Macquarie downgrades these three iron ore miners

Welcome to Charts and Caffeine - Livewire's pre-market open news and analysis wrap. We'll get you across the overnight session and share our best insights to get you better set for the investing day ahead.

MARKETS WRAP

- S&P 500 - 4,141 (+0.29%)

- NASDAQ - 12,432 (+0.41%)

- CBOE VIX - 22.89

- FTSE 100 - 7,472 (-0.22%)

- STOXX 600 - 432.41 (+0.25%)

- SPI FUTURES - 6,934 (+0.45%)

- US 10YR - 3.111%

- USD INDEX - 108.62

- GOLD - US$1,765/oz

- WTI CRUDE - US$95.31/bbl

EARNINGS WRAP AND PREVIEW

Coles (ASX: COL) hiked its dividend after reporting a single-digit increase in profits. Earnings margins were eroded away by cost pressures, but you'll be pleased to hear liquor sales were up. Speaking of profit hikes, WiseTech (ASX: WTC) shot the lights out - delivering a 72% increase in profits and a far more improved 6c/share dividend. Investors rejoiced. Speaking of rejoicing, Worley (ASX:WOR) saw net profits more than double in the past year thanks to - altogether now - soaring energy prices. In the same space, APA Group (ASX: APA) saw its earnings increase off the back of more revenues for its energy infrastructure business.

At the smaller end of the market, a slew of very different stories ranging from the positive with a tinge of concern to just downright awful. Kelsian (ASX: KLS) increased its profits and dividend as profits soared. But, as is with any business that requires lots of human capital, wages will be a core issue. That was more guidance than Sonic Healthcare (ASX: SHL) cared to offer, arguing COVID-19 still makes the outlook too cloudy. G8 Education (ASX: GEM), in contrast, more than halved its dividend but still found room to pay a penny dividend. Then, there is EML Payments (ASX: EML) which found yet another fraud case in its processing division. Just another controversy for the company that's already been through the wringer. Shares hit a seven-year low yesterday.

Finally, a day after Boral handed down its earnings, major shareholder Seven Group (ASX: SVW) saw revenues surge by 65%. And yet, net profits fell so the dividend was kept. But a flat dividend is better than none or a reduced one, right? Take the win, folks.

Today, the list is the longest it will be all reporting season. From Allkem (ASX: AKE) to Costa Group (ASX: CGC), Flight Centre (ASX: FLT) to Platinum Investment (ASX: PTM), and Woolworths (ASX: WOW), just to name a few.

STOCKS TO WATCH

Ah, iron ore. Australia's best gift to the Chinese real estate sector (and to our national accounts for that matter). But as the Chinese economy slows and the property headlines continue to dominate the press, one broker is trying to get ahead of the curve.

Macquarie's commodities team have downgraded their iron ore price outlook to a Q4 average of just $85/tonne. They've also cut their 2023 outlook given construction activity is not coming back the way they thought it would. And to make matters worse, they warn an undershoot is not out of the question.

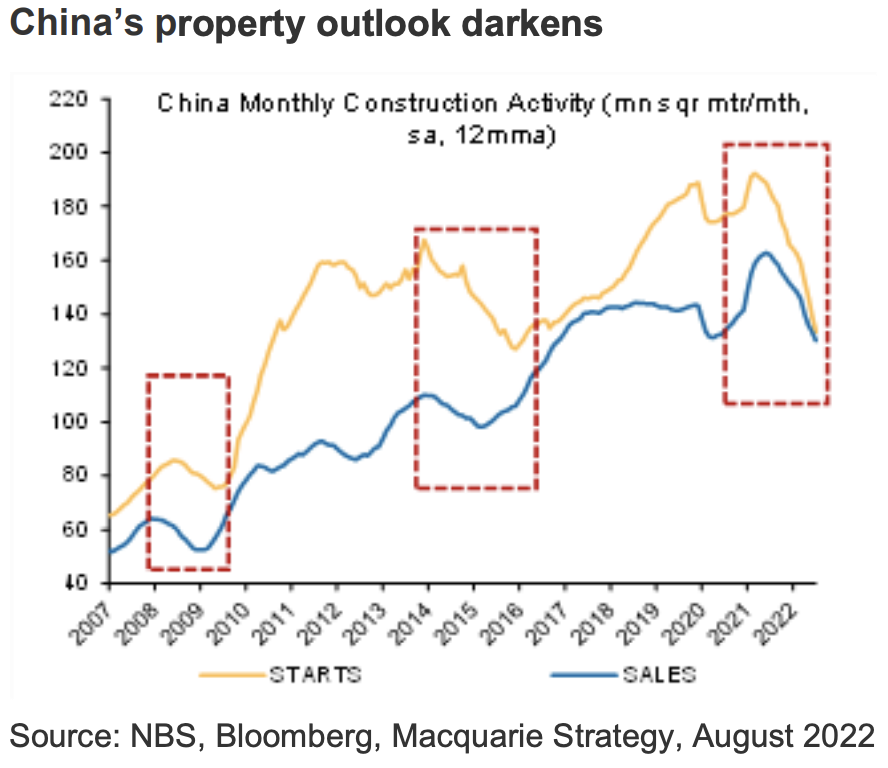

This chart shows off their thesis in part. It shows that property demand will eventually stabilise, but not for a long time. After all, it's not just activity that needs to be restored but confidence as well.

If you'd like to read more on the macro and the background behind all this, I highly recommend this piece from my learned colleague David Thornton. It features the insights of Janu Chan - a former St George economist and now, an independent analyst who has developed a special focus on the Chinese economy.

With this in mind, Macquarie has downgraded BHP's rating to neutral from outperform. Flatter CAPEX and less organic growth options are also factors behind the call. In the small end of the market, Champion Iron (ASX: CIA) and Mount Gibson Iron (ASX: MGX) are now neutral and underperform respectively. Each copped a one-notch downgrade.

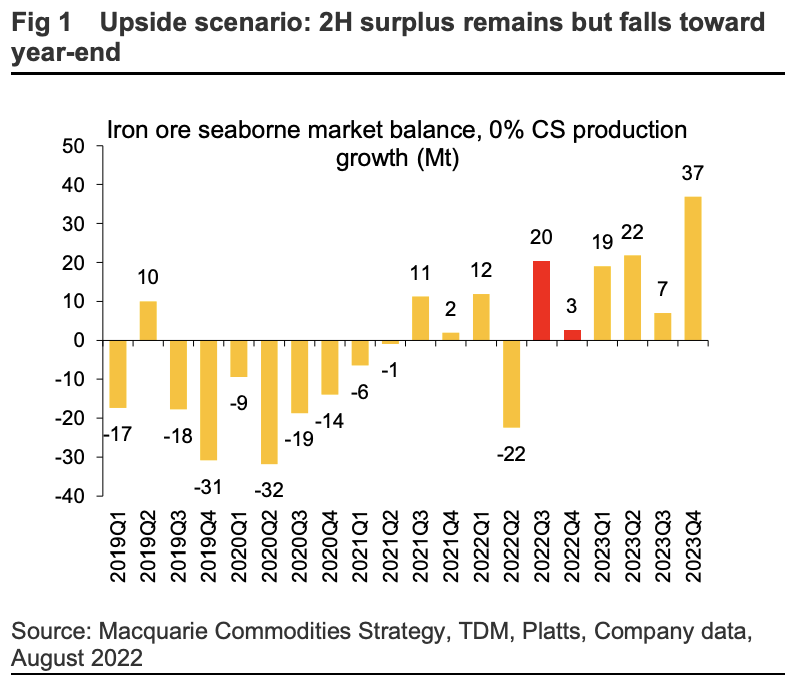

I do have good news though if you've just read the above but want to remain an iron ore bull. This chart will probably be your saving grace.

THE CHARTS

Today, I thought I would examine further a topic that we covered on Signal or Noise earlier this week. If you haven't watched that, I suggest bookmarking this video for later viewing:

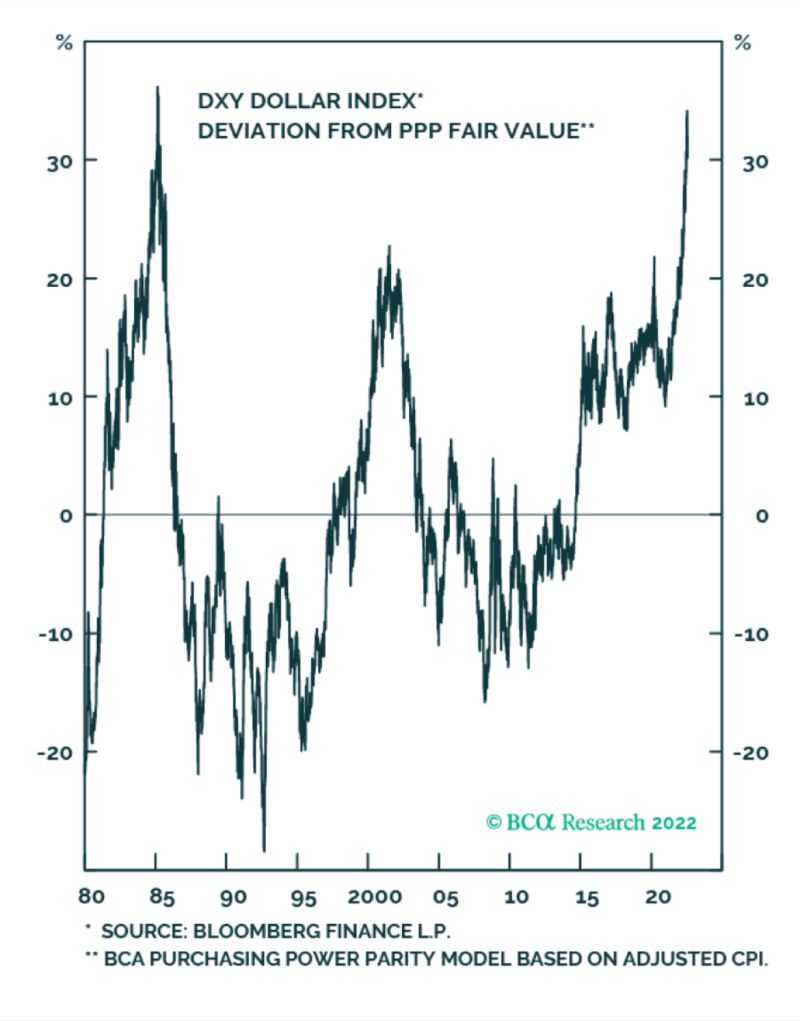

All the same, we're going to discuss the US Dollar. Its strength has been relentless this year. So much so that the Euro is now trading under parity for the second time in a year (which in turn, is for the first time in more than two decades). But if you want an indicator of just how strong it is, take a look at this first chart from BCA Research's Peter Berezin:

So now we've laid that down - consider this. If the US Dollar is strong, that weakens all other currency pairs right? That includes the Australian dollar. But how does the Australian dollar play a role in equities? David Scutt of ausbiz (ex-banker turned business anchor) charted this to provide some context and I think it's worth sharing:

If you were to put the ASX 200's performance in US Dollar terms, the ASX is actually down more than the S&P 500 over the same period. Conclusion? Praise a weaker local currency! (For now)

THE CALENDAR

TODAY'S TOP READ

After Six Months of War in Ukraine, Momentum Tilts Against Russia (WSJ): A wonderful wrap on a torrid time in global politics. There is still no end in sight, and that fact alone is enough to keep people in the agri, energy, and commodity trades for a long time to come.

Today's report was written by Hans Lee.

GET THE WRAP

If you've enjoyed this edition, hit follow on my profile to know when I post new content and click the like button so we know what you enjoy reading.

If you have a chart and/or a stat that you would like to see featured in a future edition of the newsletter, drop us a note at content@livewiremarkets.com.

4 topics

4 stocks mentioned

2 contributors mentioned