Inflation or recovery in 2021: The chicken or the egg?

If we were to organise the Grand Financial Debate ahead of 2021, what would be the main topic of discussion?

Plenty to choose from. Is inflation making a come-back, yes or no? Will there ever be a world again without financial market interference from central banks? Does debt still matter? Are economies and equity markets experiencing a rerun of the 1920s?

Potentially the most important issue at hand for investors is whether the extreme bifurcation between Winners and Laggards – growth and quality versus cyclicals and disruptees – is here to stay, or are we in the early stage of trend reversal?

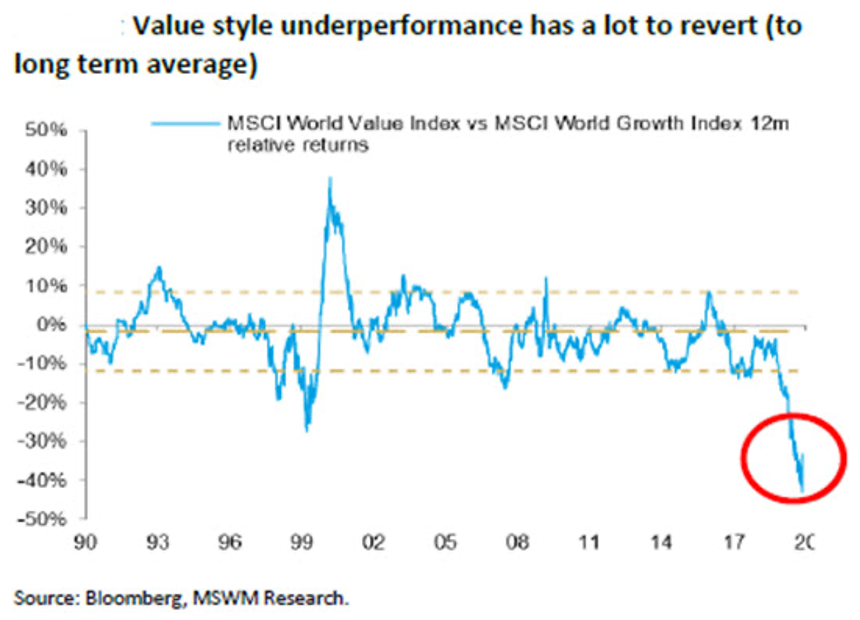

The chart below, from Morgan Stanley, captures the extreme polarisation that characterises equity markets in 2020. It only takes one instant to realise the gap between winners and laggards has never been this wide; not since the 1990s, and possibly never, full stop.

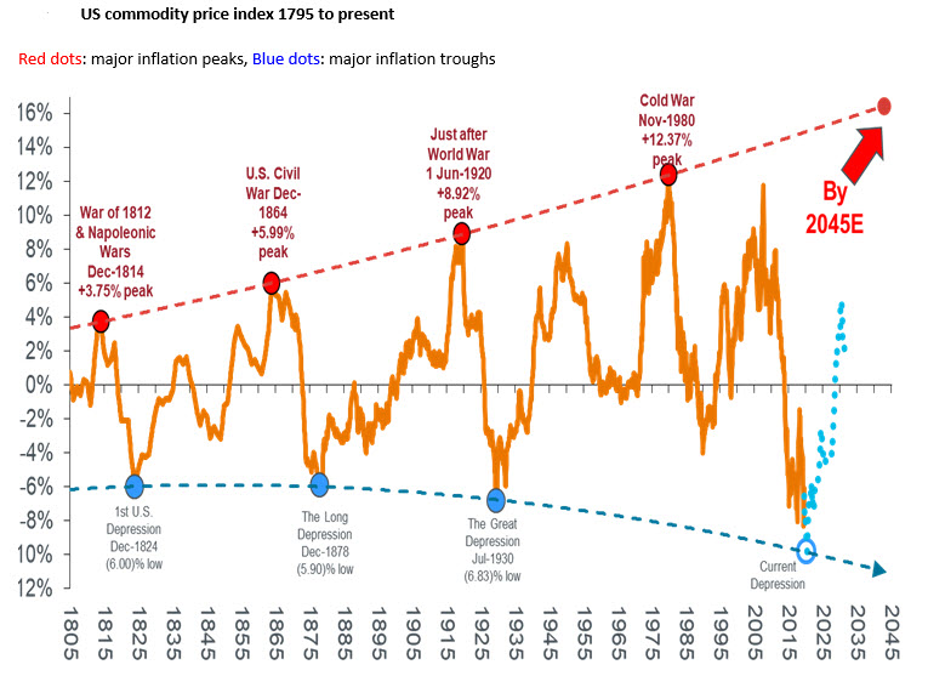

Things get even more interesting if we add the chart below from Janus Henderson, suggesting commodity prices as a group are once again scraping the bottom of one down-cycle, ready to start a new cycle and make up for the lost ground post-GFC.

Of course, the Janus Henderson capture leads us to another chicken versus egg Grand Debate: do we need inflation to pick up to make the revival of commodities and “value” stocks sustainable? Or do commodities and value stocks first need to recover substantially in order to push inflation back on everyone’s agenda?

That debate won’t be settled any time soon if 2021, as widely expected, will bring us the global economic recovery that favours higher bond yields, a weaker US dollar, rising prices for commodities and a recovery in profits for the cyclicals and those companies battling disruption.

But what exactly comes after the natural recovery from the economic trough? That will be the Grand Debate about one year from now: continuous mean reversion, or not?

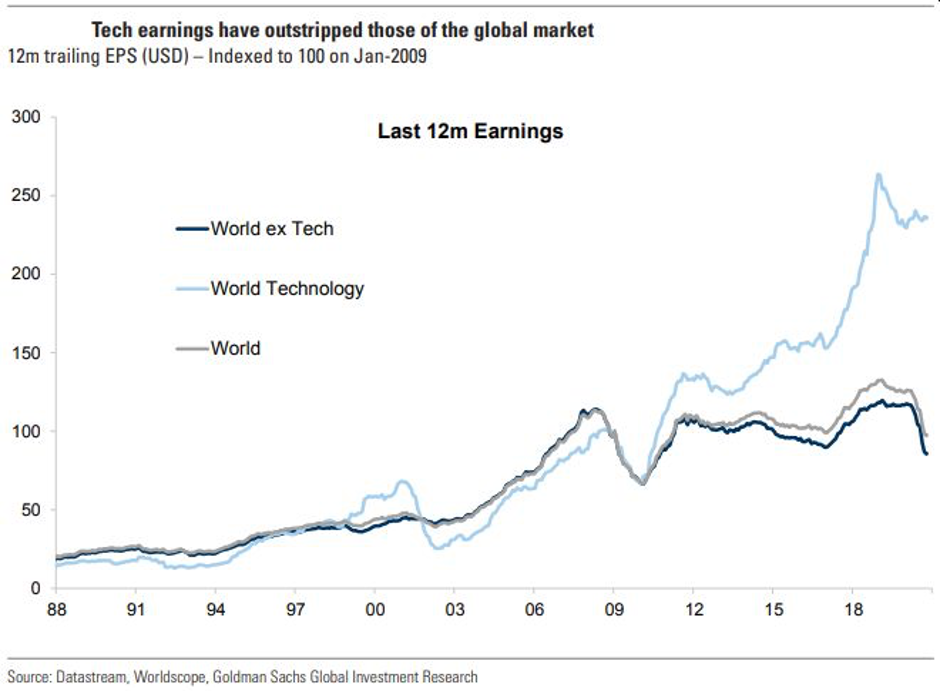

Before anyone tries to answer the question, first look at the chart below, from Goldman Sachs, showing how much the polarisation in the share market has simply mimicked the extreme divergence in corporate profit growth post-GFC.

That Goldman Sachs chart at least settles one Grand Debate from the years past: investors have not been as irrational as some critics would have us believe; they have simply followed the diverging trend in corporate profitability.

Now for the $60 million question: what is your forecast for corporate profits beyond recovery-year 2021? Let the Grand Debate begin!

One thing investors can't ignore in 2021

The above wire is part of Livewire's exclusive series titled "The one thing investors can't ignore in 2021." The series will culminate in the release of a dedicated eBook that will be sent to readers on Monday 21 December. You can stay up to date with all of my latest insights by hitting the follow button below.

1 topic