Is it all over for the WAAAX stocks (or is this just a dip to grip)?

Once the darlings of the ASX, the WAAAX stocks have recently tumbled from their throne. It would appear the hullabaloo around inflation (utter kryptonite for stocks trading at sky-high valuations) has finally taken its toll.

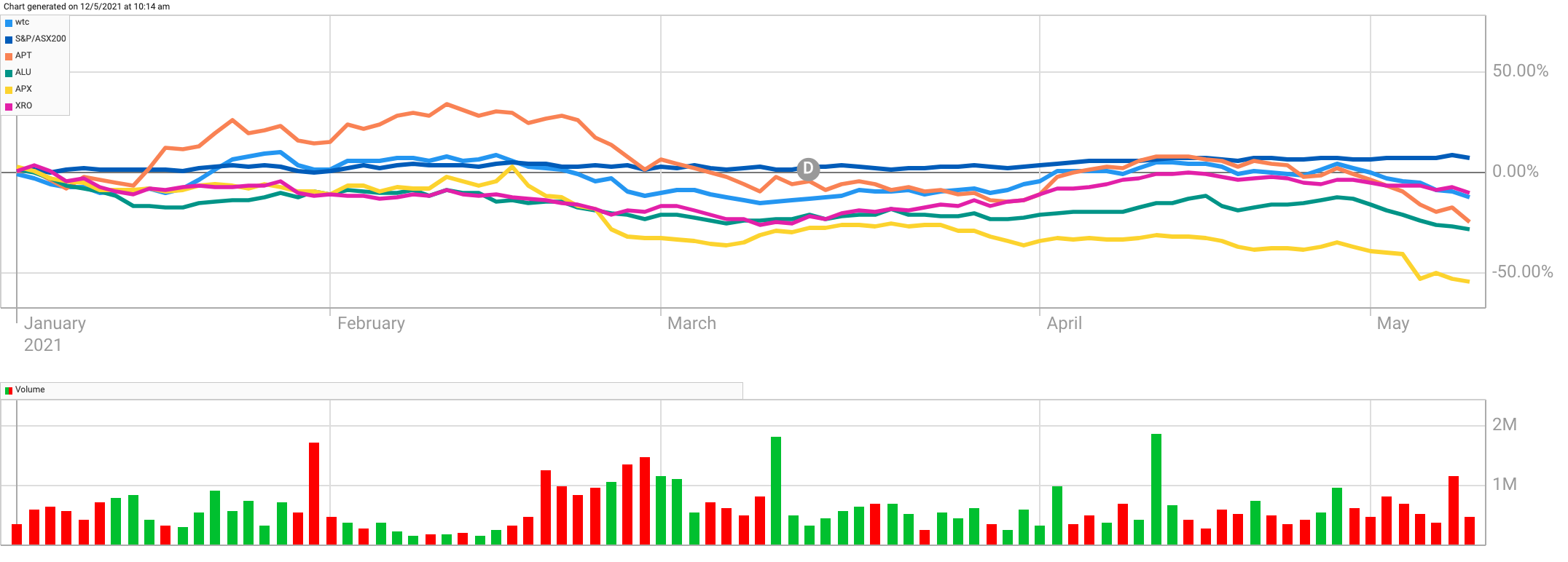

Since the beginning of the year, these tech titans have together fallen 133% (or by an average of nearly 27%), while the benchmark S&P/ASX 200 has lifted more than 6%, surpassing its monumental 7100 mark.

.png)

Meantime, the ETF tracking the performance of Australia's listed tech companies (the BetaShares S&P/ASX Australian Technology ETF) has fallen 11.5% YTD. However, it is still up more than 45% since it listed last March.

WAAAX AND WANE: 2021 PERFORMANCE AT A GLANCE

WiseTech Global (ASX: WTC): -11.80%

Afterpay (ASX: APT): -25.21%

Appen (ASX: APX): -56.02%

Altium (ASX: ALU): -28.95%

Xero (ASX: XRO): -11.15%

The NASDAQ has similarly suffered a volatile ride over the past few months. And while Facebook, Amazon and Google's (Alphabet) share price have lifted 14% and 0.12% and 33% since the beginning of the year, Apple, Netflix and Tesla have fallen 2%, 7% and 14%, respectively.

In fact, Bloomberg only yesterday reported that Cathie Wood’s Ark Innovation ETF - a bellwether for the second tier of the tech market - had plunged to a six-month low, with all but five of its 58 holdings cascading in the broader tech sell-off.

And yet, central banks haven't exactly given the green light to rising interest rates. In fact, the market seems to be greatly at odds with the stance of the world's monetary policy masters. The US Federal Reserve is steadfast on keeping rates near zero this year, while the Reserve Bank of Australia's Phillip Lowe has indicated rates will stay at 0.1% for the next few years.

So is there further pain ahead for tech stocks? Or is this just a momentary dip, an opportunity for investors to grab with both hands?

We have gathered three portfolio managers to answer these very questions, including QVG Capital's Chris Prunty, Totus Capital's Ben McGarry and Tribeca Investment Partners' Jun Bei Liu.

The fundamental question: How much of this sell-off is actually being driven by technical factors?

McGarry argues the sell-offs in the WAAAX and FAANG stocks are linked, driven by fears of inflation.

"The sell-off in tech and high valuation stocks here and offshore is not being driven by individual businesses prospects or fundamentals but is all about rising inflation pressures and what this means for interest rates, valuations and the cost of capital for companies," he says.

"Equities have been operating in an environment of zero cost capital for the last 12 months which has been hugely supportive for high PE and no PE stocks but as rates rise gravity starts to kick back in and this is what we are seeing now in the high flying growth names."

Similarly, Liu believes most of this sell-off has been driven by a shift in sentiment in offshore markets.

"We have talked to this theme since late last year when bond yields bottomed and economic recovery gathered momentum globally," she says.

"Fundamentally, most of the structural growth leaders have met lofty expectations in the past six months, however, their cyclical peers have substantially outperformed expectations in some cases doubling forecasts."

She argues the current sell-off is simply a case of investors taking profits from their investments in some of the growth leaders that have delivered substantial returns over the past 12 months.

"(Now, they are) rotating into underperforming sectors that are expected to have a better 12 months in a post-COVID-19 world," Liu says.

Meanwhile, Prunty argues the sell-off we are witnessing has been driven by both technical and fundamental factors.

"In a world that doesn't grow, i.e. pre-COVID-19, the only place you can find growth is in certain sectors like technology and healthcare," he says.

"But in a world post-COVID, where there is an enormous amount of fiscal and monetary stimulus that gives cyclical companies a leg up, some of those value stocks start to look like they have a little more growth on a relative basis."

With an improved global growth outlook, the relative earnings for these cyclical stocks doesn't look "so bad" - and thus, both institutional and retail investors are funnelling their money towards them, he says.

"It’s an overused word but the fact that certain sectors such as tech are down well more than the market and others like Resources are outperforming suggests that the dreaded R-word – Rotation – goes a long way to explain what we’re seeing in markets," Prunty says.

"As for tech, it’s really a two-speed market. At the large end, it’s hard to argue mega-cap tech fundamentals in the US are bad; the FAANGs are still delivering outstanding earnings results. Having said this valuations of second and third-tier tech stocks got overcooked and this is where we are seeing an understandable correction."

This trade has accelerated recently due to technical factors, he says, with leveraged investors de-grossing and reducing their exposures.

"Usually, when there's such dramatic moves, you'll look back in a week or a month and someone's blown up. Typically, a highly levered hedge fund or family office in the US," Prunty says.

"And I suspect we're going through one of those periods, right now."

How low can they go?

Prunty says one lesson from COVID-19's financial crisis is that "share prices can go far further than anyone thinks". However, with a longer-term view, he believes there is "quite a lot of opportunity" emerging within the tech sector.

"For the most part, the technological trends, like digital payments, are very much intact and they're not going away," he says.

"For something like e-commerce though, which has gained a massive three to five-year tailwind from COVID-19, people are now figuring out that they're actually not great businesses. Yes, they've got heaps of revenue coming their way. But at what margin?

"So it's a little bit more nuanced; stock by stock, sector by sector, but for the most part the rotation and the movement of money doesn't invalidate those secular trends at all, it just a reflection that people are performance chasers and the long term is made up of a lot of short term moves."

McGarry agrees that investors need to be careful picking which stocks to back over the coming months, arguing returns are likely going to be mixed over the coming months.

"In some of the FAANGS, we think there is already some decent valuation support. Facebook for example is now trading on about 20x PE ex-cash which is very cheap for a business of its strength and scope growing profits at 30%," he says.

"In some of the other tech names, particularly the loss-making ones and the WAAAX stocks that are already in downgrade cycles (for example, Altium (ASX:ALU) and Appen (ASX:APX) it is probably too early to buy the dip."

Meantime, Liu's overall view of the market remains strong, in spite of the fact that "one of the hardest things to do in the share market is to pick the very bottom and or peak of the turning point, without access to a crystal ball".

"Economic growth continues to improve, supported by a dovish RBA which despite upgrading its outlook over the past month, has continued to emphasise the need for ultra-accommodative policy support in order to bring the unemployment level lower," she says.

She also notes that while the vaccine roll-out has been "disappointing", it does not dent Australia's improving economic outlook, with activity nearly recovering to pre-COVID-19 levels across the country's states and territories (except Victoria).

"The May budget should provide a strong commitment by the government to continue its expansionary fiscal stance as it continues to pursue a growth mandate," Liu says.

What quality companies have been caught in the tech sell-off's net?

Liu notes that typically during growth sell-offs, higher-quality (hence more expensive) stocks can be disproportionately impacted.

"Investors are indiscriminate when it comes to selling those stocks during the early phase of a sell-off, essentially to take risks off the table," she says.

"We will then see the high-quality names recover as selling slows and investors come back to pick bargains."

An example of this is Xero (ASX:XRO), Liu says, which was heavily sold off in March, but recovered quickly in April - lifting more than 40%.

"This is a good example of how quality names will eventually find support from long term investors," Liu says.

As mentioned above, McGarry points to Facebook (NASDAQ:FB) as a quality name, and argues Alphabet (NASDAQ:GOOGL) and Microsoft (NASDAQ:MSFT) both currently look attractive.

"Year on year growth rates will slow in the second half as these companies cycle the very strong post-COVID-19 recovery but earnings will be growing off that higher base. This is very different to other sectors like retail which are likely to post negative growth in H2 as the economy opens up the stimulus bump fades," he says.

"The pandemic has entrenched the moat of these secular winners and owning them is much easier than trying to second guess when the music will stop in sectors like banks or resources (where near term prospects are good but the longer term is less certain)."

On the local front, Prunty currently likes the look of EML Payments (ASX:EML), HUB24 (ASX:HUB), Afterpay (ASX:APT), Dicker Data (ASX:DDR), Tyro Payments (ASX:TYR) and Objective Corp (ASX:OCL).

"We’re also believers in RedBubble (ASX:RBL) but won’t know whether we’re right there for quite some time," he says.

What you really came here for: A definitive ranking of the WAAAX stocks from best to worst

Since the beginning of the year, WiseTech's share price has fallen 12%, while Afterpay is down 25%, and Appen, Altium, and Xero have fallen 56%, 29% and 11%, respectively. So, we thought we would put it to McGarry, Prunty and Liu to see which stocks they think currently present the best opportunities, and which are the worst - and the verdict is in:

McGarry's best to worst:

- Xero – Great business with sticky customers, ho-hum competition and a long runway of growth ahead. But you are paying for it. Could be at risk of disappointment at its result later this month given the multiple. The last founder selldown was at $100 per share.

- WiseTech – There is a real software business in there growing organically but probably not as fast as it needs to given the multiple. Founder selling keeps a lid on price during this rotation out of growth.

- Afterpay – Market leader in BNPL, best in class management but loss-making and capital hungry isn’t a great combo as interest rates rise. Founders also selling.

- Altium – A well-run company in an attractive market niche but too hard given smallish TAM, already in a downgrade cycle with downside risk to current guidance.

- Appen – Customer spending priorities changing and competition in the sector heating up. The company has almost no visibility on customer intentions so it is difficult to see how investors can either. Plenty of insider selling here too albeit at a higher level.

Prunty's best to worst:

- Afterpay - Highest growth, largest TAM, most customer love & network effects which provide a sustainable competitive advantage.

- Xero - Highest earning certainty and durability given very low customer churn. Upside from potential to increase revenue from existing customers via new products.

- WiseTech - Most improved award. Good customer wins and more of the growth is coming organically but needs to accelerate to justify the premium valuation.

- Altium - Growth slowing. In the sin bin until they hit their numbers.

- Appen - Too much customer concentration and low value add always kept us on the sidelines.

Liu's best to worst:

- Afterpay - Global leader at an early stage of adoption of its product with the most growth potential.

- Xero - Best quality SAAS business listed on the Australian share market.

- WiseTech - Significant upside if management can execute on an ambitious plan to digitise freight forwarding and customs processes.

- Altium - Quality player with earnings cyclicality impacting near term outlook.

- Appen - Appears cheaper on valuation, though it has less earnings visibility than peers.

What catalyst should you look out for to jump back in?

Prunty argues "the market likes to take the path of maximum pain". And accordingly, investors should look out for a full rotation away from Tech to Resources and Cyclicals as a sign that money is about to "slosh back in the other direction".

"So you really want to see some sign of capitulation or people giving up on tech stocks, and evidence of that usually would be seen in redemptions from managers that are publicly and strongly in favour of tech stocks," he say.

"So if you started to see something like Cathie Wood's Ark go into redemption mode, that's usually a good sign of capitulation. Margin calls on tech-focused funds is also a good sign of being at the bottom.

"But really it's just when the marginal investor is positioned on the other side of the market... That's about the time at which the market starts to rotate back in the other direction."

Meantime, McGarry argues that a shift in interest rate and economic recovery expectations will be key.

"At some point there is always a buyer for quality profitable companies that are growing but for “growth” companies to regain market leadership over cyclical and value names we may need to wait for signs that this inflation spike is transitory (as the fed has been saying) or for the economic recovery to stumble and send interest rates back down," he says.

Liu agrees, arguing for growth leaders to regain their momentum the key will be the stabilisation of the inflationary outlook and bond yields.

"The challenge is over the next 6 months we will see some of the most extreme inflation stats in the US, despite it being transitory," she says.

These stats could continue to impact confidence in the sector over the next 6 months.

So, are you buying the dip?

Our fundies believe there still to be opportunity within the tech darlings of the ASX and NASDAQ. But what do you think? Have you been buying the dip? Or is it time to sell out of the tech titans?

Want more content like this?

Hit the 'follow' button below to be notified every time I post a wire or hit the 'like' button to let me know you enjoyed it.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

3 topics

10 stocks mentioned

3 contributors mentioned