Inflation is dead. Enter the next bull market

Introduction

As we all experience elevated inflation levels daily, it may be difficult to believe, but the forward inflation indicators look much better today. This is also important for investors because inflation, through interest rates, affects asset values and stock prices. There is increasing evidence that inflation rates have dropped dramatically, and we expect it to drop even further in the coming months which is good news for long-term investors.

Inflation is correlated globally

Inflation tends to be correlated worldwide, and inflation levels in the two largest global economies, US and China are both easing dramatically. Therefore we think it is only a matter of time before we in Australia experience what the US and China are experiencing regarding inflation and interest rates.

China is in deflation

China slid back into deflation, with its July consumer price index (CPI) falling 0.3% compared to 2022. The country’s producer price index (PPI), a lead indicator of future inflation also declined -4.4%, a tenth straight monthly decline.

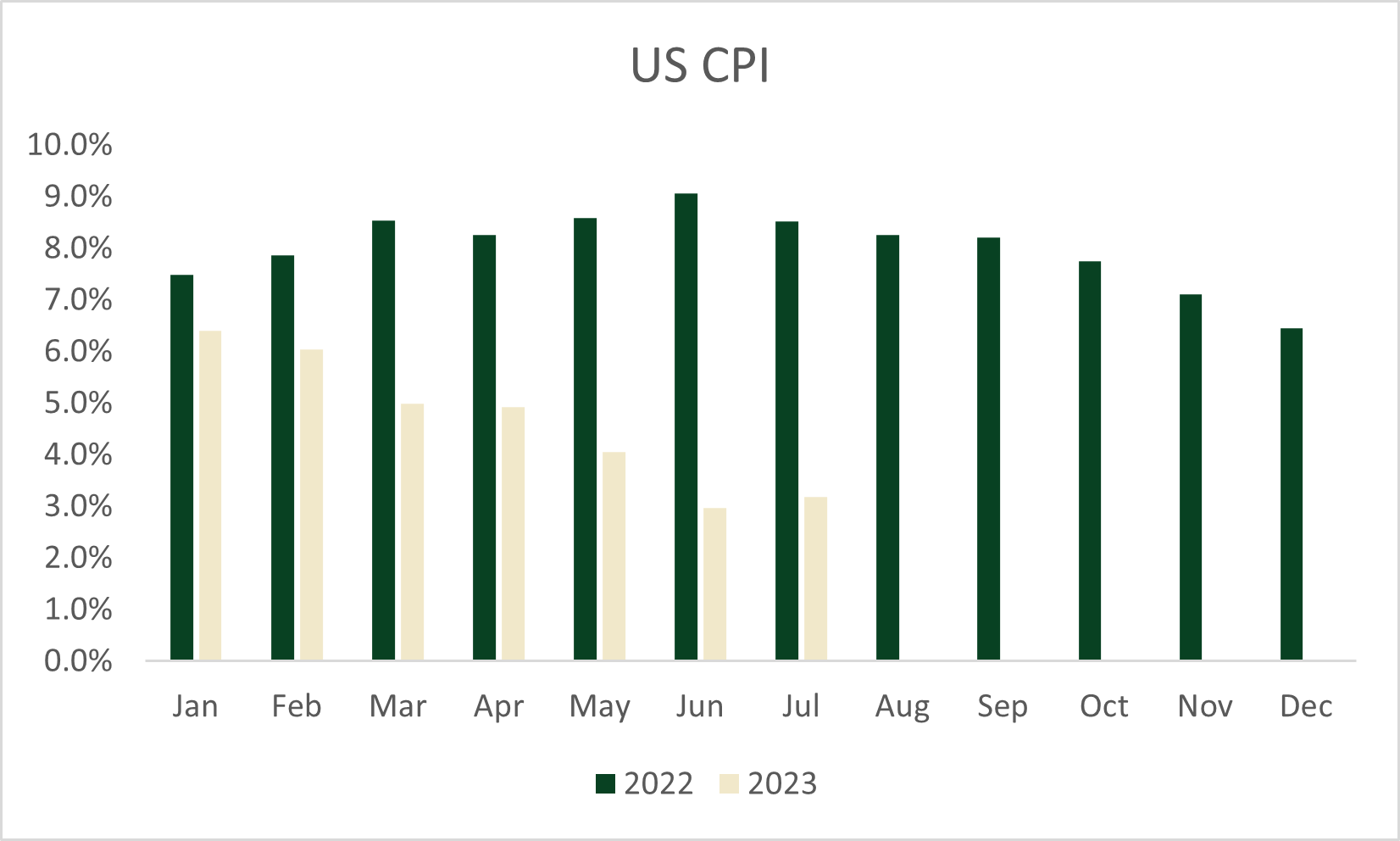

US inflation is falling

US inflation as measured by CPI rose 3.2% for the year in July, declining significantly from over 8% last year. The internals of inflation are also looking very promising with many items now in deflation territory.

Shelter makes up a significant proportion of CPI in the US, which continues to increase, putting upward pressure on the official CPI data. However, there is an acknowledgement of a significant lag in capturing the data. When we incorporate real-time shelter prices, inflation is much lower than the headline. Truflation, which uses real-time data estimates US inflation to run at 2.4% instead of the government-reported rate of 3.2%.

We expect US inflation to fall further in the coming months as the official data gradually capture the declining shelter prices. Furthermore, in May and June of 2022, we saw monthly CPI increases of 1.1% and 1.4% (annualised to 13.2% and 16.5%). These big monthly numbers have rolled off, and mathematically the annual inflation rate will decline.

Source: ELM Responsible Investments and (VIEW LINK)

Why is inflation falling?

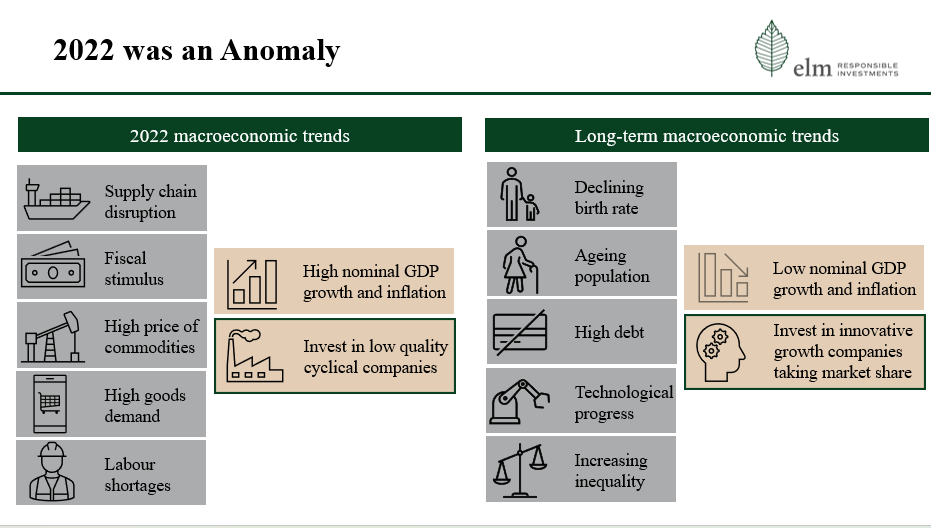

Looking at the events of 2022, it becomes clear that the global economy was operating under unusual circumstances. Following the pandemic and the start of the war in Ukraine, it was an exceptional year marked by supply chain disruptions, unprecedented fiscal stimulus, elevated commodity prices, strong demand for goods, and labour shortages.

Source: ELM Responsible Investments

These numerous shocks resulted in high nominal GDP growth and inflation, which many have not experienced.

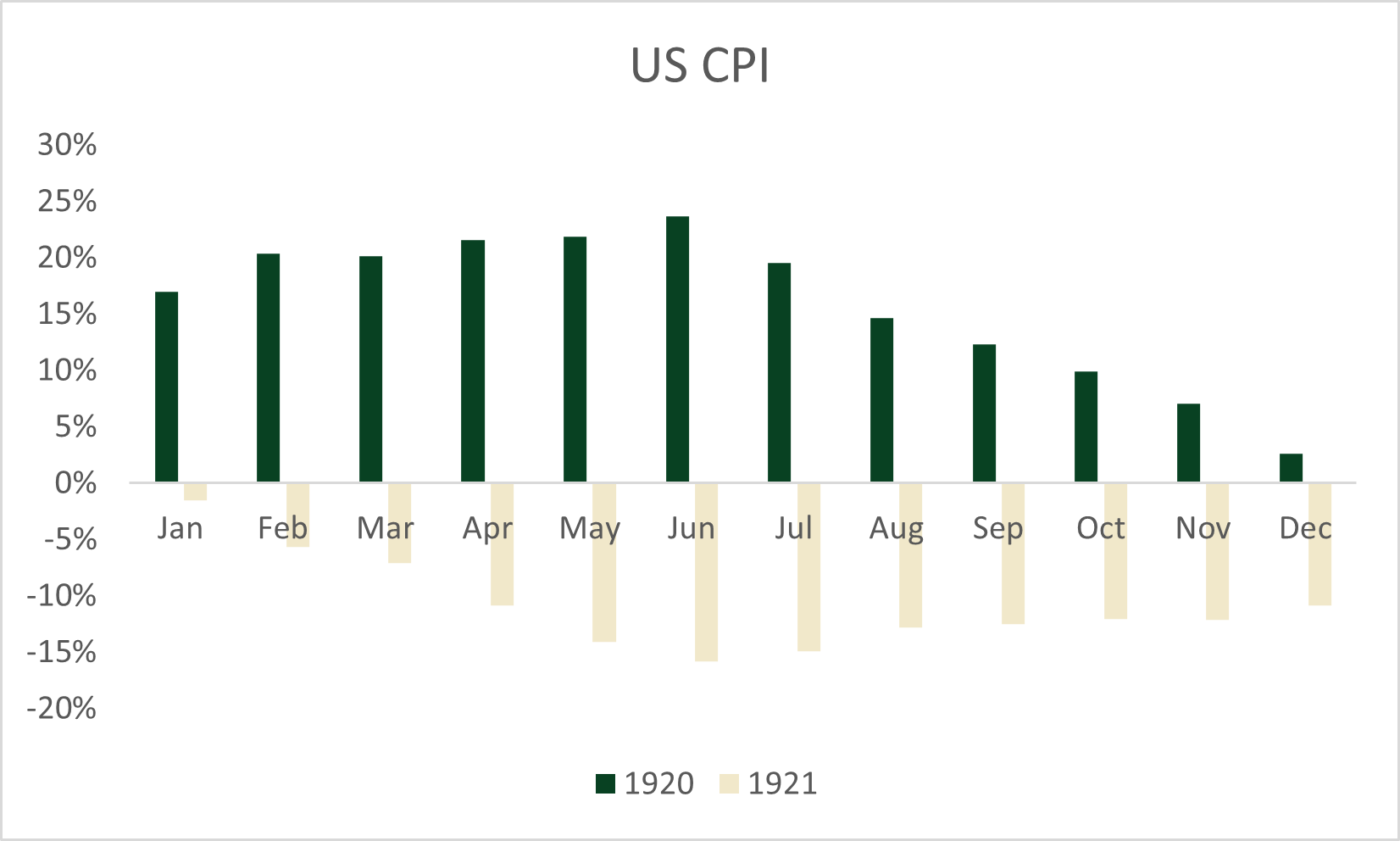

But when we look to the past, we see that the last time we had a fighting war and a pandemic that disrupted global economies was over 100 years ago - World War 1 between 1914 and 1918 and Spanish Flu between 1918-1919. It was war first then the pandemic, but the impacts on supply chains and the economy were similar. Inflation peaked at almost 24% in June 1920, only to flip to deflation in January 1921. By June 1921, prices were declining by almost 16%. As inflation declined, equity markets boomed during the 1920s, before the Great Wall Street Crash of 1929.

US Inflation as measured by CPI in 1920 and 1921

Source: ELM Responsible Investments and (VIEW LINK)

As our economies normalise after an unprecedented period, we are only now starting to see a moderation in inflation. Like in the 1920s, I expect inflation to decline over the coming years, and equities to perform well. The long-term inflation rate is closer to 3-5% than the hostile 8-10% we experienced in 2022.

Where to invest now

Investors favoured low-quality cyclical companies during high inflation and nominal growth periods like in 2022. But when considering the long-term outlook, the structural forces of declining birth rates, an aging population, high debt levels, technological advancements (particularly AI and machine learning), and growing inequality will contribute to lower nominal GDP growth and inflation, which we are slowly starting to see in our economies.

These long-term structural trends were present in 2022 but were masked by the overwhelming short-term forces caused by the unusual idiosyncratic conditions of that year. As they recede and the long-term structural trends become more evident, investing in high-quality, innovative companies taking market share becomes more essential.

Why is it essential to invest in innovative companies taking share?

Declining birth rates, an aging population, high debt levels, technological advancements (particularly AI and machine learning), and growing inequality are long-term trends that limit GDP growth. For example, companies can no longer rely on an increasing population to grow their revenues. They need to start innovating and take market share away from incumbent operators. The electric vehicle industry is a prime example. Total automotive sales have been flat or declining for years due to saturation, but electric vehicle sales have increased significantly.

Conclusion

After

a challenging 2022, the conditions are right for the start of the next bull

market. As macroeconomic conditions normalise, and the long-term structural

trends re-emerge, the high-quality, structural growth companies are well placed

to out-perform in the years ahead.

5 topics

%20(1).png)

%20(1).png)