It’s over but its not too late

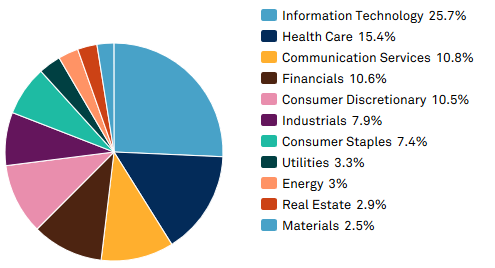

Wall St up again. It's a wonderful thing. But it's a technology sector thing in the US and as you all know, our technology sector is not big. Theirs is. Here is a sector breakdown of the S&P 500. Technology is now 25% of their market.

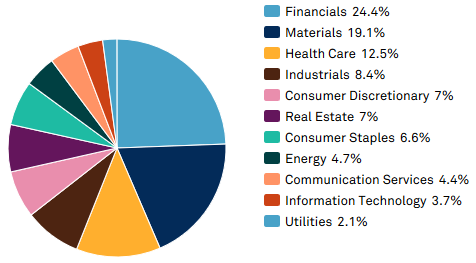

This is our sector breakdown, the sector breakdown of the All Ordinaries index – 3.7% Technology.

You'll also notice our other big differences, we have 24.4% financials (which have been badly hit), they have 10.6%, and we have 19.1% Materials (Resources – which are much in line with the market) and they have 2.5%. Healthcare is similar and has performed well.

With no Technology and too many boring 'no-growth challenged by zero rates' banks, of course the US market has performed much better than ours.

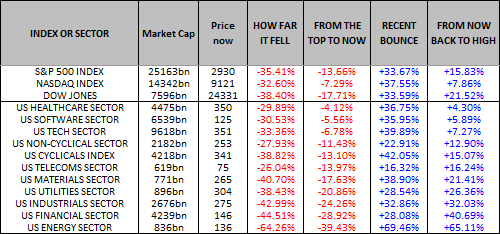

The S&P 500 is now 13.7% from the top. Our market is 24.7% from the top. The NASDAQ is now the best performing market since the top and is down just 7.3% and is up for the year. The US Technology sector is up 39.89% in 34 days, the S&P 500 is up 33.67% in 34 days.

Bottom line – To perform well so far you had to:

- Pick the top.

- Pick the bottom.

- Focus on our small technology sector for the rebound.

- Be heavily overweight healthcare the whole time.

- Avoid the banks.

And you'll find, any fund manager that has performed well did just that, cashed-up early, got back in early, was underweight banks, overweight healthcare, and was not scared of the small technology stocks.

STILL PLENTY OF OPPORTUNITY

It is hard to imagine the circumstances that could take us back to the low on March 23, circumstances that would match the peak of a full blown headless panic. So we won’t.

As the markets see the light at the end of the tunnel on COVID-19, some of you may be feeling that you've missed the bounce (Afterpay is up 397% from the bottom for instance), but there is still plenty of opportunity around.

Up until now the focus has been on 'the market', getting the big herd movements/moments right, selling at the top and buying at the bottom. From here on, assuming no CV-19 relapse, more shutdowns (it would kill the market) and another down-leg, there is a good chance that the "big moments", the top and bottom pivot points, have passed.

In which case you have to look into a bit more detail than just 'the market'. You have to go to sector level now.

Here are the US sector performances from the top:

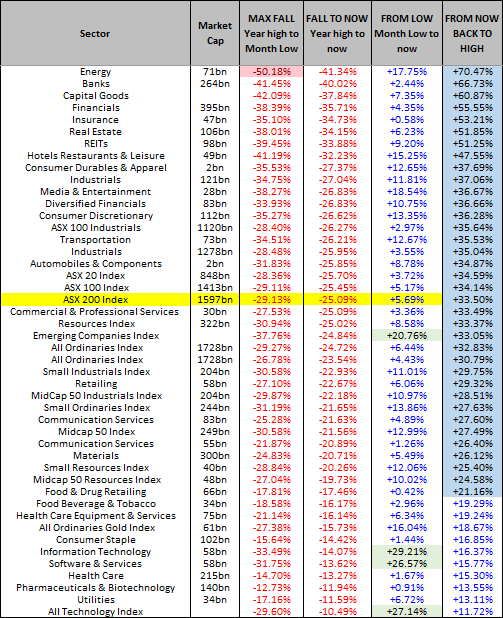

The obvious message is that even though the US market is on a technology sector tear, strip that out of the US performance and they are following the same profile as us. Energy is still down 39% (our energy sector down 41%), financials 28% (ours down 35%). Our numbers are similar – here are all our sectors in order of worst first from the top to now:

The point is that you haven't missed the opportunity CV-19 has presented, not yet. There are still plenty of opportunities. Yes you may have missed, Paypal, and Amazon and Netflix, but you haven't missed the chunky middle of the market that has not recovered.

Ideas below.

Meanwhile here are some Strategy Comments to help you focus:

No need for a second and third wave - There are a number of doomsday articles that try to relate the GFC correction to this correction. The argument goes that the anatomy of a Crash includes a sharp drop, a rally, another sharp drop, a rally and the final sharp drop. We saw a similar sort of profile in the October 2018 correction. But it doesn’t have to be that way. Not all corrections are the same. The GFC was a developing event. So was the trade war narrative behind October 2018. The coronavirus is an event. It peaked, its improving, so there is no reason the market should dip, rally and dip again. The use of past statistics as a prediction for the future isn't analysis, it’s lazy. There is no need for a second and third wave just ‘because’.

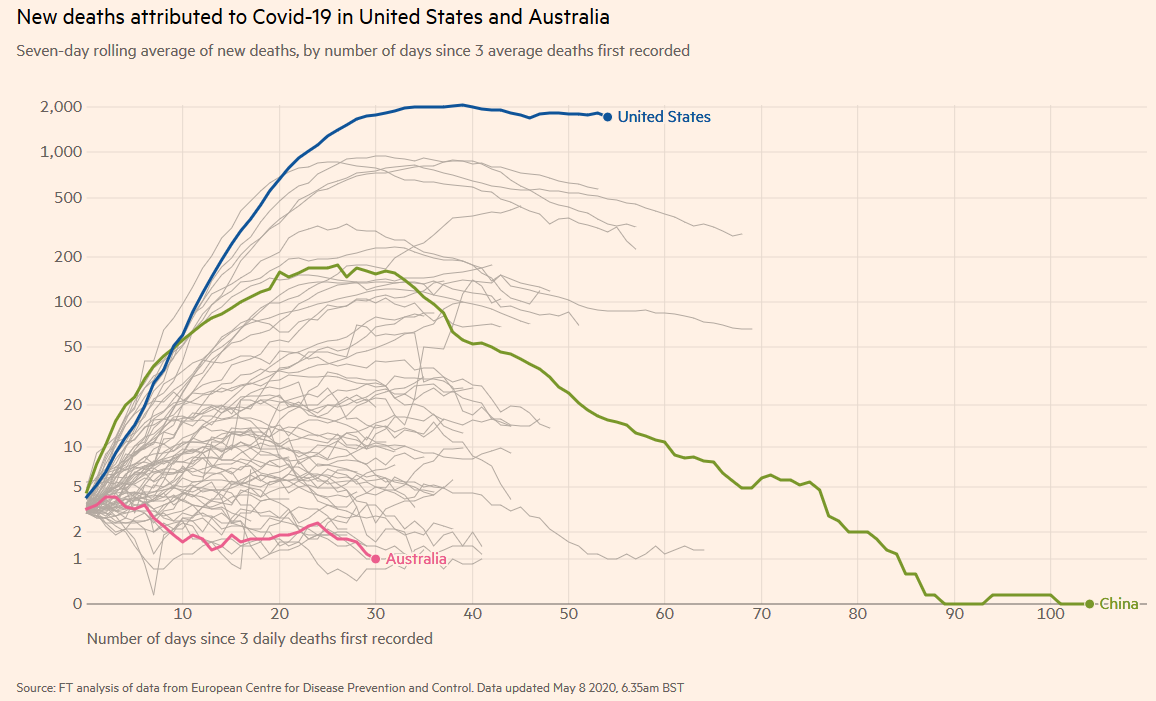

The biggest risk – This excellent Financial Times chart shows you that perhaps the US is coming out of lockdowns too early. Rather than peaking they are flat-lining and a couple of regions in the US even recorded record case numbers this week. If Australia had the US case profile I’m pretty sure Scott Morrison would have passed on his three Stage restart speech. But Trump is saying “people have to go back to their normal lives” and his commentary even implies that deaths from COVID-19 are a price they will have to pay. I’m not sure we can be confident that the US is going to do the right thing on the right timeframe. I’m sure we’ll be fine, but rather than looking over our shoulder at the chances of a relapse in COVID-19 cases we should be staring straight at the US who show every sign of cocking it up. I’m not going to do anything in the stock market to effect that over-cautious view, making predictions is not the game, watching the herd is the game and at the moment they aren’t caring about a relapse risk. So we won’t either. Just yet. But we're on watch.

Trade War Irrelevance – Trump says he’ll update us in a week if China is sticking to the Phase-1 trade deal struck in January. He says “China may or may not stick to the trade deal”. I don’t believe that against the backdrop of the current COVID-19 economic numbers (GDP expected to drop as much as 40% in the US in Q2) that the trade war matters. In 2019 it was potentially the pin that burst the sentimental bubble of an over-priced US equity market, but that bubble has already burst, the impact of COVID-19 is infinitely worse and trade war developments are now a side issue. So I’m trying to unlearn the programming from 2019 that every trade war headline is important. It's really not. Who cares if GDP is down 40% or 41% next quarter. The trade issue is not the market driver it once was, when everything else was perfect. We're no longer priced for perfection and no longer vulnerable to a pin prick.

Getting back to normal – Volatility is falling again which is good. It had a blip up when Wall St fell 600 points last Friday and when we fell 5%. We worried that we might have to resort to asset allocation decisions again. We had hoped we were over those for the next decade and let’s hope we are. We survived this week anyway. The market stayed mildly inflated this week, half pumped up you might say, and volatility is coming off again. This is what we want to see. The world getting back to a normal level of confidence from which the next bull market can build. Its takes three times as long for the market to build confidence as it does to lose it, which why the market never “Crashes up”, it only ever Crashes down. Volatility, or ‘fear’ if you like, is still elevated, but its better and heading the right way. Before we can start to rely on a comfortable bull market trend again this will have to return to those bull market levels around 10-15. Now 31.

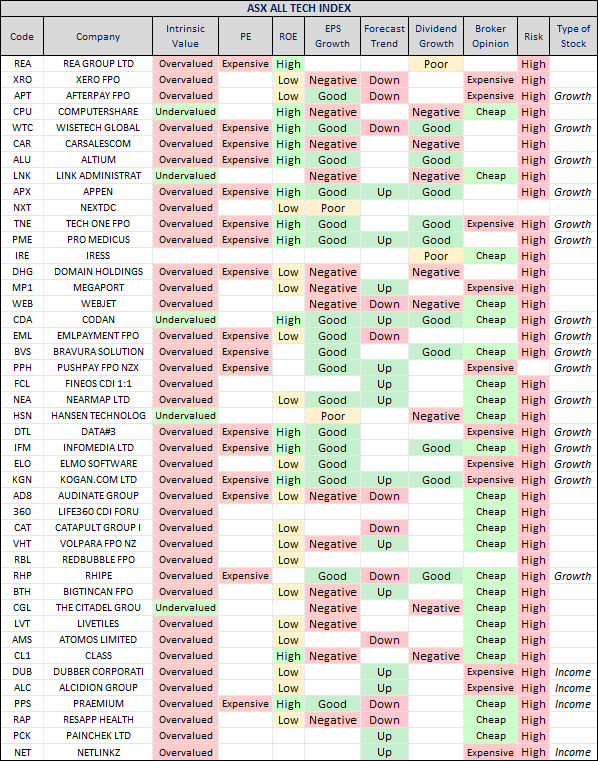

The importance of Technology investments – In the US on Thursday Paypal hit a record high up 14% on results, Viacom was up 10% on results, Uber was up 11% on results, Atlassian hit a record high. The NASDAQ is now up for the year. And you’re probably still wondering whether to buy Westpac or Telstra. And I’m sure there’s a big broker analyst out there somewhere, who is paid $250,000 a year, working on a piece of research at this very moment to tell their clients whether Wesfarmers or Woolworths is the better stock. As I wrote in the newsletter this week, a growth investor has to have a meaningful exposure to Technology long term. Companies with global reach are the focus. Tencent taking a stake in APT confirms its global relevance. We don’t have the technology behemoths that the US has but we do have some exposures and they are now all neatly corralled for us in the ASX ALL TECH sector (there is an ETF over the ALL TECH sector – see the ETF section in the newsletter on Friday for a lesson in ETFs). We should all keep a list of the Australian technology stocks on our desk long-term. The right technology businesses have the opportunity to grow their businesses globally and exponentially. It makes investing in Woolworths and Wesfarmers, the Banks, and Telstra, look so pedestrian. As a growth investor you have to embrace that. The fact that many of these companies are not ‘index relevant’ in Australia is good. They are not on all institutional radars.

But when Afterpay is the biggest company in Australia the big funds and the traditional buy & hold investors will wake up. And if you think that’s a stupid comment let me point out, Atlassian if it was listed here would be the fifth biggest company in Australia with a market cap bigger than WBC, NAB, ANZ, WOW and WES, and Paypal if it was listed here would be the biggest company in Australia worth 60% more than either BHP and CSL.

Here is a list of the All Technology constituents.

Coming out best – Barring a CV-19 relapse Australia’s economic rebound will be one of the best. Read Shane Oliver’s latest Livewire article here. I have to commend Shane for bringing us a rare economic calm and clarity during this period. Other economists are painfully losing their heads. Shane tells us that thanks to: Better weather; Less congested living; A younger population; A CV-19 strategy based on Medical Advice rather than politics and bravado; the wisdom of the JobKeeper strategy; the proximity to China which is 2-3 months ahead of the World on restart; and our unique culture of Mateship – doing the right thing by other Australians, we are going to come out of this faster and better than the rest of the globe. We have the lowest number of deaths per million followed by New Zealand. The deaths per million in the US are 56 times ours. As Shane says, we are the lucky country this time, other countries are not so good, especially at the Mateship thing, instead they bought more guns to shoot each other! Lucky us. When we’re back at work and shouting at the Footy again, the coronavirus correction will be seen for what it was, all opportunity (in the stock market, a disaster for some obviously).

Going sideways now – This is the ASX 200 chart on a daily basis. We had the drop, we had the recovery and now we are going sideways. We use but don't slavishly obey the charts, but 'technically' speaking, you should now look for a break out of the trading channel. You are supposed to chase the break in the same direction it breaks out, buy if it breaks up through the resistance at the top of the range and sell if it breaks down through the support at the bottom of the range. That’s the technical theory anyway. That’ll do in the absence of other entertainment. It’ll be interesting to see which way it breaks, that might be the next lead indicator. One newswire described us as having a “Fragile rally”. Not sure it's that fragile but it's obviously subject to change and at the moment, its having a think.

This chart is a Heikin-Ashi chart - it averages a couple of days in a candle and smooths out the 'noise'

WHERE TO NOW

If there’s one thing we learned in this correction is it not to bother making market predictions. Leave that foolishness to others. When the herd is rushing around you watch it don't join it. Read everything, listen to everything and make decisions every morning is our plan. When the herd is on the move, market decisions come first and stock decisions come second. It works – in just seven weeks, since February 20, we have outperformed the market by 21.96%.

The herd will settle down one day, hopefully soon, and we'll be able to get back to 'normal', worrying about stock selection not assert allocation. For now we're doing both. At the moment we are fully invested and playing recovery stocks. The time to build a long term growth portfolio is not yet, you still have the opportunity to exploit beaten up stocks and sectors.

WHICH STOCKS

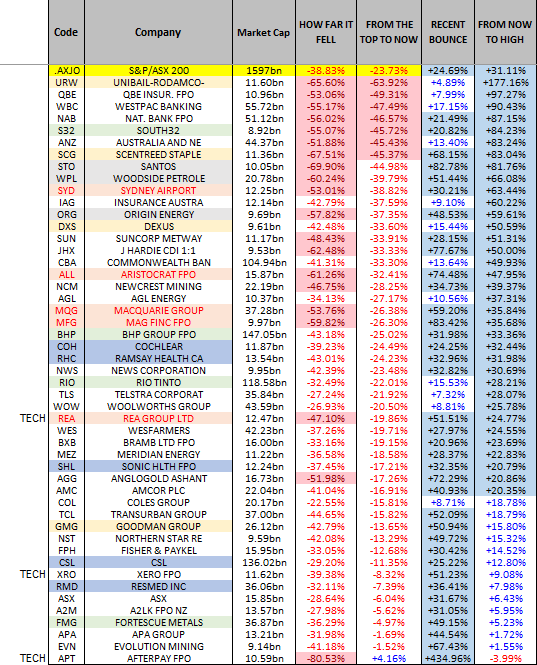

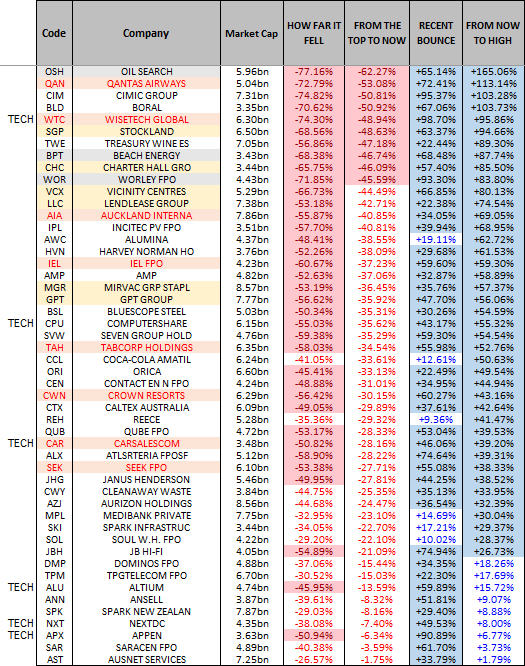

Here is a list of the TOP 50 and the NEXT 50 stocks showing how far they have fallen, bounced and how far they have to rally to recover their highs. You can spot the big cap CV-19 victims in here. Stocks in the All Technology sector labelled on the left.

TOP 50 in order of worst performers since the top first:

NEXT 50 also listed in order of worst performers first:

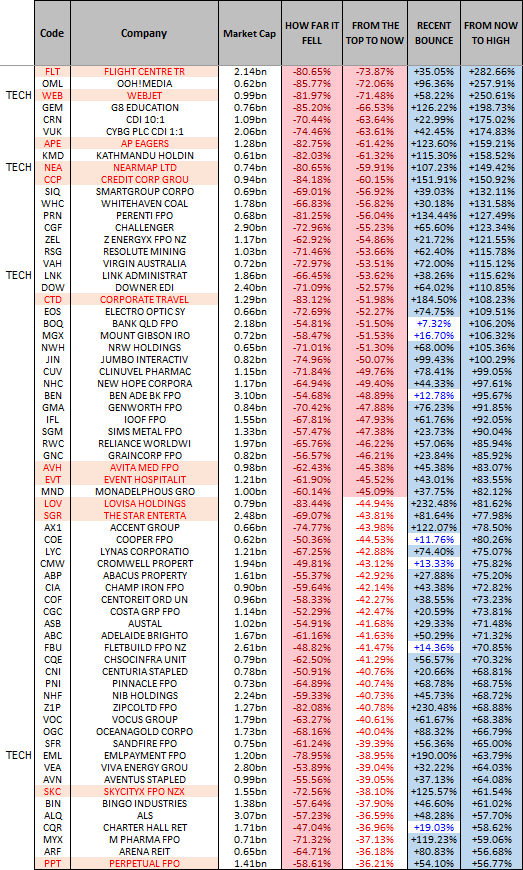

WORST OF THE REST - Stocks outside the top 100 listed in order of worst performers first:

We offer our investors and newsletter Members complete transparency on our investment decisions. You can follow what we do in our portfolios on a daily basis via our daily podcasts and in the newsletter.

For our daily Strategy advice you can join Marcus Today - click here for a free trial or here to subscribe - we have created a Promotional Code for Livewire readers only - use this when subscribing - MT5GS

4 topics