M&A continues to gather pace in Global Biotech

M&A is a critical part of the global biotech and biopharmaceutical value chain. While some biotech companies will go on to have their drugs approved and take them to market, a large proportion will partner or be acquired by a larger biopharmaceutical firm. Why is this?

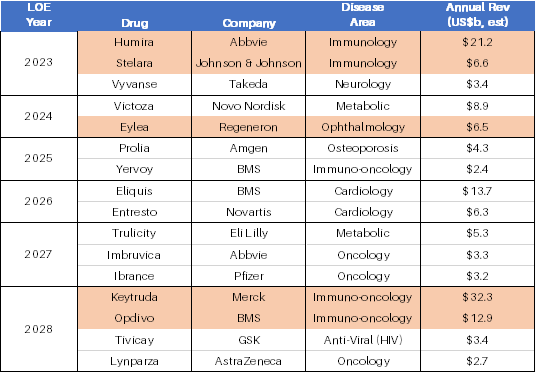

From the time a drug is approved to be marketed it typically has ~10-12 years patent life left which is the time a pharmaceutical company has to recoup the expense of developing a drug (which typically takes 10-14 years and US$800m - $2b to develop). As patents expire on branded pharmaceuticals (Loss of Exclusivity, or "LOE"), generic and biosimilar competition eats into their pricing and market share.

Especially as ‘blockbuster’ drugs reach their

LOE, there is a financial imperative for biopharmaceutical companies to replace

this revenue. From 2023 to 2028 there is

an estimated US$160b+ of large-cap biopharmaceutical revenue at risk from LOE. A selection of the some of the biggest drugs

at risk of LOE in the next 5 years is shown in the table below.

The 20 largest biopharmaceutical companies collectively spend in the order of ~US$50b p.a. on their internal R&D pipelines, however they also supplement this with approximately the same amount in M&A each year. With a combined ~US$300b cash on their collective balance sheets, and having publicly signalled their intent to pursue M&A, it is not surprising that the pace (and value) of M&A is picking up in global biotech.

While there was scant M&A activity in early 2022 since the broad-based market correction from Jan 2022 to May 2022, the acquisition of Turning Point Therapeutics (an omen?) by Bristol Myers Squibb (NYSE:BMY) for $4.1b marked the start of the current wave of M&A in global biotech. There have now been 27 transactions > US$1b since May 2022 for a combined total of US$163b, the latest of which, CTI Biopharma (NASDAQ:CTIC), announced that it is to be acquired by Swedish Orphan Biovitrum AB (STO:SOBI) for US$1.7b, an 89% premium to the last close price.

The largest deal so far in the current wave of M&A is Pfizer's (NYSE:PFE) US$43b acquisition of Seagen (NASDAQ:SGEN), a leader in antibody-drug-conjugates (ADCs) which use antibodies linked to powerful cancer-killing molecules to better target tumours without as many side effects.

With M&A picking up pace, it pays to understand where large biopharmaceutical companies may be seeking to bolster their pipeline, and the LOE table above is a good place to start.

For example, the recent acquisition of Prometheus Biosciences (NASDAQ:RXDX) by Merck for US$10.8b underscores the near-term interest in immunology as blockbuster drugs such as Abbvie’s Humira and J&J’s Stelara begin to compete with biosimilars. Consequently, companies with novel drugs and compelling data in the immunology space, such as Morphic Holdings (NASDAQ:MORF) and Dice Therapeutics (NASDAQ:DICE) have since garnered significant investor interest, up ~60% and ~35% respectively, since the Prometheus acquisition was announced.

While recognising that biotech is an extremely competitive market, often with multiple drug candidates from competing companies being developed for the same indication, and there is certainly no guarantee of an acquisition occurring, there are several local companies that also have the potential to address the LOE issues in the table above:

Opthea’s (ASX:OPT) OPT-302, a VEGF-C and D inhibitor, is a potential LOE solution for Regeneron’s Eylea, a VEGF-A inhibitor for wet age-related macular degeneration. Apart from risk of LOE as early as 2024, Eylea is already under pressure from products such as Roche’s Vabysmo, an extended-dosing VEGF-A inhibitor. OPT-302 is currently in two Phase 3 trials, being combined with VEGF-A inhibitors (one of which is Eylea). In Phase 2 trials, OPT-302 has already shown clinically significant visual acuity benefit when combined with Lucentis, a VEGF-A inhibitor. Should this be repeated in the current Phase 3 trials, OPT would arguably become a very attractive M&A target.

Immutep’s (ASX:IMM) lead drug eftilagimod-alpha (efti) is a potential LOE solution to Merck’s Keytruda, an (ultra) blockbuster PD1 immuno-oncology (I-O) drug indicated for numerous cancers such as non-small cell lung cancer (NSCLC), melanoma and head & neck squamous cell cancer (HNSCC), to name just a few. In multiple Phase 2 trials, efti has shown promising initial results when combined with Keytruda in a range of high value indications such as NSCLC and HNSCC. While recognising that the immuno-oncology market is highly competitive, with multiple novel I-O combination targets and approaches in development (e.g. TIGIT, PCVs, oncolytic viruses, 41BB, OX40, etc), efti’s clinical results to date make it a potential M&A target, not just for Merck / Keytuda, but potentially for any of the PD1 checkpoint inhibitors in the market (of which multiple are nearing LOE issues).

Remembering that there is no guarantee that any given company will be the target of M&A, we continue to believe the global biotech market, as a whole, will

recover from its recent correction, with the rising pace and value of M&A

playing a central role to the recovery thesis.

1 topic

9 stocks mentioned