I sold my CBA to buy these two financials

Instead of relying on a greater fool to pay higher valuations for the same flat growth in Commonwealth Bank (ASX: CBA), consider these two high-dividend, growing financial companies. They are dominant players in their respective markets, which are supported by both cyclical and more structural tailwinds.

Australian Finance Group (ASX: AFG)

Ever since I read about Adobe’s (NYSE: ADBE) transition to a subscription-based recurring revenue model in 2012, I’ve been obsessed with businesses that can create significant value by growing a recurring revenue business model. It’s inspired much of what we do at Seneca, both as investors and as business operators.

As a result, we really like recurring-revenue, financial services businesses. While they might not have the ‘sex appeal’ of a technology-laden software company, their growth is supported by a range of structural and cyclical tailwinds that we believe can add significant value to our portfolios.

In the recent past, we’ve talked about (here and here) current portfolio companies like Euroz Hartleys (ASX: EZL) and the market’s underappreciation of their recurring revenue financial planning business. Going back further, we’ve successfully invested in general insurance broker AUB Group (ASX: AUB), as it closed the valuation gap between it and its nearest comparable on the ASX, Steadfast (ASX: SDF) – both of which receive a percentage of premiums.

Australian Finance Group (ASX: AFG) is Australia’s largest mortgage aggregator, and we believe it could be one of the best-performing companies in the S&P/ASX 300 over the next 12 months.

AFG have a few ways to make money:

a) Distribute loans for other lenders via their network of independent mortgage brokers – either acting as a broker or under a white-label agreement.

b) Provide a range of technology tools and financial services to brokers who use their platform.

On these businesses, AFG receives a share of upfront and trailing commissions calculated on the loan value plus subscription revenue for licensing, technology, etc.

c) Make loans using their own money via AFG Securities (AFGS).

Here, they receive the net interest margin (NIM) on the loans but incur any bad debt expenses like any other non-bank lender.

Our thesis on AFG is simple.

1. AFG’s mortgage broking business is dominant—mortgage brokers now account for 75% of loan volumes in Australia, and AFG is the largest aggregator, growing volumes by 13% in 1H25 pcp. This essentially underwrites our investment and protects us on the downside.

2. AFG Securities is growing rapidly—it now accounts for 10.5% of non-bank lending nationally, up from 8.2% in 2022. It grew +23% vs. pcp in 1H'25.

3. Margin impact of AFG Securities business underappreciated by the market – AFG makes about ~2.2 basis points (0.022%) on every loan they distribute, plus recurring trailing revenue of ~4.5bps, so let's call it ~7bps (0.07%) in any given year. If they manufacture that loan, they make something like ~56bps (or 0.56%)!

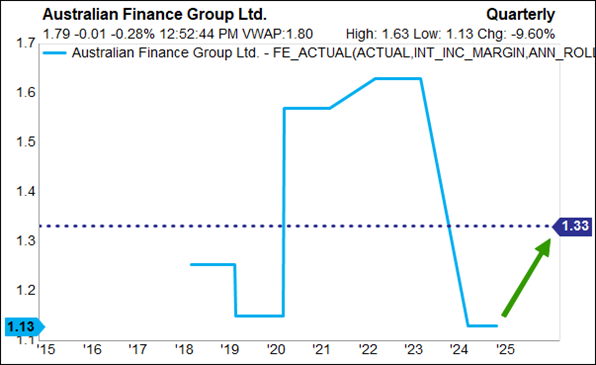

On this basis, we think AFG can return to net interest margins of 1.25%, with real scope to exceed their previous median margins of 1.33%.

AFG Net Interest Margins (NIM)

And making modest assumptions on loan book growth, this could see earnings per share balloon to beyond $0.16 per share, placing the stock on a valuation of only 11 or 12x earnings, well below the 16x earnings the company traded on in the previous cycle.

While you wait for the cycle to turn, you can rest easy knowing that AFG has always paid a healthy dividend, currently yielding ~8% p.a. (inclusive of franking credits).

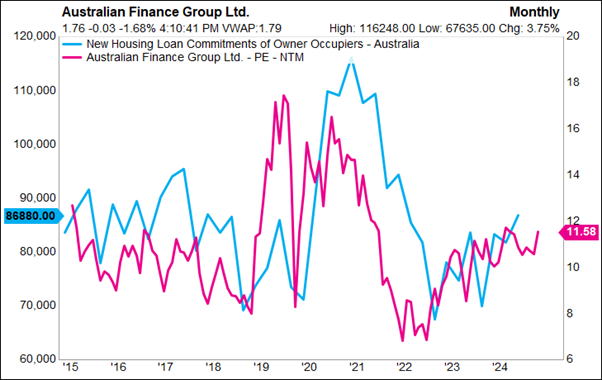

New Housing Loans vs AFG NTM PE

Is the cycle turning? We don’t profess to have any specific or incremental macroeconomic insight, and our view is that we are at or near peak cash rates in Australia. With both political parties seemingly unwilling to address affordability with tax reform, we see clear air for property demand to increase as the price of money declines.

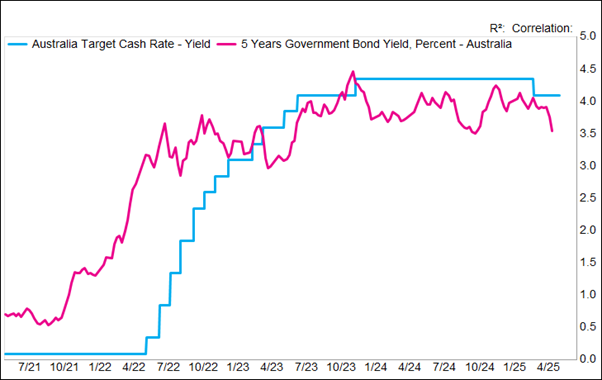

RBA Cash Rate & Australian 5y Government Bond Yield

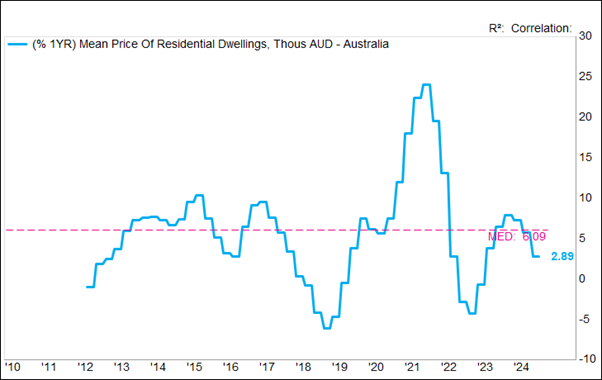

Especially given that property price growth has been below trend in the aggregate.

Rolling 1-year Growth in Average Australian House Price

This lines up with the recent data, AFG reported 3Q’25 lodgements up +18.5% yoy. In short, we think the cycle is turning for lenders, with more people demanding larger loans.

The ASX is littered with companies that could benefit from such an inflection point in the cycle. You could buy a big four bank like Commonwealth Bank (CBA) on a 30-year high PE and a 30-year low dividend yield (26x, 3.2%) – or Westpac (WBC), NAB (NAB) or ANZ (ANZ) on slightly less egregious 13-16x earnings and dividend yields in the 5% range. But let’s be honest with ourselves, what outperformance can you reasonably expect from those sorts of valuations?

Last time AFG made the sort of money we think it’s about to make, it was a $3.00 company, which is why we think it’s set to finish FY26 among the best-performing companies inside the ASX 300.

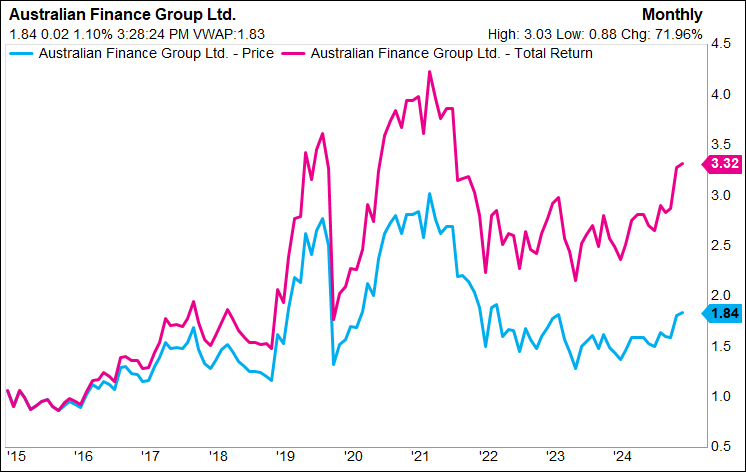

AFG Share Price & Total Return - 10 years

Challenger (ASX: CGF)

Challenger sells annuities. You know, you give them $1m, and they guarantee they will return your capital and pay you a pension. It’s like an insurance policy for your lifestyle income in retirement. Boring. Ultra conservative.

And an excellent business model.

If you have been paying attention, you would have noticed the recent share price run. This was caused by TAL Dia-Ichi Life taking a 15.1% stake in Challenger at the equivalent of $8.46 per share, an 18% premium to the current price.

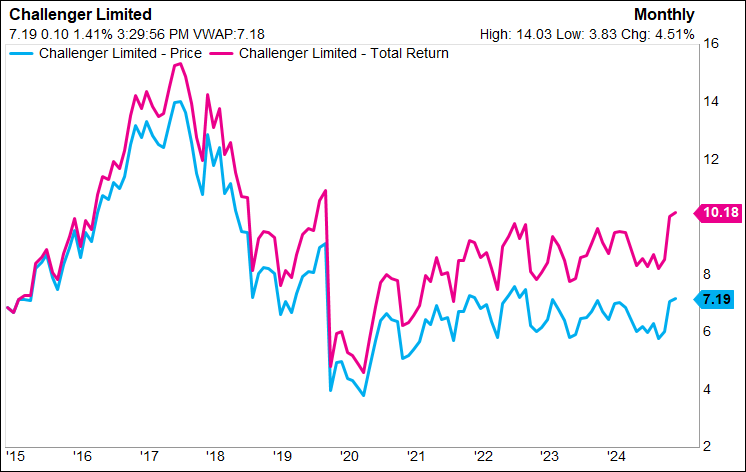

CGF Share Price & Total Return

And while TAL Dia-Ichi Life do have form, acquiring the life insurance businesses of Westpac in 2021 and Suncorp (including brands like AAMI, APIA & GIO) in 2019, our investment thesis is not reliant on an immediate takeover (we think there are plenty of other immediate takeover targets on the ASX)

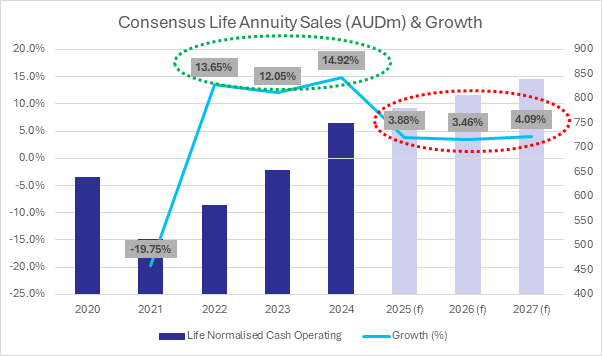

Our thesis is built around a recovery in annuity sales. After the COVID slump, they’ve been running at low-mid double digits, while consensus is still overly conservative, with low single-digit estimates for growth out to 2027.

This is despite the most recent update from the company showing ~20% growth pcp.

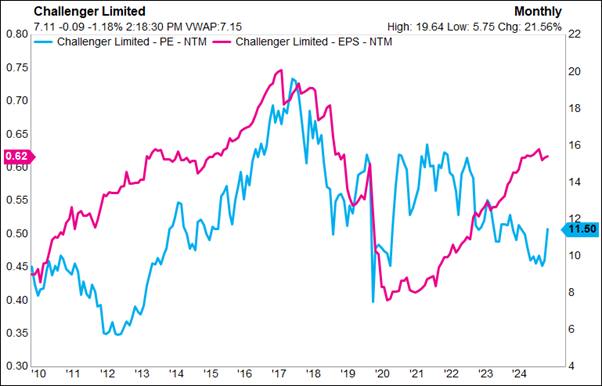

You don’t need to be a rocket scientist to determine that if Challenger can do $870-900m in life sales, the stock is probably trading on more like 10x earnings, rather than the 12x implied by consensus. In any case, we think the earnings recovery is well underway and completely mispriced.

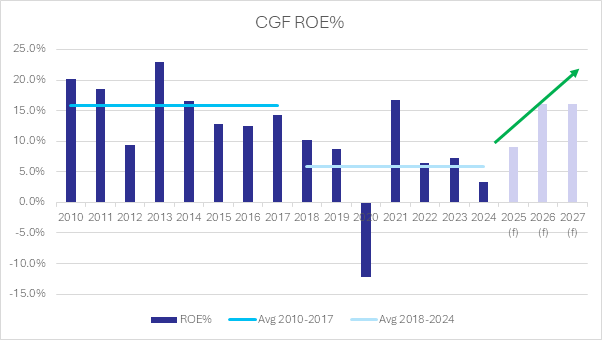

We think these results can be further enhanced through prudent cost management and business simplification. As a result, we expect return on equity (ROE%) to return to the mid-teens quickly.

And while we don’t think a transaction is imminent, the TAL-Daiichi stake should provide ample downside protection if annuity sales disappoint or don’t eventuate as we expect.

We might be wrong, but CGF is cheap, laden with catalysts and is already demonstrating a distinct shift in operating momentum. While we wait for the re-rate on accelerated earnings, we pick up a c. 5.93% p.a. gross dividend yield.

But if we are right, we see CGF trading back above $10 per share for a ~40% capital gain.

We hold AFG and/or CGF across the Seneca Australian Shares SMA and the Seneca Australian Small Companies Fund, which has delivered 28.78% returns over the last 12 months, more than +30% ahead of the benchmark.

If you're interested in investing in our fund/SMAs or working directly with me on improving your existing portfolio, book an initial consultation directly with me using this link or email the team at info@senecafs.com.au.

3 topics

7 stocks mentioned