Market sold hard into the close

The market held up pretty well for most of the session and was actually up +42 points at the high, however in the last hour of trade there was a big seller of stocks out there – most large caps finished on their lows with the market dropping -11 points in the match after falling around 25 points from 3pm onwards. The large caps felt the brunt – futures led selling by the look – or a large portfolio exiting. Asian markets were actually strong while US Futures were in the green all day however it seemed to be Aussie focussed selling that really kicked in late in the day. When that sort of sell off happens, it tends to last a few days so we could be in for a period of underperformance, giving back some of the recent outperformance.

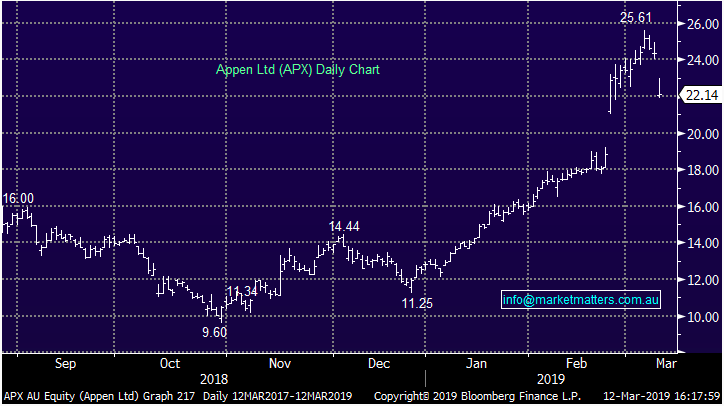

Energy bounced back today after yesterday’s sell off - Beach Energy (BPT) the best of them adding +3% while Appen (APX) dropped by 9% after coming back on stream following a capital raise – the retail component still to complete which we cover below. Elsewhere, those stocks exposed to the UK rallied, Janus (JHG) up +4.19% and CYBG (CYB) added +3.03% on positive developments around BREXIT - although still come way to go it would seem. They vote tomorrow, then the next day and the one after that on various parts to the deal – more to come here and those stocks will likely stay in focus.

Overall today, the ASX 200 lost -5 points or -0.09% to 6174. Dow Futures are currently trading up +68pts / +0.27%.

ASX 200 Chart

ASX 200 Chart

CATCHING OUR EYE

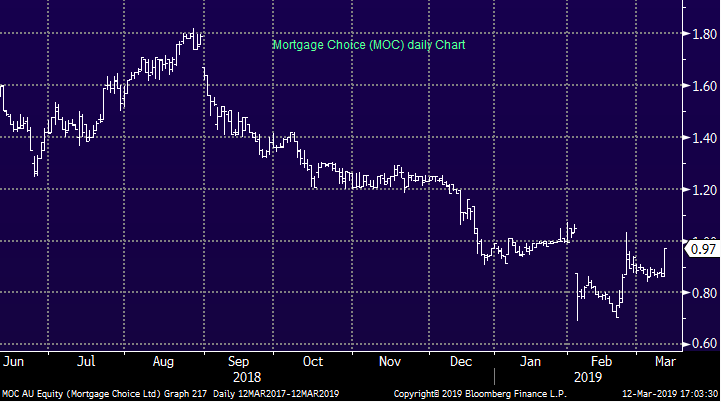

Mortgage Brokers;In a backflip from the Government, they’ve reverseda decision to ban trail commissions for mortgage brokers, as proposed by the royal commission – they now say it’s a bad idea. Good news for Mortgage Choice (MOC) which put on +12% today although it’s been a tough year for them…

Mortgage (MOC) Chart

Appen (APX) -9.15% today after successfully raising $285m via an institutional placement at $21.50 per share for the US acquisition we discussed yesterday. New shares are expected to settle with institutions on the 15th March making them tradable on Monday 18th March. The company also launched a retail offer via a Share Purchase Plan (SPP) for existing shareholders in the company. Shareholders had to be on the register on Friday 8th March 2019. Under the offer, each retail shareholder can apply for up to $15,000 worth of new shares at $21.50, or if the Appen share price is trading below $21.50, shares will be allotted at a price that reflects a 2% discount to the volume weighted average price up to and including the closing date of the SPP. As an example, if we assume APX’s share price on a volume weighted basis is $21.00 over the 5 days of the offer, new shares will be issued at $20.58. The SPP document is yet to be issued (due out 20th March).

Appen (APX) Chart

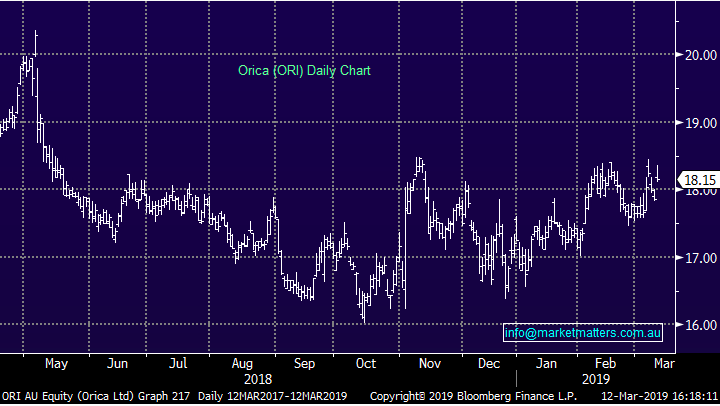

The mining chemicals & explosives stock we own in the Platinum Portfolio, Orica (ORI), bucked the index weakness and traded higher today, closing +1.68%. The explosives space has long been the subject of consolidation whispers and news articles today suggest we are getting closer to a deal. The Australian reported that private equity firms such Brookfield, BGH & Bain Capital have been keen watchers of the space, consisting of two major ASX listed stocks in Incitec Pivot (IPL) and Orica.

Another player expected to join the fun isWesfarmers (WES). Rob Scott, who was shuffled into the CEO role early in 2017, has been divesting assets out of the Wesfarmers in an effort to ‘shrink to grow,’ culminating in the demerger of Coles (COL) late last year. Now a cashed up Wesfarmer’s will be eyeing bolt on opportunities to add to its existing businesses. Prior to becoming the CEO, Rob was the head of the Wesfarmer’s industrials division and he has previously earmarked this as an area for growth. Still though, a deal is not done, and some obvious issues to make those on the offensive nervous. Orica has suffered some operational issues at its new Burrup plant in WA, the worst of which saw the operation out of action for a whole month in the middle of last year. We like Orica, with or without a takeover bid.

Orica (ORI) Chart

Broker Moves

· Qube Upgraded to Buy at Goldman; PT A$3.12

· Appen Upgraded to Buy at Citi; PT A$28.04

· Coles Group Upgraded to Buy at Morningstar

· Perpetual Downgraded to Sell at Morningstar

· InvoCare Upgraded to Buy at Morningstar

· Chorus Rated New Buy at New Street Research; PT NZ$6.80

· ANZ Bank Downgraded to Neutral at Credit Suisse; PT A$28

· Star Entertainment Raised to Outperform at Credit Suisse

· Charter Hall Education T Cut to Neutral at Goldman; PT A$3.31

Never miss an update

Stay up to date with the latest news from Market Matters by hitting the 'follow' button below and you'll be notified every time I post a wire.

Market Matters publishes daily market reports and sends SMS alerts when we transact on our portfolio. To get our latest market views and hear when we take new positions, trial Market Matters for 14 days at no cost by clicking here.

4 stocks mentioned