IGO's bumper FY23 lithium performance and special dividend surprise

IGO (ASX: IGO ) seems to be full of surprises – Suffering from an almost $1 billion impairment on its nickel assets a month ago to now declaring an unexpected special dividend on the back of record FY23 results.

“In FY23, we have generated the strongest set of financial results in IGO’s 21-year history, with record revenue, EBITDA and net profit,” said Acting Chief Executive Officer Matt Dusci.

But the road to a record set of results has been fraught with challenges, including the nickel asset impairment, the sudden loss of CEO Peter Bradford and a slower-than-expected ramp-up of lithium hydroxide production. Maybe the dividend surprise is just what the market after such a prolonged period of operational and managerial uncertainty.

While lithium volatility might be here to stay (at least in the short-to-medium term), there’s a lot to like about these results, according to WaveStone Capital’s Senior Investment Analyst Luke Nelson and Portfolio Manager Catherine Allfrey.

In this wire, Nelson and Allfrey break down the dividend surprise, what’s next for IGO’s nickel and lithium assets and what the future holds for these battery metals.

IGO FY23 results highlights

Financial

- Revenue of $1.02 billion, up 13% but below consensus expectations of $1.08 billion

- Underlying EBITDA of $1.99 billion, up 177% and in-line with consensus

- Underlying net profit after tax of $549 million, up 278% and in-line with consensus

- Cash on balance sheet of $775 million, up 111%

- Final fully franked dividend of 44 cents per share plus a special dividend of 16 cents per share

Operational

- Greenbushes annual spodumene production of 1,491kt exceeded guidance and unit costs were marginally above the top end of guidance of $279 a tonne

- Production ramp-up at Train 1 at the Kwinana Lithium Hydroxide Refinery was “challenged”

- Group nickel production of 34,846 a tonne at cash costs of $5.63 a tonne was in-line with revised guidance

FY24 Outlook

- Nickel production: 29,000-32,500 tonnes

- Copper production: 8,500-10,000 tonnes

- Cobalt production: 700,800 tonnes

- Lithium spodumene production: 1,400-1,500kt

- Lithium hydroxide production: Not provided

- Total capex (incl nickel, lithium and exploration): $980 million to $1.11 billion

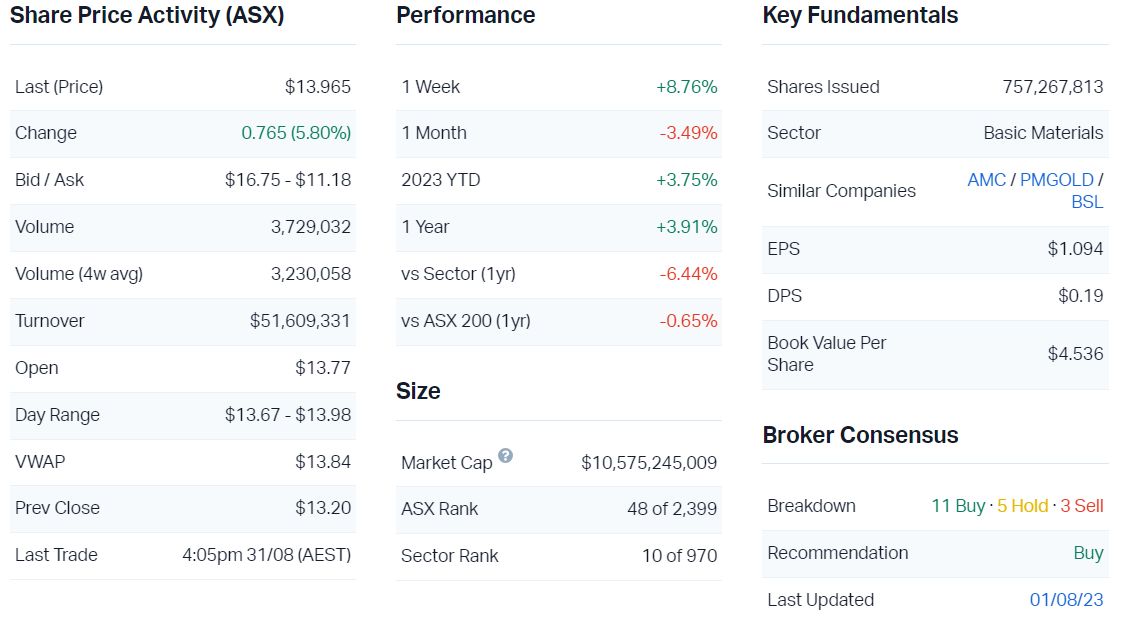

Key company data

%20Share%20Price%20-%20Market%20Index.png)

Company snapshot for IGO (Source: Market Index, 31 August 2023)

%20Share%20Price%20-%20Market%20Index.png)

IGO 12-month price chart (Source: Market Index)

Catherine Allfrey – Portfolio Manager and Principal at WaveStone Capital

In one sentence, what was the key takeaway from this result?

All the financial items were pre-guided – So the main thing was the dividend, which was well above expectations and beat consensus by approximately 80%.

IGO shares are up 4.5% on the result. Is this an appropriate reaction?

Reaction: Appropriate

The dividend was not expected by consensus and reinforces the board’s confidence around cash flow. IGO has a policy to return 20-40% of free cash flow and they’ve paid well above that with the special dividend today.

There’s also a new CEO, Ivan Vella who is starting at the end of this year. I thought that they might have kept some powder in the bank ahead of him starting but it goes to show the confidence in the free cash flow generation of the business.

Are there any major surprises in the result that investors should be aware of?

Operationally, IGO has had some issues with Train 1 at the Kwinana Lithium Hydroxide plant. That’s been a sore point. They’re targeting 50% utilisation by the end of the year. We’re watching that closely and it will be interesting to see how they ramp up into the new year.

They impaired the Western Areas assets a month or so ago, which was disappointing given how that’s taken place within 12 months of buying the asset.

I think they need to get some runs back on the board and restore market confidence, particularly around those nickel assets.

On that vein, there wasn’t any guidance on Cosmos, which is their next nickel growth project. An update is expected before December and the project is highly likely to face delays and higher capex. The associated risk around that is just the quantum of the delay or capital increase.

Would you buy, hold or sell IGO on the back of these results?

Rating: Hold

We hold it and continue to like the story. IGO has a 25% interest in what is the best hard-rock spodumene project in the world. That affords it the optionality to withstand volatility in commodity prices, particularly with what we’re seeing in lithium in the last three to six months. I think that’s really valuable.

In terms of valuation, the company trades at approximately 10-15% free cash flow, with a strong balance sheet that provides optionality going forward around its growth projects.

We also like lithium as a commodity over the medium-to-long term and the growth that’s coming through from the electrification thematic. We believe that the costs associated with new supply, particularly brine, is going to be more expensive than expected, which will ultimately lead to higher long-term pricing. Going back to IGO, it has a project that’s at the low end of the cost curve, so they accrue that rent.

There are some short-term risks around the nickel side of the business. But the lithium side is going very well.

What’s your outlook on IGO and its sector over the year ahead? Are there any risks that investors should be aware of?

From a market point of view, the biggest risk is lithium and lithium prices. Approximately 80% of IGO’s value is tied to its lithium joint venture. What lithium pricing does will have a very strong correlation with the IGO share price.

We like the lithium outlook but there clearly will be volatility over the short-to-medium term. It’s a very nascent industry at the moment that has to mature in a number of ways, in terms of both demand, supply and pricing functions.

We’re close watching factors like EV penetration globally and particularly in places like China. The Chinese pivot towards electrification is going to happen, despite the well-known risks in China from a growth perspective.

From an operational perspective, the lithium hydroxide plant and Cosmos are the two key risks. If they can put them to bed, they’ll be pretty strong.

From 1-5, where 1 is cheap and 5 is expensive, how much value are you seeing on the ASX right now? Are you excited or are you cautious on the market in general?

Rating: 4

The market is slightly expensive versus historic averages, trading at 15.7x and earnings are forecast to fall 4% in FY24 due to a weak outlook for commodity prices as well as margin pressures and rising debts for banks. The overall market outlook is pretty poor in terms of earnings. But then you’ve got the industrial sector that’s still demonstrating earnings growth over the next couple of years.

This reporting season has been very interesting because it’s been a contrast in a post-covid world with rising interest rates. Within different sectors, you’ve seen the ‘haves’ and ‘have nots’, the ‘well managed’ and ‘not-so well managed’ – I would point you to the Coles (ASX: COL) versus Woolworths (ASX: WOW) or the Goodman (ASX: GMG) versus Dexus (ASX: DXS) or Carsales (ASX: CAR) versus Seek (ASX: SEK) – In terms of how different boards and management have operated within this environment. Some have been very successful and others not so.

Overall, the market is steady as you go and I still see some opportunities out there.

3 topics

7 stocks mentioned

1 contributor mentioned