Pro Medicus: awesome or overvalued? The brokers are still divided

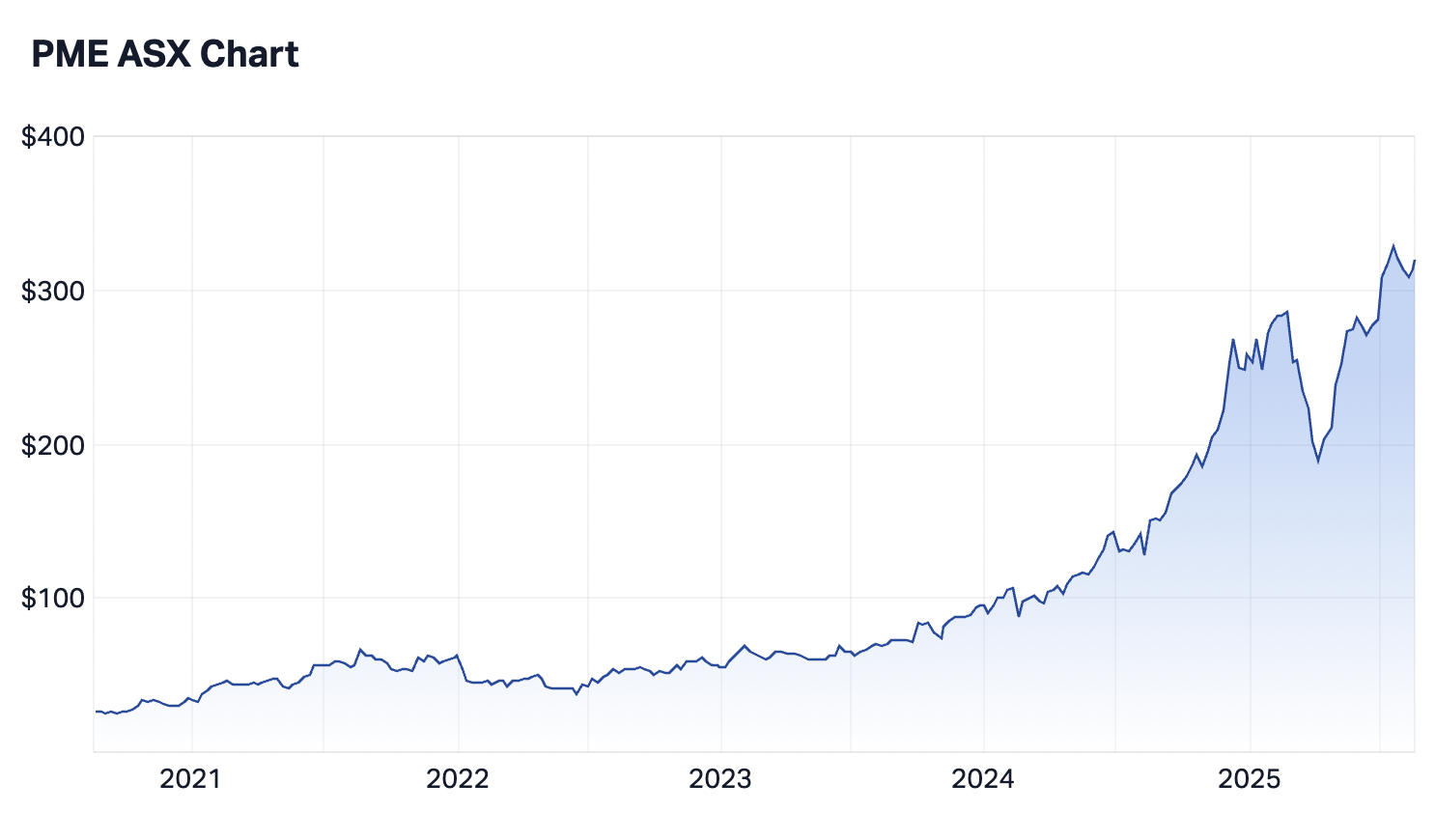

It should come as no surprise that one of the big winners from reporting season so far has been Pro Medicus (ASX: PME), a company that has made a habit of winning over the last few years.

While big names were hit hard on relatively in-line results last week, PME maintained its market darling status despite only modest beats to revenue and net profit when it released its FY25 results last Thursday.

The PME share price surged from $290 to around $316 by Thursday’s close and has maintained that price on Monday.

Ten Cap’s Jun Bei Liu told Livewire that Pro Medicus is “the highest quality company on the ASX" in a post-earnings interview.

She cited predictable earnings, strong growth and a huge addressable market as reasons she considered it a "buy", despite its considerable outperformance over the last few years.

But Thursday's results did little to change an already-divided broker consensus on Pro Medicus.

What some see as an overvalued stock that’s already run well too far, others are busy revising price targets upwards as the company looks to cement its place in the digital medical imaging space.

It’s perhaps indicative of how brokers and investors are thinking about markets more broadly.

There’s a growing sense that we’re at an inflection point where an already-overheated equities market could easily be on the precipice of a crash, or continue on its current trajectory without much fuss.

Both outcomes seem entirely reasonable, which makes it even harder to properly evaluate growth stocks like PME.

Brokers divided

While there’s been few ratings revisions, the divergence in opinion remains apparent.

According to analysis from 10 brokers, price targets for PME now range from $220 to $350.

How brokers are rating PME post-reporting and their current price targets:

- Wilsons: Overweight, $350 (up from $325)

- CSLA: Outperform, $350 (up from $308)

- Morgan Stanley: Overweight, $350 (up from $320)

- RBC Capital Markets: Sector perform, $340 (down from $350)

- Macquarie: Neutral, $321.60 (up from $258.90)

- Bell Potter: Hold, $320 (retain)

- E&P: Neutral, $307.20 (Up from $225.65)

- Jeffries: Hold, $300 (Up from $250)

- Morgans: Trim, $285 (up from $280)

- Citi: Sell, $220 (up from $165)

On the bullish side, while Wilsons is the only broker to have upgraded its rating, five brokers are now targeting a PME share price over $320.

Wilsons called Pro Medicus’s results an "embarrassment of EBIT” and identified three factors attributed to its post-results rally.

First was the strength of PME’s margin leverage in the second half of FY25, the second was the upside of its cardiology suite, and the third was the introduction of digital pathology capabilities in 2026 through Visage.

It rerated PME to Overweight and revised its price target up 8%, while conceding its valuation approach was "unashamedly aggressive”.

CSLA is also now targeting $350 a share (and maintains an outperform rating), while RBC Capital has revised its $350 target down slightly to $340.

Bell Potter left it as a hold, but pointed to PME’s impressive market share gains and lack of competition as a positive.

“We believe the price leadership established by PME in the core business is set to continue. Competitors remain constrained by traditional compress and send technology with no apparent motivation to rein in PME’s market share growth,” it wrote in a note to clients.

On the bearish side, Citi maintained its Sell rating based on its already-stretched price, despite AI potentially also helping to drive PME’s TAM up 10-15%.

“We view PME’s business model as attractive, with a real competitive advantage in the PACS space. However, our Sell rating is based on rich valuation,” Citi said.

It is targeting a price of $220, implying a 29% drop from current prices.

Morgans also maintained its Trim rating, after revenue fell just short of its forecast, despite a year of record contracts and five-year forward contract revenue pushing $1 billion.

All in all, you can make a convincing argument in both directions. And that's the problem.

Could PME prove to be the canary in the coal mine for investors and brokers trying to play in a market that could go either way right now?

If things continue to run in Australia and elsewhere, PME could continue to lead the charge.

If things take a turn for the worse, it could be an obvious sell-off candidate.

Ultimately, someone has to be wrong.

3 topics

1 stock mentioned

1 contributor mentioned