Opportunity knocks: Europe

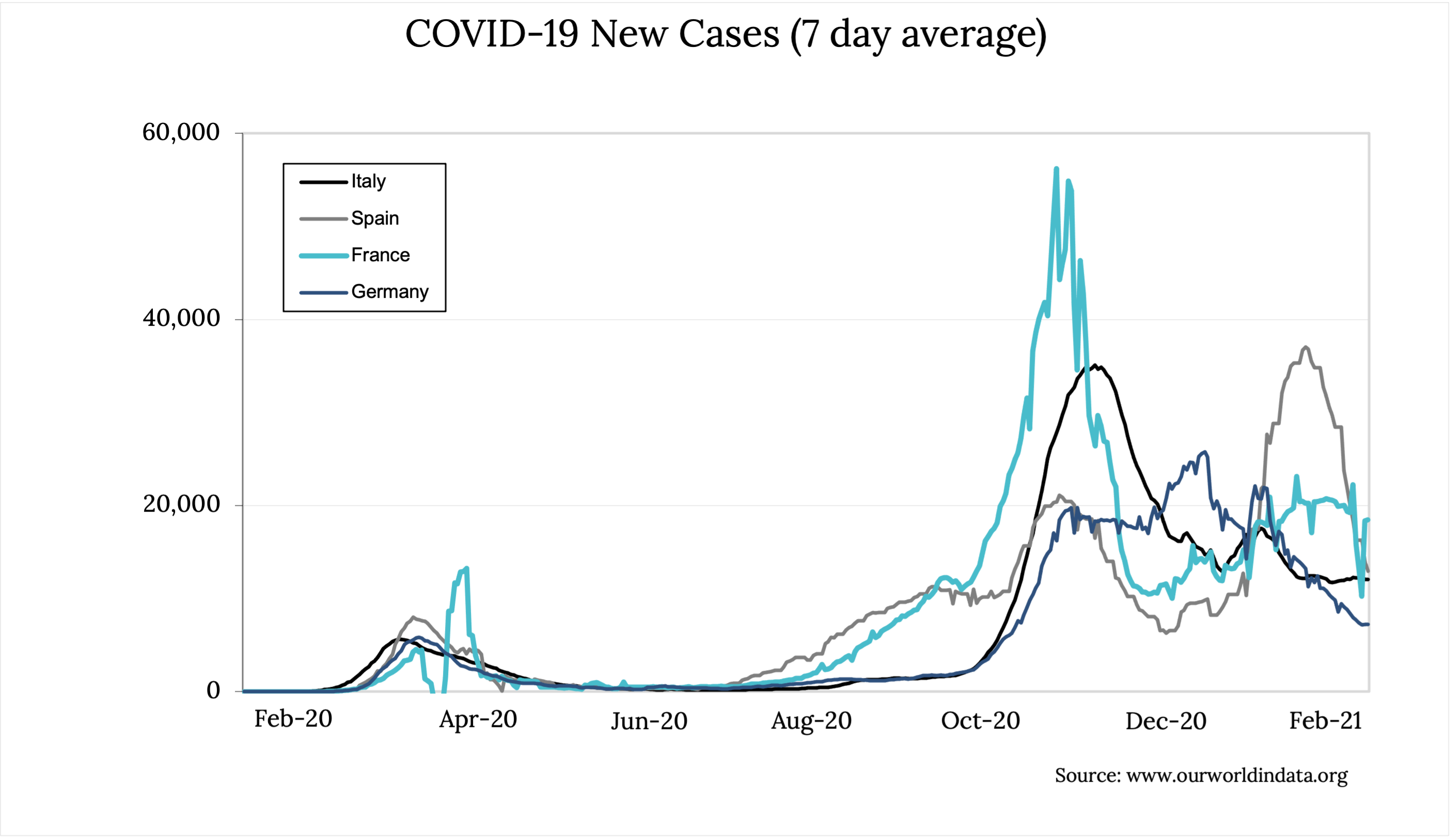

Since late last year we’ve viewed 2021 as a year of potential and opportunity in global equity markets. While a lot of focus has been on the US and the mega-cap Tech companies dominating indices, Europe has lagged with economic headwinds from renewed social restrictions associated with COVID, while the region’s disproportionately large exposure to the leisure and tourism sector has caused relative earnings momentum to be poor.

However these conditions provide some of the best opportunities for investors –with the region in aggregate being cheap vs its own 10-year history. In addition to this there are 4 good signs things are beginning to turn around:

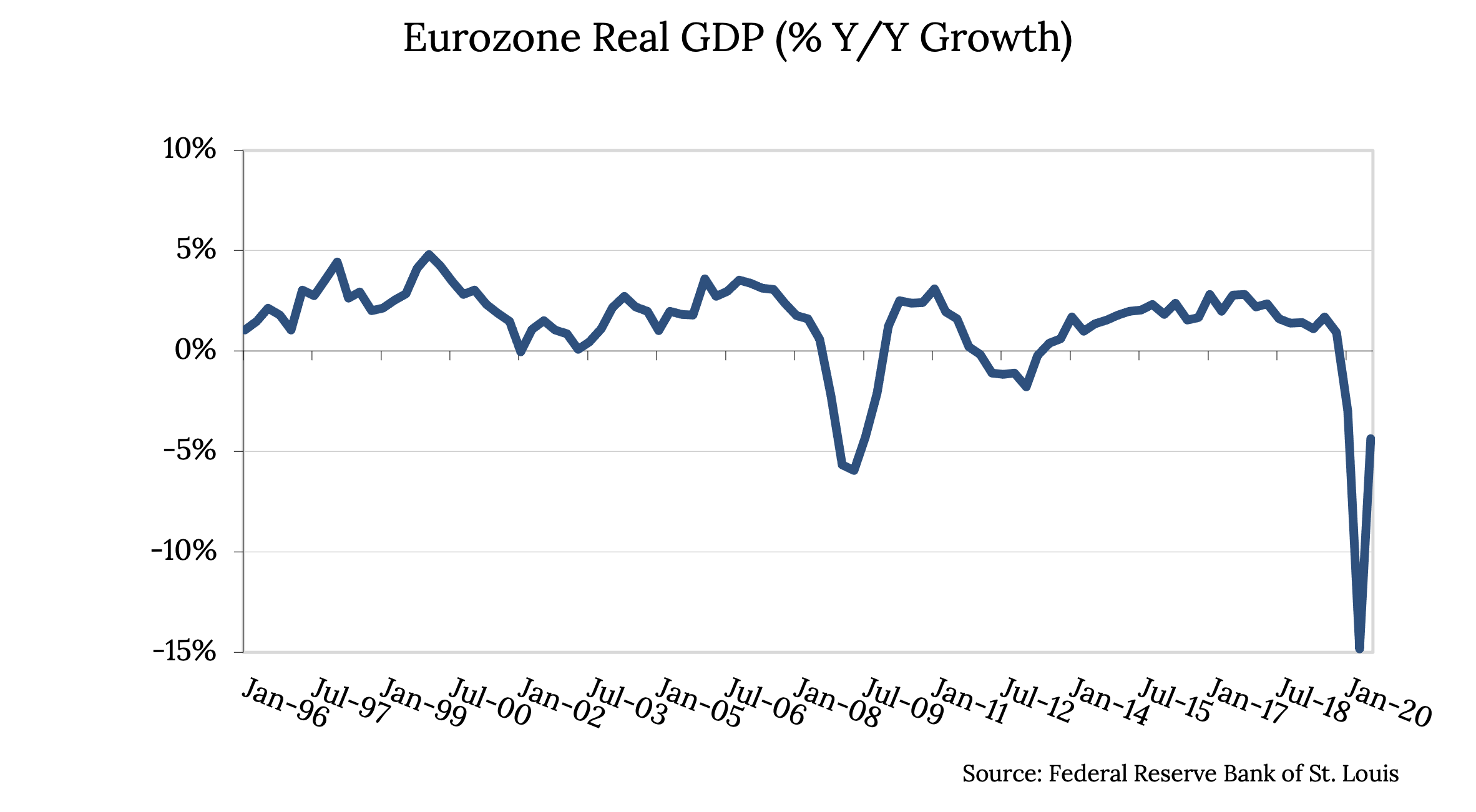

1. Enormous stimulus is likely to be a significant tailwind, with growth set to continue its acceleration.

2. COVID is abating and vaccine roll out is accelerating in the Eurozone.

3. Tourism and Leisure is an outsized percentage of the Eurozone economy – so the region will get an outsized boost as reopening takes place.

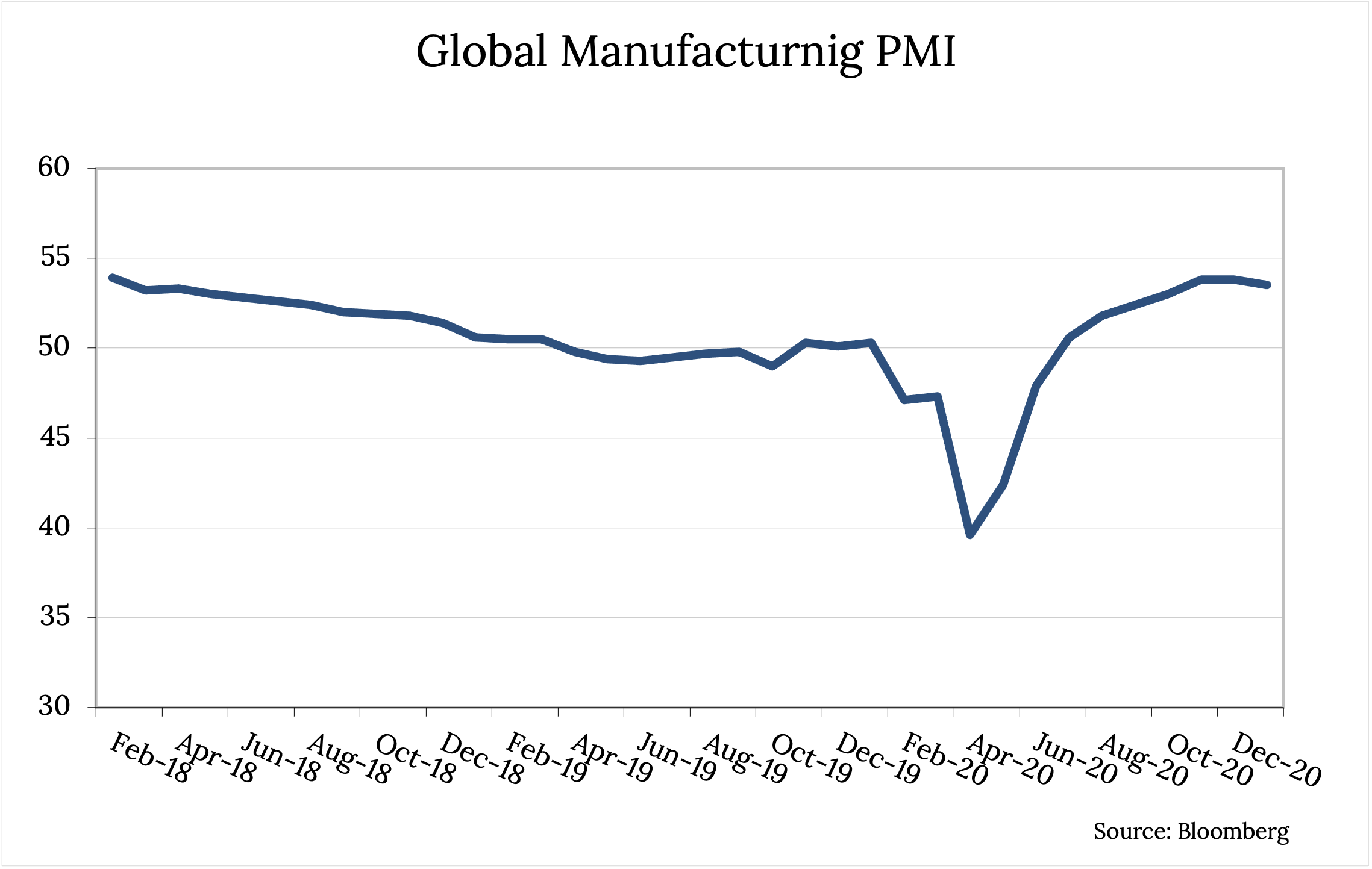

4. The bounce in global manufacturing PMI’s signals a strong rebound in the manufacturing sector which will help Eurozone exports, which make up 45% of the nominal GDP of the region.

Coupled with absolute and relative low company valuations, the region is well set to be reassessed by investors in the coming 6 months.

As an added bonus - the region is likely to disproportionately benefit were there to be even a small amount of sustainable inflation.

The UK may have left, but there are still plenty of opportunities.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia’s leading investors.

5 topics