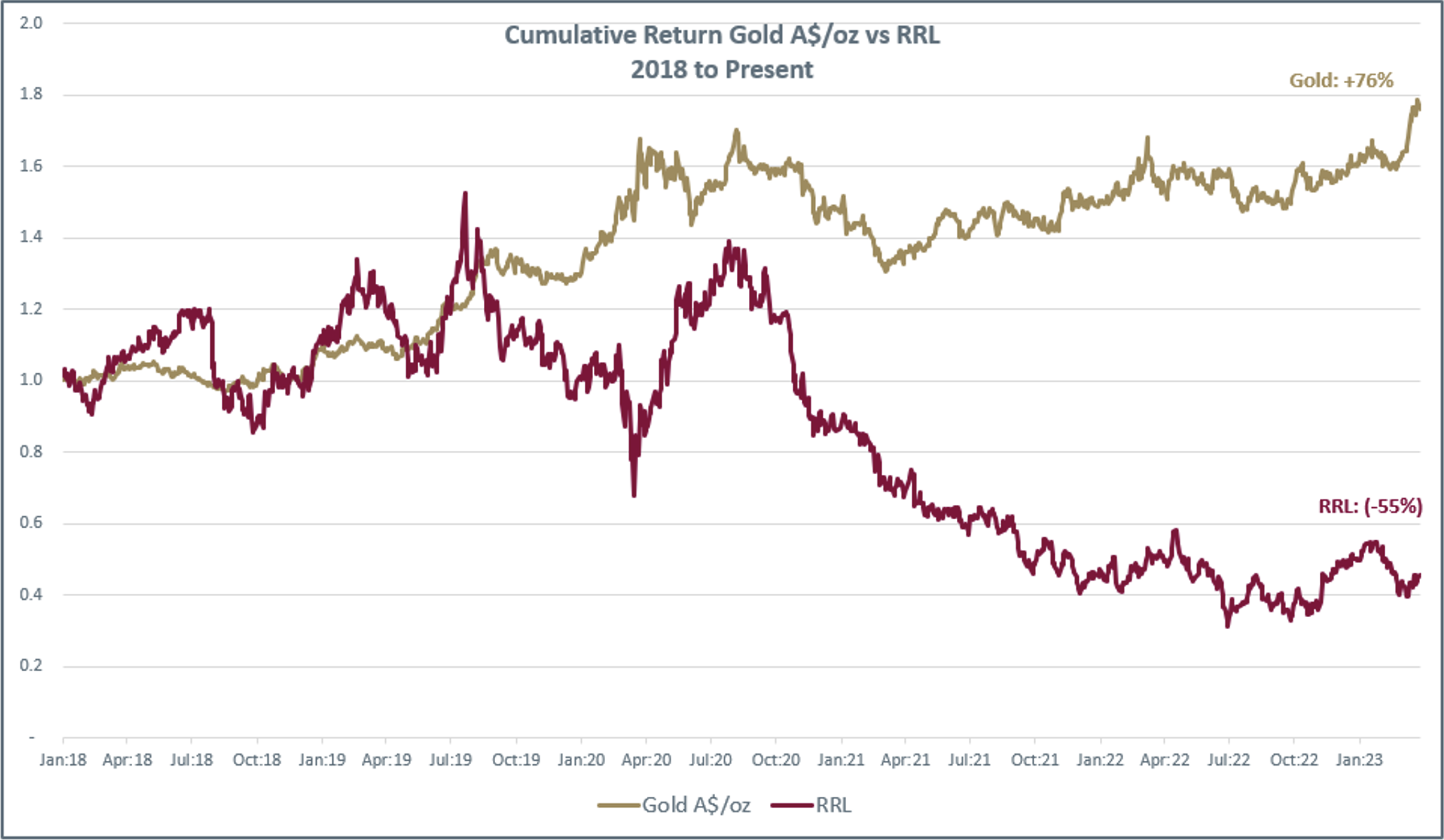

Our top gold pick was 230% higher when gold was last at this price

Consistently determining the direction of the gold price is beyond us. Whilst the US$ is (supposedly) the dominant driver, we have mapped out at least seven factors that can impact the price of gold. And at any point in time, the market can choose to focus or neglect any of these factors. So, our preferred way to play gold is via a company that has a compelling investment proposition irrespective of which direction the gold price moves. If the market for gold cools, we are still likely to do well given its bottom-up drivers. If the gold price continues to rally, then the macro will magnify our returns.

Regis Resources Ltd (ASX: RRL) in our view, is the most compelling gold play on the ASX. To whet your appetite, it’s worth noting that when gold was previously near these levels, RRL was trading 230% higher.

And importantly – most importantly - we have identified six discrete triggers (seven if the gold price keeps going). Any of which could lead to a healthy re-rating.

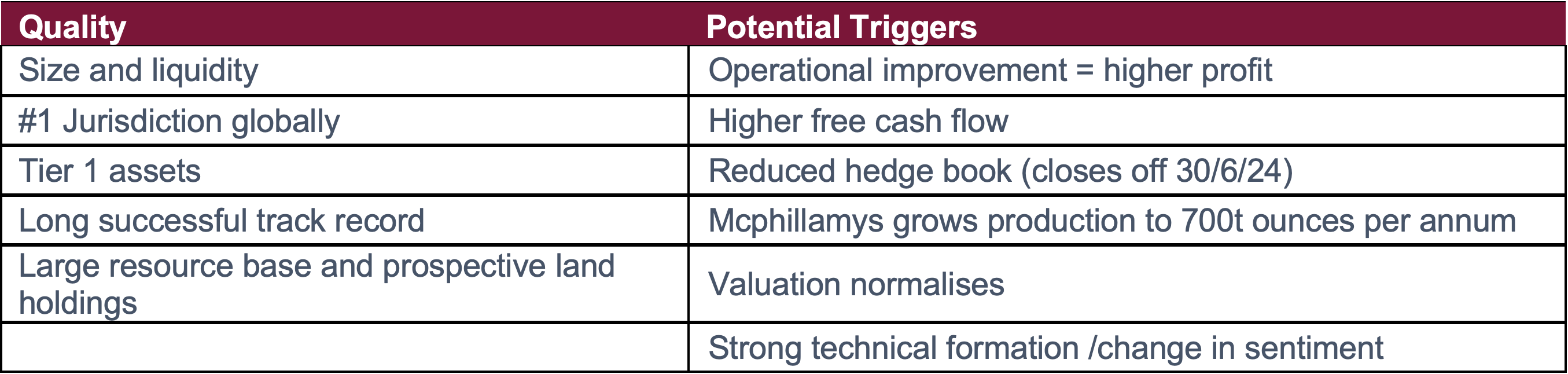

But before we look at these triggers, it’s worth understanding why we see RRL as being of a high calibre, despite its current price weakness.

High-Quality Miner

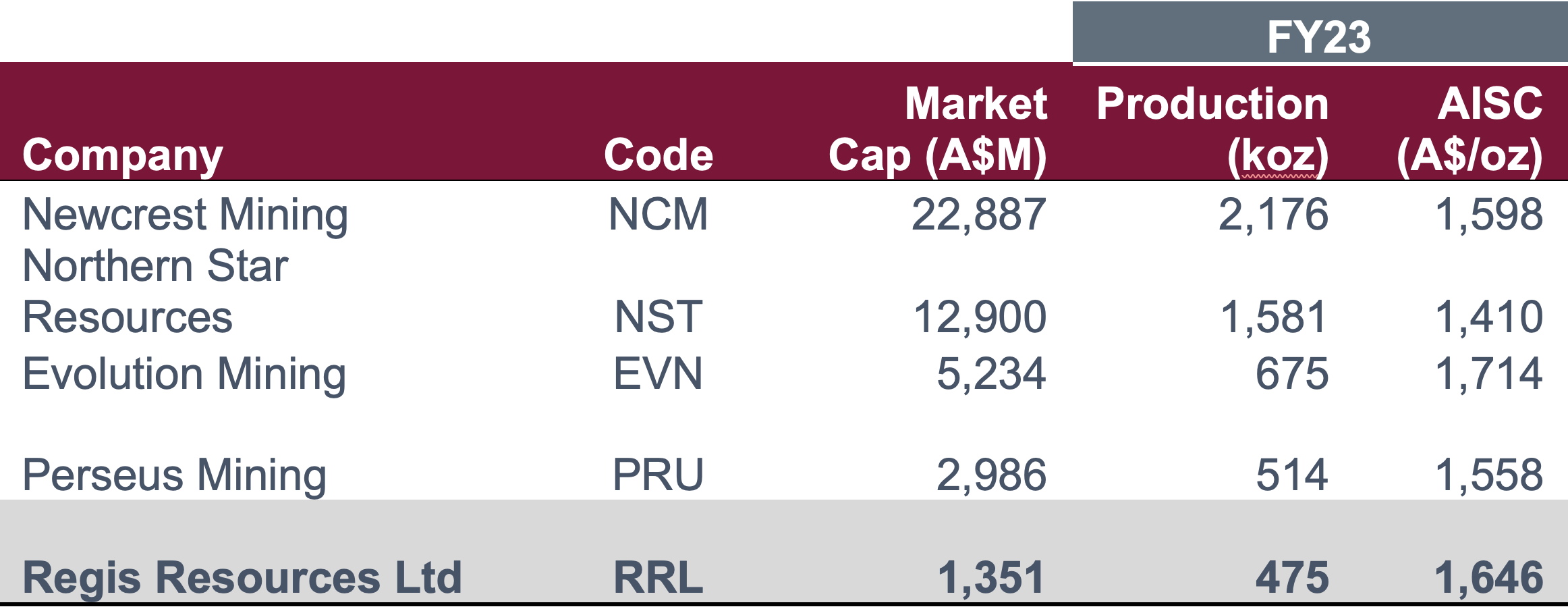

Size and liquidity are important across all stocks, but even more so in the case of gold mining companies. RRL is currently the fifth-largest Australian gold producer listed on the ASX. In terms of domestic producers, RRL is the fourth-largest, with Perseus Mining Ltd (ASX: PRU) producing from mines located in West Africa. The three producers above RRL are Newcrest, Northern Star and Evolution – all household names. RRL has very much flown under the radar to date.

Secondly, both of RRL’s operations are based in Western Australia. Arguably there is no better jurisdiction globally to mine gold than in WA in terms of skills and experience, infrastructure, geology, sovereignty and tax regime. No better jurisdiction. With the utmost respect to Perseus, would you prefer your gold mines in WA or Ghana and Cote d’Ivoire? Yet surprisingly, Perseus’s market capitalisation is near twice that of Regis for a similar level of production.

Next, Regis’s two assets are what we would consider Tier 1. In the case of Tropicana, this is indisputable. In the case of Duketon, there is some wiggle room. But in our view, an objective assessment of the Duketon operations over the past decade is supportive of that assertion.

And this, in part, brings us to the fourth characteristic, which is a long successful track record of operation. Duketon commenced operation in August 2010 and has produced 3.385moz of gold over that time. Over the past 8 years, production has not dipped below 300k ounces per annum. In the past 2 years, productivity, grade and costs have been well off historical levels. However as we will see below, this has now turned a corner. Importantly, this long-term track record provides a high degree of insight, understanding and confidence in the operations. It’s important to realise that the strong track record also translated into high free cash flow. And RRL is one of a handful of gold miners that has paid a dividend every year since 2015 (and in fact was the highest-yielding gold stock for many years).

Perhaps the only area of contention may be around reserves. For the existing operations this stands at around 2m ounces. However, there are some important nuances. Firstly, the resource base for the WA operations stands at 7m+ ounces. Regis is now heading underground at all of its operations, and underground operations have a much higher level of reserve replacement. Already we are seeing this at Tropicana, where underground reserves are outpacing depletion. Regis has also used a conservative gold price of US$1,400, which is likely to increase in coming years. And importantly, Regis holds prospective tenements, with their respective operations containing the largest land holdings in two of the youngest but emerging greenstone regions in WA – the Duketon and Tropicana gold belts.

Potential Triggers

Good companies can remain cheap for long periods of time. What is required is a catalyst or 2 or 3! Regis looks to have a number of near-term triggers.

To begin with, after two difficult years, the company is heading into a sweet spot from an operational perspective. Over the coming 18 months, we will see a material reduction in stripping ratios at Duketon North and commercial production from Havana open pit and Garden Well underground. The new sources of ore will also enable better sequencing and the capacity to focus on productivity and not just throughput. Combined, these will generate better grades, more gold, lower costs and a material increase in net profit.

Similarly, both WA operations have undergone a period of heightened capex during FY22 and FY23. Investors seem to have simplistically extrapolated this as the new norm for Regis. However, management have made it clear that capex will significantly reduce during FY24 and onwards. Along with the improved operational performance outlined in the aforementioned point, this will see a material increase in free cash flow.

Thirdly, Regis is in the final stages of dealing with its problematic hedge book. When Jim Beyer took over as CEO in October 2019, the previous management left him a horribly out-of-the-money hedge book. At the time this comprised 427,000 ounces to be delivered at a paltry A$1,598 per ounce. This has created a significant drag on profitability for the past 3+ years. But the hedge book is now down to 145,000 ounces, which will be delivered in full by 30th June 2024. Whilst this will still create an impost this year and next, there is now light at the end of the tunnel. And within a little over 12 months, Regis will be completely hedge-free.

Next, the company was finally able to announce that all NSW state approvals for the important Mcphillamys Gold mine in NSW were received in the last week of March. This is a watershed moment for the company. Mcphillamys is one of the largest undeveloped open pit mines in Australia. It is slated to commence producing at 200,000 ounces per annum in the bottom cost quartile. The initial reserve is 2m ounces, but there is no doubt that his will grow substantially based on what has already been delineated. This new production will organically evolve Regis into a 700t ounce per annum producer.

At 700t ounces per annum, across 2 long-life mines and 3 high-quality operations, Regis will be squarely in the cross-hairs of potential predators. There are only 3 other domestic gold producers in Australia with a larger production profile. Any domestic or international gold company looking to grow production in Australia will have to take a close look at Regis. There are literally only a handful of stocks of this size. At the current valuation, one of 2 things is likely to happen: 1. Either the market rerates the stock price or 2. The company will be acquired. Not surprisingly, Bell Potter Securities recently listed Regis as their #1 takeover pick in the gold space.

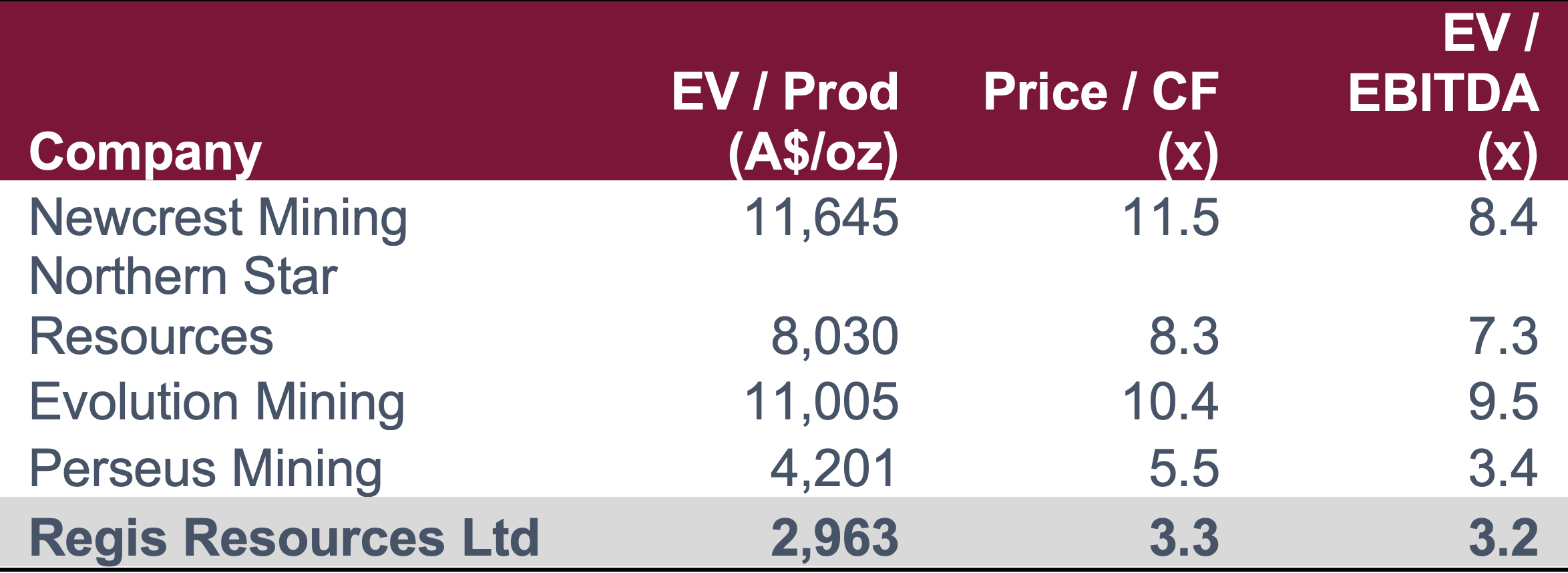

And this brings us to valuation. On most metrics Regis is trading at a fraction of the attributable value of its closest peers. Whether we consider enterprise value: production, price to free cashflow or enterprise value to EBITDA, Regis is substantially cheaper on every metric. Of course, it would be unwise to take this on face value without asking ‘why’? Why is Regis so cheap? Our answer to that question is that Regis has had a difficult period, but the company is now at an inflection point (as outlined above). However, it takes time for the market to recognise this, as many investors make decisions by looking in the rear view mirror. In our assessment, as the market comes to recognise the recovery underway, the valuation will normalise and the share price progressively appreciate.

Which brings us to the final point being sentiment as defined by the price technicals. Regis has mapped out a pronounced accumulation phase and has established a strong technical (read price) foundation. It has broken 4 downtrend lines, completed its first upside breakout and has demonstrated good commitment to the price moves. A move above $2.31 is the final piece to the technical puzzle and would be an emphatic confirmation that sentiment has indeed turned.

Summary

Despite the price weakness over the past 2-3 years, Regis is a high-quality company. We believe that it is at an important inflection point and there are 6 potential price triggers in addition to the price of gold itself.

There are of course no certainties in markets. For example if the gold price capitulates, then no amount of bottom up drivers will prevail. However, a quality business, trading on a cheap valuation with multiple price triggers, is about as close to a ‘certainty’ as the market is likely to afford.

Want more content like this?

Romano is a portfolio manager at Katana Asset Management. You can follow this profile to read more great content like this or click the fund card below to learn more about the Katana Australian Equity Fund.

4 topics

1 stock mentioned

1 fund mentioned

.jpg)

.jpg)