Phil King’s top themes, and some stock ideas to play them

Energy is a standout theme for Regal Funds Management’s Australian equities portfolio, as nominated by King, chief investment officer, during an investor webinar on Thursday.

He believes the demand for the natural resources that power the world's homes, businesses, industries, and vehicles – including electric vehicles – will remain strong for years to come.

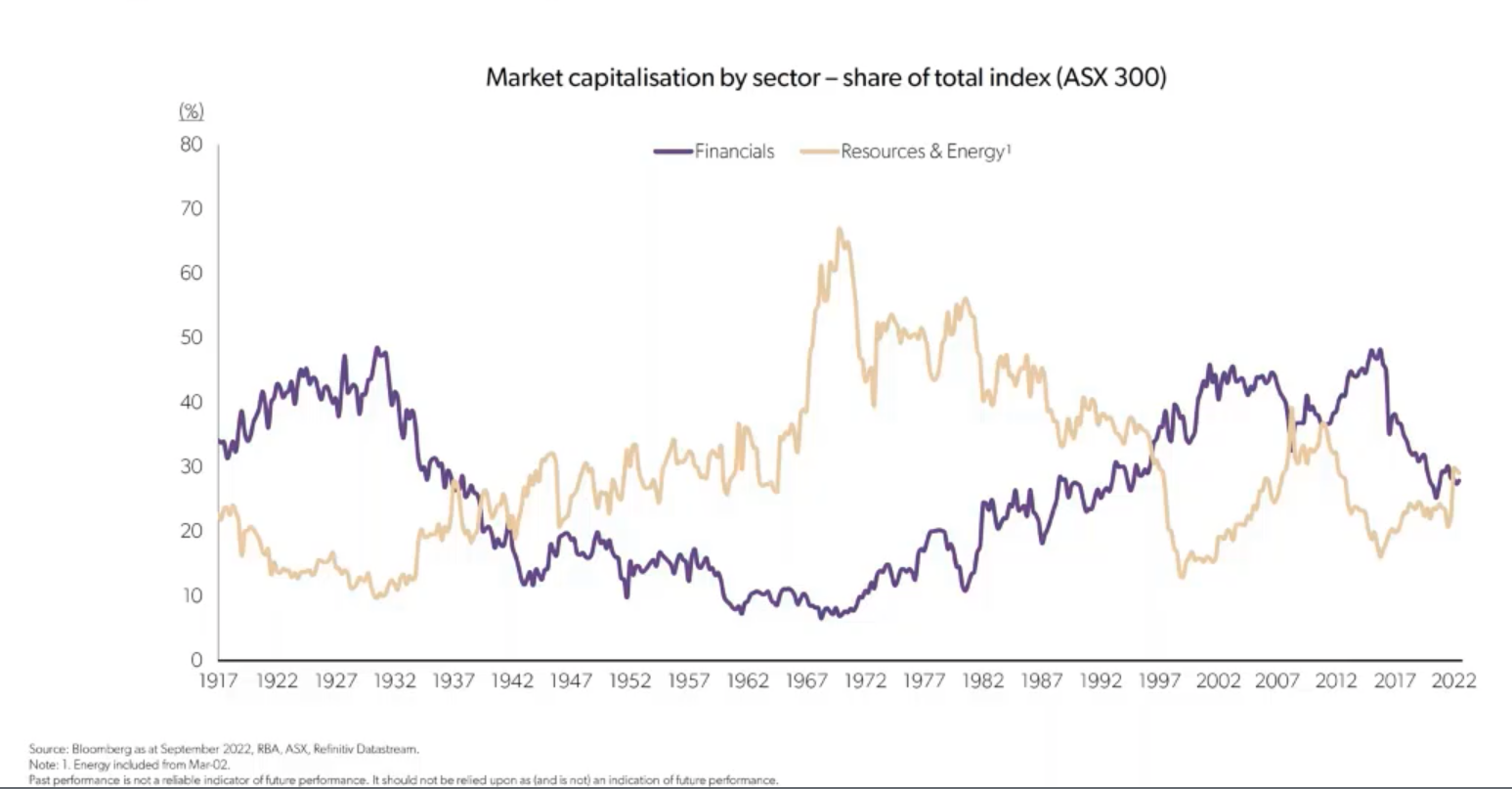

“With rising commodity prices recently, we’ve seen mining and energy now become the largest parts of the Australian market. And we expect the share of these stocks to increase,” King says.

“Not only are the large, listed mining companies and energy stocks getting bigger, but we're also seeing many more stocks join the index. In fact, in the last two years, 16 mining and energy stocks have joined the index and six of these have been lithium stocks.”

On the back of the windfall mining companies are earning from high commodity prices, King notes many are returning cash to shareholders rather than investing in new supply.

His outlook for a strong supply-driven commodities sector is further bolstered by the extreme levels of global fiscal monetary stimulus we saw in response to the pandemic, which King believes will support long-term demand.

What history says about the future

King believes rising inflation makes it critical to look at nominal prices, which many investors and even analysts who assess commodity prices, are ignoring.

“Because if you look at real prices, I think you miss the extent to which prices can increase. And what we often find with modelling prices is that they do nothing for maybe 10 or 20 years. And then they can go up between 400% and 500%,” King says.

“And so, when nickel goes to $100,000 dollars a tonne or lithium goes up to $60,000 or $70,000, they're surprised.”

King sees similarities between the current lithium market and what happened in iron ore back in the early 2000s.

“We had four iron ore companies listed in the ASX and a lot of sceptics would tell me that there was a lot of iron ore up in the Pilbara and that there was no way the rally was going to last,” he says.

“But then we saw the iron oil prices increase something like 10 times over a four-year period. And we saw the number of listed stocks increase from four to 87.”

Australia’s largest oil and gas producer Woodside (ASX: WDS) is highlighted as one of the fund’s strongest performers in the last three or four months.

And over the next six months, he also likes another energy company, Santos (ASX: STO)

Bullish on battery metals

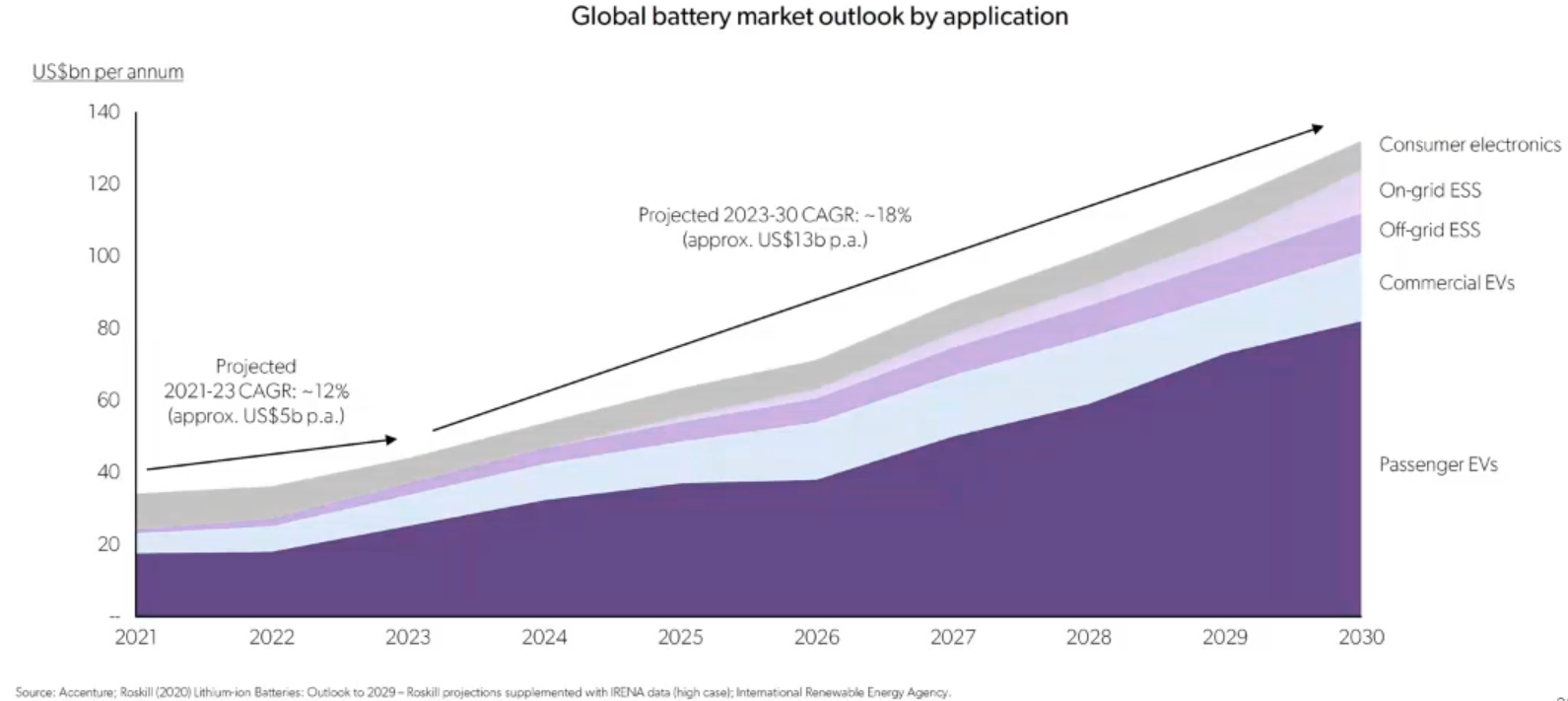

“I think most analysts are underestimating the demand that’s going to arise for things like battery metals, in things like lithium, graphite and cobalt,” King says.

He also refers to research from one industry body that suggests Australia needs more than 300 new battery metal mines over the next 10 years just to keep pace with demand.

“We’ve done very well out of lithium and still remain very positive on the sector and think the huge increase in demand for electric vehicles will at some stage flow through into other commodities,” King says.

In line with this view, he likes Syrah Resources (ASX: SYR), Australia’s largest miner of graphite.

Why Chinese tech might be a Buy

Shifting his discussion toward a regional rather than sector view, King emphasises that China is the only country that’s trying to stimulate its economy, while most others are trying to pare activity and raise interest rates.

“It possibly could be a good time to buy some Chinese tech stocks, which would benefit from falling rates and stocks that have re-rated more highly,” he says.

Examples of Chinese stocks added to the portfolio recently include online e-commerce firm Alibaba (NASDAQ: BABA) and the country’s largest social media company Tencent.

“Things like BABA look cheap, on 12 times PE, with earnings still growing despite the weakness in the Chinese economy,” King says.

“It’s probably too early to call the bottom in the NASDAQ, but we think China is now very close to the bottom.”

Chinese property is concerning

On China’s property market, King expressed concern at the collapse in sales growth for many of the country’s property developers. This is, in turn, pushing prices down and is only now starting to flow into China’s construction sector.

In this context, he says it’s little surprise that the iron ore price is under a lot of pressure, pointing to this as one of the few parts of the mining sector his team is more cautious on in the near term.

Approach retail sector with caution

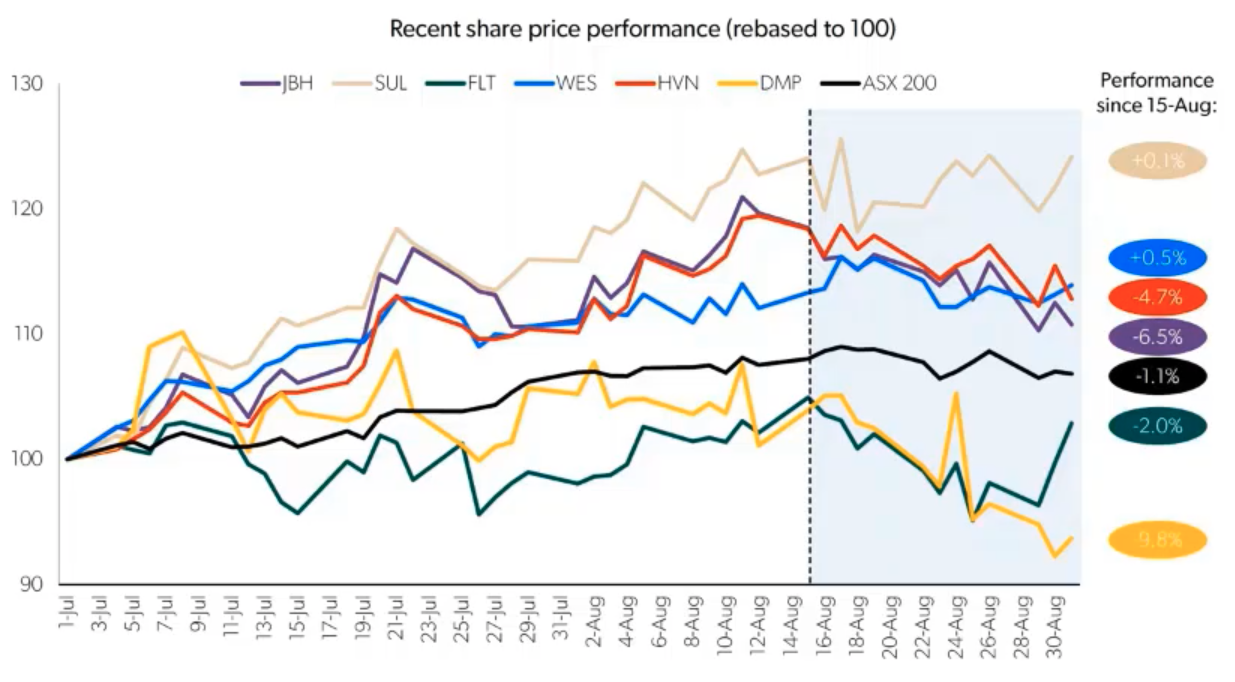

Retail is another part of the market Regal is approaching with caution, as discussed by Australian equities portfolio manager Jovita Khilnani.

Khilnani cited the rising pressures on Australians’ cost of living and the Reserve Bank’s rate hikes, which have lifted the cash rate to 2.35% in just over four months.

But she says the effects are still working their way through to Australian consumers, referencing a recent update from the Commonwealth Bank, Australia’s biggest mortgage lender.

“We would expect this pressure on households to ramp up materially come November or December of this year. And by all accounts, the RBA hasn't finished its tightening cycle,” Khilnani says.

“This lag effect goes a long way to explaining the disconnect we’re seeing between the current strength in consumer spending and the weaker outlook to come.”

Another factor here is the large number of Australian households that accumulated savings during the peak COVID periods of recent years. Khilnani points to research that showed during the pandemic, Australians amassed around $335 billion more in savings than they normally would. As these pent-up savings are run down in the months ahead, she expects further declines in the demand for discretionary consumer goods.

But Khilnani notes that these factors – including a reallocation of household spending towards services rather than goods and a “negative wealth effect” as house prices decline from long-term highs – are now becoming a consensus view among analysts.

She also points to a couple of aspects that are providing the team with more comfort on the sector:

- Retail stocks underperformed the market in FY22, despite strong results and trading updates through August.

- The short interest on retail stocks – “a good measure of the bearish bets,” is now much lower than in the two years before the pandemic hit.

Another key theme in the sector is the elevated stock inventory levels many retailers are holding, on the expectation Christmas trading this year will be comparable with that of last year. If this undershoots expectations, retailers are likely to be sitting on too much inventory, which would, in turn, hit their growth margins as they have to discount sales in order to clear stock.

So, this means the retail sector is one that Regal is playing primarily on the short side of its portfolio.

Never miss an insight

If you're not an existing Livewire subscriber you can sign up to get free access to investment ideas and strategies from Australia's leading investors.

And you can follow my profile to stay up to date with other wires as they're published – don't forget to give them a “like”.

1 topic

5 stocks mentioned