Office isn’t dead, growth isn’t guaranteed but global "value" is ripe for the picking

The enduring defensiveness of property yields; the folly of an unwavering belief in growth; and some promising post-pandemic picks dominated the conversation among this trio of global fund portfolio managers earlier this week.

Chief investment officers Andrew Parsons and Jacob Mitchell of Resolution Capital and Antipodes Partners joined Hyperion chairman Tim Samway on day three of the Pinnacle Investment Summit.

In a sign of the times, this year’s event is virtual – a theme that has itself taken on more urgency in the last nine months. Coronavirus lockdowns have accelerated several online trends, including widespread adoption of tools like Zoom for conferences and meetings, by half a decade or more. This has prompted various reactions ranging from dire predictions to opportunistic enthusiasm – often a bit of both – from professional investors and retail shareholders alike.

The death of the office is one of these highlighted by Parsons, from global real estate investment trust manager Resolution Capital.

Since the GREIT strategy launched in 2006 the world economy has been buffeted by the US and EU credit crises; quantitative easing; US President Trump’s shock election; BREXIT and now COVID-19.

“We didn’t predict this stuff and we don’t try to. We believe real estate is a cycle and try to look through the long-term to find pricing power, where we believe landlords have the ability to increase their income streams,” Parsons said.

“Over the last six to nine months we’ve seen huge uncertainty over the traditional rent structure, but investors have to remember that a lease contract is a legally binding contact, there is no get-out clause for pandemics in 99.9% of cases…tenants are required to pay rent.”

He refers to Qantas management’s recent revelation it’s weighing a move of headquarters to help trim its $40 million annual spend on rent.

“Some are unfairly claiming business disruption to negotiate better leases, and the latest is Qantas threatening they’re going to leave their Sydney headquarters, which is leased from a REIT and has 12 years left on the lease,” Parsons said.

“But unless we’re going to have literal anarchy in contracts, then a lease is a lease is a lease.”

In any case, Parsons is far more concerned about the broader economic contraction caused by COVID, which has in turn reduced tenant demand.

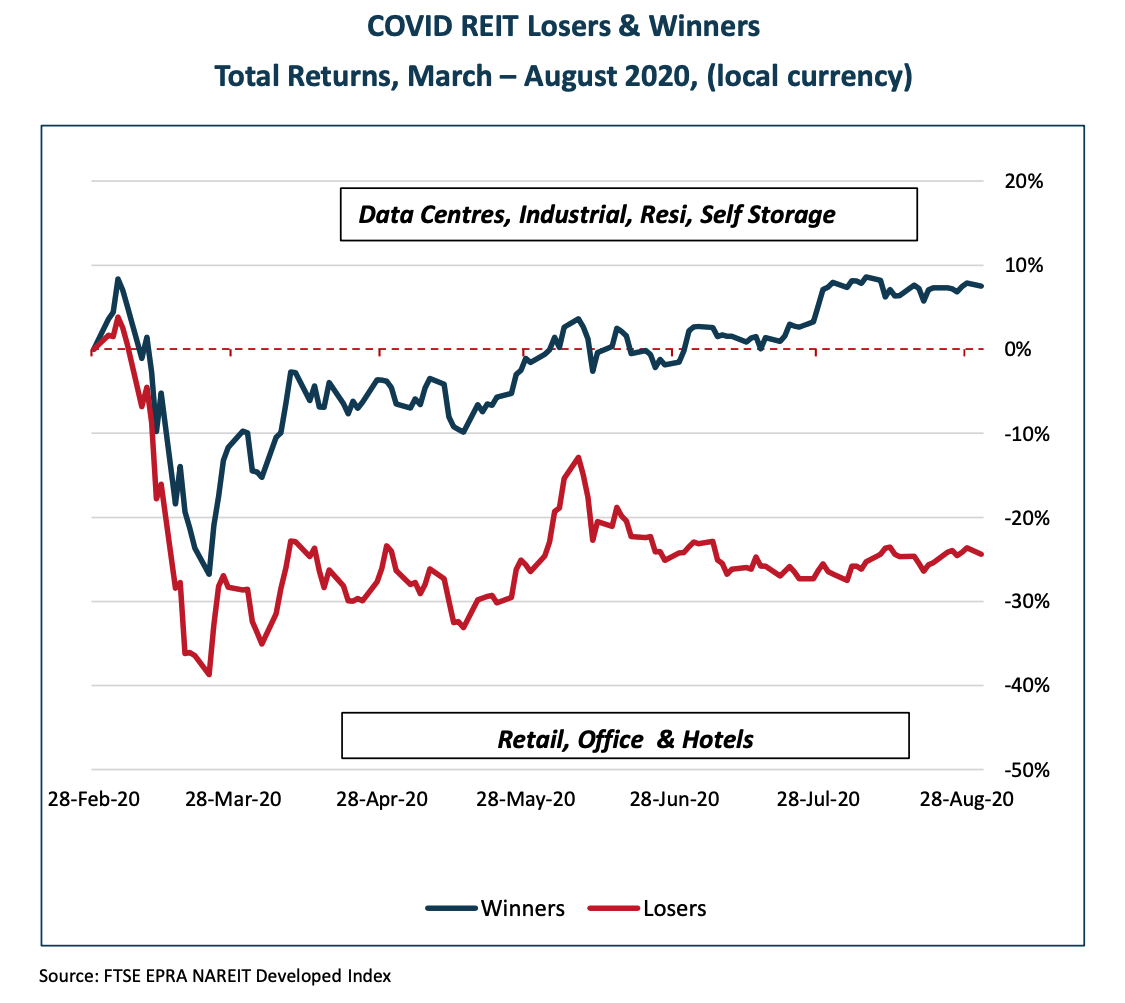

He said areas that have benefited from some aspects of the virus lockdowns were mostly doing well beforehand.

“And those that have been hit hardest have been retail and office, which have already been affected over the last decade.”

“It’s fascinating to us, because office has always been challenged…very volatile with very poor cashflow and highly commoditised,” Parsons said.

“Work from home and work from anywhere is really just the latest chapter.”

In line with this, office buildings hold one of the smallest allocations within Resolution’s portfolio, comprising just 6% as at 31 August.

On the other side of the ledger are data centres, which hold the biggest portfolio weight. But he stresses there are different types of data centres, some being only storage facilities while others are far more sophisticated.

“With the growth in online traffic and the internet of things, this is an ongoing key infrastructure area where the landlord has pricing power,” Parsons said.

“People keep underestimating it and that’s fine – but when they pay too much for a commodity data centre, we wish them well in chasing that thematic.”

US internet connection and data centre Equinix, which has 205 facilities in 25 countries, is one of Resolution’s preferred picks in the sector owing to its diversified tenant base with more than 9,500 customers, healthy balance sheet and solid return on invested capital.

Targeting different types of businesses riding high amid the information age acceleration, Hyperion Asset Management chairman Tim Samway explained how its global equity funds has been so successful.

“We think we have a market setup where we’ve had winners in the cloud space, but many of those trends are starting to mature, the valuations are elevated and we see the beginning of market cycles that could be very labour and capital intensive,” he said

In this “changing of the guard” Samway expects some of the headwinds of its quality and growth focused fund to turn into tailwinds.

One of the local stocks in Hyperion’s concentrated portfolio of between 15 and 30 stocks is real estate listing website REA Group. Samway recalled a casual chat with another fund manager in REA’s early days – on the sidelines of a weekend soccer match – who expressed his scepticism: “It’s just a website, it’s not a business!” REA has since become a 100-bagger for Hyperion.

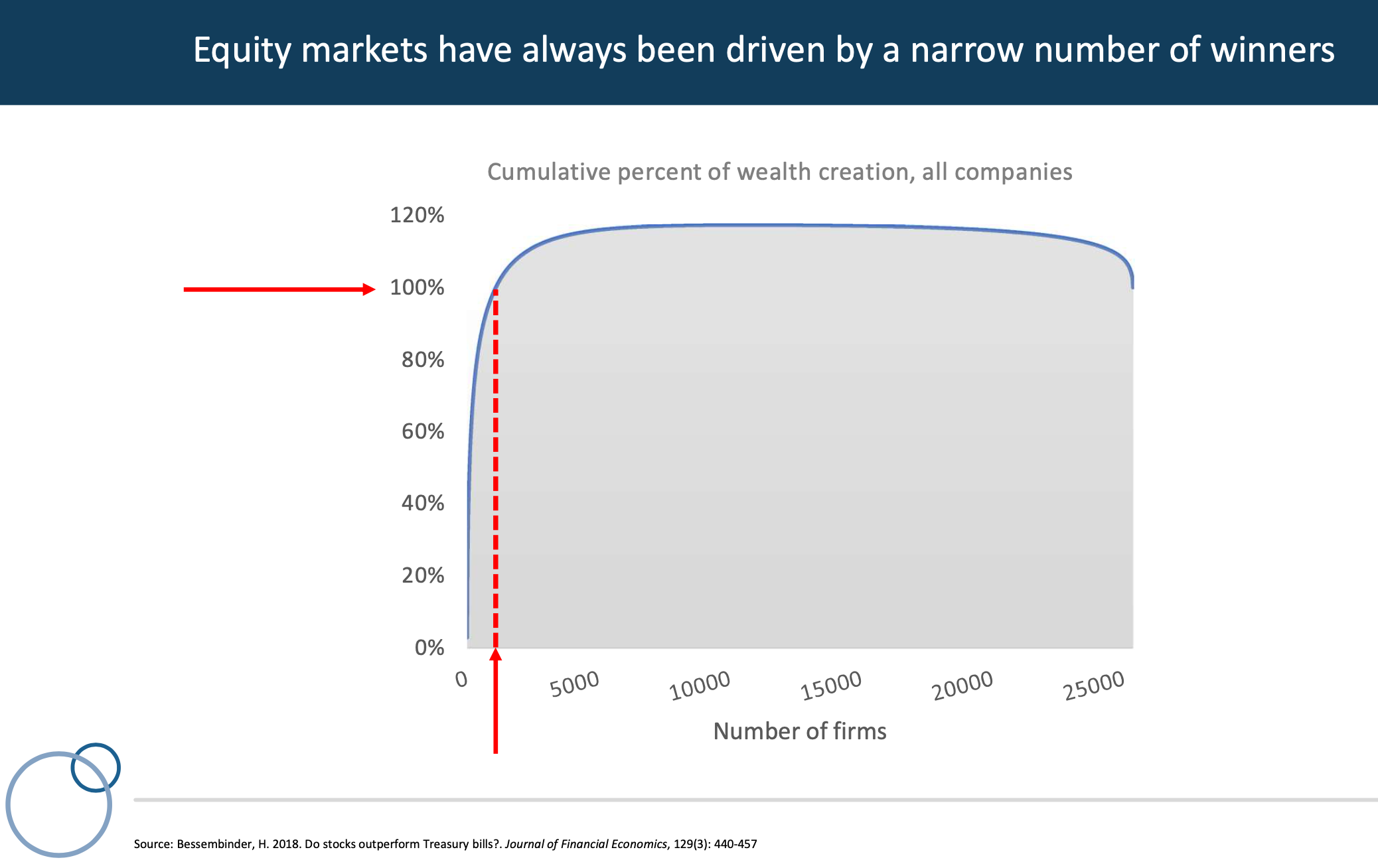

In the modern internet-enabled world, the power law distributions have moved from being regionally based to globally based, “so it’s become a winner takes most’ market.”

“Strong platforms with global scale win the most customers, the strong get stronger and take market share from the weak,” said Samway.

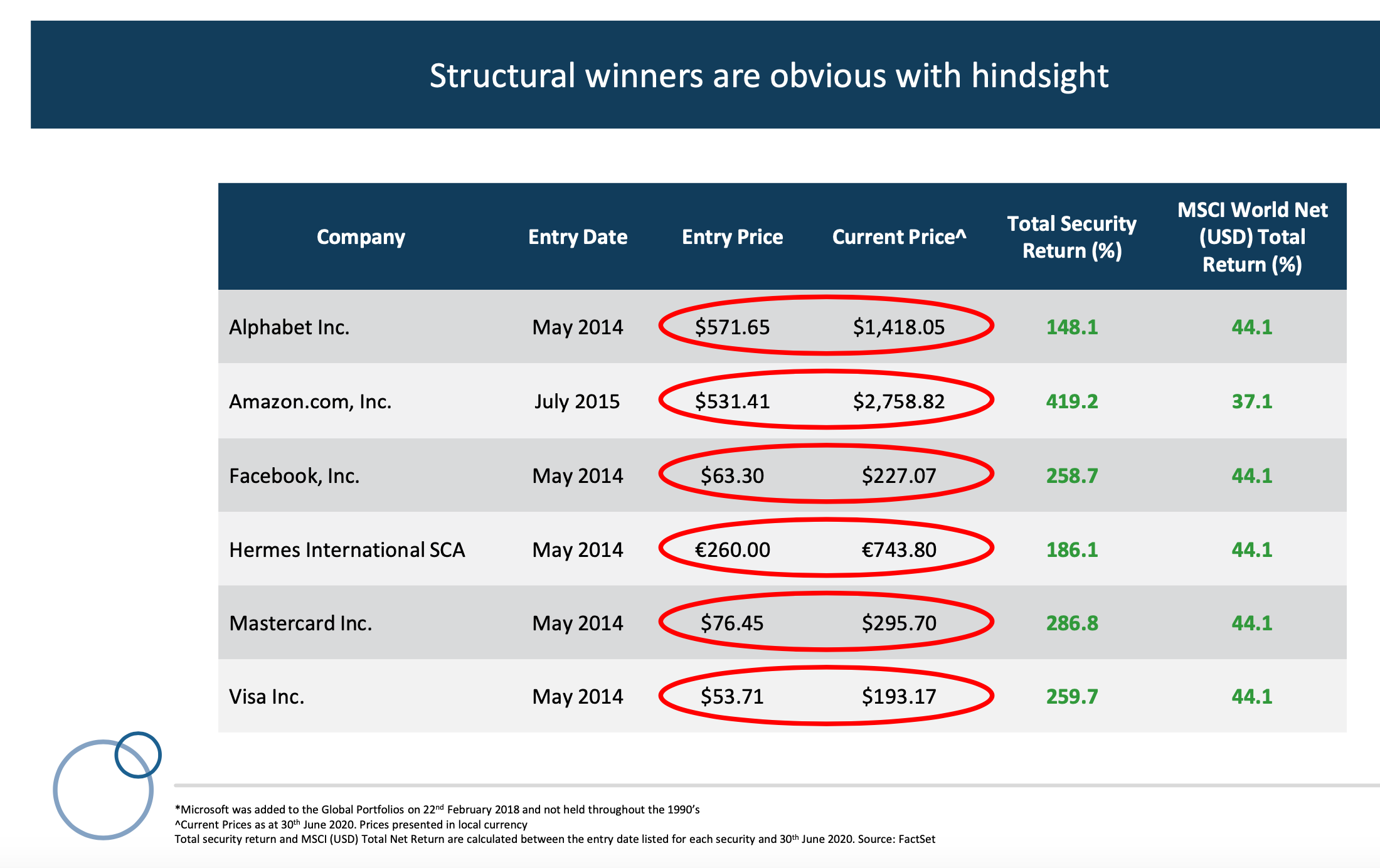

Successful identification of companies whose longer-term success wasn’t immediately obvious also saw the manager buy-in early to the likes of Alphabet, Amazon and Facebook back in 2014.

“But incumbent managers have only really begun to drive towards them in the last five years,” he said

“If you looked only at the PE ratio to provide insights for companies like these, you were actually wasting your time.

“You would have missed the boat if you were tracking only PE or only earnings.”

Another company Hyperion holds in high conviction is point-of-sale technology firm Square. With a total addressable market of around $140 billion, the company currently has penetration of only around 3%. “The stock has been on a tear since March…and we don’t see that trend reverting,” Samway said.

But he emphasises that not all growth stocks will be winners, and that the concentration of success among a small number of firms is something that is only becoming more pronounced over time: “We know that equity market returns are always driven by a narrow number of market leaders.”

On the value front, Antipodes’ Mitchell discussed his belief that some of the most successful high PE growth stocks of more recent times are due to underperform.

“Since December 2018 when the Fed blinked and pivoted, that outperformance of growth has accelerated, and COVID was the final application of the steroids, with many of those e-commerce and cloud computing stock trends having accelerated the adoption of some of these business models,” Mitchell said.

“But let’s understand: these stocks’ share prices are going up faster than their earnings and they’re now more than two standard deviations expensive."

By the same measure, he says value stocks are more than two standard deviations cheap.

Mitchell discussed several areas Antipodes sees as very compelling, including the huge untapped potential in supermarket food in China for conglomerate Alibaba; food delivery for KFC and Pizza Hut owner Yum China and in life insurance for Ping An.

And within western markets, the manager likes some well-established firms including Volkswagen – which has been under a cloud since the “diesel-gate” emissions scandal of recent years. But because of this, the auto manufacturer has doubled down on electric vehicle drivetrains.

“They’ve gone all in on EVs and we think they could be the largest manufacturer of EVs in the next couple of years,” Mitchell said. Currently trading at a 30 per cent discount to book, he believes the firm is currently on a 6-times earnings multiple.

Coca-Cola is another world-famous name that’s fallen out of favour, but Antipodes tips its supply chain efficiency will drive a long-term opportunity. “And COVID’s giving you an opportunity to buy a great long-term opportunity at a decent price,” Mitchell said.

Pinnacle Summit continues tomorrow

Throughout the week, Pinnacle has brought together some of the brightest minds in Australian investment management to help you build more robust, resilient portfolios.

In case you missed it, my colleague Vishal Teckchandani wrote a wire "Small caps turned 'Upside Down' as fundamentals fly out the window" discussing Spheria, Longwave and Firetrail fundies' views on whether quality matters, the dangers of chasing expensive stocks and where value can be found.

Click here to register and to view the full schedule.

Never miss an insight

Hit the 'follow' button below to be notified every time I post a wire, and don't forget to also click the 'like' button. Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

4 topics

1 stock mentioned

4 contributors mentioned