Is the Retail Sector finally looking for a bottom?

Today’s report is again going to look at the retail stocks following Gerry Harveys volatile comments at Harvey Norman’s (ASX: HVN) recent AGM including a declaration that critics of the retailer were “totally friggen mad”.

Australian Retail, is now the time?

The concerns around the levels of Australian household debt is now a well-trodden path which has helped apply pressure on our retailing stocks. The sector as a whole has fallen over 25% since mid-2016 while the broad market was rallying strongly.

The performance of some household names over 3-months also makes for un pleasant reading e.g. Harvey Norman (ASX: HVN) -15.4%, Webjet (ASX: WEB) -29.8% and Super Retail Group (ASX: SUL) -25% raising the common question at present – “is it time to be brave and buy this falling knife?”.

Today I have looked at 4 “battered” stocks within the sector looking for value.

Australian Retail Sector Chart

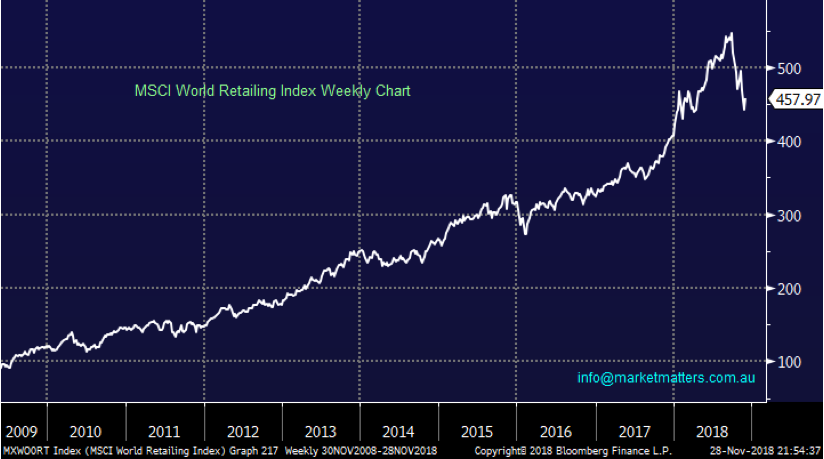

It’s unfortunately a sad story when we compare the Australian retailing sector to that of the whole world which has simply soared since the GFC. However, recently we may have seen a 20% correction as investors have focused on a potential US recession in 2019 / 2020 but technically we would now be buyers for at least a 10% bounce.

The comments overnight by Jerome Powell can be interpreted in 2 ways; either classic glass half full or half empty stuff!

1. A slowing of interest rate hikes in the US should help retail as consumers have more $$ in their pocket + importantly there’s less chance the US will be pushed into a recession in 2019/ 2020.

or,

2. The Fed is also becoming concerned around the US economy moving forward and a recession may well be on the horizon.

MSCI World Retailing Index Chart

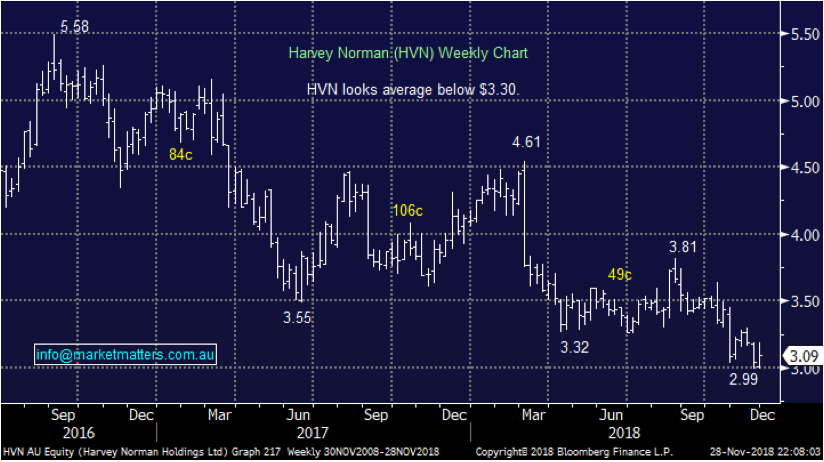

1 Harvey Norman (ASX: HVN) $3.09

HVN has been under pressure recently for a number of reasons but simply as housing prices fall and people move less often the demand to spend on household goods and appliances falls away i.e. Harvey Normans' bread and butter. They also hold $3.6bn worthy of property on their balance sheet which has fallen in value in recent times.

While we believe this trend has further to unfold stocks generally travel at least 6-months ahead of fundamentals so we question if HVN is now too cheap – Gerry certainly thinks so!

HVN has a large 8.8% short position telling us professional investors believe the stock has further to fall. HVN is cheap, trading on an Est. PE for 2019 of 10x while yielding almost 10% fully franked which is attractive but HVN has been a classic “yield trap” of late as the stock has fallen significantly in 2018. Also worth noting they have a huge franking credit balance that Gerry will want to do something with before Bill Shorten moves into the Lodge.

MM is now neutral to slightly positive HVN with the stock slowly becoming tempting for our Income Portfolio once again

Harvey Norman (ASX: HVN) Chart

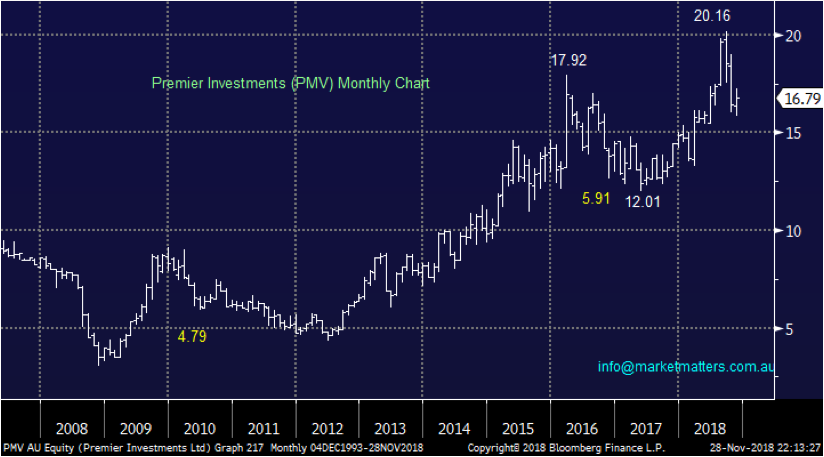

2 Premier Investments (ASX: PMV) $16.79

Interestingly PMV looks a lot like much of the ASX200 to MM i.e. bullish short-term for a bounce but bearish in the bigger picture, in this case with an eventual target under $13.

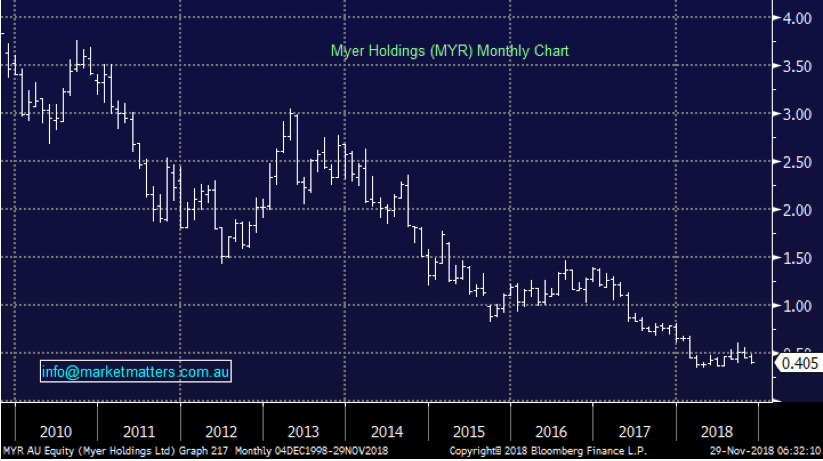

PMV has been in the press a lot recently as major shareholder Soloman Lew agitates for change at embattled department store Myer. PMV owns ~88.5m shares, more than 10% of MYR - definitely not a good investment at this point in time showing a paper loss of more than 50%.

We can see PMV making a play for MYR at some stage but then the hard work begins, turning that tanker around will be no easy feat. Interestingly, Geoff Wilson’s WAM owns ~44.8m shares in MYR having paid 50c for them in September.

MM is mildly positive PMV in the short-term targeting the $17.25 area but bearish into 2019 / 2020.

Premier Investments (ASX: PMV) Chart

Myer Holdings (ASX: MYR) Chart

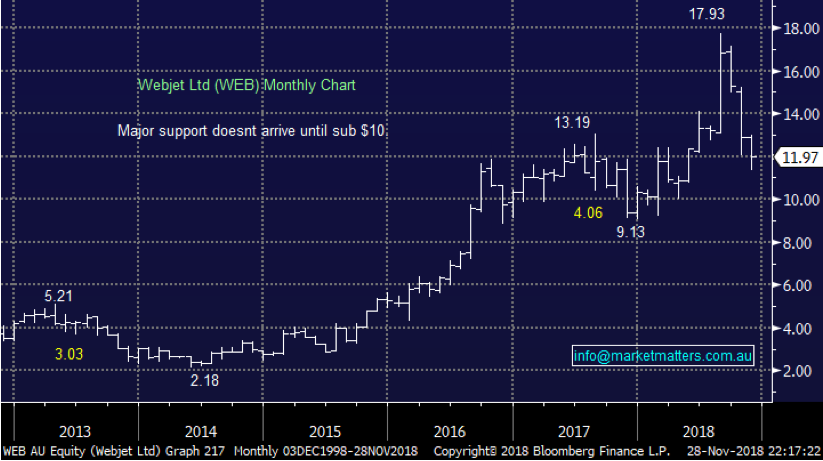

3 Webjet (ASX: WEB) $11.97

MM has enjoyed some solid success with WEB having realised an almost 40% profit selling our holding back in June well above $13 – it felt premature in August but looks correct today.

The stock came under pressure earlier this month following managements earnings guidance for 2019, not what many wanted / expected!

Plenty of investors will be long WEB from $11.50 where it raised capital to help fund the company’s acquisition of Destinations of the World (DOTW). Time will tell if the costs savings from this takeover unfold as WEB hope but risks clearly remain as the online business strives to maintain exciting levels of growth.

MM remains bearish WEB eventually targeting sub $10.

Webjet (ASX: WEB) Chart

4 JB HIFI (ASX: JBH) $23.15

JBH has chopped around the $25 area in a volatile manner for the last few years as the market continues to second guess what comes next for the retailer.

The stock is now the most heavily shorted on the ASX with almost 20% of its shares “sold short”, almost double Myer which now ’only’ has a 11.2% short position – we rarely like trading against professional traders as their very existence tells you they get its right more than wrong.

This is a large negative position considering the business is performing well with consistent profits / dividend growth. We assume the “shorts” are betting the electronic & white goods retailer will see its margins and market share decline due to competition from online overseas rivals like Amazon.

MM remains neutral JBH.

JBH HIFI (ASX: JBH) Chart

Conclusion

MM found nothing compelling in the stocks discussed above

From an income perspective, we remain comfortable holders of Nick Scali (ASX:NCK) & Super Retail (ASX:SUL)

Want to receive daily market updates?

Market Matters publishes daily market reports and sends SMS alerts when we transact on our portfolio. To get our latest market views and hear when we take new positions, trial Market Matters for 14 days at no cost by clicking here.

6 stocks mentioned