Mega opportunity in networking as a service

Megaport (ASX: MP1), a Brisbane-based business founded by Bevan Slattery in 2013, stands as an early pioneer in the provision of networking as a service, disrupting traditional networking paradigms. Networking as a service may be unfamiliar to many readers, just as it was for us initially. Megaport offers a range of services, but at its core, it facilitates connectivity between data centres (DCs). This service is pivotal for large enterprises with complex networks, a scenario becoming increasingly common with the ascent of cloud computing.

Creating connectivity between two DCs can be a complex endeavour involving:

- Installation of networking equipment.

- Securing ports in each DC to facilitate connection within the DC.

- Leasing fibre from local telecommunication providers to connect the DC’s.

While it’s possible to replicate this connectivity by leasing directly from traditional telecom firms, DCs and managing your equipment, this approach is costly, typically involves rigid, long-term contracts, and requires significant time and effort. Moreover, global clients seeking connectivity across DCs worldwide would face the challenge of dealing with multiple providers.

Megaport’s Offering

Megaport’s business model centres on establishing global DC connectivity and leasing capacity to clients through software-defined networks. Setting up connectivity for Megaport clients is straightforward: users log into the Megaport platform, select the desired DCs and capacity, and almost instantly, the capacity becomes available. Scaling up capacity and adding new connections is similarly straightforward, making it simple, scalable, and cost- effective.

Megaport began in 2014, offering a connectivity ecosystem for Australia, New Zealand, Singapore, and Hong Kong. In 2015, the company successfully raised capital through an Initial Public Offering and listed on the ASX, raising $25 million at $1.25 per share to fuel its growth strategy. By 2016, Megaport had expanded to include North America and Europe in its network. In subsequent years, the company further expanded its global ecosystem and service offerings.

Megaport primarily targets enterprise customers with intricate networks, often relying on software from multiple cloud providers such as Microsoft Azure, Salesforce, Amazon AWS, and Oracle Cloud.

Industry

In the realm of industry dynamics, Megaport finds itself in an advantageous position, riding on the coattails of several key tailwinds:

1. The relentless ascent of cloud computing and the increasing adoption of multi- cloud solutions represent enduring trends. With data scattered across multiple cloud providers, the demand for connectivity surges as employees navigate the intricate web of data flows.

2. The escalating data requirements propel Megaport’s sales, as the company specialises in selling connectivity capacity.

3. The ongoing developments and adoptions of new software as a service and artificial intelligence offerings further bolster Megaport’s position.

These factors position Megaport squarely within a vast and expanding market underpinned by structural tailwinds.

Competitive Landscape

Megaport faces two key competitors: Equinix (NASDAQ: EQIX) and Console Connect.

Equinix is one of the world’s largest data centre providers, however, only offers interconnection services within its DC ecosystem, unlike Megaport, which is DC provider- agnostic. Like Megaport, Console Connect is also DC provider-agnostic and has aggressively expanded its global network in recent years. There are other competitors, but they lack the scale and reach to compete with Megaport globally.

Recent Challenges

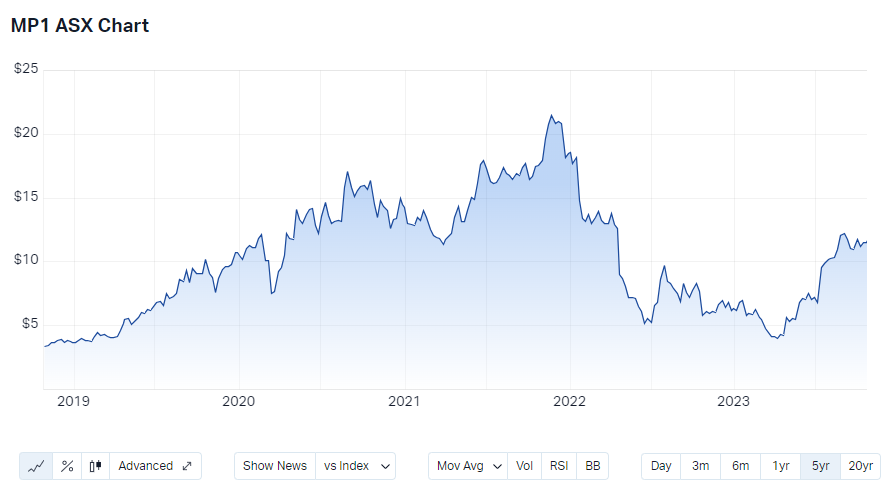

Throughout calendar year 2022 and into early 2023, Megaport’s share price faced significant downward pressure. This decline commenced with macroeconomic headwinds, including a slowing economy and rising interest rates, and was further exacerbated by emerging business-specific challenges.

Front and centre of these concerns were issues related to the company’s balance sheet. Megaport had been heavily investing in growth, depleting its cash reserves, prompting speculation about the necessity of a capital raise to bridge the gap to free cash flow breakeven. These concerns coincided with a period where expected growth initiatives were not materialising as anticipated. Additionally, management’s focus on developing a robust reseller channel proved challenging to scale efficiently, ultimately detracting from direct sales efforts and hindering growth. The departure of both the CEO and CFO at the start of the year marked a low point for the company.

In response to these challenges, Chairman and Founder Bevan Slattery stepped in as interim CEO and conducted a strategic review of the business. The review led to a series of initiatives, including repricing certain services, cost-cutting measures, and a renewed focus on the direct sales channel, with swift implementation.

The benefits of these strategic initiatives have been substantial. Megaport delivered several guidance upgrades, achieving free cash flow breakeven ahead of expectations in Q4. The better-than-expected profitability has alleviated concerns regarding the need for additional capital. The business has regained its footing, and the rebound in the share price reflects the abatement of earlier concerns. The appointments of Michael Reid as the new CEO and Leticia Dorman as CFO have stabilised the leadership team.

Investment Thesis

Considering the broader industry landscape, we prefer to invest in companies competing in fragmented, large, and growing markets with a demonstrated ability to capture market share. Such industry dynamics instil confidence in long-term value creation, and Megaport aligns perfectly with these criteria.

Replicating Megaport’s global network infrastructure, including leasing fibre and data centre connections worldwide, is no small feat. It necessitates substantial, ongoing investment and uncertainty of reaching sufficient scale, acting as a formidable barrier to new entrants. The company already holds scale advantages over most existing competitors and, like newcomers, faces challenges matching Megaport’s comprehensive offering. While Console Connect and Equinix are strong competitors, it’s worth noting that this market is not a winner-takes-all, and multiple businesses can thrive.

Megaport’s superior reach and capabilities are expected to continue attracting new customers. Existing customers tend to exhibit strong loyalty, with sales growing as their network complexity and data usage increase. A substantial runway remains for revenue growth from both existing and new customers.

Significant operating leverage has been witnessed recently. The expectation is that profit will outpace sales growth for several years as the business leverages its fixed cost base. We anticipate the company will compound earnings at high rates throughout the 5-year investment horizon.

Over the last 12 months, maintaining confidence in Megaport has, at times, proven challenging. While leadership turnover is typically a concern, the continued presence of founder and chairman Bevan Slattery helped us maintain conviction. Additionally, the company benefits from strong structural tailwinds and value propositions, both remaining intact and contributing to us sustaining our investment thesis.

Risks

All investments carry inherent risks. Megaport, being at an earlier stage of its growth cycle, presents additional risk compared to more mature portfolio peers. Risks include:

- Failure to reinvigorate the direct sales channel. The strategic review identified a neglect of the direct sales channel. Management is focused on strengthening this sales engine, failure to do so would suggest other issues are in play.

- Potential technological disruptions in the cloud and multi-cloud computing landscape.

- Significant shifts in the competitive landscape.

Portfolio construction

Megaport offers a unique, high-quality exposure with a distinct client base compared to the other businesses held in the Elston Australian Emerging Leaders portfolio. Its global revenue base provides diversification benefits. While its market capitalisation surpasses the portfolio and benchmark average, its relatively early growth stage suggests that capital appreciation will be the primary driver of returns. Megaport’s presence also exposes the portfolio to growing data consumption and cloud computing thematic. Over a 5-year investment horizon, we expect Megaport to deliver a total return in line with the portfolio’s weighted average, considerably exceeding our hurdle rate.

1 topic

2 stocks mentioned