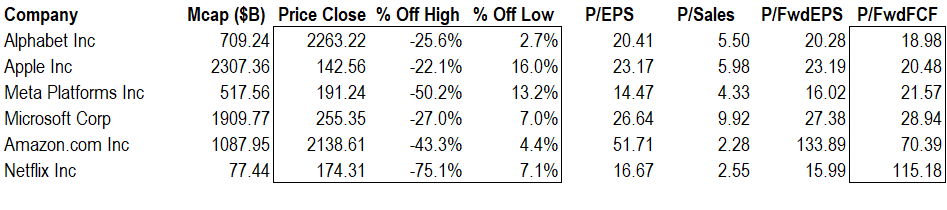

The table shows some pricing and valuation data for the tech leaders. The first thing to note is the message from the market in the first box. The % Off High and % Off Low items show the change in price versus the 52 week high and 52 week low. These are the maximum possible unrealized loss, and maximum possible unrealized profit for any purchase in the last year.

You can easily tell we are in a bear market since the % Off High numbers are of much greater magnitude than the % Off Low. Also you can see that the journey for Meta and Netflix has been a lot worse than that for the other stocks. Amazon is in the middle. Microsoft, Alphabet and Apple have modest drawdowns, and are pretty close to their 52 week lows.

The other highlighted box is valuation, ranked by the price to forecast free cash flow (P/FwdFCF). This is a better valuation measure than accounting profits for technology firms since their producing assets are software developers, and the free cash measures available investible funds.

Firms with a modest price earnings multiple, but high free cash multiple, such as the bottom ranked Netflix, have little room for maneuver in their future investment decisions. This can be very important in a bear market when the business mix may need to be altered. Former high flying growth stocks with high price to free cash multiples can be risky in a bear market.

The two clearest examples above are Amazon and Netflix. In recent earnings reports they have warned of excess capacity in warehouse logistics for Amazon, and weakened subscriber growth and higher competitive pressures to spend on new programming, for Netflix. In contrast, the numbers for Meta look a little more enticing, and the stock may even be cheap.

Let's strengthen that analysis by looking at how these companies have been trading, in the order that I ranked them by valuation.

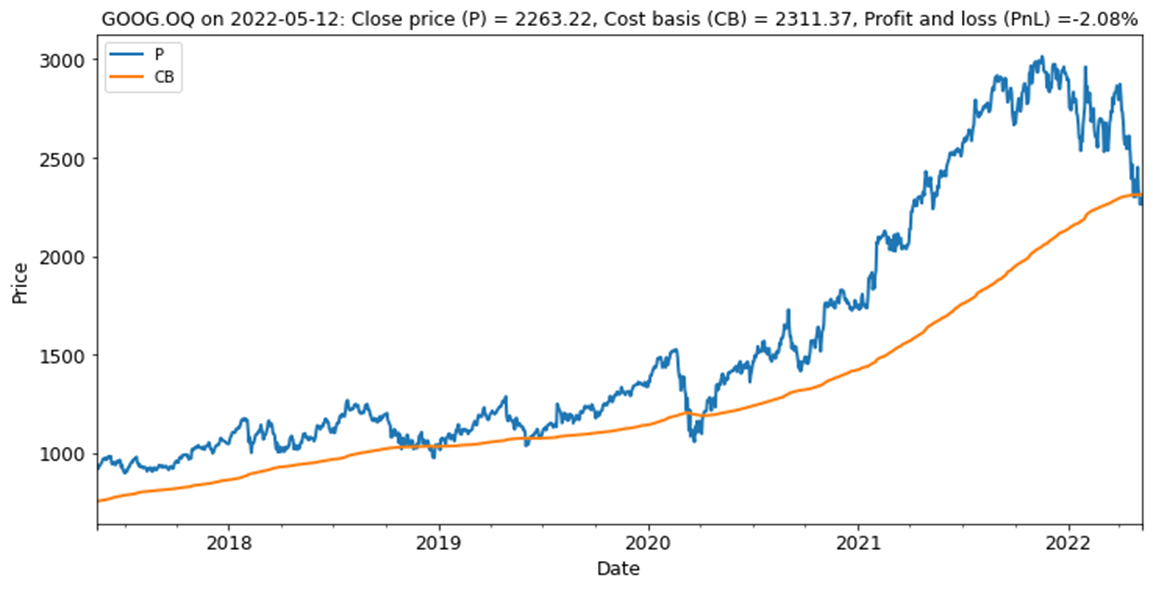

First in line of free-cashflow valuation comes Alphabet:

The unrealized profit and loss in Alphabet is estimated to have peaked over 50%.

Since Alphabet rates best on free cash-flow valuation, and started this bear market phase on a very high unrealized investor profit, we interpret this as "profit taking". For those who were short this might be an opportune time to cover shorts and look for other opportunities.

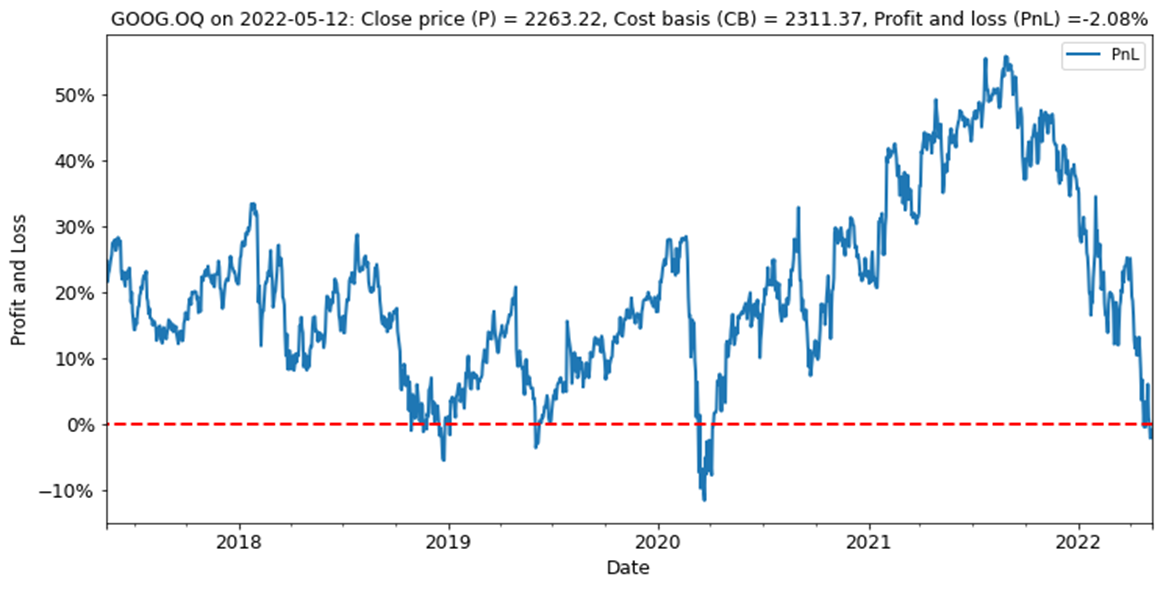

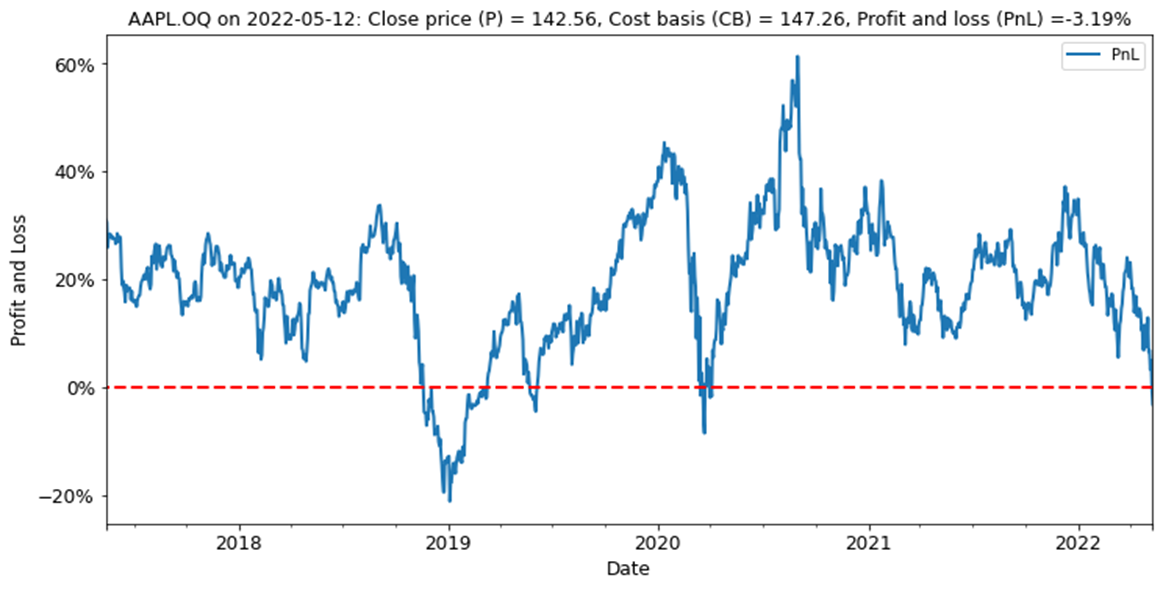

Next in line of free-cashflow valuation comes Apple:

Clearly, the typical investor has a good journey with Apple over five years. The sell off this week saw a quite steep sell down at last night's open, with a rally off the lows.

The above chart converts the price and estimated average entry price into the profit and loss expressed as a percentage. Apple spent very little time showing unrealized losses. Since the business outlook on earnings calls was mostly positive, a rally off this level seems likely.

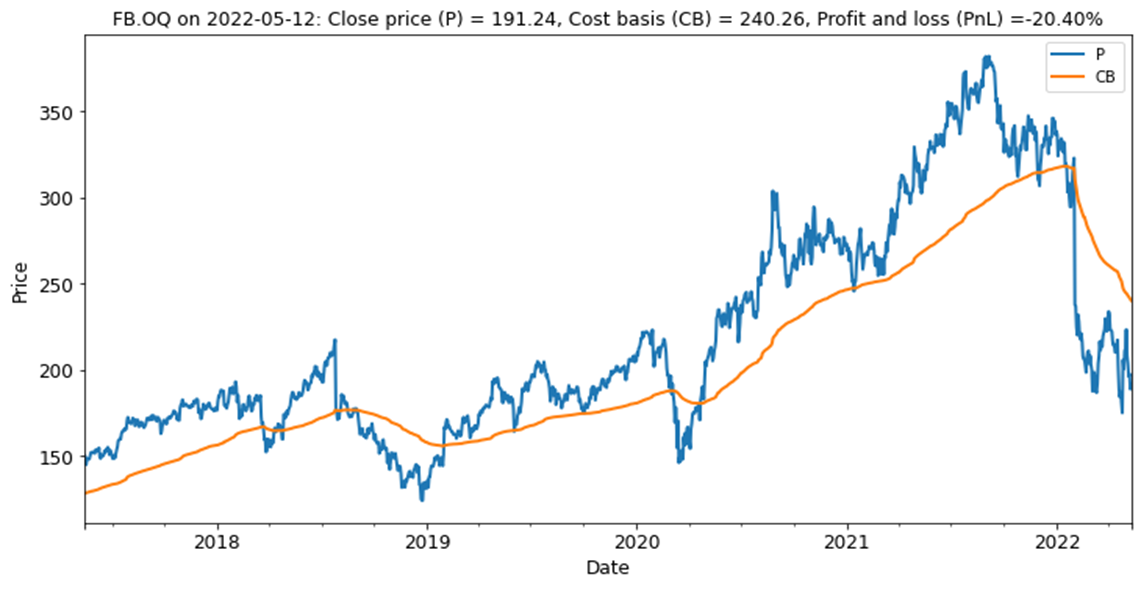

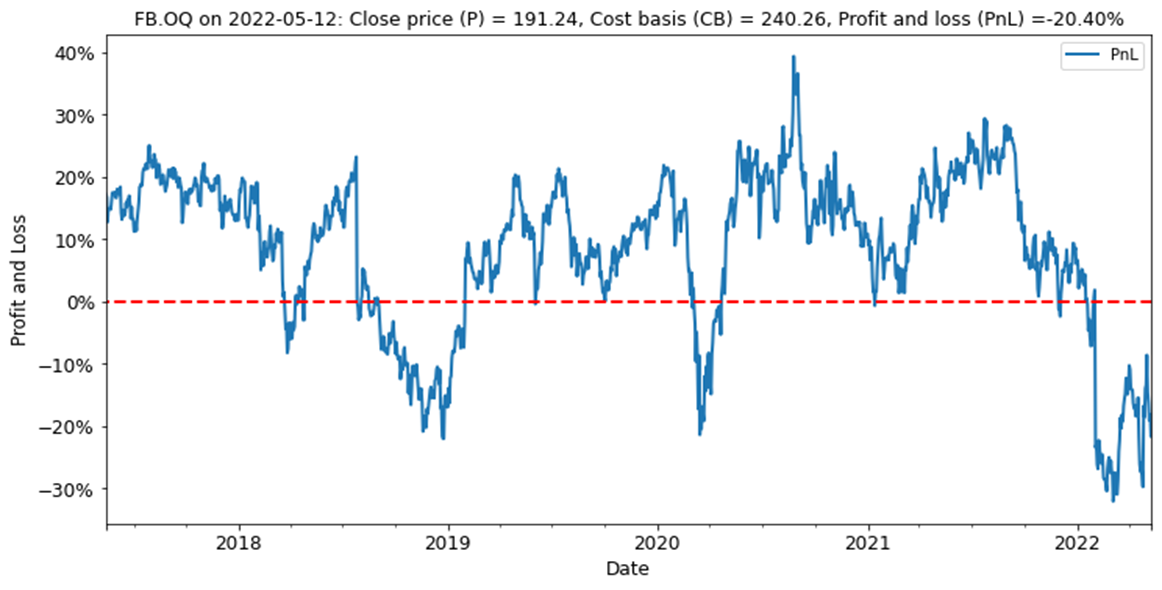

In contrast, the experience of Meta investors has been very different.

There is likely a significant overhang of investors with poor sentiment who have yet to sell.

In contrast to Alphabet and Apple, the typical Meta Platforms investor is likely to be showing significant unrealized losses. While the stock appears cheap, new longs may need to sell into strength once the price approaches break-even. This is when stale longs may sell in order to convert their unrealized loss into a "get even" break-even exit.

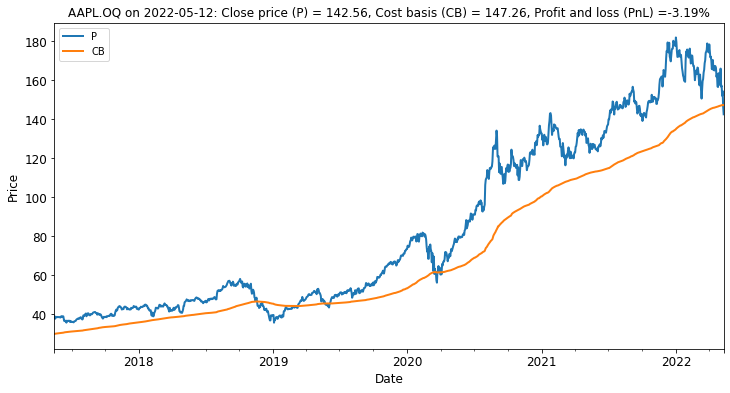

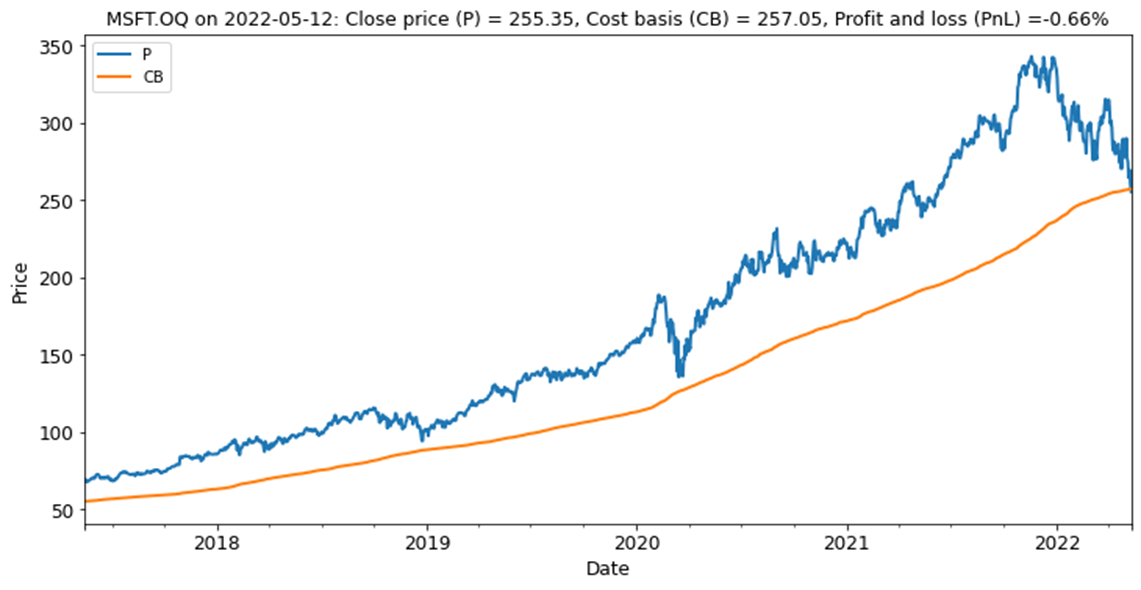

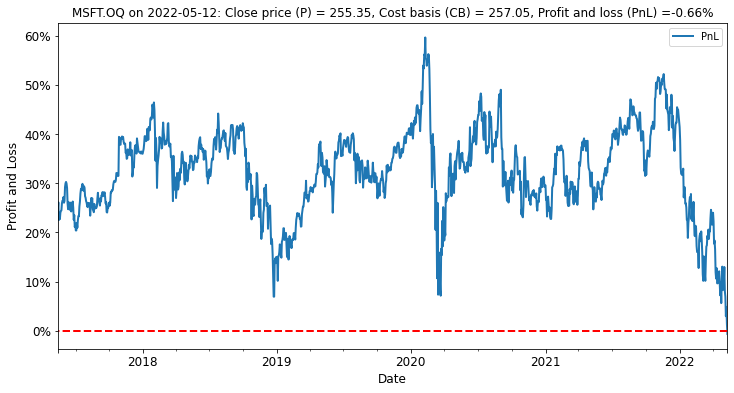

Microsoft, in contrast has had such a good run, that investors are only now getting worried.

This is probably not such a concern, because the stock valuation is premium, but modest.

When you put the above into proper context, it would not be surprising to see investors who have spare cash topping up their holdings in Microsoft. Their experience has been good. The stock will probably find cashed up investors, who own it long-term, seek to buy more.

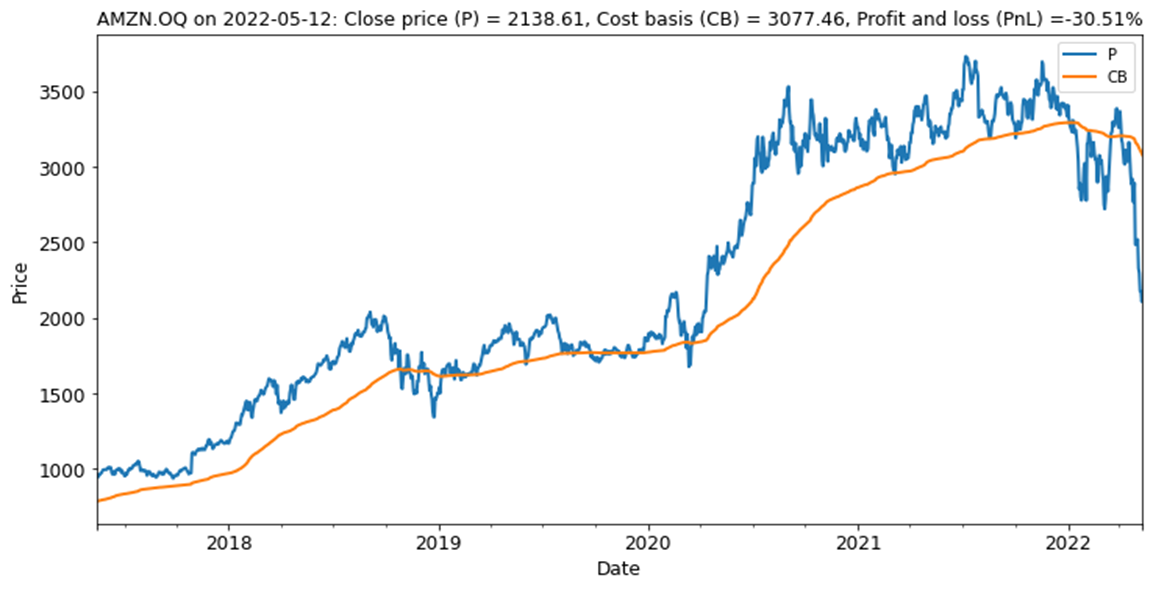

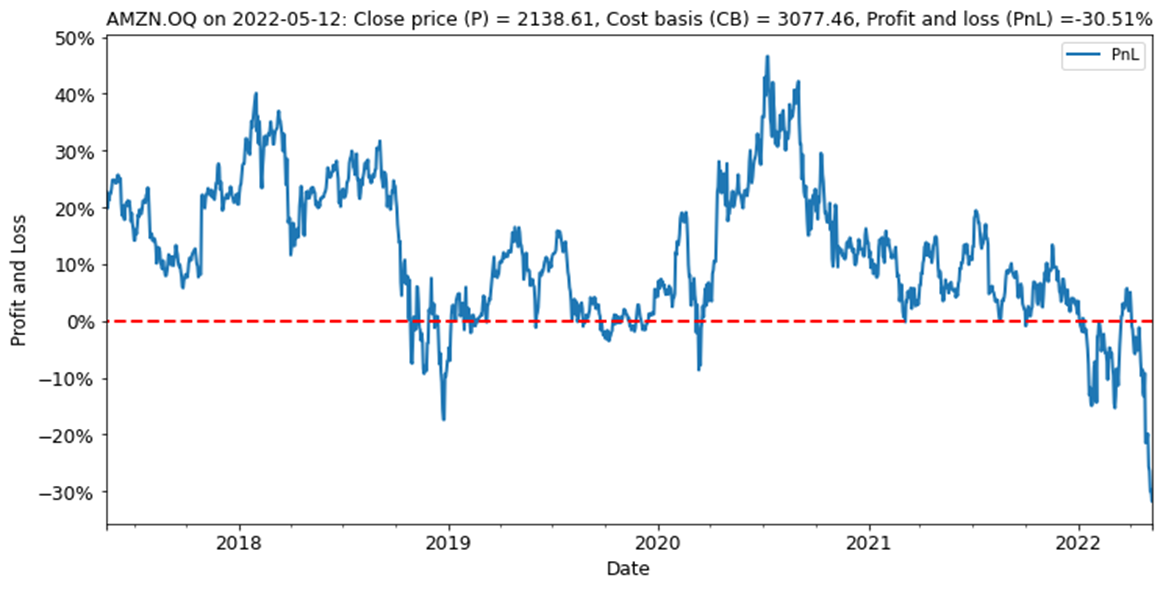

Amazon has been an absolute powerhouse in this bull market, but is now rather shaky.

The typical investor is likely experiencing very poor sentiment, and possible margin calls.

The history of Amazon has been patchy for investors, but generally positive over the last five years, except for this year, and especially after their earnings call disappointment. This is a stock that many investors are likely to be selling on rallies to reduce exposures.

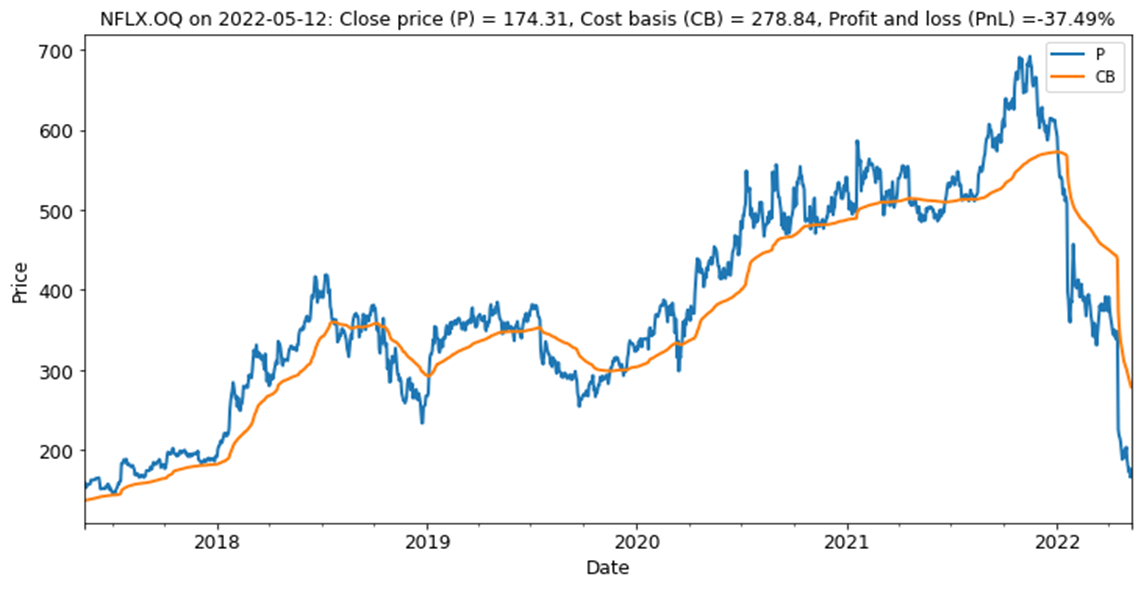

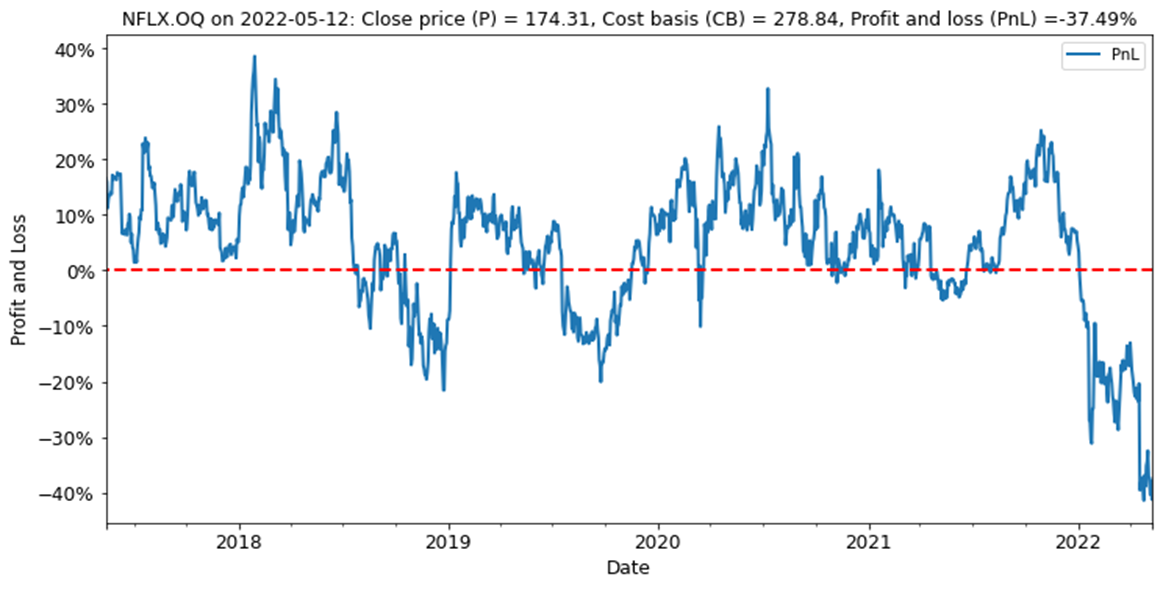

Netflix is another horror story, and one that befits a purveyor of dark mood filmed content.

The estimated drawdowns for Netflix investors have been fairly extreme.

If we square this observation with the group-leading high free-cashflow multiple, Netflix looks set to continue its severe bear market. Investors are likely to be increasingly emotional, if not a little desperate for the pain to end. They will likely sell rallies of any sizeable strength.

The above tour of the FANG market is intended to illustrate a few key points on managing the stress in a bear market. Once we accept that the world has changed, and can see for ourselves that the pain is shared, but not always at the same level in each stock, then it can become a little easier to reason dispassionately about your own investment strategy.

In the bracing words of boxer Mike Tyson:

Everyone has a plan until they get punched in the mouth.

The one consolation of a bear market is this:

Everyone gets punched in the mouth so whomever has a plan will get up again.

The above pointers may be useful for those who have not had their jaws broken by the wild nature of financial markets. Once you take the measure of your own holdings, and take the step to rationalize them around keepers versus weepers, you can use tools like cost basis analysis to develop strategies to manage your way back, get up, and keep smiling.

In the above analysis, which relates to my own book, we closed our shorts in Amazon and Alphabet this week, and are looking to add to longs in Microsoft and Apple.

The wildcards to emerge from this analysis are Meta Platforms and Alphabet.

Likely as not, we will reverse and now go long Alphabet for the long term.

In the case of Meta Platforms, it looks cheap, but there is a likely big overhang of investor selling to come. That leaves plenty of time to study the business, and prepare.

That is how I am thinking about these questions in the light of what is happening.

Disclosure: the author is long Microsoft and Apple.

If you like this approach to markets please follow me.

(Image Credit: Photo by Mark Basarab on Unsplash)

Never miss an insight

Enjoy this wire? Hit the ‘like’ button to let us know. Stay up to date with my content by hitting the ‘follow’ button below and you’ll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

4 topics

6 stocks mentioned