Is this the global macro landmine no one is talking about?

While all eyes are on the recent rise in yields, the debate has largely been centered around inflation expectations and how far the Fed will actually let inflation run before raising rates. While all this is all very interesting and sounds smart and logical, there is a much more concerning issue, deep within the technical plumbing of money markets, that equity traders are mostly unaware of.

On February 23rd 2021, testifying before congress, Jay Powell was asked the following question, and his answer, although somewhat vague, should have warranted a much more intense interrogation.

Question: Senator Rounds: It would appear Congress is going to create even more bottlenecks in our financial plumbing by flooding the economy with about $1.9 trillion in new money, that banks will have to hold capital against as soon as the treasury starts writing the checks. My question is would you agree that it makes sense to seriously consider extending the SLR exclusion, given the other measures the Fed and Congress are taking to facilitate our economy’s recovery?

Answer: Jerome Powell: So I do think that the SLR exclusion, I know it expires at the end of March, and we actually haven’t made a decision on what to do. It’s something we’re in the middle of thinking about right now. And so I’m just going to have to say that we’ll be making a decision in announcing pretty soon here.

So what is the SLR?

The supplementary leverage ratio, or SLR, requires banks with more than $250 billion of assets to maintain an extra cushion of high-quality capital against their total assets. Banks must maintain a minimum 3% ratio against their total leverage exposure. The ratio is 5% for the largest bank holding companies. In April 2020, the Fed allowed U.S. Treasury securities and deposits held by commercial banks at Federal Reserve Banks to be excluded from the calculation of total leverage exposure for purposes of the supplementary leverage ratio. This exclusion however, expires on March 31st 2021.

And, why does this matter?

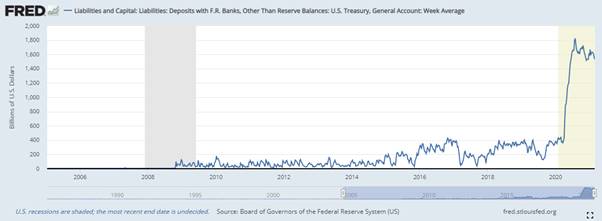

Its all related to the Treasury’s General Account, the TGA, which is essentially the governments bank account that holds the proceeds of selling T-bills. The proceeds are a liability on the government balance sheet and the funds are supposed to be spent on government bills, stimulus payments and anything they need to fund. Former Treasury Secretary Steve Mnuchin allowed the account to skyrocket to $1.6 trillion. To put this into perspective, the account generally held ~$5bn prior to 2008, and more recently between ~$150bn on average.

Current Treasury Secretary, Janet Yellen recently outlined plans to reduce the TGA account (remember it is a liability) from $1.6trillion to $800 billion by the end of March, and then further to $500 billion by the end of June. That’s a whopping $1.1trillion of liquidity that is being unleashed into the system within a very short time frame. So big, it has been dubbed a “tsunami of liquidity” into the economy.

.jpeg)

Yellen needs the account to be at a more manageable size for several reasons, the first being she needs it to meet 2019’s debt ceiling requirements for holding no more than $120 billion in the TGA by August this year. But whatever the reason, the cash needs to be deployed somewhere, and the first stop is usually the banking system. Banks have previously been able to absorb this liquidity and allow their reserve accounts at the Fed to grow dramatically. But commercial banks currently hold $3.4 trillion in reserves and they probably don’t want to hold anymore earnings almost 0% interest while inflating their leverage ratios to uncomfortable levels which will only limit lending and risk another repo rate market explosion.

This comes at a time where there is a shortage of collateral that the banks can find in the market to hold against a wave of cash. The Treasury has been reducing its T-bill issuance in order to extend the duration of its debt portfolio and take advantage of the lower longer term interest rates. Banks simply cant comply with the SLR requirement.

So Fed Powell has one clear option, extend the temporary exemption of bank reserves and treasury securities from the supplementary leverage ratio (SLR) calculation and/or increase the leverage ratio. But, as explained above, there is no incentive for the banks to participate. In fact, releasing so much liquidity into the system lies another problem, money market rates are already trading close to 0%. This sort of influx can take short-term rates into negative territory.

BAML bond strategists like Mark Cabana thinks the Fed will have to raise IOER (interest on excess reserves) to keep rates from slipping below zero. This would be a “technical” rate rise and not one associated with any kind of change in its policy stance, but how would it be viewed by the Market? The real net effect will be a steeper yield curve, as the long end continues to rally, the short end will be fighting to hold above zero. At the end of the day, its the rate of change that determines how the market views rising rates. And all this is taking place at a time when markets are already nervous about inflation and financial market bubbles.

While we all like to sit back and debate on inflation and the rising 10yr yield, we should be more concerned about what is happening at the short end and how steep the curve can go. How will the market react to a IOER rate rise, despite it being strictly technical in nature? How much of this excess liquidity finds its way to the equity market? And what does this mean for the US Dollar?

10yr vs 3mth yields: While 10yr rates are rising, short term rates have been trading lower, the risk is a test of 0%, and potentially negative rates:

.jpeg)

4 topics