RBA's third bond buying program arrives and will likely be more than $100bn in size...

After months of anticipation, the RBA finally delivered on its third quantitative easing (QE) program. Way back on 5 February 2021, when Coolabah first forecast a $100 billion QE3 program, the notion of a third stanza of QE extending into 2022 was not fashionable amongst economists at the time. (On January 22 we had predicted $100 billion of QE2, which the RBA delivered on 2 February.)

On 1 June 2021, we updated our QE3 forecast to a flexible, open-ended and state-dependent program, which was calibrated at the same weekly bond purchase pace as QE1 and QE2 (most other banks, save CBA, embraced this view later in the month). The idea had come from the insights published by The Australian Financial Review’s Economics Editor, John Kehoe, a key RBA media conduit, who first canvassed an open-ended bond-buying program following the RBA’s May 2021 board meeting, and then doubled-down on the proposal after the RBA’s June board meeting.

As it turned out, we are indeed getting a new open-ended and state-dependent form of QE3 once QE2 expires in September, which will be reviewed by the RBA on a quarterly basis at the same time as it releases its long-term forecasts via its Statement on Monetary Policy. The first quarterly review will be in November 2021, followed by subsequent reviews in February, May, and August.

One modest surprise from the RBA’s July meeting was the sizing of the weekly run-rate of purchases. Whereas we had been expecting $5 billion/week based on Kehoe’s repeated guidance, the RBA ultimately opted for a slight taper to $4 billion/week in what was very likely a line-ball call driven by the dramatic drop-off in bond issuance by the Commonwealth government, according to News Ltd’s Terry McCrann (see more on this later).

We don’t currently know exactly how big QE3 will be because the RBA has now shifted from time-dependent bond purchase programs (ie, QE1 and QE2) to a state-dependent model.

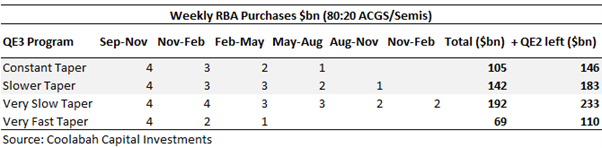

Having said that, it is easy to make some educated guesses that suggest QE3 will be between $105 billion and $142 billion in size, give or take. There is also $41 billion remaining in QE2 that you need to add to these numbers (see the table below).

Assume, for example, that the RBA tapers its weekly bond purchase pace by $1 billion at every quarterly review meeting (ie, from $4 billion/week in quarter one to $3 billion/week in the next quarter, etc), which would be relatively fast compared to the US Federal Reserve and other key central banks. To consistently taper in this fashion, the RBA would have to be highly confident of hitting its ambitious wages growth and inflation goals of more than 3% annualised and 2% annualised, respectively. Even in this positive scenario, the RBA will end-up buying $105 billion of bonds via QE3. And that supposes a straight-line recovery in the economy with zero adversity.

Some may argue that the RBA could get radical and slash its bond purchases from $4 billion/week to $2 billion/week and then say $1/billion per week over three quarters for a total program size of $69 billion in a super-fast taper. Yet this is (1) inconsistent with both Governor Lowe’s statements and his media signalling that any potential future tapering of QE will be very gradual and extend well into 2022, along the lines of the Bank of Canada’s model, and (2) would put the RBA miles ahead of the US Federal Reserve, which has led the market to believe that it will be tapering QE all the way through 2022. That would in turn risk putting serious high upward pressure on the Aussie dollar, which the RBA is very keen to avoid.

NAB's economics team, which had previously been in the hard-taper camp apropos QE3, concluded following yesterday's RBA statements that:

“QE purchases will likely have a long taper. The Governor indicated little appetite to taper quickly, suggesting the Bank would want to see evidence of the improvement in activity and employment translating into higher wage and inflation pressures before further tapering QE purchases” NAB economics

During his remarks, Governor Lowe repeatedly stated that the RBA could increase or decrease QE3 at its quarterly reviews, with perhaps a more likely situation being that it holds the bond purchases steady at say $4 billion/week or $3 billion/week over at least a couple of quarters. A scenario involving one pause at say $3 billion/week over two quarters implies a total program size of $142 billion (plus the remaining QE2), highlighted in the second row below. An even slower taper again gets the RBA to about $192 billion of purchases for QE3.

Given how eager the RBA has been to appropriately highlight the tremendous success it has had with its QE program thus far (in various speeches and recent Bulletin research papers), and in particular how cheap the Aussie dollar remains relative to fair value estimates north of US85 cents, it is hard to imagine that the RBA will be rushing to aggressively taper QE3 in view of the asymmetric consequences of doing so.

If it tapers QE3 too quickly, and its forecasts prove wrong and/or the Aussie dollar appreciates materially, it will have to undertake the humiliating exercise of accepting defeat and ramping it back-up again. Going slow on any future QE3 taper, and keeping the Aussie dollar low while supply some extra support to the economy, has few if any downside risks.

Drop in $5bn/week to $4bn/week driven by smaller budget deficits

It would appear that the "line-ball call" for the RBA to opt for bond purchases of $4 billion/week rather than $5 billion/week was not driven by any especially strong desire to taper ahead of the rest of the world, but rather due to the fact that Australia's budget deficit, and hence government bond issuance, has been dropping like a stone.

Key RBA watcher Terry McCrann wrote on Wednesday that “although the RBA would not concede this, the cutback really only follows the budget deficit down as it drops sharply, not just from year-to-year as specific, measures like JobKeeper end, but as the deficit falls faster than expected because the economy’s been stronger than Treasury (and the RBA) expected".

“A lower deficit means quite simply that the RBA has to buy fewer bonds to offset any interest rate pressure and maintain liquidity in the financial market,” McCrann added.

Heading into the meeting, this was our number one question: while the RBA had repeatedly conditioned the market to expect $5 billion/week via Kehoe, the Commonwealth government was at the same time signalling a potentially large reduction in its own weekly bond issuance via its debt issuance agency, the Australian Office of Financial Management (AOFM).

Based on the May budget, the Commonwealth was planning on issuing $130 billion of bonds this financial year. Yet the AOFM recently advised market participants that the federal budget is running $14 billion ahead of the government’s excessively conservative forecasts (we’ve repeatedly argued that both Federal and State budgets will blow their gloomy forecasts out of the water). Accordingly, the AOFM has signalled that its total debt issuance will be materially reduced once the government updates its budget outlook in December.

As Commonwealth bond issuance is slashed, the RBA is buying more securities on a relative basis, de facto increasing QE rather than holding it constant. The massive upside surprise on the Commonwealth budget seems to have left Martin Place no choice but to trim the weekly run-rate of purchases for fear of generating enormous negative bond supply and injecting much more QE stimulus than it had planned (eg, buying in secondary markets double what the Commonwealth was actually issuing as new bonds in primary markets).

Trimming the QE3 weekly purchases from $5 billion/week to $4 billion/week is not, therefore, economically a taper when juxtaposed against the dramatic reduction in Commonwealth bond issuance: it is rather a right-sizing of the QE3 program to significantly changed conditions.

It also explains why Governor Phil Lowe remains “uber-dovish”, as Westpac’s Bill Evans described it, while presiding over what appears to ostensibly be a tightening of policy.

Interestingly, a similar dynamic is playing out with the State governments. Based on the State budgets that have been released so far, UBS estimates the States will issue $85 billion of gross bonds in the 2022 financial year, notably less than the $94 billion they issued last year and also less than the $88 billion issued in the 2020 financial year.*

Importantly, this $85 billion includes an unusually large $35.5 billion of gross debt issuance from NSW that assumes it does not use any of the funding provided by the sale of its $13 billion interest in its WestConnex asset (expected to be realised in October).

NSW’s surprisingly large $35.5 billion funding task also assumes away the possibility that the government’s Debt Retirement Fund, which holds about $15 billion, will be used for its legislated purpose of reducing NSW’s gross debt, recovering NSW’s AAA credit rating (lost in December last year), and cutting taxpayer’s borrowing costs, which have increased sharply of late back to October 2020 levels.**

The bottom line is that it would be reasonable to expect that as the budget deficits continue to shrink, both the Commonwealth and the States will pare-back their debt issuance needs, as they have done repeatedly over the last 12 months.

In this context, it makes some sense for the RBA to trim its $5 billion/week QE3 program to $4 billion/week to avoid increasing QE on a relative basis, noting that when it first announced its $100 billion QE1 program in November 2020 the amount of public debt issuance from both the Commonwealth and the States was going to be substantially larger than current levels.

QE3 likely to be elongated affair

While the RBA’s 2.30pm statement on the new QE3 program was sparse on details, it did state that the “the Bank will continue to purchase bonds given that we remain some distance from the inflation and employment objectives”.

In a separate speech after the meeting, Governor Lowe outlined the benefits of additional QE, including lower bond yields, lower funding costs, a lower exchange rate, and higher asset prices, which has “supported the economic recovery in Australia”.

He then set the expectation for a prolonged QE3 program, stating that after QE2 ends in September, the RBA “will continue to purchase bonds after this date, providing ongoing support to the Australian economy”.

Lowe explained that the RBA will review the pace of QE3 bond purchases in November, timed to coincide with its updated economic forecasts released via its quarterly Statement on Monetary Policy, which “allows the possibility of a timely recalibration of the Bank's [QE3] bond purchases in either direction”. Many RBA watchers noted the reference to symmetrical changes up or down.

So after November, QE3 could remain at the same pace, be lifted a little, or trimmed further (the ECB increased its run-rate of bond purchases earlier this year). To underscore this point, Lowe reiterated that “we are not locked into any particular path and bond purchases could be scaled up again if economic conditions warrant”.

Crucially, Lowe made it clear that QE3 is state-dependent, and will continue until the RBA is confident of hitting its inflation and employment targets, both of which subsume a wages goal:

“We will continue buying bonds until there is further material progress towards the goals for full employment and inflation. We want to see clear evidence that the stronger economy is translating into a pick-up in aggregate wage growth and a lift in inflation towards the target. We will also be reviewing the ongoing rate of purchases in light of our forecasts for future progress towards our goals. So both the outcomes and the forecasts are important here…The additional bond purchases that we announced today provide an ongoing important source of support to the Australian economy. I want to emphasise that the step-down from $5 billion to $4 billion does not represent a withdrawal of support by the RBA.”

Flagging the likelihood that QE3 will run well into 2022, Lowe declared that “we are still well short of our goals for full employment and inflation, and this means that a continuation of monetary support through bond purchases is appropriate”.

The decision-rules for tapering QE3 are clear. Lowe explained that “for inflation to be sustainably in the 2 to 3 per cent range, it is likely that wages growth will need to exceed 3 per cent”. “The current rate of wage growth is materially less than 3 per cent and we expect it will be a few years still before it increases back above 3 per cent [emphasis added]. Further progress on reducing unemployment and underemployment will be needed to get there.”

To be confident that wages are heading above 3 per cent annually, the RBA will want to see at least two to three quarters of data to validate this view. This is unlikely to be obtained until some time in 2023.

Media Proxies Chirping

If there was any doubt that QE3 will be elongated, the RBA’s trusted media proxies offered further guidance. Writing in the AFR after the meeting, John Kehoe commented that “the slight taper” would likely mean that QE3 could “run well into next year”, emphasising that QE3 does not mean the RBA will reflexively reduce the weekly pace of purchases after every quarterly review.

“When the RBA board next reviews QE in November, it is not on a preset path to further reduce the $4 billion weekly bond purchases and could sit at this level if not enough economic progress is made,” Kehoe said. “Before further QE tapering, the unemployment rate will likely require a 4 in front of it.”

“From there, gradual data-dependent reductions in QE will be considered periodically next year. Furthermore, Lowe signalled the RBA will only fully exit QE once it sees clear evidence that progress is being made towards its 4 per cent full-employment estimate, wages are accelerating and inflation is rising towards the goal.”

Despite differences in the Australian and Canadian inflation stories (Aussie inflation is much weaker), Kehoe highlighted that the RBA QE program is following in the Bank of Canada’s foot-steps, albeit with a lag. (He cited the Bank of Canada model of tapering when he first proposed a $5 billion/week open-ended program after the RBA’s May meeting.)

“Rather than waiting for a tapering from the world’s most influential central bank, the US Federal Reserve, the RBA is in effect adopting the Bank of Canada’s tapering model, albeit lagging its Canadian cousin,” Kehoe said.

“The BoC has slowed its weekly bond purchases from a peak of $C5 billion ($5.3 billion) last year, to $C4 billion since October 2020 and $C3 billion since April 2021. But that’s where the similarities end. The BoC expects to increase interest rates in late 2022. Canada is much closer to the 2 per cent midpoint of its inflation target. [Australian] annual inflation is only 1.1 per cent, well below the 2-3 per cent band.”

Kehoe and others also highlighted an important statement from Lowe during his Q&A that “because the inflation and wage outcomes have been lower in Australia than other places, we’re going to keep the stimulus going probably longer than the other countries [including New Zealand and Canada]”. That is to say, the RBA remains committed to keeping it stimulus, including QE, around until it has high conviction that it will meet its targets, which might not be until some time in 2023.

*As a technical aside, both UBS and CBA expect the four biggest debt issuing states, NSW, VIC, QLD and SA, to supply gross debt of $76 billion in the 2022 financial year, which will likely be materially pulled back as a result of NSW downgrading issuance needs, and other states doing the same as budgets outperform.

**Coolabah believes NSW might have a change-of-heart on this topic, especially if Standard & Poor's adjusts NSW's ability to net the value of the Debt Retirement Fund's investments off NSW's gross debt, which we think is quite likely. This globally unusual treatment, which S&P warned NSW it might withdraw in December last year, has no material impact on NSW's credit rating. But removing the netting exception would mean that the Debt Retirement Fund no longer reduces NSW's net debt, which would in turn provide Treasurer Dominic Perrottet with an extremely strong incentive to apply the Debt Retirement Fund's capital to its intended legislative purpose of reducing public debt, cutting borrowing costs and working towards winning back NSW's prized AAA rating.

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers. Click the ‘FOLLOW’ button below for more of our insights.

2 topics