Laying the foundations for increased flows into digital assets

The end of Q2 saw a lot of newsworthy events for the digital asset industry, most notably regulatory action and institutional interest in the US.

These developments lay the foundations for increased flows into digital assets. Furthermore, global efforts from the likes of Hong Kong to establish themselves as crypto hubs underscore the widening reach of the digital asset space.

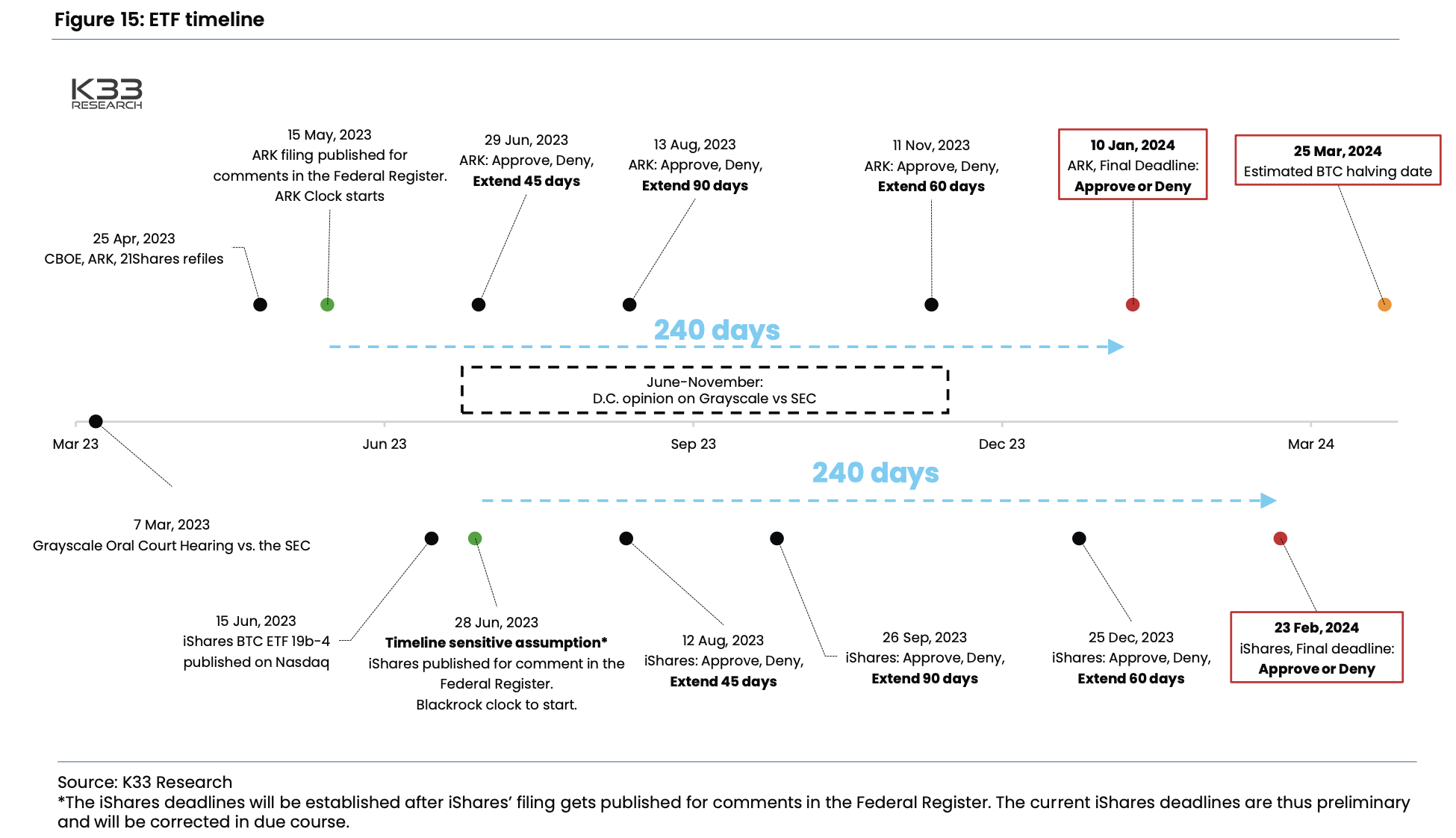

The resolutions of ongoing legal battles and decisions on ETF applications hold significant potential to steer the industry's course as we come closer to the Bitcoin halving in 2024.

Top Events

The largest stablecoin issuer Tether (USDT) has been a beneficiary of increased pressure (often referred to as “Operation Choke Point 2.0”) applied to on-shore stablecoin issuers, with its current supply reaching an all-time high of US$85 billion. In stark contrast, USDC’s current supply has fallen to $26 billion, revisiting levels last seen in September 2021.

The SEC intensified regulatory scrutiny on digital asset markets, filing a lawsuit against Binance, the largest global crypto exchange. The allegations spanned from inadequate user fund segregation to unlicensed US operations and offering unregistered securities. Simultaneously, Coinbase (NASDAQ: COIN) faced an SEC suit for alleged securities-related violations, and operating as an unregistered exchange, broker and clearing agency.

Commonwealth Bank (ASX: CBA) limited crypto payments ‘for customer protection’ as the US-led crackdown spread to our shores.

The second half of June saw a flurry of positive institutional interest. A flood of ETF applications emerged, led by BlackRock (NYSE: BLK)—the largest asset manager with $9 trillion in assets under management—followed by Fidelity. Prior applicants—including WisdomTree (NYSE: WT), Invesco (NYSE: IVZ), Valkyrie, and ARK Invest—also rejoined the race.

Lightning Network Updates

Binance has confirmed their presence on the Lightning Network. Their node has 5 channels with 30 BTC of public capacity.

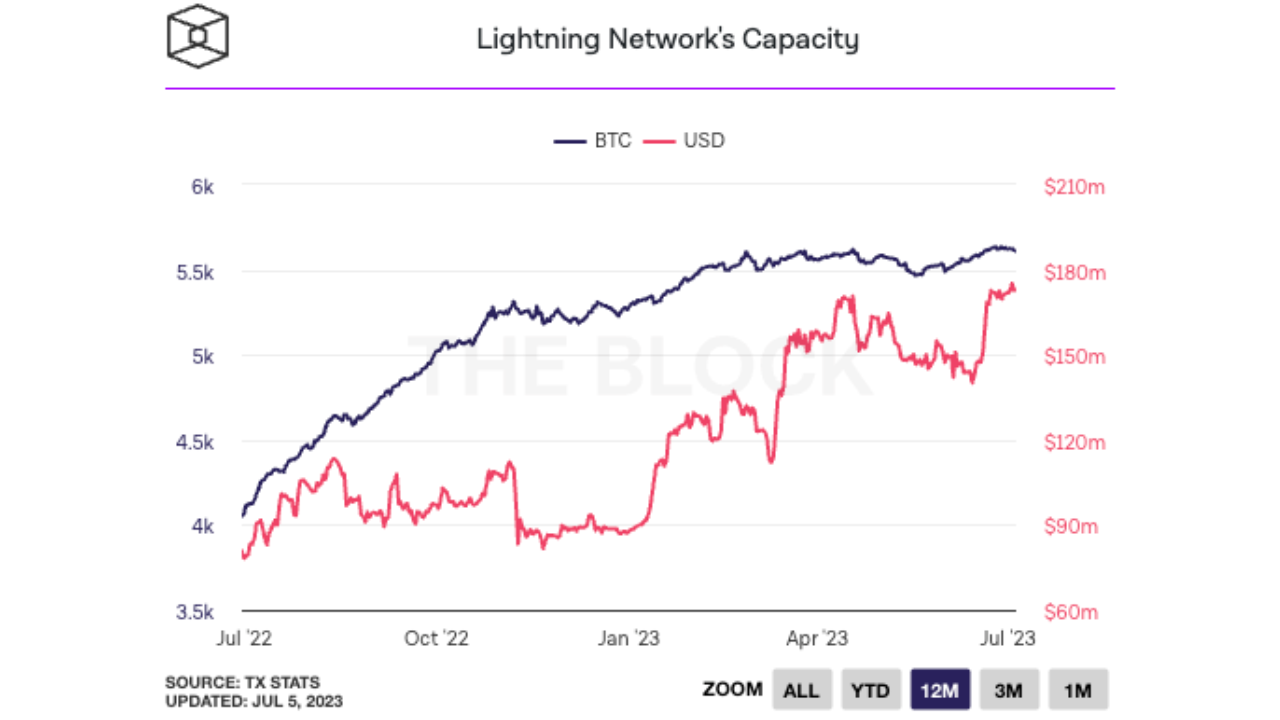

Lightning Network hits all-time high in bitcoin and US Dollar capacity — the amount of bitcoin locked in payment channels on the network.

Bitcoin Mining

Australian oil and gas exploration and production company Bengal Energy (TSX: BNG) launched a Bitcoin mining ‘donga’ project in outback Queensland, the first of its kind in Australia.

Related: Can Bitcoin mining serve as a catalyst for the wider adoption of renewable energy? A case study from an engineering firm in Australia who worked with Bengal Energy to get the project off the ground.

The state of bitcoin mining is core to the overall industry. See these notes on a recent industry conference, along with takeaways on bitcoin mining, regulation, power grids, hash rate, and where the industry is going over the coming 2-3 years.

Stablecoin issuer Tether joins US$1 billion funding to build El Salvador's massive bitcoin mining farm. A game-changing investment paving the way for sustainable mining and showcasing El Salvador's emerging role in tech.

Best Articles and Podcasts

I urge you to read this. You will need at least half an hour but it will be worth your time. Written in 2015, its forecasts about the speed of human development are absolutely excellent. Among other things, it predicts that right about now we will have artificial intelligence that is about as good as we are. I think that assessment is correct; more exciting though is what happens next and just how quickly it happens.

Voltage CEO Graham Krizek wrote a blog post titled “Every Company Will Be a Lightning Company.

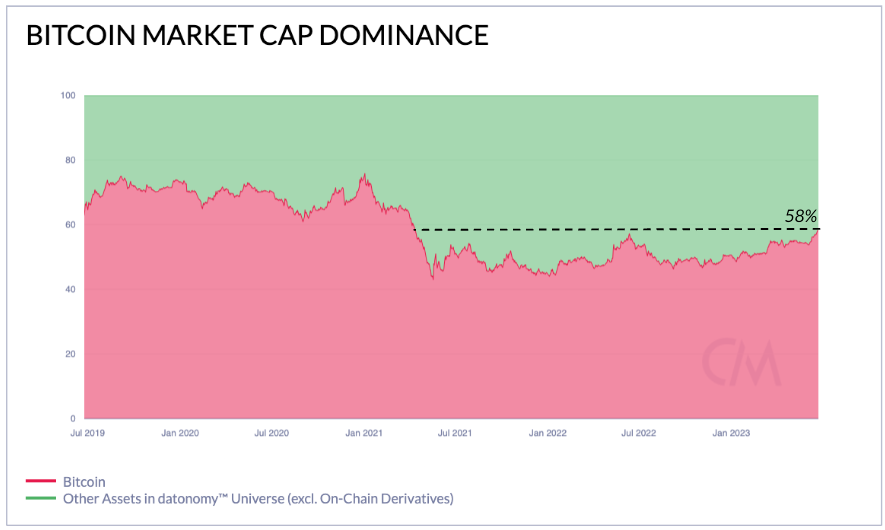

BTC’s dominance is up to 58%, the highest since April 2021.

Predictions of a “flippening” of the most valuable digital asset have not materialised. Source: Coin Metrics

Macro and Politics

The US Treasury who have announced a buyback of bonds from 2024. The buyback is “technical” in that longer dated debt will be bought back and it will be financed by issuing shorter dated debt.

Since the US debt ceiling was suspended earlier this month, the US government has borrowed $700 billion dollars. It’s a monumental level of debt issuance in just 13 working days since. $2,000 for every American.

Tough times in the UK. Their inflation stats fell in Q1 but core inflation went back up. Food is absolutely off the scale with some prices going up 50%.

Meme of the month

5 topics

5 stocks mentioned