Liquidity runs dry

When the stock market sold off dramatically in March this year the US Federal Reserve responded by pumping financial markets with liquidity for the next three months and the stock market rocketed. But the Fed’s role in financial markets has moderated recently and signals that share market investors should proceed with caution.

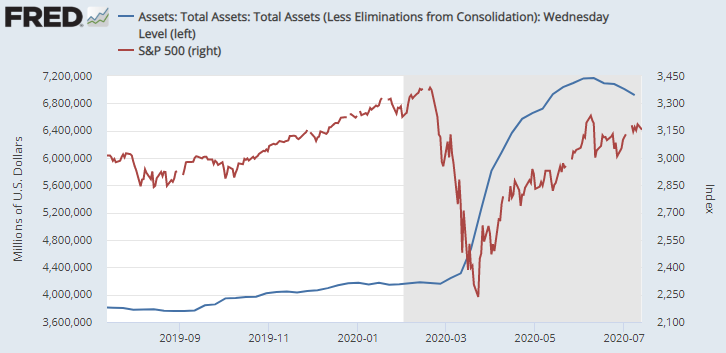

By the beginning of this year the US Federal Reserve’s total assets hovered around US$4 trillion, after gradually coming down over the past two years. Then the coronavirus pandemic broke and shook health systems, economies, and financial markets worldwide. By the end of March, the Fed had taken unprecedented actions and introduced a slew of programs to keep credit flowing through the financial system, which drove its balance sheet – and the stock market – up quickly.

Over the course of two months in April and May, the Fed’s holding of assets increased to more than US$7 trillion, or more than a third of US GDP. At the same time, the S&P500 index, a measure of the US share market, rebounded from a low of 2,237 on 23rd March to of 3,232 on 8th June, its highest level since the coronavirus turmoil began.

US Federal Reserve’s total assets vs S&P500

Source: Federal Reserve Bank of St. Louis

Since then, though, the Fed’s buying has subsided, and its balance sheet has come off from its peak. Interestingly, so too has the stock market, with the S&P500 peaking at the same time as the Fed’s assets at the beginning of June. It appears that the stock market is struggling to post further gains without the ongoing support of the Fed. This is particularly concerning as the US quarterly reporting season starts this week and more states and counties resume social restrictions after daily coronavirus case counts accelerated at the weekend.

While we own some wonderful investments ion the Montaka and Montgomery Global Funds, that will provide strong compounding for decades we are also cautious about equities in the nearer term. This means that the funds remain defensively positioned today, with relatively high cash weightings, low equity market exposure, and enhanced capital protections where appropriate, in order to protect investor capital.

Never miss an update

Stay up to date with my content by hitting the 'follow' button below and you'll be notified every time I post a wire. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

3 topics