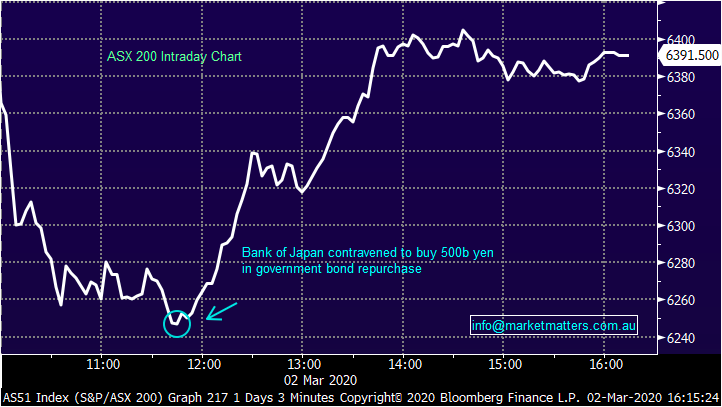

Japan adds liquidity, market stages turnaround from lows

Volatility continued first up this morning with the weekend’s news flow hitting our market on open. We were pricing in a decline of 60pts based on Fridays trade in the US, however that number was vastly undercooked by around 11.30am this morning, with the market down around 200pts at the lows. The Japanese stepped up to the plate announcing liquidity measures + a reassurance that they would maintain market stability - that saw markets around the region start to trade higher, a good rally ensued with the ASX 200 closing just shy of ~6400, still down on the session but a lot better than it was in early trade.

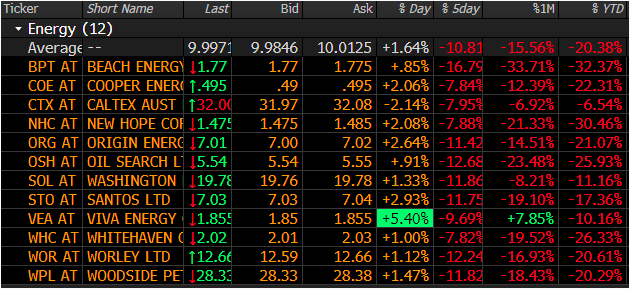

The Energy stocks were supported by a strong rally by Crude in Asia today, the sector saw the most broad based gains as shown below, all constituents bar Caltex finishing the session higher, Santos (STO) the major that enjoyed most upside ahead of the OPEC+ this week to discuss new output cuts at a time when Russia says they are content with current prices…interesting week expected for these stocks below.

Energy Sector Today – best on ground

Source: Bloomberg

– US Futures were trading +0.70% higher at our close this afternoon while Asian markets were also in the green, Chinese stocks up +3% in Shanghai which is a positive sign.

Overall, the ASX 200 lost -49pts / -0.77% today to close at 6391. Dow Futures are trading up +182pts/+0.72%

ASX 200 Chart

ASX 200 Chart

CATCHING MY EYE

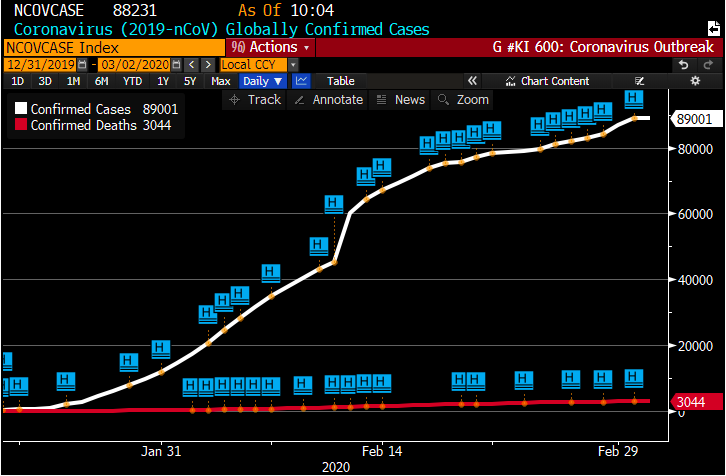

Virus Update: Death toll passes through 3000 as Trump plans to meetPharma Executives. There was the first case reported in New York while South Korea saw its total climb past 4,200. Indonesia reported its first cases. In Australia, we reported our first case of human to human transmission of the virus. The total number infected now sits just shy of 90,000 according to Bloomberg.

Virus Cases and Death Toll

Source: Bloomberg

Central Banks: The Bank of Japan says it offered to buy 500b yen in government bond repurchase for future delivery with the announcement following a statement from Governor Haruhiko Kuroda that it’s closely monitoring future developments and will strive to provide ample liquidity and ensure stability in financial markets through appropriate market operations and asset purchases….Tomorrow we have the RBA front and centre with the market now pricing in a 100% chance of a 25bp cut while there also a slight chance for a bigger 50bp cut.

BROKER MOVES -

· Coles Group Raised to Outperform at Macquarie; PT A$17.20

· Cromwell Property Raised to Neutral at Macquarie; PT A$1.20

· Regis Resources Raised to Overweight at Morgan Stanley

· Newcrest Raised to Overweight at Morgan Stanley; PT A$32.20

· Costa Raised to Market-Weight at Wilsons; PT A$2.95

· ANZ Bank Raised to Buy at Morningstar

· Super Retail Raised to Hold at Morningstar

· Star Entertainment Raised to Buy at Morningstar

· GrainCorp Raised to Buy at Morningstar

· Blackmores Raised to Buy at Morningstar

· Sonic Healthcare Raised to Hold at Morningstar

· Boral Raised to Buy at Morningstar

· Qantas Raised to Hold at Morningstar

· Iluka Raised to Buy at Morningstar

· Premier Investments Raised to Hold at Morningstar

· QBE Insurance Raised to Hold at Morningstar

· NAB Raised to Buy at Morningstar

· Harvey Norman Raised to Neutral at JPMorgan; PT A$3.75

· Perenti Raised to Buy at Moelis & Company; PT A$1.70

· Charter Hall Group Cut to Neutral at JPMorgan; PT A$12.50

Get regular market updates

Market Matters publishes daily market reports and sends SMS alerts when we transact on our portfolio. To get our latest market views and hear when we take new positions, trial Market Matters for 14 days at no cost by clicking the 'CONTACT' button bellow.

1 topic