Mortgage vs investing: Which is better?

Betashares

Congratulations! You’ve just bought a home. No small feat in today’s environment. Even better, you’ve been responsible with your purchase and have $500 to spare in your budget each month. So do you:

- Increase your mortgage repayments by $500, or

- Invest that money in the share market?

Let’s look at a couple of hypothetical scenarios to work it out.

But first, our assumptions

To make a comparison, let’s make the following assumptions for both our scenarios:

- A starting balance on the mortgage of $624,000. This was the average mortgage amount across Australia at the end of 2023[1].

- An interest rate on the mortgage of 6.18%. This was the average mortgage rate in Australia at the end of 2023[2].

- A 30-year loan period.

- A minimum repayment of $3,814 per month. This is the minimum repayment, given the above assumptions.

- Investment is via low-cost ETFs with a 50/50 mix of Australian and international share exposure.

- A nominal pre-tax return on shares of 8.55% p.a. This was the average annual return on global equities (shares) between 1951 and 2015[3].

- An effective tax rate of 15.9%, resulting in an after-tax return of 7.2% p.a.*

- ETF management fees average 0.06% p.a. assuming a 50/50 mix of a broad-based low-cost Australian shares ETF and a broad-based low-cost global shares ETF.

- All dollar amounts are in nominal terms, unadjusted for inflation.**

Scenario 1 – Careful Cathy

Careful Cathy wants to pay off her mortgage as soon as possible. She doesn’t like having the debt hanging over her and hates paying interest to the banks. So rather than paying the minimum $3,814, she starts making repayments of $4,314 per month. In doing so, each $500 in additional monthly payments goes to the principal and saves interest at 6.18%. (pre-tax), which has a compounding effect. This saves Cathy thousands of dollars in interest and reduces the length of the mortgage.

Thanks to Cathy’s diligence, she pays her mortgage off after 266 months, or just over 22 years. Over that time, she made a total of $1,147,363 in repayments, which meant she paid off her mortgage 94 months early, saving her $225,378 in interest.

Once her mortgage is paid off, she has an extra $4,314 each month that she can use. But being the diligent person she is, she decides to put that extra cash into shares. Cathy decides to invest that cash in the same way as Sally (in Scenario 2) – a 50/50 mix of Australian and international shares, via low-cost ETFs.

After nearly eight years of investing her money in the share market each month, she’s accumulated a balance of $541,562, of which, $135,885 was investment returns.

So after 30 years, she’s got no mortgage outstanding and has over $540,000 sitting in her portfolio. Cathy is very pleased with this outcome!

Scenario 2 – Share Market Sally

Sally, on the other hand, loves investing in ETFs. She decides to invest her extra $500 per month in the same way as Cathy – a 50/50 mix of Australian and international shares, via low-cost ETFs.

Because she’s only making the minimum repayment, it takes Sally the full 30 years to finish paying off her mortgage. Over that time, she made a total of $1,372,740 in repayments, which included $748,740 of interest repayments – $225,378 more than Cathy.

But wait! Sally has exposure to shares that she’s been building up over the last 30 years. Her investments may have been smaller, but her portfolio has had much longer to compound. So how’s that doing?

Over these 30 years, Sally has invested $180,000 in ETFs. But through the power of compounding, she’s received investment returns of $447,107, leaving her with $627,107 in her portfolio.

The results

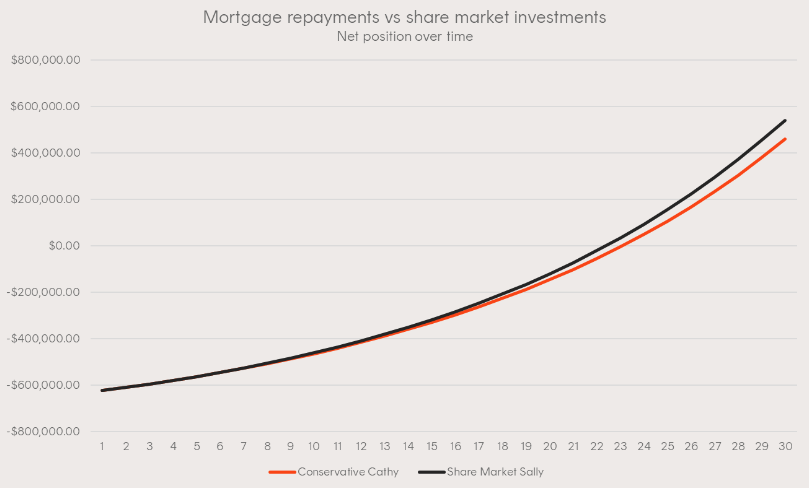

At the end of all this, both have fully paid off their mortgages, but Share Market Sally has over $85,000 more in her portfolio. The chart below shows how their respective positions grew over time.

Source: Betashares. A hypothetical example provided for illustrative purposes only. Not a recommendation to invest or adopt any investment strategy. Actual results may differ materially.

A few final considerations

While in this hypothetical, Share Market Sally came out ahead, real life is not as simple.

Firstly, the two options are not mutually exclusive. The examples are considered separately here for comparison, but there’s no reason someone couldn’t do a mix of both.

We’ve also used current average interest rates, which can change over time. And while 7.2% p.a. might be a reasonable long-run return to expect from shares, the actual outcomes will depend on how investors construct their portfolios, and the market’s future performance. Also, the outcome will be different if the investor is subject to a higher effective tax rate.

There is also the option of making additional super contributions, allowing our hypothetical investors to put their extra cash to work within the super system. There are tax concessions available for investing in super which could make this an attractive option to build long-term wealth, but there are also rules around contributing to super that Cathy and Sally would need to consider. However, the logic explored in the hypotheticals above still applies whether the investments are made inside superannuation or not.

Another important factor to consider is risk. This is a simplified example, but in real life, Sally and Cathy’s returns from shares should be expected to be volatile (i.e. vary up and down), while Cathy’s additional mortgage repayments are risk-free.

When all is said and done, there’s not just a single correct answer as to the best option. An investor’s risk tolerance, investment goals and time horizon all need to be considered. But now you know the important factors to consider when making this decision for yourself. You may also want to consider seeking personalised advice from a financial adviser or tax professional.

* Underlying assumptions for effective tax rate:

- 34.5% marginal tax rate (including 2% Medicare levy).

- 50% CGT discount.

- 82.5% franking on distributions from a broad-based Australian shares ETF.

- A 5% distribution a broad-based Australian shares ETF.

- A 2% distribution (unfranked) on broad-based global shares ETF.

- A franking credit percentage of 35.29%.

- A foreign tax offset percentage of 15% for a broad-based global shares ETF.

References:

- 1. Source: ABS ↑

- 2. Source: ASIC Money Smart ↑

- 3. Source: Jordà, Òscar, Katharina Knoll, Dmitry Kuvshinov, Moritz Schularick, Alan M. Taylor. 2017. “The Rate of Return on Everything, 1870–2015” Federal Reserve Bank of San Francisco Working Paper 2017-25. Page 13. ↑

3 topics

Patrick is the Editorial Director at Betashares and a member of the Investment Strategy and Research Team. He has over 15 years of finance and financial media experience with past roles at Livewire, netwealth, Link Group, and others.

Expertise

Patrick is the Editorial Director at Betashares and a member of the Investment Strategy and Research Team. He has over 15 years of finance and financial media experience with past roles at Livewire, netwealth, Link Group, and others.