Opportunities in the great reweighting

Despite a worldwide rotation into value and cyclically-exposed companies, the rotation in Australia has been modest, and weighted to the performance of just seven companies: the big four banks and three iron ore miners. The Allan Gray Australia Equity portfolio has modest exposure to the banks, and no exposure to iron ore miners (as we currently see better long-term value in other companies), which has held back our performance. Despite this, we continue to be very attracted by the portfolio’s positioning and relative return potential.

In this wire, rather than focus on a single company thesis we're looking at one specific example of the opportunities arising from a structural shift to non-fundamental-driven buying and selling of shares (that is, buying and selling that is independent of a company’s earnings prospects). As we shall see, trends like these have pushed the market to extremes, increasing the opportunity for outperformance, but also makes discipline as important as ever.

The great reweighting

On 11 May this year, MSCI Inc., a global provider and creator of indices, announced the outcome of its semi- annual MSCI Equity Indexes Review. Through this process, 109 securities would be added to and 96 securities would be removed from the MSCI ACWI Index, MSCI’s flagship index that covers both the developed and developing world. These changes became effective on 27 May 2021. Any index funds that track the MSCI ACWI Index were forced to buy the companies that were added and sell those that were removed, regardless of price, on the effective date. Anything else would result in these index funds deviating from the underlying indices they commit to track.

Only two of these 109 additions are listed in Australia: Reece Limited and Domino’s Pizza Enterprises Limited. Only three of the 96 securities removed are listed in Australia: TPG Telecom Limited, AMP Limited and CIMIC Group Limited.

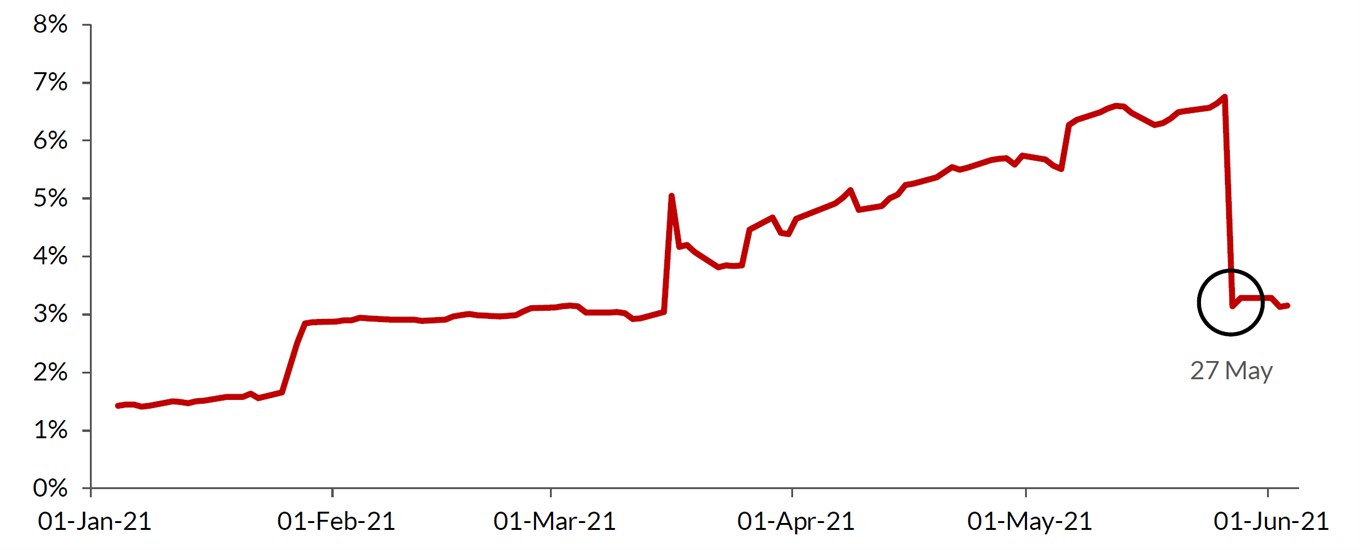

As the size of index funds has grown, so too has the impact of these rebalances. This is manna from heaven for hedge funds. They dedicate considerable resources to predicting (with reasonable accuracy!) which companies are likely to be added or removed and then position themselves accordingly by buying those companies expected to be added and selling (shorting) those expected to be removed. TPG Telecom’s short interest reflected in Graph 1 highlights this.

Graph 1 - TPG Telecom short interest as a percentage of its free float

Source: ASIC, six months to 4 June 2021.

This financial positioning happens well before the effective date of the index rebalance, with the short positions being easily closed out on the effective date by entering into offsetting positions with the index funds as large swathes of these shares trade. Again, focusing on TPG Telecom, Graph 1 shows this clearly, with the short interest increasing significantly from early-March 2021 and then dropping dramatically on 27 May 2021, the index rebalance date.

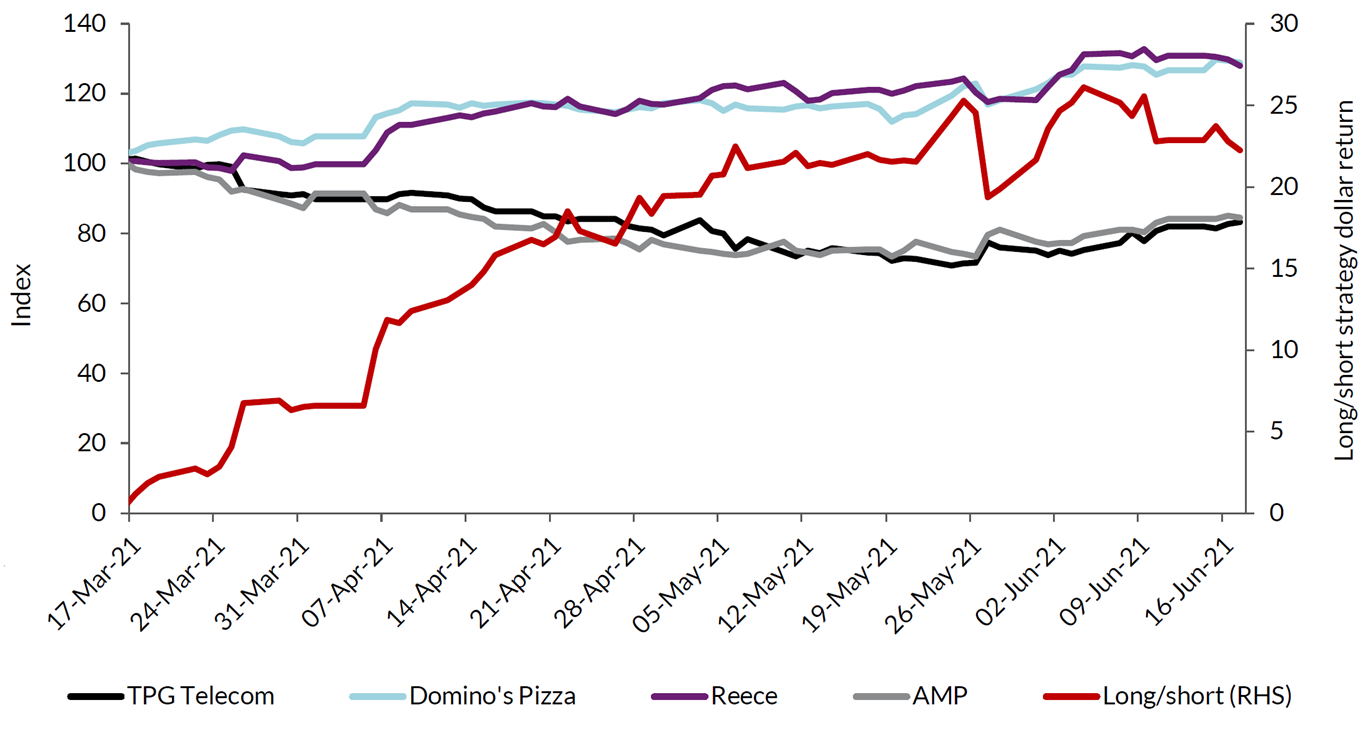

Generally, the outperformance of the ‘adds’ and underperformance of the ‘removes’ has made this long/short strategy reasonably profitable over time and especially of late. This is illustrated in Graph 2.

Graph 2 - Performance of May 2021 ‘adds’, ‘removes’ and long/short strategy dollar returns

Source: FactSet, three months to 17 June 2021.

Graph 2 shows the indexed returns of four of these companies over the past three months, a period straddling the MSCI ACWI Index rebalance effective date. We have included TPG Telecom, Domino’s Pizza, Reece and AMP in the graph, but excluded CIMIC. We believe there is a lower potential price impact from CIMIC’s removal from the index, given the number of shares affected, and the average daily trading volume, are both relatively low.

The graph also shows, in red, the performance of the long/short strategy over time (for simplicity, we’ve assumed an equal dollar investment in each of Reece and Domino’s Pizza and an equal but opposite short position in each of TPG Telecom and AMP).

The extent of the outperformance of the ‘adds’ is clear relative to that of the ‘removes’. More recently the ‘removes’ have appreciated strongly from the late-May index rebalance trade date, but the ‘adds’ have not weakened much. The long/short rebalance strategy has had a strong payoff (red line) but has only weakened modestly since the rebalance effective date. We expect the gap between these ‘adds’ and ‘removes’ to narrow as we move further from the rebalance effective date and the impact of the rebalance is diluted.

Reinforcing the point

Admittedly, analysis like this is short-term focused and comprises only four data points. The water is also easily muddied by stock-specific noise. Two things counter this pushback:

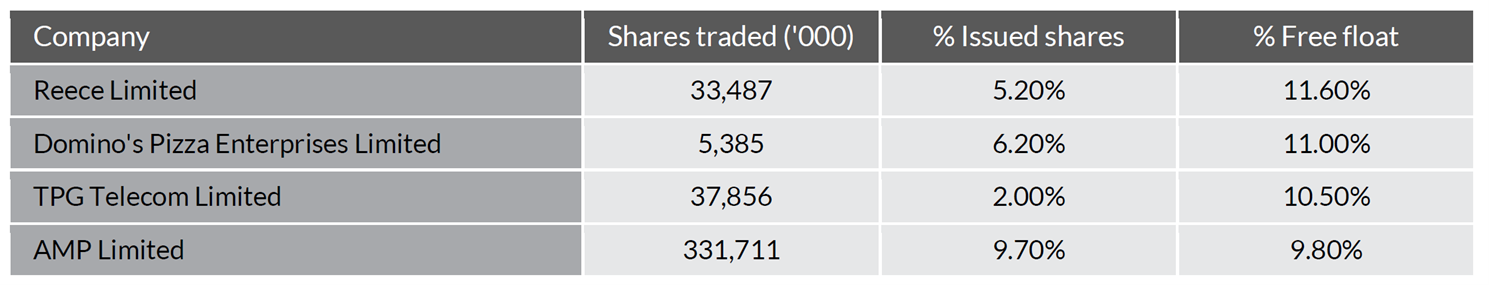

First, when the extent of the trading activity is assessed, it is hard to conclude that the financial positioning in the lead up to the rebalance effective date would not account for a significant part of the price divergence. Table 1 shows the total number of shares that traded after the 4:00pm close on 27 May 2021, as index funds performed their rebalancing.

Table 1 - Trading activity post market close, 27 May 2021

Source: Iress, FactSet.

Approximately 10% of each company’s free float changed hands in a matter of minutes. Buying or selling shares in any company to this degree in the weeks prior to the rebalance (so as to enter into offsetting transactions at the rebalance date) would almost certainly have had a material impact on the share price over such a short trading window. Without such positioning ahead of time, one would expect a much bigger impact on the trading day itself as a large percentage of the free float would have to trade at the close.

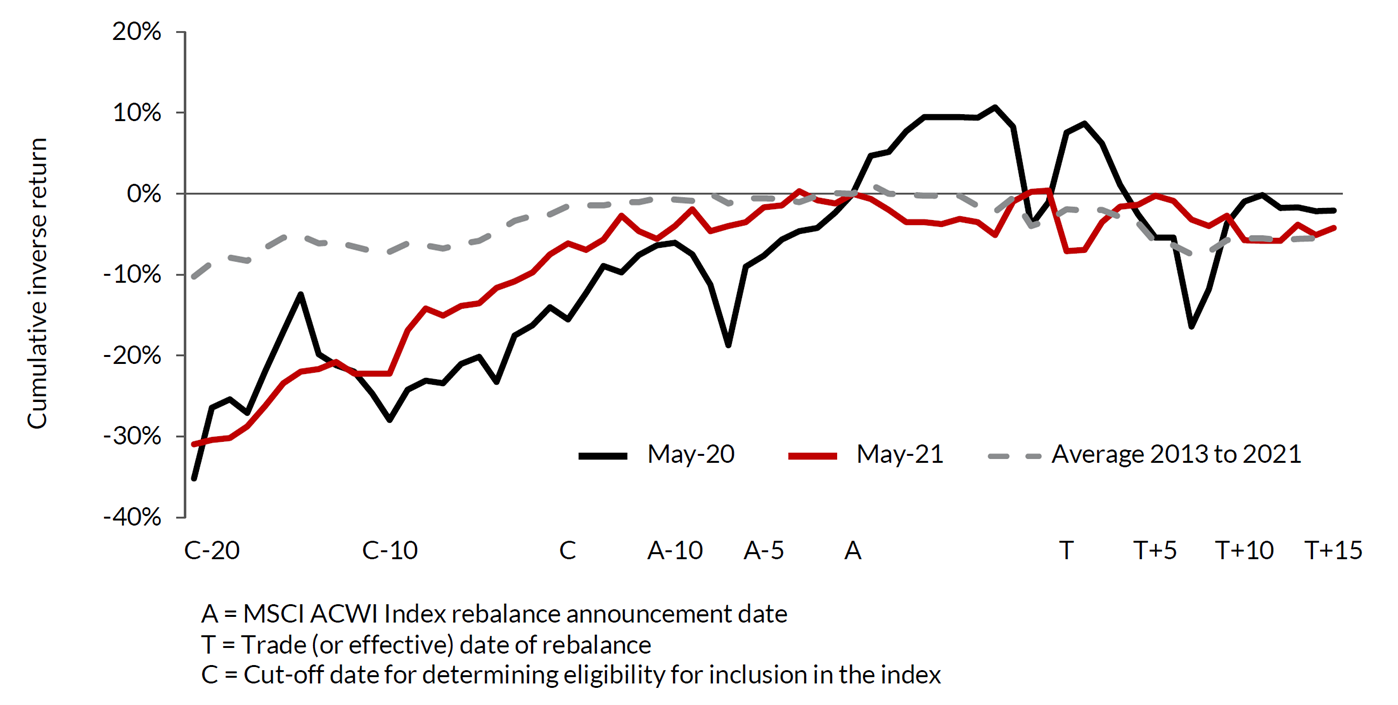

Second, extending the analysis of the performance of these long/short rebalance strategies over time and by geography confirms the above results.

Graph 3 shows the performance of the long/short index rebalance strategies in Australia for the May 2020 and May 2021 MSCI ACWI Index rebalances, as well as the average returns for this strategy across these index rebalances since 2013. The horizontal axis represents time (A = MSCI ACWI Index rebalance announcement date, T = trade date or effective date of rebalance and C = the cut-off date for determining eligibility for inclusion in the index). The vertical axis is effectively the cumulative inverse return that the strategy generates.

Graph 3 - Long/short index rebalance strategy returns

Source: Jefferies.

While Graph 3 is a little complicated, we can take from it some interesting observations:

- This strategy has worked well over time, not just recently. In fact, recent returns have been far better than the average over the past eight years, as shown by the red and black lines being significantly below the grey dotted average line.

- On average, strategy returns begin to fade after T, the trade date of the rebalance, as shown by the red and black lines trending downwards around the time of the trade date. This is intuitive. The decision to include or exclude a company from a sharemarket index does not change its underlying intrinsic value. This is why we think this selling pressure is non-fundamental (that is, it is independent of a company’s earnings prospects).

Although not apparent from Graph 3, when looking at results across all markets (not just Australia), this long/ short strategy delivers significantly lower, but still positive, returns.

What does all this mean for investors?

Other than (hopefully) being vaguely interesting, readers would be justified in questioning how any of this is relevant for a long-term fundamental investor like Allan Gray. On some levels they’re right. However, there are a number of interesting takeaways from the observations above:

- We’ve always said that a deep understanding of why somebody is selling a company to us or buying it from us is important. This increases the odds of being on the correct side of any particular trade. After all, normally, we are buying from an equally smart, if not smarter, market participant who has taken the exact opposite view to us. This means even fundamental investors (like us) stand to benefit from an understanding of the forces that drive short-term share price movements, like index rebalances in this case, especially when the sellers have non-fundamental considerations and the selling pressure is transitory. On occasion, these can present excellent buying or selling opportunities for companies that are already in the portfolio or those that become cheap enough to warrant inclusion. For example, we used TPG Telecom’s share price weakness in May to accumulate a near 1% position for the Equity portfolio at prices significantly lower than would otherwise have been possible were these rebalancing trading strategies in Australia not as impactful.

- The extreme returns that these strategies generate in Australia can’t be ignored. This may be the product of an increased shift to passive investment in Australia relative to the rest of world. Maybe it’s symptomatic of an absence of investment appetite for companies with negative price momentum. It might even just be noise. No matter the reason, it is likely that a healthy dose of patience will go a long way when it comes to actively deploying capital here. Possibly more so than ever in today’s volatile and fickle market.

- It’s hard not to question the true cost of passive investing. Despite having its merits, index investing is likely to be costlier than the headline handful of basis points explicit in the fees one pays. The above activities by those seeking to profit from index rebalancing clearly adds to the opportunity costs of those replicating an index and, therefore, investors in those index funds.

Non-fundamental trends like these have pushed the market to extremes. This tends to increase the opportunity for outperformance, but also makes discipline as important as ever. We continue to position the portfolio accordingly. In our next Quarterly Commentary, we’ll return to our usual stock-specific commentary.

Want to learn more?

Contrarian investing is not for everyone, however there can be rewards for the patient investor who embraces Allan Gray’s approach. Visit the Allan Gray Australia Equity Fund profile to find out more.

The above wire is an extract from Allan Gray Australia’s June 2021 Quarterly Commentary, which you can read in full here.

1 topic

5 stocks mentioned

1 fund mentioned