How vulnerable are the world's biggest economies to a recession?

.png)

Combining variables from housing to bond yields – and special indicators reflecting key sectors, such as chips for South Korea and commodities for Canada and Australia – we compile a “pressure index” to predict the likelihood of recession for each country. The outcomes are diverse. China’s picture is mixed. While the US and UK have shown some improvement, Germany remains in the doldrums. By comparison, it’s smoother sailing for Japan and Australia.

The dashboards are up to date as of Feb. 8, and Macrobond users should note that they require premium add-on data packages from IHS Markit PMI and MSCI.

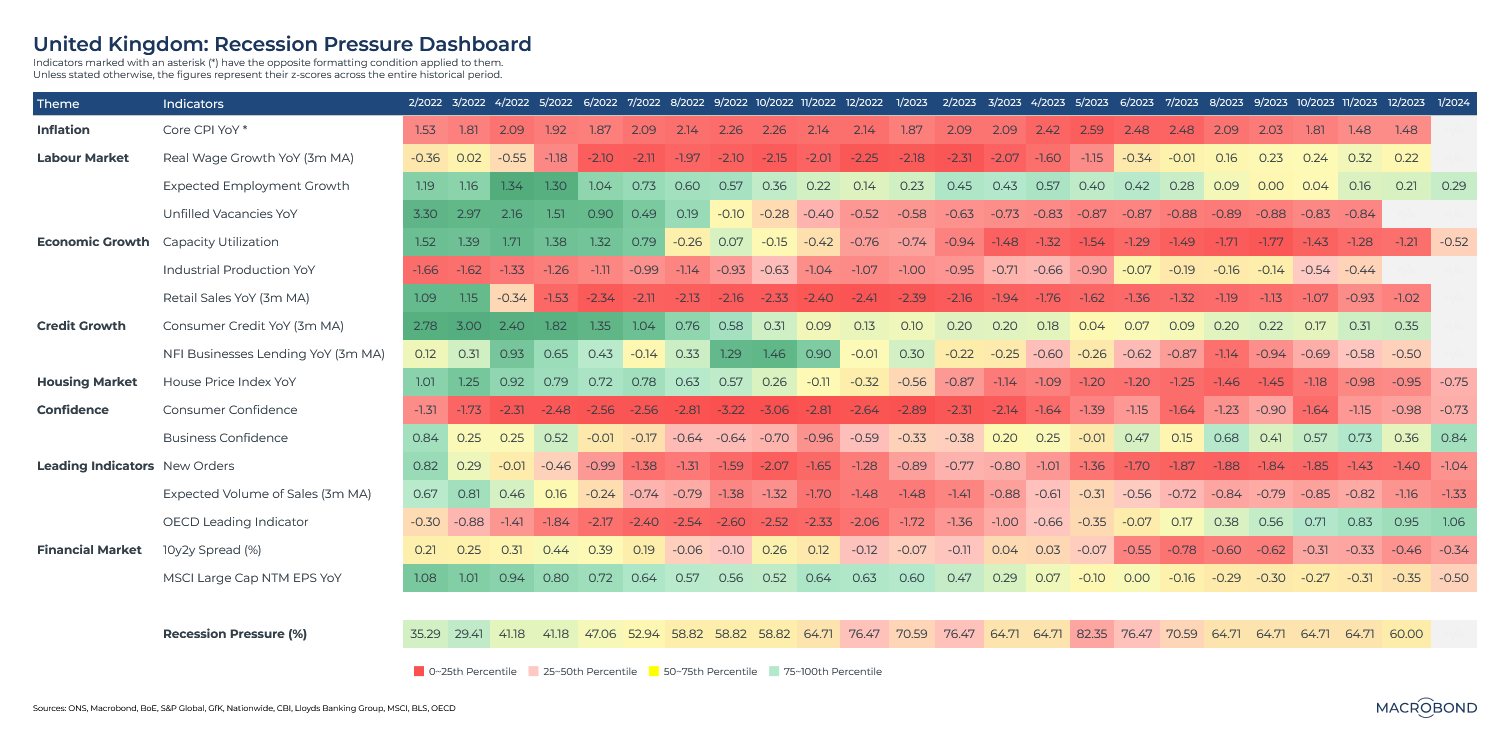

The UK: stagnant, but improving?

Recession pressure: 60%

One of the steepest, fastest and most globally synchronized monetary tightening cycles in history has come to an end. (Or so it seems.) Will a global recession be the result?

Compared with the middle of last year, prospects for a recession in Britain seem to be receding.

However, the economy remains in rather morose state, with a prevalence of red and yellow cells in the most recent columns of our dashboard.

(The “heat-mapping” of all figures in these dashboards tracks their deviations from decades of historic data.)

We last calculated a recession pressure indicator in December. As the January indicators trickle in, job growth and business confidence are improving. Some indicators, like housing, are benefiting from a shift from dark red to “pink.”

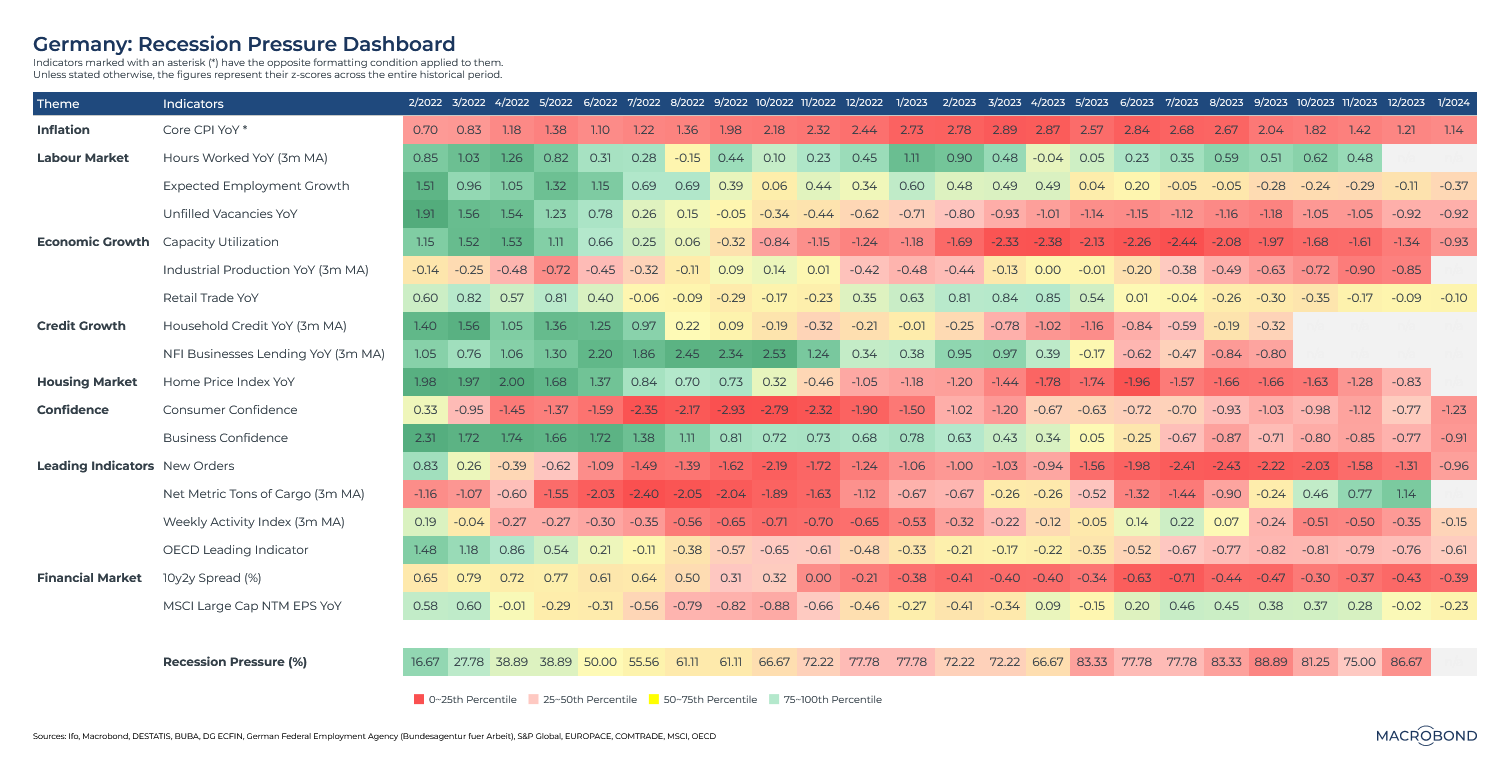

Germany: danger zone

Recession pressure: 87%

Germany’s economy has suffered for some time from the disruption of its industrial model, which relied on expanding globalization and cheap energy from Russia.

As the trajectory of our recession indicator shows, its economic indicators are getting even worse. On Jan. 30, the national statistics office said the economy indeed shrank in the final three months of 2023, though revisions mean Germany narrowly avoided a technical recession (two consecutive quarters of contraction).

Most of our dashboard is flashing red, with a measure of cargo shipping the only recent bright spot. New orders, inflation and capacity utilization remain problematic. Data trickling in for January is showing a worsening job market and receding business confidence.

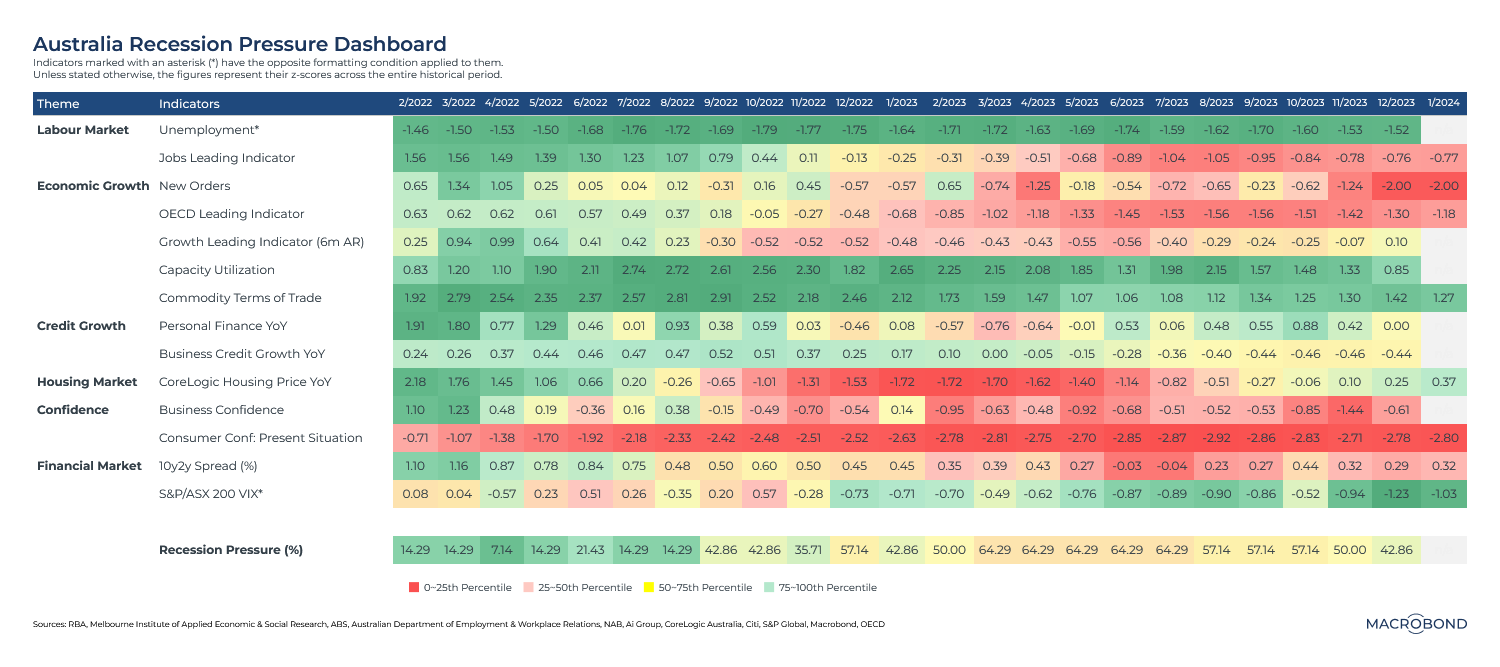

Australia: still lucky

Recession pressure: 43%

Resource-rich Australia is famous for having avoided recession in the 30 years between the early 1990s and the pandemic. Even its Covid-19 downturn was less severe than those of its peers in developed markets.

According to our dashboard, the nation looks set to remain the “lucky country” versus the rest of the economies we examined.

While consumer confidence remains weak, optimistic trends in the stock market, a robust labor market and healthy terms of trade for the nation’s critical commodity exports have pushed chances of recession down.

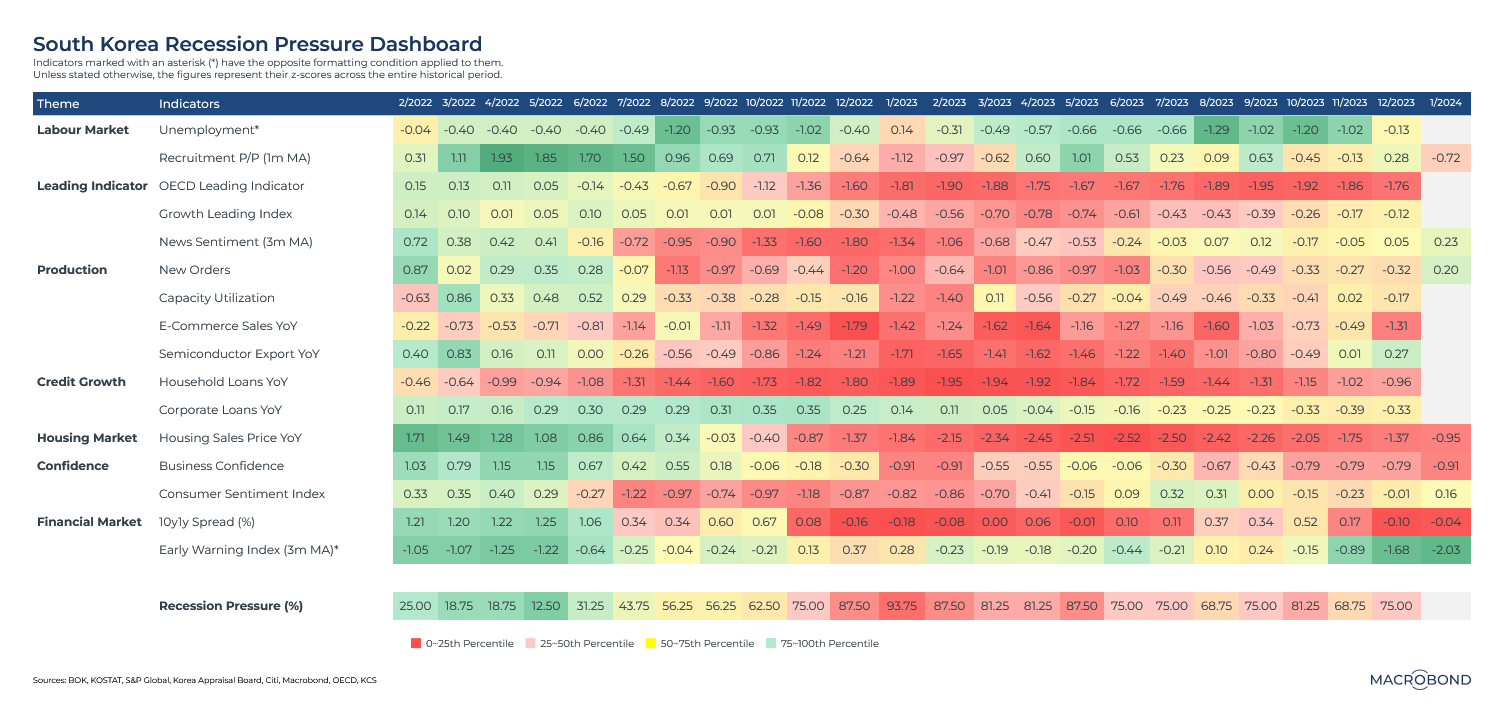

South Korea: a semiconductor bright spot

Recession pressure: 75%

South Korea’s recession pressure level is elevated relative to several Asian peers. The export-driven economy has suffered amid weakness in its key Chinese market. Business confidence and e-commerce indicators have been worsening.

Still, things have improved since early 2023, when our indicator surpassed 90% and a recession seemed certain. The key semiconductor industry is also worth watching; it recently tipped into green on our dashboard.

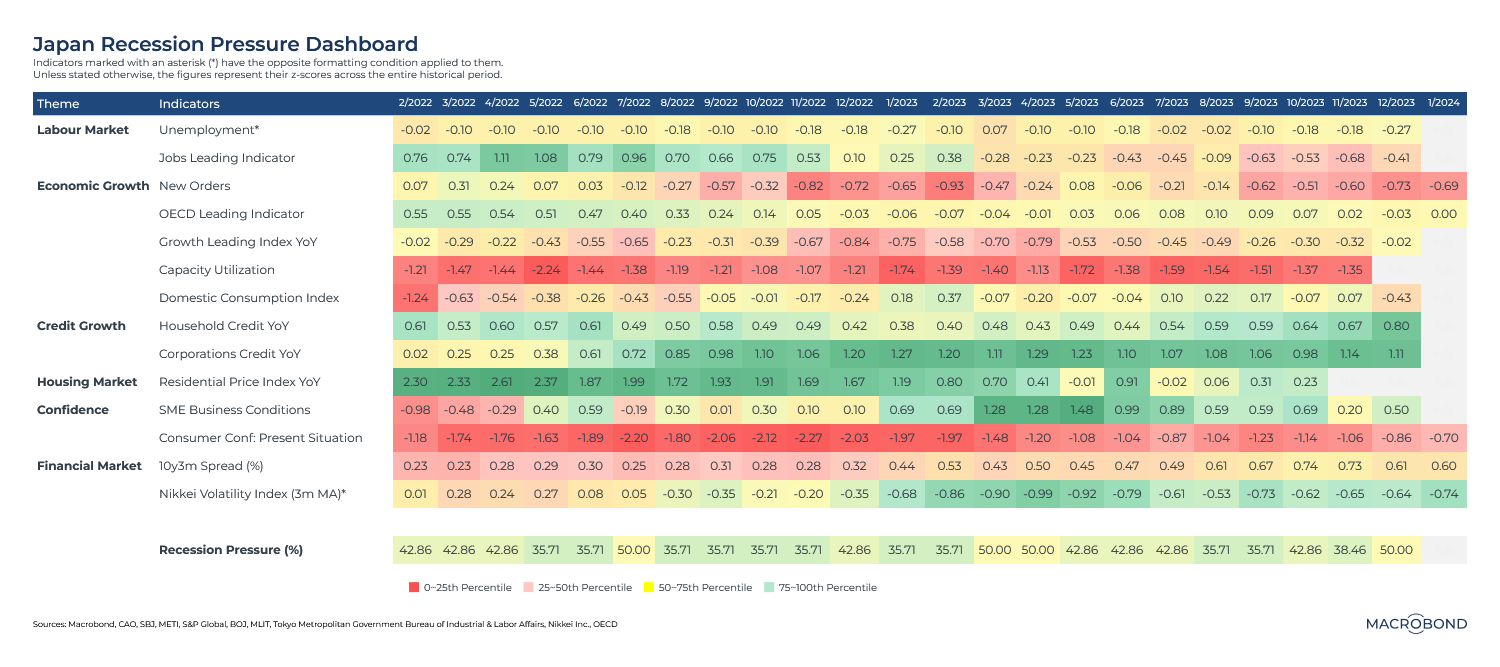

Japan: rising sun, blue skies

Recession pressure: 50%

Japan’s economy is a global outlier: its central bank is expected to raise rates, and it’s chasing a positive wage-price spiral.

Corporate credit indicators are in good shape, and consumer confidence is improving. New orders and capacity utilization remain relatively weak.

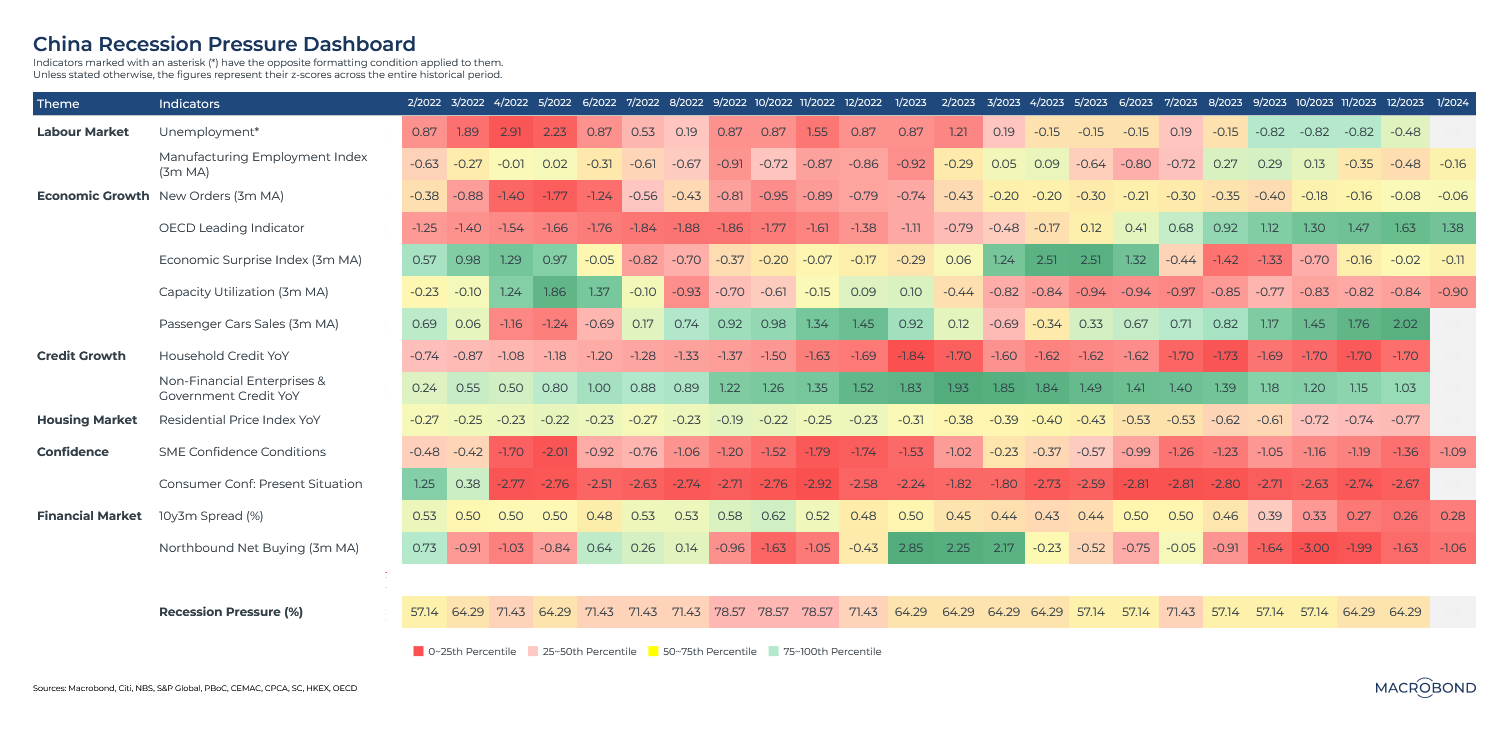

China: a mixed picture

Recession pressure: 64%

China’s dashboard offers a striking contrast of some bright green and more red.

The labor market is improving. And we’ve previously pointed out the nation’s healthy OECD leading indicator, a data point whose components include early-stage production – though that has now weakened for January.

Negative signals are coming from household credit and confidence measures for consumers and small business. And even after a series of crises in the property market, the residential housing price index continues to deteriorate.

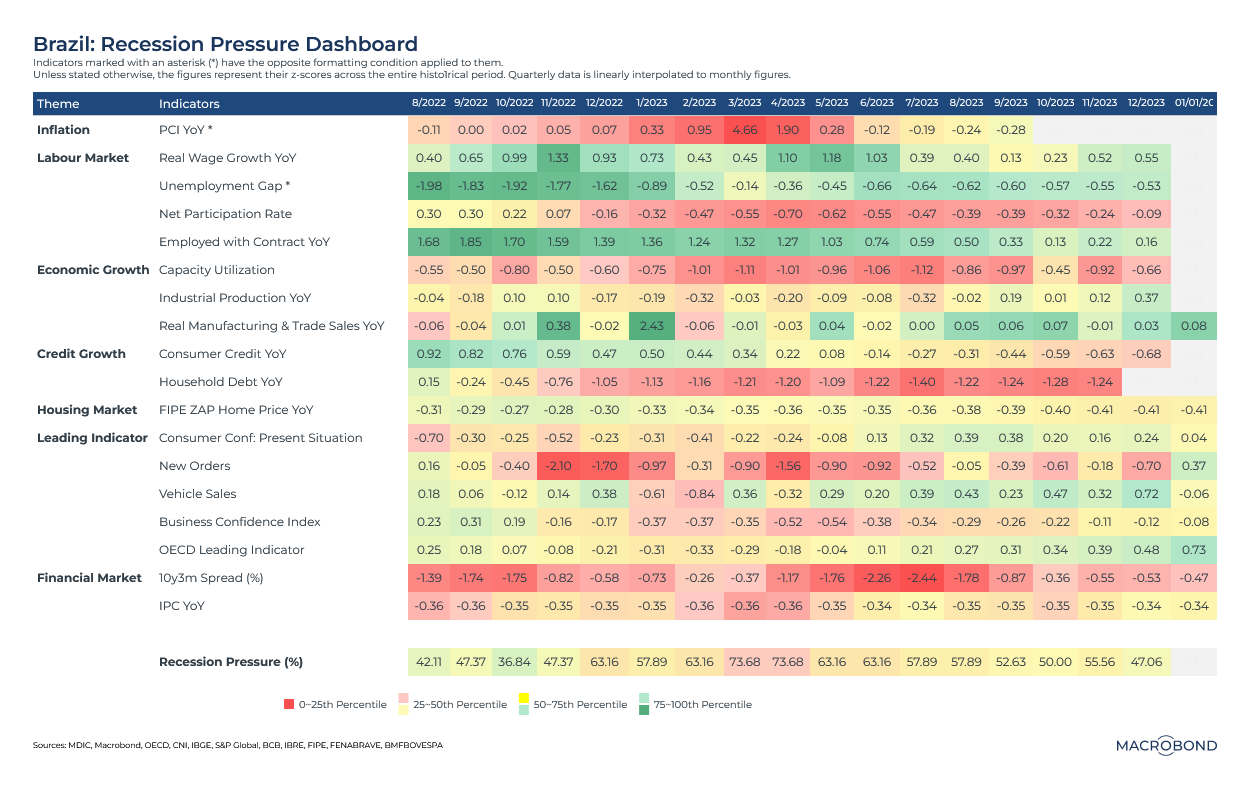

Brazil: unexpected growth

Recession pressure: 47%

Returning Brazilian President Lula has had good economic news since he took office. December figures showed the economy unexpectedly grew in the third quarter.

Our recession gauge has steadily receded over the past year, and the dashboard looks a lot like the national soccer jersey lately, showing mostly green and yellow cells for December and January. The OECD leading indicator and manufacturing figures are historically healthy.

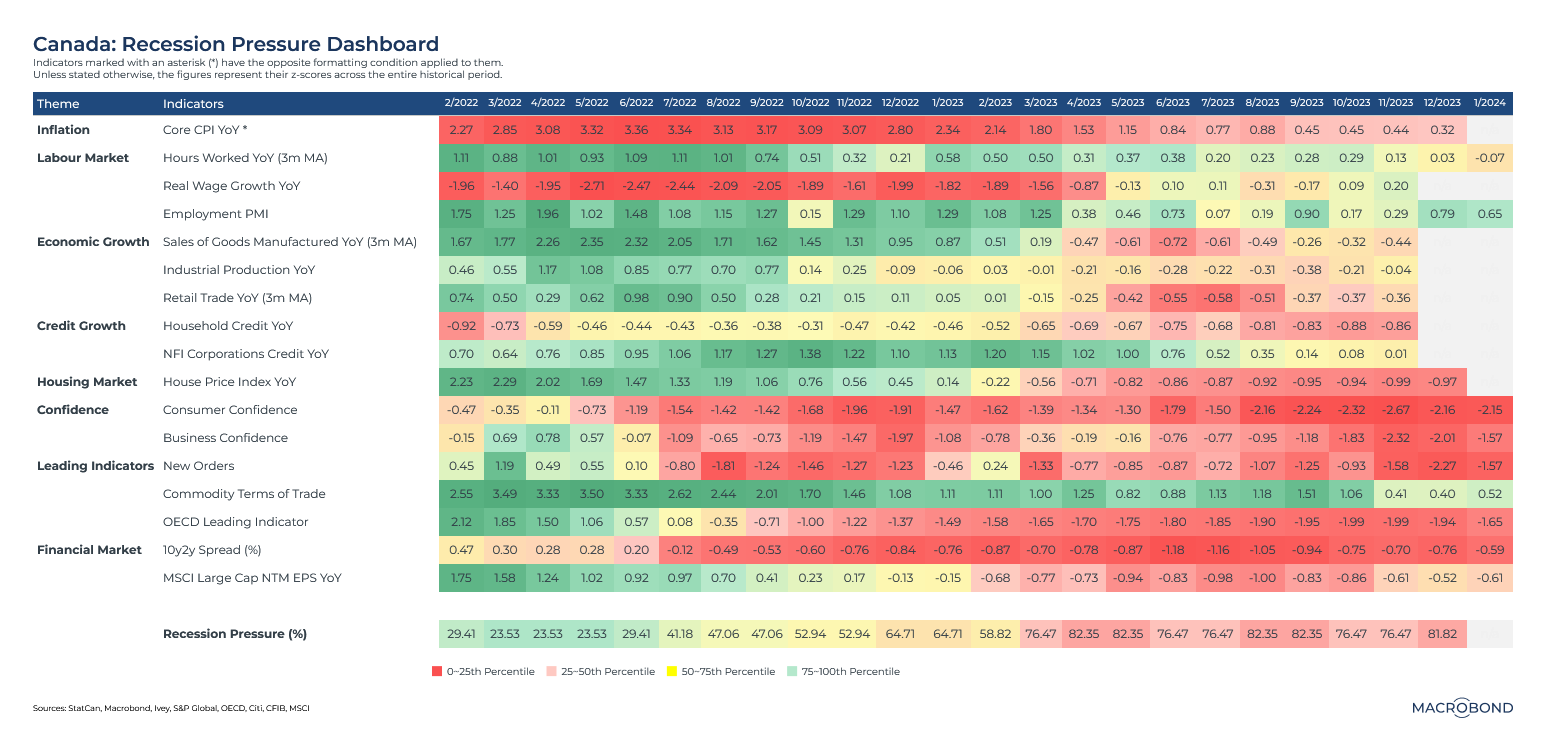

Canada: resource pressure, worried consumers

Recession pressure: 82%

The economies of Canada and the US are closely intertwined, but our dashboard has been suggesting for a year that the Great White North is much likelier to stumble into recession.

While employment and inflation trends seem positive, consumer confidence remains in the doldrums. Business confidence is in the red, receiving only a small uplift from the positive economic figures south of the border recently.

Meanwhile, Canada’s key resource sector is under growing pressure: the “commodity terms of trade” indicator (compiled by Citigroup) slid from positive into neutral territory over the three most recent readings.

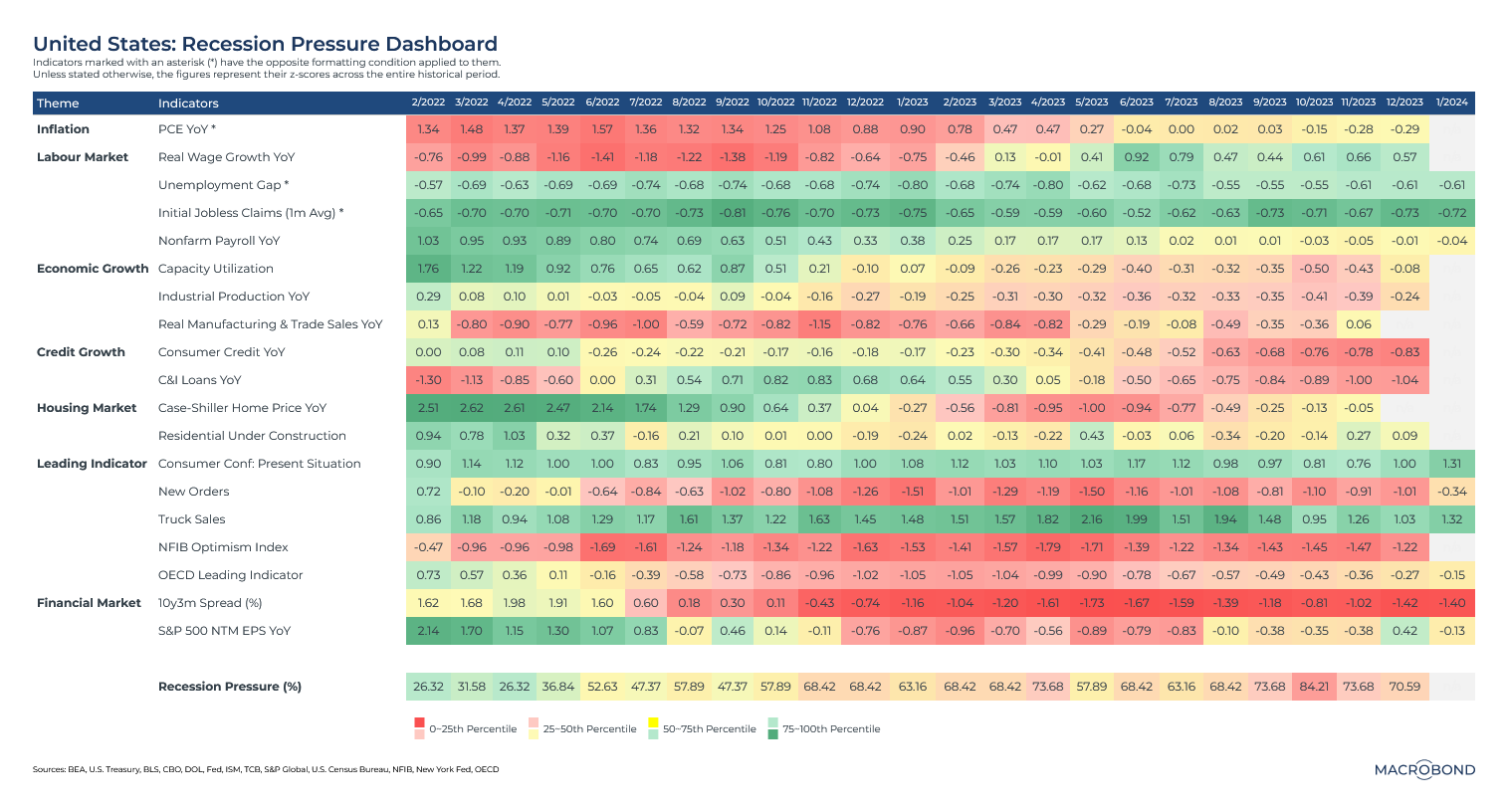

The US revisited: pondering a soft landing

Recession pressure: 71%

We wrap up this chart pack by revisiting our US dashboard. Compared with two weeks ago, new and revised data has given us a more complete picture. Our recession indicator for December has crept somewhat higher (from 60%).

Is a recession inevitable, or will Fed Chair Jay Powell pull off his coveted soft landing? Or, a third possibility: will continued robust inflationary growth after all these rate hikes wrong-foot the markets and central bankers?

As we noted in January, some leading economic and financial indicators (such as the NFIB’s small-business confidence index) seem to have bottomed out earlier in 2023, bolstering the case for a soft landing.

Data trickling in for January has been positive overall versus historic norms: unemployment, consumer confidence, even truck sales.

However, the inverted yield curve, a classic recession indicator, is still flashing bright red – especially after Chair Powell downplayed rate-cut prospects.

3 topics

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

Expertise

.png)

Macrobond delivers the world’s most extensive macroeconomic & financial data alongside the tools and technologies to quickly analyse, visualise and share insights – from a single integrated platform. Our application is a single source of truth for...

.png)