Investors chase 52-week highs, but not all stories are equal

A stock at its 52-week high commands attention. It could signal momentum, a company rewarded for growth, or a sector basking in renewed optimism. On today’s ASX, the list of highs maps where investors are putting their trust.

Yet, it’s a double-edged signal – strength can quickly morph into exuberance, and knowing the difference is the real edge. Every rally leaves a trail of winners, and the 52-week high list tells their story.

These are stocks riding strong earnings, sector tailwinds, or sheer market momentum.

For some, a record high signals strength and resilience, proof that management is executing and confidence is building.

For others, it raises a tougher question: are these companies breaking into new territory – or just stretching valuations to unsustainable peaks?

Markets are never even. Some names languish, while others rewrite records and notch new highs. They capture confidence through results, structural shifts, or momentum feeding on itself. The challenge for investors: how much optimism is already priced in?

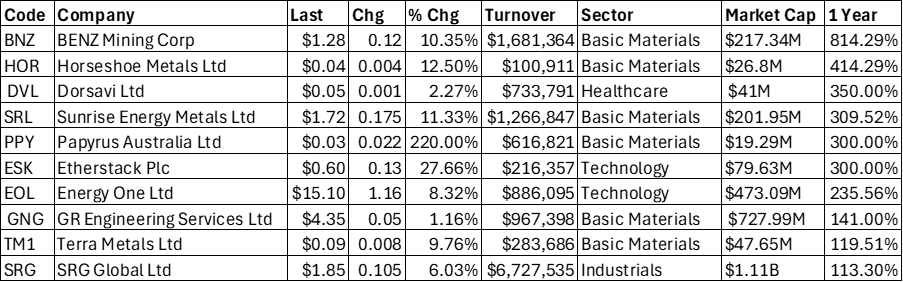

To test that, we’ve highlighted the top 10 highs by sector – spotting leaders and potential over-heaters.

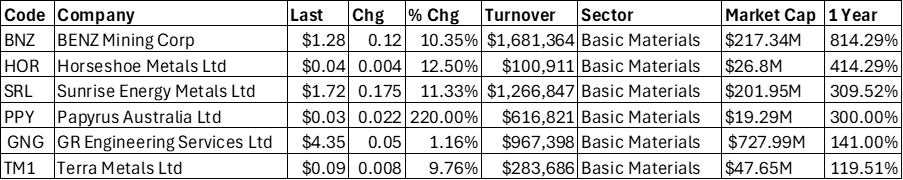

Basic materials - riding the commodity wave

The Basic Materials sector has been a standout on the ASX, with several stocks hitting 52-week highs as investors chase critical resources. Gains have been strongest among smaller-cap explorers and niche producers, where speculative flows meet the green energy transition.

Benz Mining (ASX: BNZ) leads the charge with an eye-watering 814% one-year return, fuelled by lithium and battery metals exploration. Horseshoe Metals (ASX: HOR) has also surged on copper optimism, posting a 414% gain, while Sunrise Energy Metals (ASX: SRL) is up 309% on nickel and cobalt demand.

Papyrus Australia (ASX: PPY) grabbed attention with a 300% rise by riding ESG capital, and Terra Metals (ASX: TM1) gained 119% on battery metals exploration. Among steadier names, GR Engineering Services (ASX: GNG) climbed 141% on strong mining project demand.

Together, this sector's highs reflect momentum in electrification metals, speculative inflows into small caps, and steady project activity for service providers.

The challenge for investors: separating sustainable growth stories like Benz, Sunrise, and GNG from higher-risk, sentiment-driven plays.

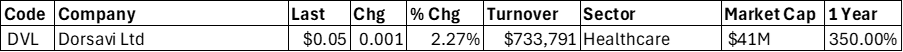

Healthcare - a small-cap standout

The Healthcare sector hasn’t seen the same broad rally as resources, but one small-cap name has quietly been rewriting its story.

Dorsavi (ASX: DVL), a wearable sensor and movement analytics company, has surged 350% over the past year, marking one of the sharpest climbs in its corner of the market.

With a $41 million market cap, the outlook hinges on converting pilot projects into recurring contracts and scaling globally.

Execution risk is high, but if adoption grows, the upside case is compelling. Dorsavi’s run highlights investor appetite for small-cap healthtech aligned with digital transformation and preventative care.

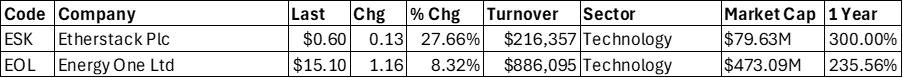

Technology - momentum meets market demand

The ASX tech space is no stranger to volatility, but two names have stood out by delivering outsized gains over the past year.

Both Etherstack (ASX: ESK) and Energy One (ASX: EOL) have climbed sharply, riding different narratives but pointing to the same investor appetite for scalable, high-demand solutions.

Etherstack surged 300% over 12 months, with demand for secure wireless communications making it a leveraged play on defence and emergency networks. With a $79.6m market cap, its growth hinges on contract wins and recurring revenues.

Energy One delivered a similarly impressive 235% return, backed by its software for energy trading and risk management. With a significantly larger $473 million market cap, EOL is increasingly seen as a scale player with the ability to expand its footprint internationally.

Together, the pair reflect two sides of ASX tech: ESK as a speculative, high-beta bet, and EOL as a structural growth story with scale.

Industrials - building on momentum

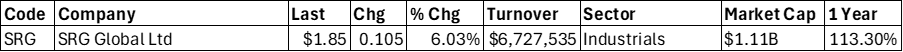

The Industrials sector has quietly carved out its own rally, with SRG Global (ASX: SRG) leading the charge.

SRG has surged 113% in a year, driven by strong earnings and confidence in its ability to capture infrastructure and mining spend. The engineering and maintenance group balances cyclical exposure with long-term contracts, making it a standout in the sector.

With a $1.1b market cap and diversified revenue streams, SRG offers dual exposure to government infrastructure and resource projects. The outlook is constructive, though execution on margins and growth will be key.

Unlike speculative plays, its 52-week high reflects fundamentals aligning with macro trends—making SRG a balanced way to ride the Industrials upswing.

For investors seeking exposure to infrastructure growth and mining services, SRG Global offers a relatively balanced way to play the Industrials upswing.

Two sides of the market rally

Small caps like Benz Mining, Horseshoe Metals, Etherstack, and Dorsavi capture the high-beta excitement of the market, outsized potential, but are heavily tied to sentiment and execution.

In contrast, mid-caps such as GR Engineering, SRG Global, Sunrise Energy Metals, and Energy One show how scale and recurring revenue can anchor growth in the same structural themes.

With rates easing and risk appetite improving, both ends of the spectrum are finding support. For investors, the real opportunity lies in balance, blending nimble, high-upside small caps with steadier mid-caps positioned for long-term tailwinds.

Momentum is being rewarded, but only those companies that can turn thematic buzz into sustainable growth will prove worthy of their highs.

The challenge - and the edge - comes from picking which stories endure once the rally cools.

4 topics

10 stocks mentioned