Peak virus has passed: Updated COVID-19 forecasts for the US, UK, Germany, France, Spain, Italy & Australia

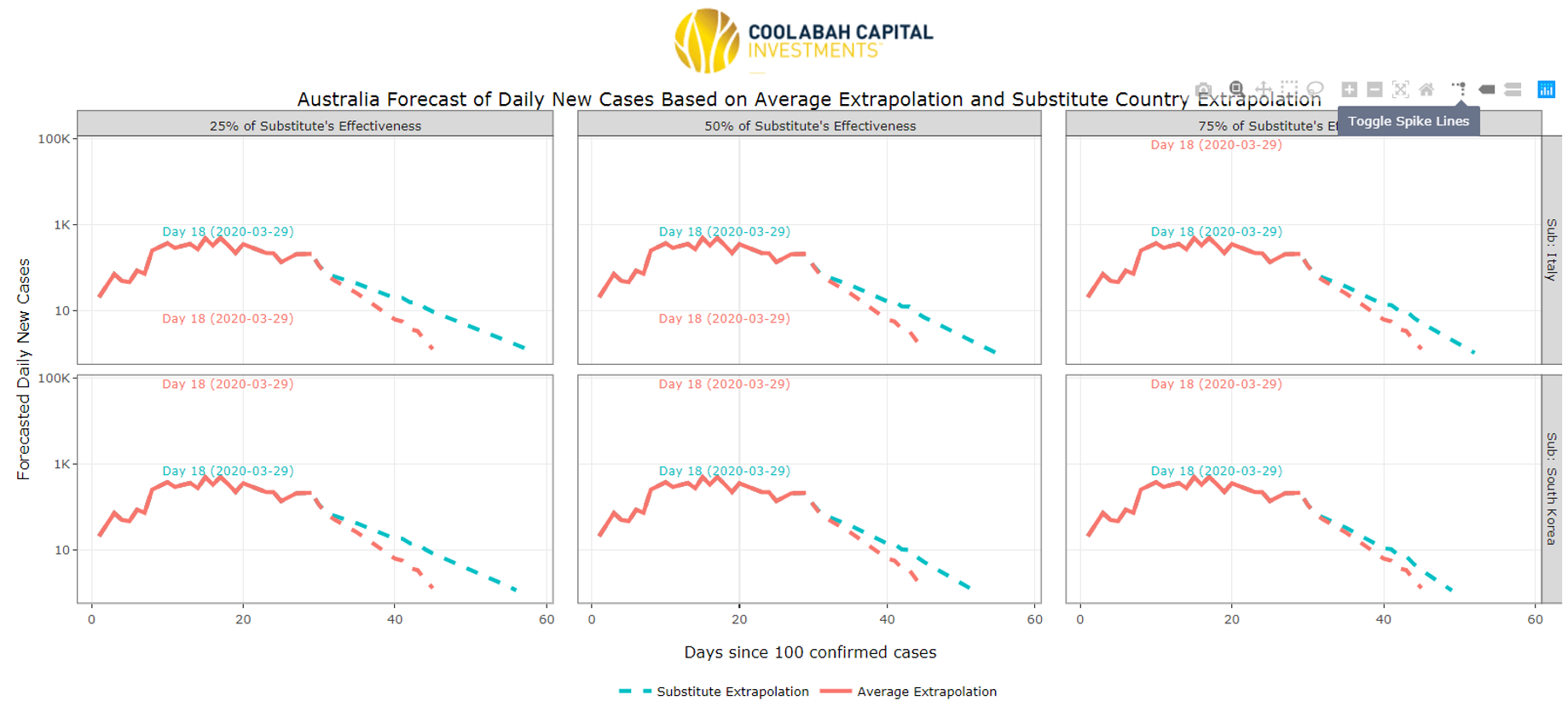

We've called the peak in new COVID-19 infections in Australia, which appears to have occurred a week or two ago in line with our contrarian March forecasts (see the screenshots below and the full technical forecasting paper here).

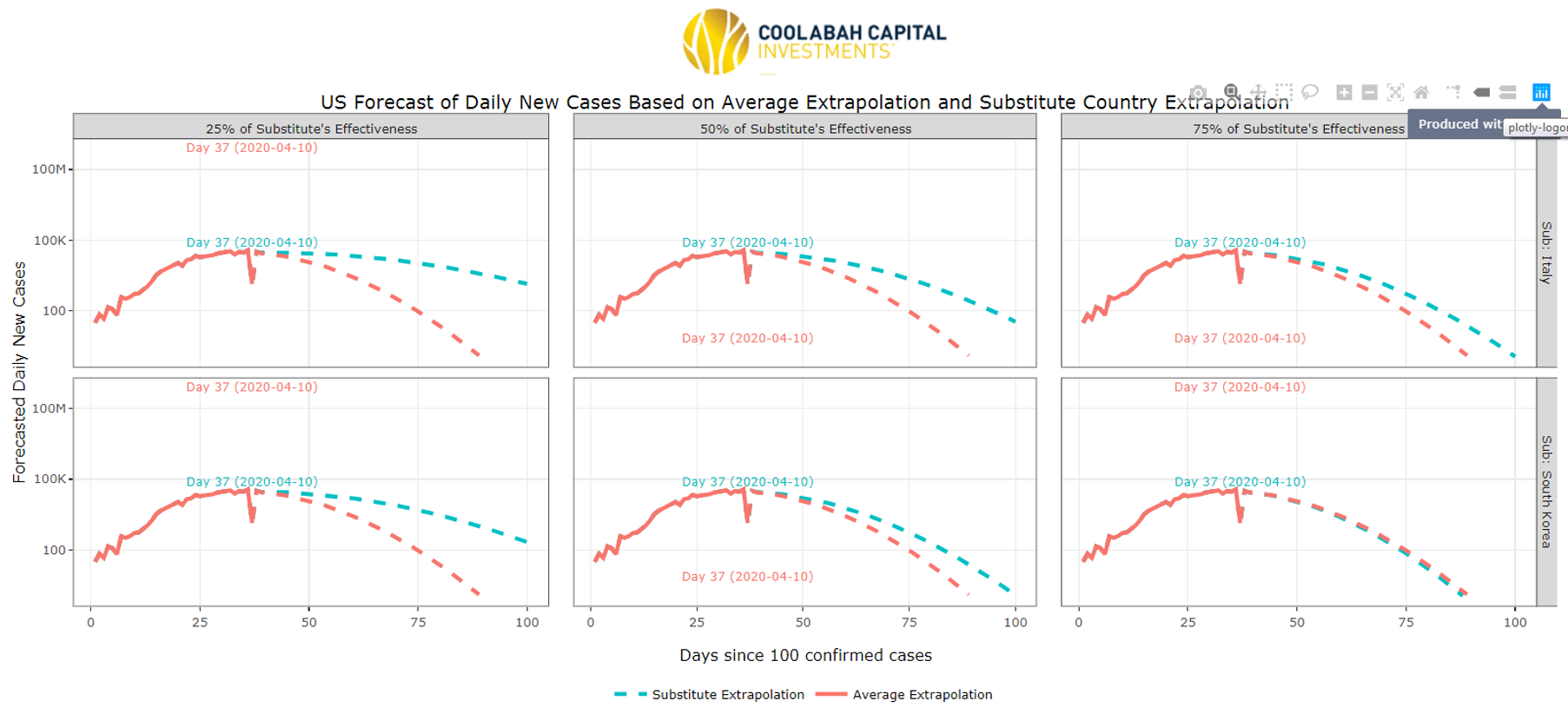

Much more interestingly, the latest numbers out of the US also appear to confirm our projection that America's peak will arrive in early-to-mid April. In fact, it is possible we are passing through that peak right now (our models currently finger April 10 as the zenith). The risk to this estimate is the whack-a-mole nature of the US federation, which could see a sequence of substantial outbreaks as different states employ asynchronous containment approaches.

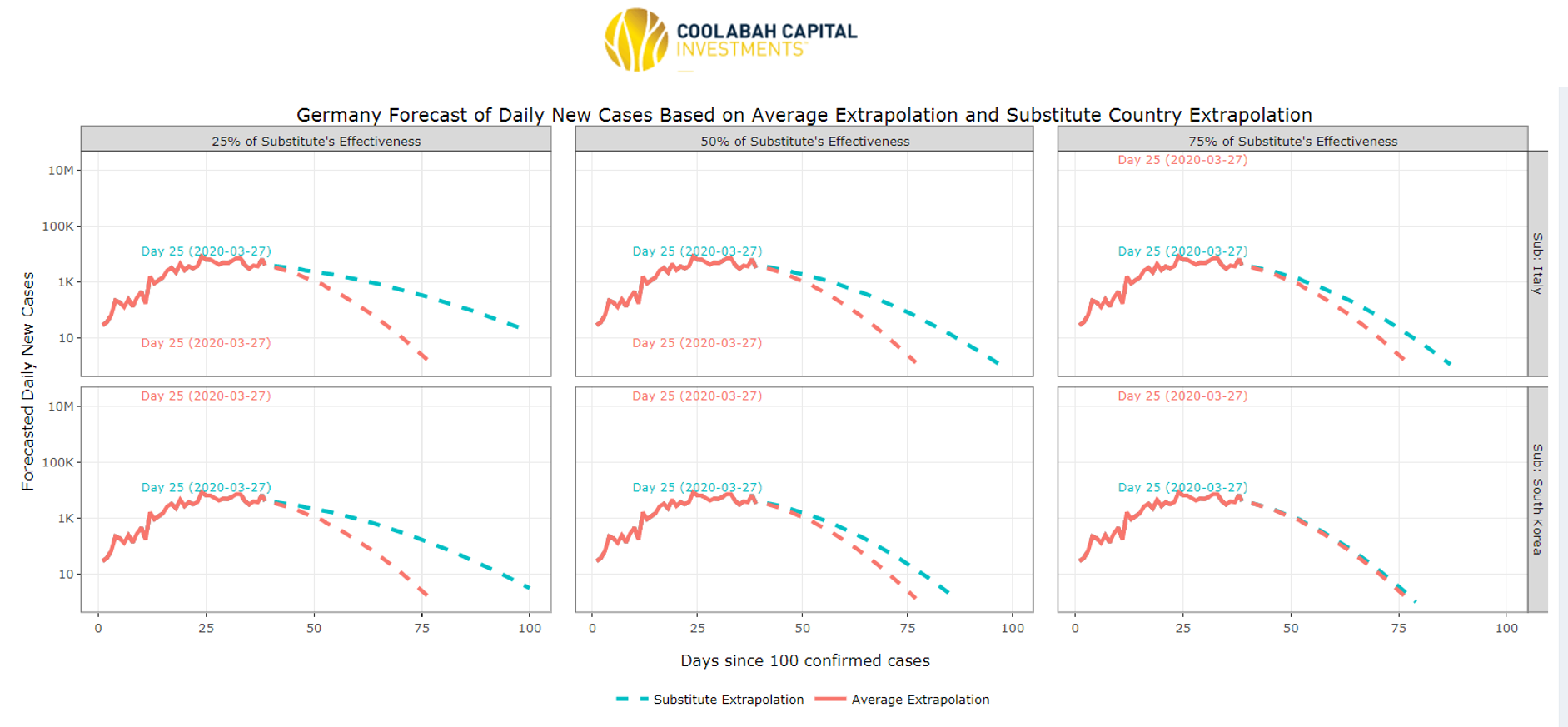

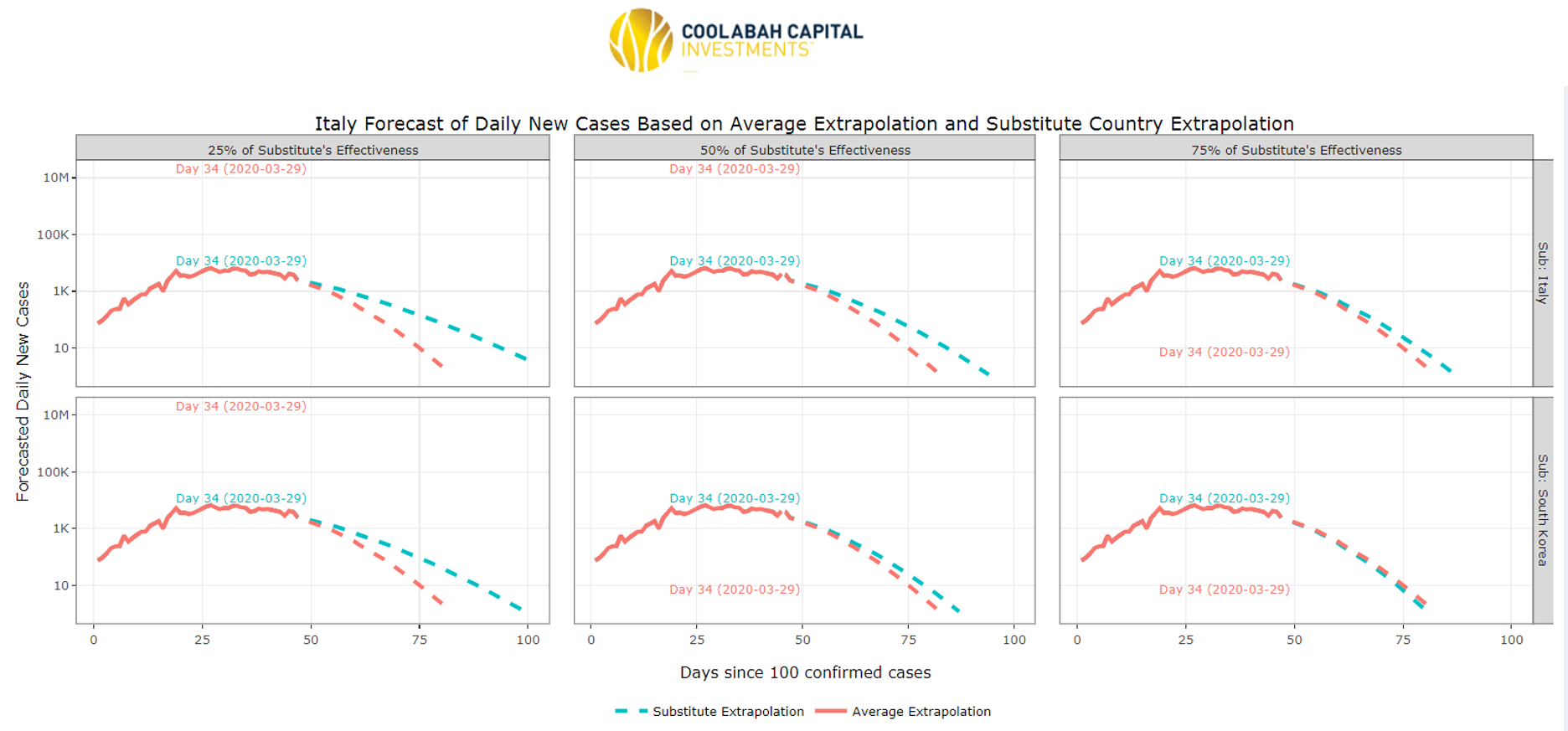

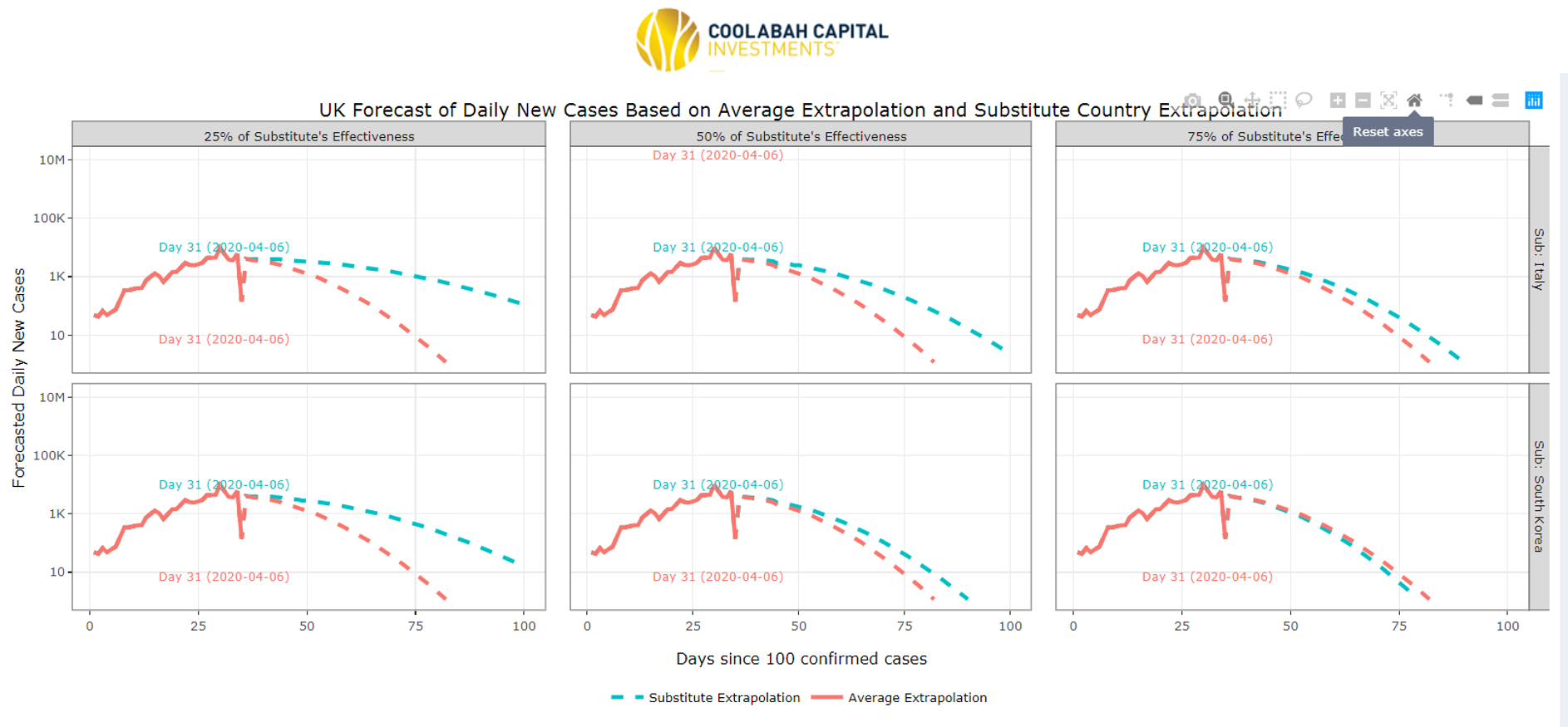

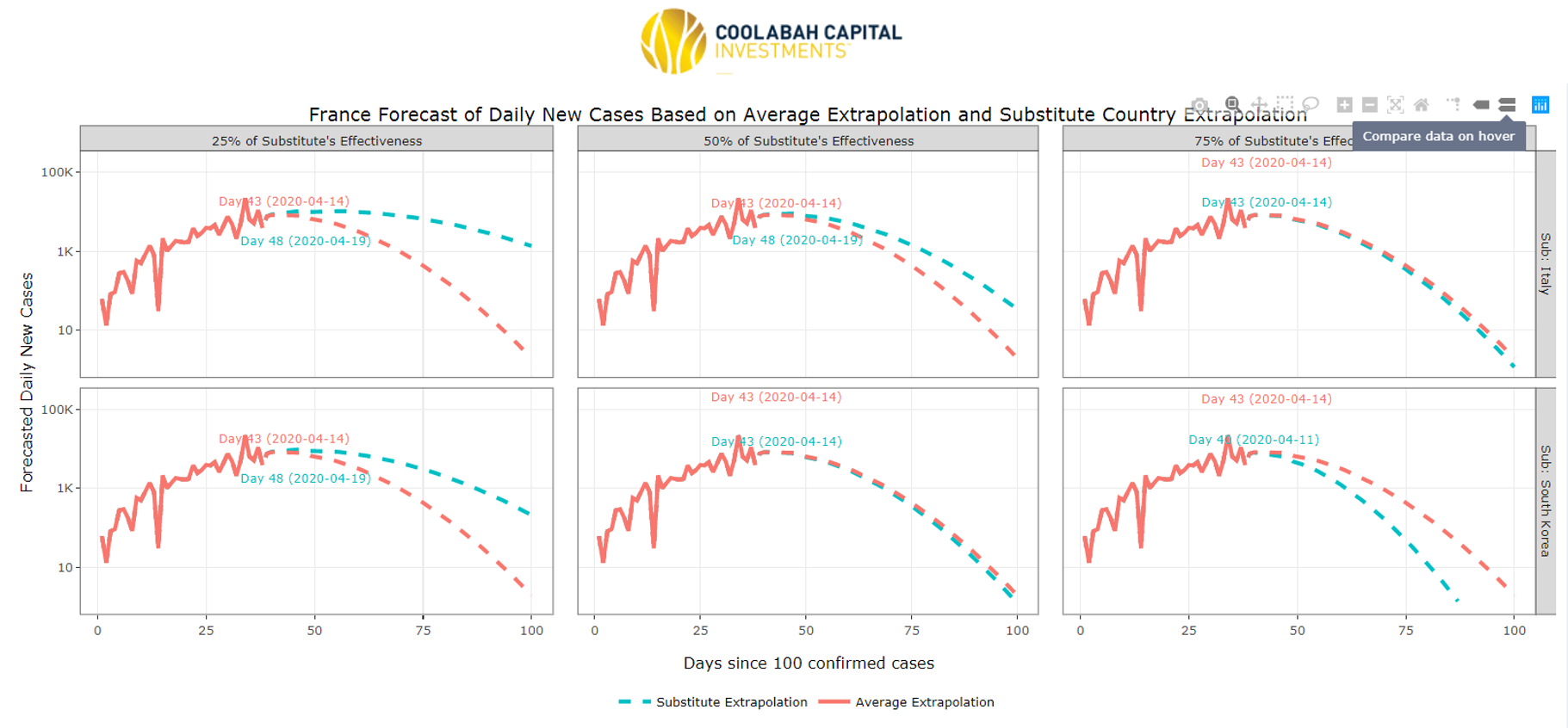

The good news is that similarly truncated coronavirus stories are playing out around the rest of the world (see the country-by-country screenshots below). Germany looks like it peaked on March 27. Italy and Spain were a few days later on March 29 and April 1, respectively. UK infections climaxed on April 6. And our models anticipate that France will get there on April 14.

We hypothesised that markets would react positively to passing through the peak in new cases and fixing their eyes more firmly on the other side of the liquidity, QE, and fiscal stimulus bridges that connect us to the eventual arrival of effective anti-viral drugs and/or a vaccine. And that has been the governing influence that has defined markets in recent days.

We further argued that the next critical phase for investors will be the political pivots away from hard containment as the economic, social and health costs of a depression overwhelm the desire to eliminate risk for that small proportion of the vulnerable population over the age of 65. And we are starting to see that now as leaders begin to toy with the idea of getting their working-age members of the community back into their jobs. In late March we maintained that this was a demonstrably superior approach to the idea of a six-month hibernation.

Concurrently, the central banks and treasuries have not disappointed. In February we argued that the inability of markets to price global pandemic risks would propagate the mother of all liquidity and solvency crises, which would in turn necessitate extreme liquidity support and quantitative easing. (We nonetheless never imagined that the Fed would go as far as buying high yield bonds!)

The central banks and treasuries took about 3-4 weeks to embrace this idea and eventually unleashed unprecedented policy support, which is exactly what we needed to insure against the horrific downside risks.

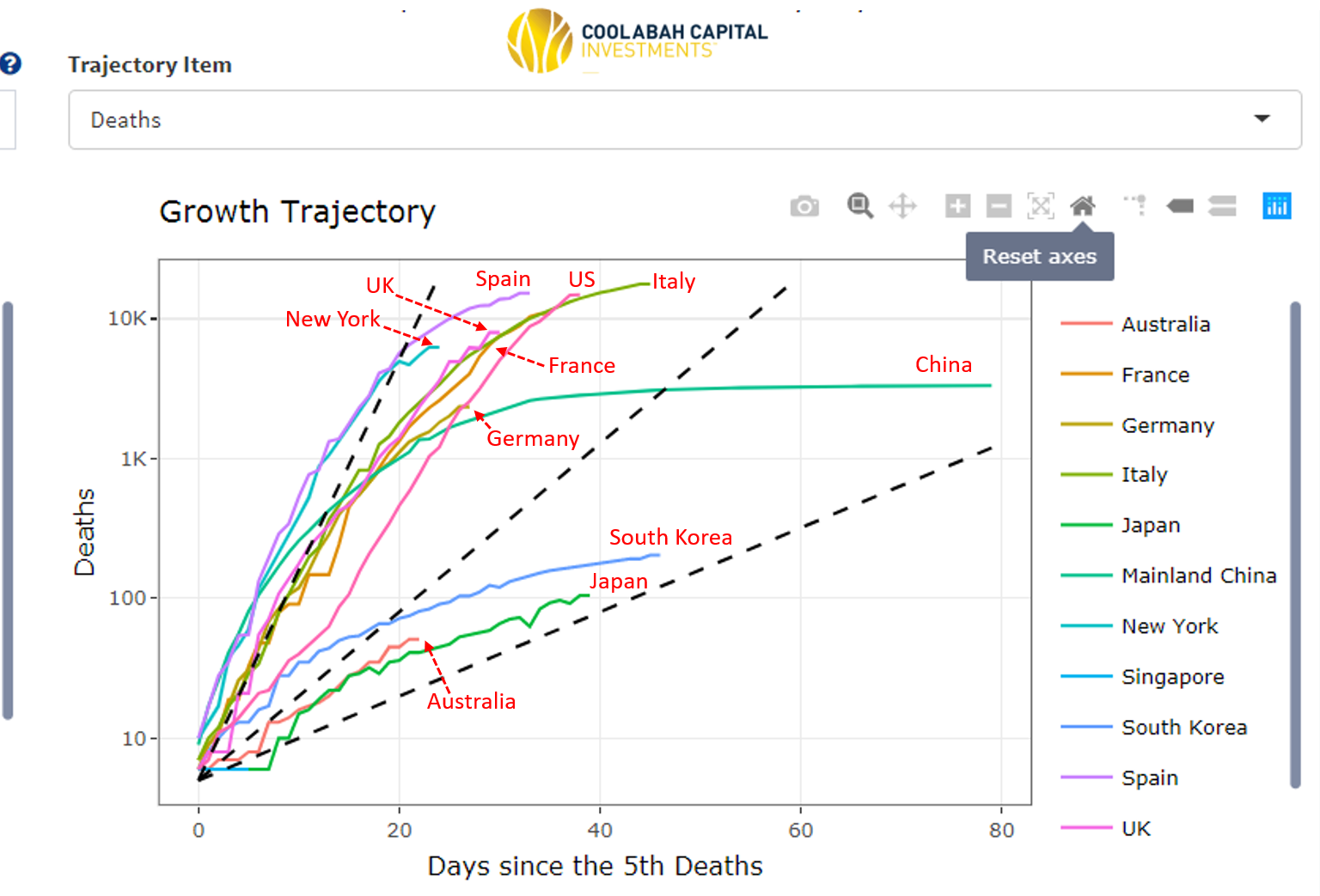

A few final comments on the screenshots from our COVID-19 tracking systems, which are enclosed for your benefit. First, Australia has clearly flattened the curve, which is a tremendous credit to all concerned. We are tracing South Korea's path, which we should continue to emulate as a gold-standard globally for containment following a serious outbreak. The rate of increase in new Australian deaths is also growing more slowly than most of our larger peers, bested only by those long-living Japanese.

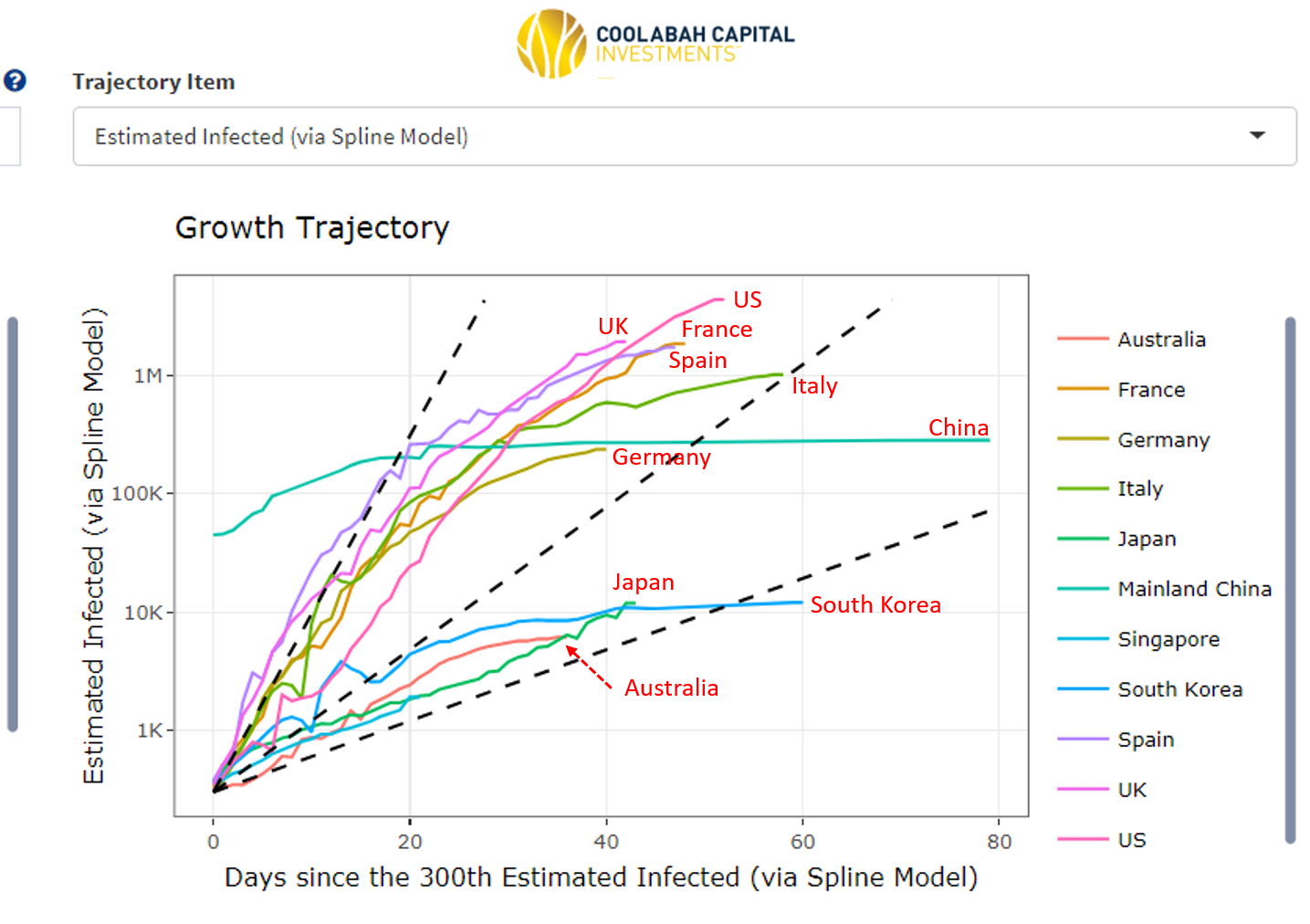

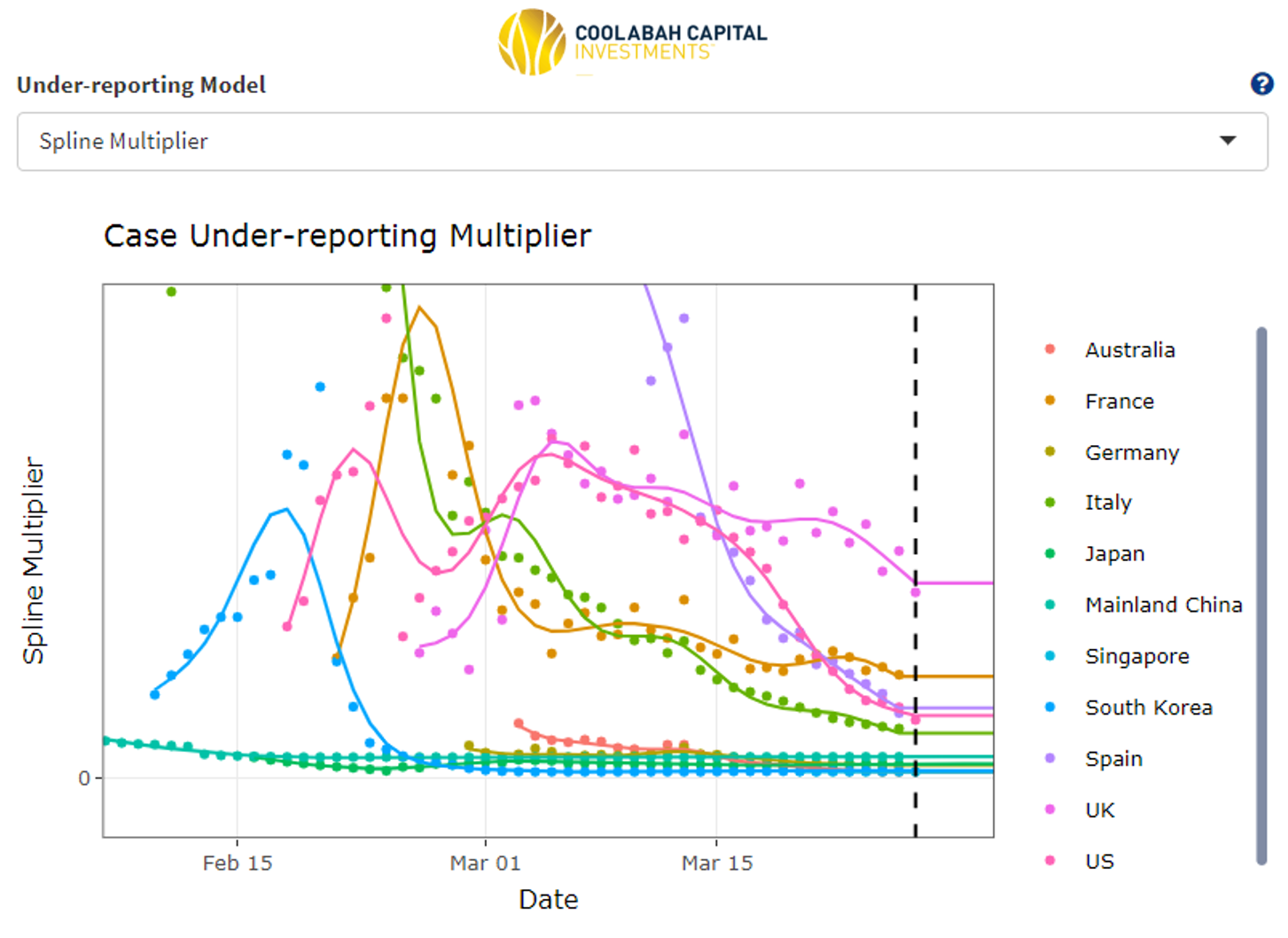

Our team has also built a new suite of models to try to quantify the extent to which countries are understating their infections, which then allows us to project our own version of the truth. The team does this by first calculating a steady-state 14 day lagged fatality rate, which they parameterise at circa 2%. They then adjust this fatality rate for each country's population pyramid, noting that the probability of dying increases sharply with age.

Using the officially-reported death data, which we assume to be more reliable than the infection numbers, they then compute their own estimate of the real infection paths, which you can see in the third chart below. The fourth chart shows the under-reporting multiplier over time for different nations.

The fifth screen-shot is our synthesis of the Google Mobility Reports for different activities and countries, which reinforces the point (alongside restaurant booking data) that Australia has managed to get away with a somewhat less draconian version of the containment strategies adopted elsewhere. This may be because we were relatively quick to move to cauterise the threat early in its life-cycle.

The final suite of screen-shots contain the aforementioned forecasts for the peak in new infection numbers for different countries, conditional on the Italian and South Korean containment experiences with a 25%, 50% or 75% discount to proxy for relatively inferior containment efficacies in the target country in question...

2 topics