How to "time" your bond portfolio, and why it's so important now

If you invest in any form of fixed income – whether bonds, managed funds or private credit – you’ve probably heard the word "duration" used. But why does a measure of time matter to fixed income investors and how can you use it to your advantage?

What is duration?

You probably already know that the value of a bond typically drops with rising interest rates and inflation; and rises with falling interest rates and inflation. Duration will help you work out an estimate of how much – it is a measure of sensitivity to interest rates.

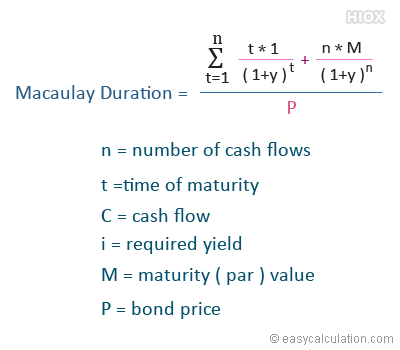

The full explanation of duration is that it is the time it takes for the bond to repay its price – no, not the maturity of the bond where the principal is repaid but the total sum of cash flows (coupons and final principal) compared to the price that you paid for that bond. It is typically calculated by a formula called the Macauley Duration Formula which calculates the present value of the coupon payments and par value and divides this by the market price of the bond. It looks like this.

So how exactly does duration work and what does the output actually mean?

Cameron McCormack, portfolio manager at VanEck, answers this with an example.

“If the duration of a bond is 4, it means that with a 1% rate rise, the value of the bond would fall 4%. A bond with a duration of 2 would only fall 2% on a 1% rate rise.”

If you’d rather stick pins in your eyes than try to calculate this yourself, it’s worth noting a simple google search will uncover a few websites with automated calculators to do it for you – though accuracy isn’t guaranteed. If you are invested in managed funds, the fund manager will typically publish the average duration of the entire portfolio for you.

How do you make duration work for you in periods of rising inflation?

According to McCormack, “One way it may be prudent for investors to consider bonds is to shorten the duration of their fixed-term bond investments to mitigate the impact of rising interest rates and target higher-rated bonds to mitigate credit risks.”

Some examples of fixed income instruments that may be more likely to have shorter duration include:

- Short-dated bonds with a maturity under 12 months.

- Floating-rate bonds where the rate resets with the cash rate on a set timing

- Private credit and debt which are generally structured with floating rates.

Jessica Rusit from FIIG Securities also suggests investors can maximise their returns in these times by selling bonds that are close to reaching maturity and repayment of their principal. Here's how Rusit explains it:

“Over the life of the bond, as the length of time to maturity gradually shortens, the credit spread and risk-free rate both decrease (all things being equal) as duration and credit risk are gradually priced out. With this, the bond’s original yield moves lower, causing the bond price to rally.”

If you are looking at managed funds, generally speaking, those with shorter durations of two to three years are more likely to be built to manage the current market conditions. They do this by investing in a range of bonds with differing structures (fixed as well as floating rate), different maturities, and different durations – but you should read through the latest fund fact sheets and the PDS to understand the complete structure and strategy.

For the latest insights on fixed income investing, please click here.

.png)

2 topics

2 contributors mentioned