Lack of critical metals set to derail the green energy transition

Today we’re going to jump into the data that spells trouble for the green energy transition.

We’ll look at the problem, the miscalculations and the single-minded approach that’s put the global economy on a path toward heightened energy volatility.

So, what’s the end game for net zero?

Higher energy costs, an erosion of living standards and much higher inflation!

But for every downbeat forecast lies an opportunity… That’s what we’ll uncover in this piece for those of you who are looking to take shelter from the energy transition fallout.

But first, what exactly is the problem and how did we get here?

It starts with a lack of new oil and gas discovery.

Around 8 years ago discovery for new oil and gas fields began to hit multi-decade lows on the back of falling capex spending.

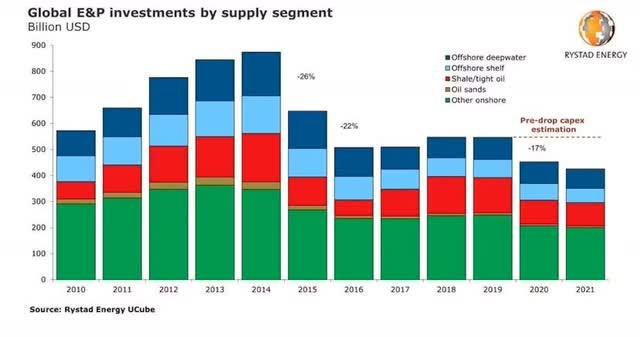

As you can see below, investment in O&G development started to dry up in 2015 and has steadily declined in the proceeding years…

Its why the research group Rystad Energy started to warn of future supply problems back in 2015… Precisely when new discovery hit multi-decade lows on the back of declining investment… The lowest since 1952.

But the warning fell on deaf ears…

5-years later and the energy analytics firm identified that we’d now entered the lowest rate of oil and gas discovery in 75 years.

We’d need to go as far as 1946 to repeat that level.

So why is that a problem?

Well, go back to the 1940’s and this post-World War II era held a global population of around 2.5 billion.

Fast forward to today and the global population stands at around 8 billion.

With many more mouths to feed, homes to heat, cars and trucks on the road it’s not surprising that our energy needs have grown exponentially since then.

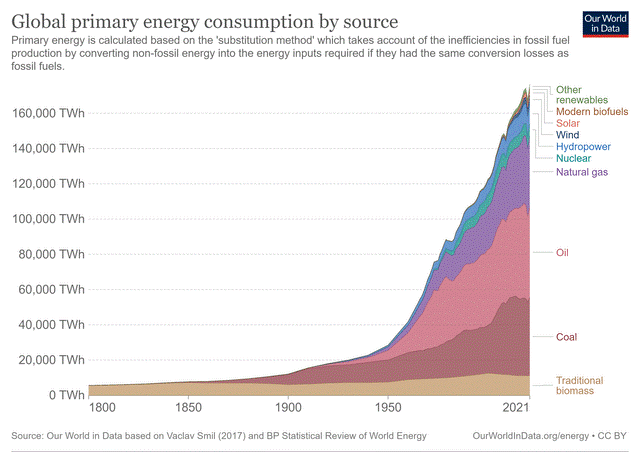

As the graph below shows you, in 1946 energy demand stood at 20,000 TWh (terawatt-hours).

In 2021 demand escalated to a staggering 160,000 TWh.

Same rate of discovery from 75 years ago but an 8-fold increase in energy demand!

That puts incredible pressure on current reserves and sits at the heart of the looming energy problem…

Rapidly declining oil fields without replacement reserves in sight.

Its why the world’s largest oil producer is sounding the alarm-bells on energy security.

According to Saudi Aramco's chief, spare capacity for oil and gas supplies now runs extremely tight at just 2%.

Any uptick in demand will likely push prices far higher.

But some would argue the threat of energy volatility is overblown.

China’s re-opening in late 2022 following the prolonged Covid-19 shutdown should have placed enormous pressure on demand… But the supply crunch never happened.

Why?

Well, as the latest data shows, China’s reopening has remained tepid… Perhaps deliberately as it attempts to avoid its own energy crisis and surging inflation.

Industrial production for April rose by 5.6% year-on-year, compared to the 10.9% expected by economists surveyed in a Reuters Poll.

Well below expectations.

Its masks the fundamental problem… Supply remains incredibly tight.

Given that it takes up to 10 years from discovery to first production any pressure on the supply chain could create enormous volatility.

Which brings us back to the underlying problem… Political leaders have successfully put their stranglehold over oil and gas development… But at what cost?

Stagflation, lowered living standards and economic depravity are all consequences of far higher energy prices… These are the outcomes the global economy experienced back in the 1970’s, albeit relatively brief in duration.

In reality no government would purposefully evoke energy volatility.

It builds civil dissent and brings into question a governments ability to lead.

But what this current looming energy crisis does achieve is a steadfast global push to bring about renewables BEFORE oil and gas depletion rears its ugly head.

The impetus to do so has been brought forward thanks to a decade of underinvestment in the fossil fuel industry.

So, with that in mind, are we going to create the vast solar panels, wind farms, and electric vehicles in time to avert the looming ‘supply-gap’ in our energy needs?

Well according to some high-level academics the problem is not so much a supply gap rather a permanent shortfall of energy supply.

You see, when it comes to transitioning away from fossil fuels the key issue is the availability of critical metals.

The supply of which is dictated by new mineral discovery and mine expansion… Both capital and time intensive undertakings.

A copper mine for example can take up to 15-years from discovery to maidan production.

Barrick’s (NYSE: GOLD) Reko Diq project on the border of Pakistan and Afghanistan is one of the world’s largest copper developments but has taken more than a decade to move beyond feasibility.

But it’s not just the time lag in bringing new mines into production, it’s also the sheer quantity of critical metals needed to end fossil fuel reliance.

Its why some researchers have questioned our ability to ever reach net zero.

One of the key global critics is Associate Professor Simon Micheaux.

Micheaux was engaged by the Geological Survey of Finland to calculate the entire volume of metals needed to bring one-generation of solar panels, windfarms, and EV’s into our energy mix.

Now, when Micheaux explains ‘one-generation’ this means the volume of raw materials needed to entirely replace fossil fuel reliance with renewables.

According to his research, these wind farms, solar panels and EVs have a service life of around 15-20 years.

Once that’s complete we’ll need to re-start and build the next generation all over again!

So how much metal do we actually need to create that first round of renewables?

This is the part that will make most politicians shift uneasily in their seats…

Based on current annual output, Micheaux’s peer reviewed study indicates we’ll need a staggering…

- 9,920 years’ worth of Lithium production

- 1,733 years’ worth of Cobalt production

- 3,287 years’ worth of Graphite production

- 189 years’ worth of Copper production

- 400 years’ worth of Nickel production

All condensed into 20-30 years!

But as Micheaux’s data highlights, the crux of the problem is not so much the enormous increase in output but the fact we don’t actually have the metal in the ground.

Using data from the US Geological Survey, Micheaux discovered global copper reserves will fall short by 80%, global nickel reserves by 90%, and cobalt by around 96%.

Simply put, of all the cobalt we know that exists in the ground today, if we were to mine all of it then we’d have just 4% of the cobalt needed to achieve net zero.

It highlights a gross miscalculation by political leaders in their assumption that renewables would naturally pick up the slack from declining oil and gas output.

It also points toward a disturbingly high probability of global energy shortages… This is backed up by Goehring & Rozencwajg most recent report predicting multi-fold increases to energy prices set to manifest by the mid-2020’s.

This is a complex problem that has the potential to erode our standard of living.

It’s also highly inflationary.

For over a century we have taken for granted uninterrupted access to abundant energy that has enabled technological innovation and improved standards of living.

But the seeds have been sown… An end to civilisations ‘era of abundance’ is fast approaching.

Which brings us to the opportunities...

While this is set to be a monumental miscalculation with dire consequences for the global economy… There are perhaps a few key areas for investors to take shelter from a looming energy crisis.

The first and most obvious solution is gaining broad exposure through a highly liquid oil and gas ETF.

The iShares U.S. Oil & Gas Exploration & Production ETF (IEO) offers a market-cap-weighted ETF with exposure to companies engaged in the exploration, production, and distribution of oil and gas. Assets under management stand at around $1.3 billion… The ETF also offers investors a 1.96% annual dividend yield.

With leverage to rising oil and gas prices it also enables investors to capture upside from future discovery.

Given the impetus to find more oil after a decade-long slump, holding exposure to both production and exploration should serve investors well.

However, the service-side of the oil and gas business is also set to capitalise on future energy volatility.

It offers investors a strategy to de-risk their exposure to production shortfalls and declining output among those companies that have NOT chosen to invest in future supply thanks to government net-zero mandates.

Should the global economy look to re-align itself with stabilising energy supply then capex spending will be enormous… Service companies will benefit the most.

The VanEck Oil Services ETF (NYSE: OIH) tracks the largest 25 US-listed oil service companies… Including big names like Schlumberger (NYSE: SLB), Halliburton (NYSE: HAL) and Baker Hughes (NYSE: BKR).

These are multi-national companies with global operations.

This limits jurisdictional risk… Something that hangs over producers operating in countries committed to ending oil and gas licenses and development applications.

Given that energy is the lifeblood that feeds the global economy this is perhaps one of the most important investment themes over the coming decade.

Global capital may soon wake up to the insurmountable challenge in achieving net zero… When it does investment into traditional energy will surge.

Investing ahead of this trend may enable you to capture strong early gains while protecting your portfolio against the economic fallout that comes through heightened energy volatility.

If you're interested in staying up-to-date on the latest developments in the Australian Commodities space, click this link now to get insights from James Cooper in his publication Diggers and Drillers.

5 topics

5 stocks mentioned