Liquidity crisis shocks investors

In the AFR I write that the commercial real estate market, and the non-bank lenders that finance it, face burgeoning liquidity crises. This echoes similar dynamics playing out in the commercial property and sub-prime corporate lending sectors overseas.

Investors say many unlisted property trusts are now being frozen as investors rush for the exits, while the fund managers that operate these trusts are reluctant to sell the underlying assets to liberate their clients’ money because they know the prices they would obtain for these properties would be miles below their inflated NTAs.

A derivative issue is that a 20 per cent to 30 per cent reduction in official NTAs would force many properties’ loan-to-value ratios to leap to levels that would threaten to breach these funds’ internal leverage targets and their lenders’ debt covenants, which could precipitate defaults and forced sales, driving prices down even further.

Similar challenges have emerged in the US and European commercial real estate and non-bank lending markets. Brand-name REITs have gated investor withdrawals. And large global fund managers are defaulting on their commercial property loans.

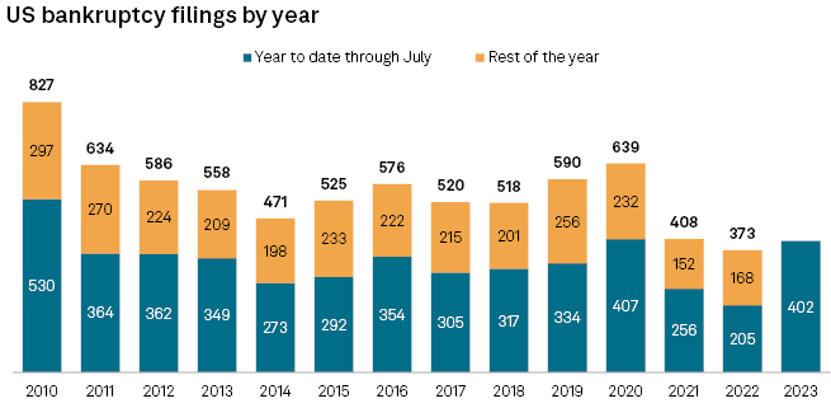

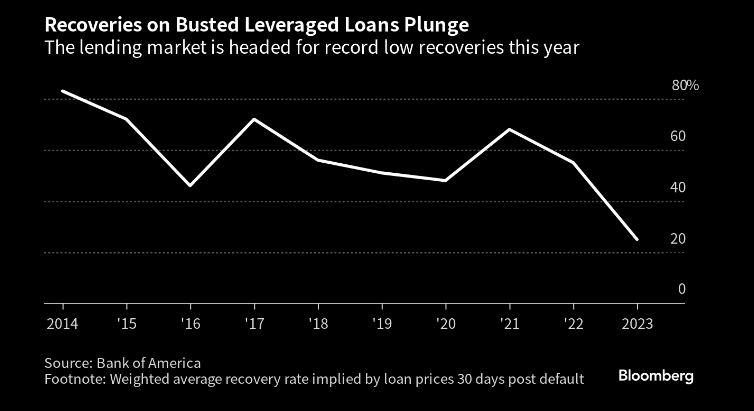

Even in the ostensibly strong US economy bankruptcy filings are on track for their worst year since the global financial crisis. As corporate defaults soar, the recovery rate on non-bank loans to these companies, known as “leveraged loans”, has plunged to the worst level on record.

The chief financial officer of a commercial property group wrote to me to relay his own anxieties about his industry and the non-banks that finance it.

“I have been concerned for a number of years that investors in funds [lending to commercial property] are not being adequately compensated for the risk they are taking,” he wrote.

“My view is that this is further increased by concentration risk as often these loan books and associated businesses are not diversified and heavily overweight residential property developers and commercial property (similar to the industry-specific exposure of Silicon Valley Bank).

“A number of these funds are currently experiencing liquidity issues due to severe construction delays, which are delaying settlements on residential projects and the subsequent repayment of [their] loan facilities.

“The problem downstream is that these non-bank lenders have unfunded commitments on other development projects as they were expecting to be able to recycle these loan repayments. As these trusts are not APRA regulated, diversified, and do not hold sufficient liquidity buffers, they are not adequately capitalised and have been approaching large family offices for emergency funding.”

4 topics