Lazard's Temple: US stocks could fall 15% even without a recession

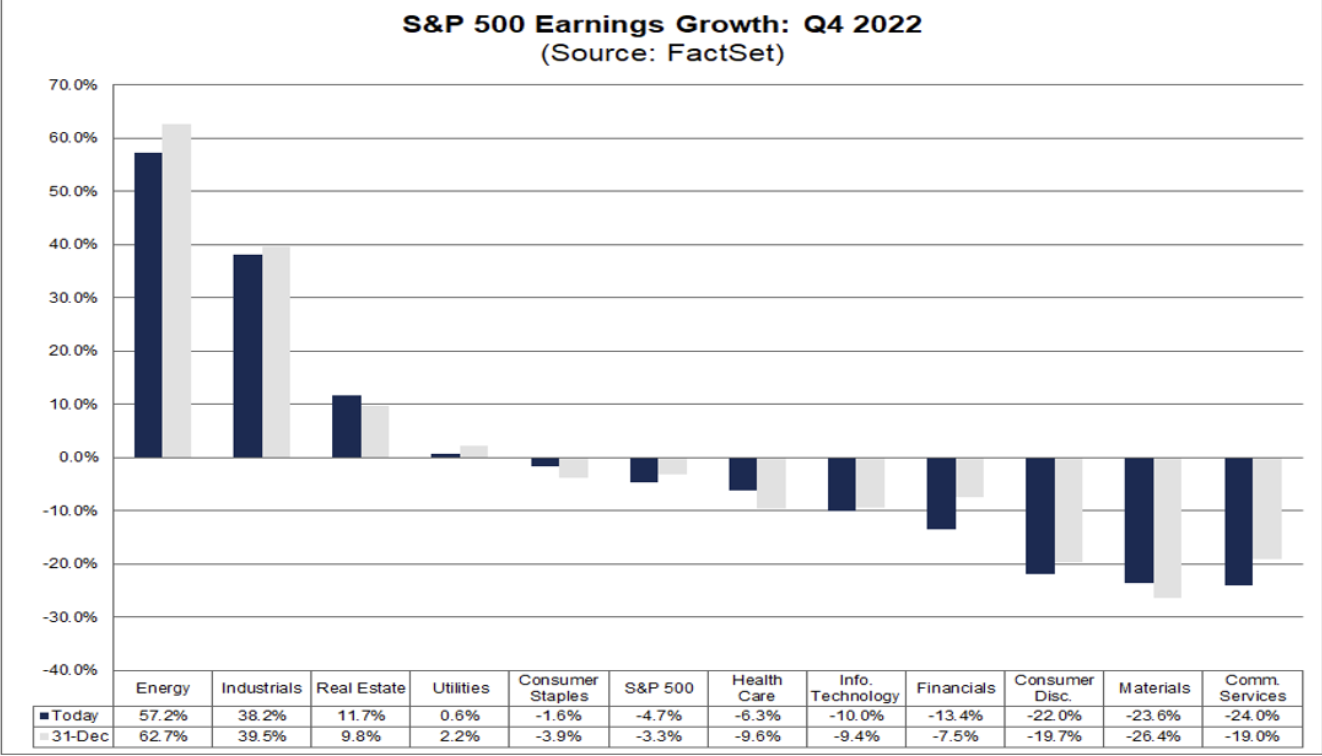

If the most recent earnings season proved anything, it might be that investor optimism might be misplaced. In Australia, earnings beats have just squeaked past misses in percentage terms. In the US, the decline in earnings forecasts for the rest of 2023 is palpable with FactSet's numbers showing a near-5% drop for the most recent quarter. On a forward-looking basis, that brings the former EPS growth target from 3% to zero.

And even that may not be enough, says Ronald Temple, Chief Market Strategist at Lazard. Temple wants to see an even larger pullback in earnings expectations and sentiment before he starts to become interested again.

The biggest driver behind Temple's core view is a "paradigm shift" in inflation - the kind where central banks will have to put up with above-2% inflation for longer.

In this feature interview, I had the great privilege of sitting down with Ron to discuss his views on the market, opportunities within them, and his thoughts on the Federal Reserve's approach to monetary policy.

Note: This interview was taped Tuesday February 21, 2023.

edited summary

The "paradigm shift" in inflation

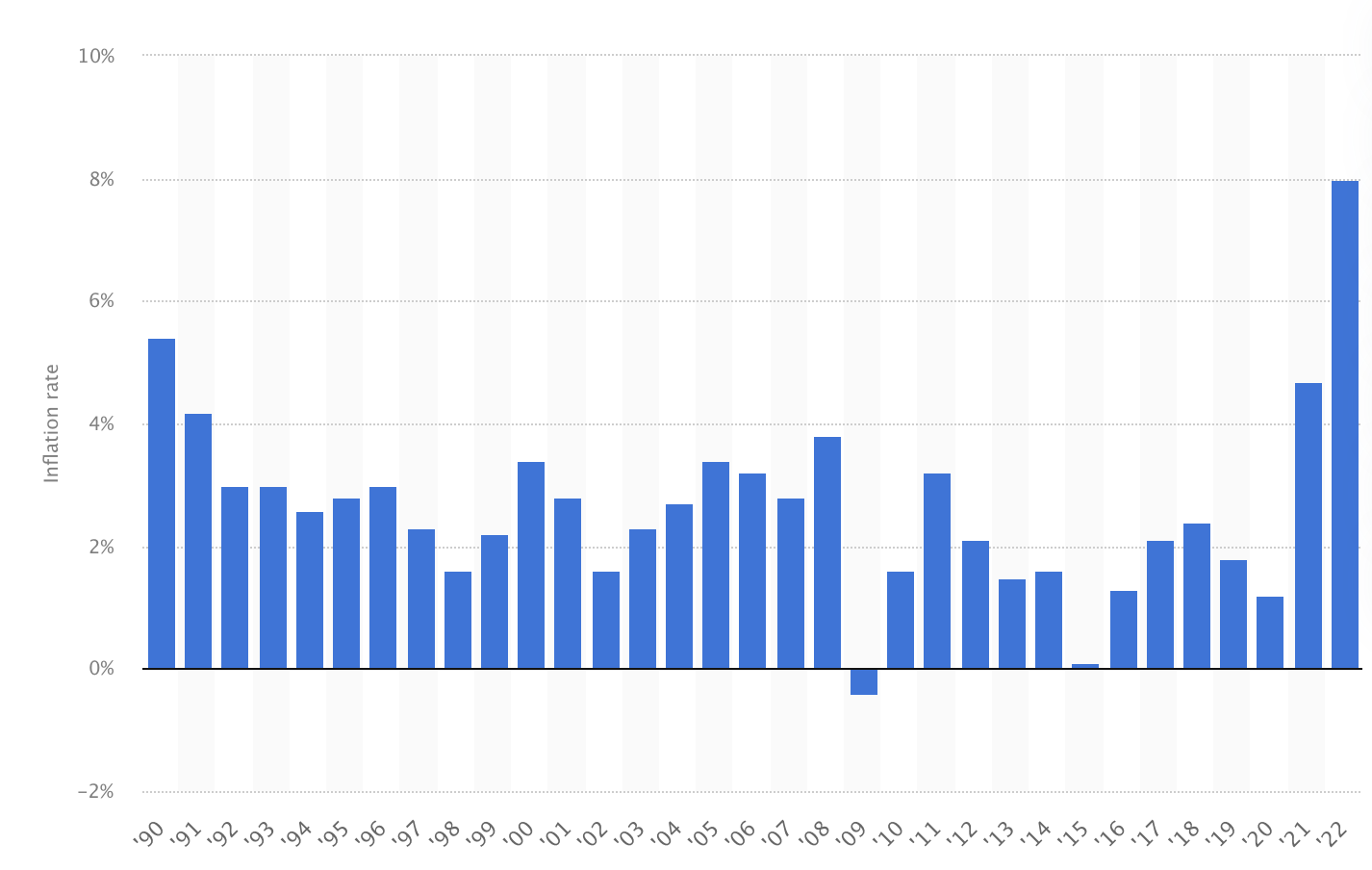

In the 12 years prior to the COVID-19 pandemic, global inflation was uncharacteristically below target for most of that time. In the US, the 2% fixed inflation target goal was reached only four times and above 3% only once - a pattern described as "undesirably low" by Temple.

But Temple also argues times have changed and that inflation is now going to be higher for longer.

"I think we're moving into a new paradigm where there is a much higher probability that we have higher structural inflation," Temple told me. "Over the next decade, we could be in a 2.5-3% or even 3-3.5% inflation range," he added.

Why is this the case? The reason is many-fold:

- A reconfiguration of global supply chains

- Immigration reform, as a direct result of changing views toward globalisation

- China's ability to export deflation has diminished

- The energy transition and climate volatility-related costs

But are central banks getting it right?

"On the short term, I think the Federal Reserve is getting it right," Temple said. "On the structural side, I think it will take time to be able to transition."

The last regular review of the Fed's operations saw the introduction of "average" inflation targeting (that is, inflation can have ebbs and flows so long as it all smooths out to 2%). But Temple believes the next step for the world's most consequential central bank is to go down the RBA's route:

"I think in the next review, the Fed would be well-advised to emulate the RBA and moving to a range as supposed to a single point target," Temple said.

On the question of shifting its long-held inflation target upwards from 2% to 3 or more, Temple said markets may be rattled if the Fed decides to change the goal posts.

The state of corporate earnings

The earnings performance of S&P 500 companies during the Q4 earnings season was subpar. The estimated decline for earnings during the last quarter of 2022 was 4.7%. If this holds, it will be the first time an earnings decline has been recorded in two years. Temple also points out this 4.7% figure masks the massive earnings from the US energy sector.

Forward earnings projections have also been impacted, with the consensus now expecting the S&P 500 will not record any earnings growth for 2023 at all. But that's still not enough to get Temple interested.

"I think the market is still too optimistic and as we move through 2023, we're going to see more earnings compression," Temple said.

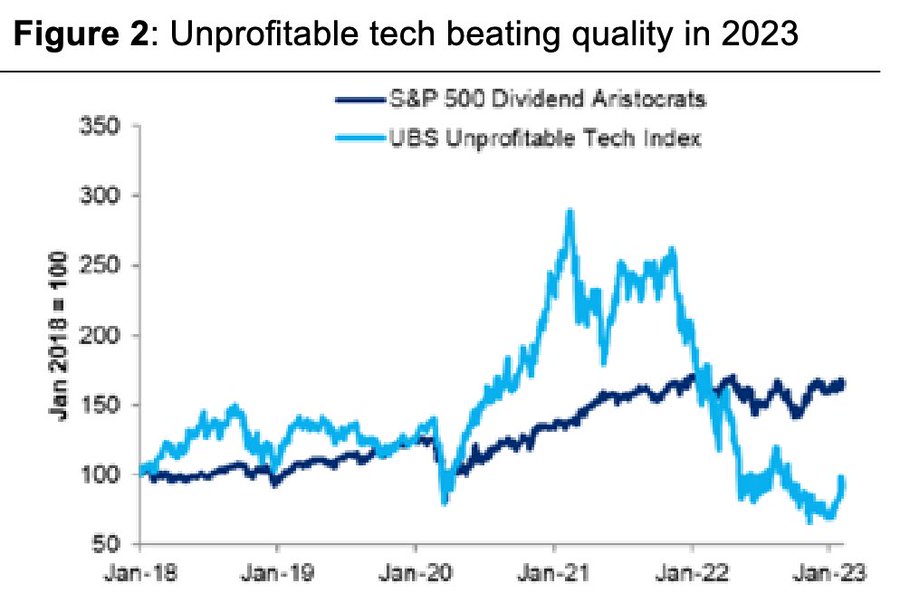

But just because margins are down does not mean balance sheets are not strong generally. Having said this, the traits that separate a great company from an unprofitable one are beginning to show.

"The ability of companies to use financial engineering to grow earnings in the future is going to be a lot more constrained," Temple told me. "The road ahead is going to be a bit tougher in terms of that ability to grow earnings per share."

In short, the worst is yet to come.

The 15% decline for equities

As Temple put it, every investor has a choice. But he does have a simple equation for anyone who wants to calculate valuations of the S&P 500 index. As of taping, the Moody's BAA corporate bond yield was 5.6%. Take the reciprocal of this figure and you get 0.56. 1 divided by 0.56 gives you an S&P 500 multiple of 17.5, the so-called fair value.

The S&P 500's earnings multiple is currently above that (albeit, fractionally). But that's still not enough to get Temple interested.

"I think equities should trade at a cheaper multiple than bonds," Temple said. "I get to a potential decline of 15% or even more even in a very soft landing situation," he added.

But Temple's wish for the equity market to go lower may be upset by history. While history doesn't always repeat, it does often rhyme. And in the case of many bull market rallies in this cycle (as well as in 2000-2002), it's unprofitable tech companies leading the gains.

Learn more

For further insights from Lazard Asset Management's global group of experts, please visit their website.

3 topics

1 contributor mentioned