RBA to accelerate recovery

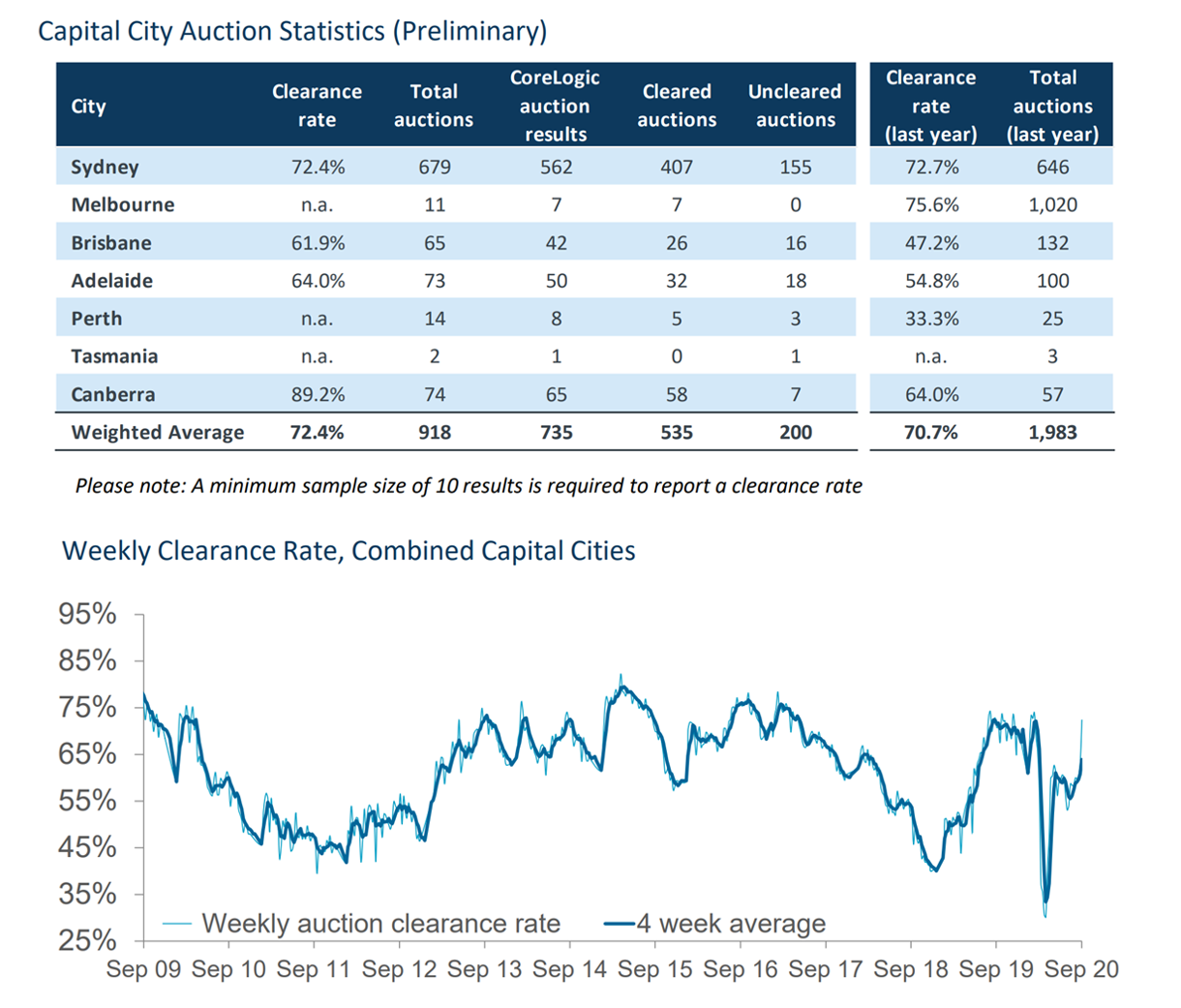

In the AFR I write that another week passes and yet another bank has upgraded its housing outlook in line with our heterodox March forecast for a zero to 5 per cent decline in the 6 months after the COVID-19 shock followed by 10 per cent to 20 per cent capital gains. Australia's auction clearance rates over the weekend added further weight to this momentum, printing their best preliminary results since way back in March. During the week we also published this research on the price of expanding fiscal policy, which was really well received if you have not read it already. Otherwise, have a look at the excerpt from my AFR column enclosed (click here to read online or AFR subs can also click here). Excerpt:

Last week CBA sensationally dumped its call for 10 per cent peak-to-trough declines in favour of a 6 per cent drop which it says will be superseded by healthy capital gains running at a 6 per cent annual pace in the second half of 2021.

On Thursday Westpac’s Bill Evans and his offsider, Matthew Hassan, joined the party, slashing their projection for 10 per cent home value losses to a “mild” five per cent correction. They then expect prices to climb by a stonking 15 per cent over the next two years. ANZ and NAB’s economists should similarly fold soon.

“To date our view has been for a 10 per cent fall in prices from the peak in April 2020 through to June next year,” Evans and Hassan wrote on Thursday.

“We now expect many capital city markets to be more resilient with a national fall of 5 per cent between April and June next year. For the near term, our revised view this means prices nationally are now only expected to fall a further 2.3 per cent (prices having already declined 2.7 per cent since April).”

“Of most importance is that we are much more optimistic about the pace of price appreciation over the following two years with a total expected increase of around 15 per cent.”

Westpac’s amended forecasts correlate almost perfectly with the projections this column outlined back in March. And they are a big deal coming from Hassan, who has been one of the best sell-side analysts of local housing dynamics.

Evans’ age-defying energy, baritone oratory, and track-record of divining crucial turning points ahead of peers make him the gold-standard for chief economists.

Speaking of which, Goldman Sachs’ top economist, Andrew Boak, has been the stand-out this cycle with his deft call for a modest, 5 per cent housing draw-down matriculating into capital growth of up to 15 per cent.

These revisions should not be surprising: the housing market’s resilience is simply the powerful monetary policy transmission mechanism at work. The huge expansion in home buyers’ purchasing power since Martin Place started cutting its 1.5 per cent cash in mid 2019 will help drive the value of bricks and mortar higher, supporting animal spirits, investment, construction, and the broader recovery in the post-COVID 19 period. Similarly positive housing stories are playing out in the US, UK, and Canada where home values are all inflating.

The experts who called for house price falls of 10 per cent to 30 per cent have thus far proven wide of the mark, as have doomsayers warning of the September fiscal policy cliff. And although we remain anxious about mortgage defaults rising to record levels next year as repayment holidays are officially recorded as arrears, this will not be the end of the world.

ME Bank reports that three-quarters of its customers who had been granted holidays are now returning to meeting their obligations. “The early signs are quite positive—the vast majority are going back to payments,” ME Bank’s chief executive, Adam Crane, says. “Then there are a cohort going onto hardship. More than what we would have expected are going back to repayments."

Another important chapter in the global recovery will be the advent of tractable COVID-19 vaccines. America’s chief immunologist, Dr Anthony Fauci, told Bloomberg this week that he is reasonably confident effective vaccines will be approved by November and December with public distribution commencing thereafter. In fact, the US government has started aspirational preparations for the mass deployment of vaccines as soon as October.

This timetable does nonetheless accord with the central case we have held since March, which involves the approval of vaccines in 2020 ahead of consensus expectations for a much longer 18 month process.

Further insights into how policymakers propose to accelerate the domestic recovery will be unveiled in what is billed as a “major address” by the Reserve Bank of Australia’s deputy governor, Dr Guy Debelle, next Tuesday.

Analysts and investors have focussed on the fact that the RBA’s governor, Dr Phil Lowe, used Debelle as his vehicle of choice to ventilate Martin Place’s yield curve control policy in March.

And while there is a view in markets that the RBA has tended to disappoint with its stimulus program, Bill Evans thinks the central bank will do more heavy-lifting as part of its commitment to “consider how further monetary measures could support the recovery”.

This rebound is on track with the unemployment rate shocking forecasters with a large decline from 7.5 per cent to 6.8 per cent in August, which reconciles with our expectation for it to settle between 6 per cent and 7 per cent (most economists have anticipated much greater labour market slack).

With Debelle’s speech looming large, it might have been more than a coincidence that the RBA released three new Bulletin papers on Thursday that examine its unconventional policy actions.

The most important sought to quantify “the economic effects of low interest rates and unconventional monetary policy”. Applying the RBA’s macroeconometric model of the Australian economy, the authors found that unconventional policies that “lower government bond yields and household and business lending rates are effective in further reducing the unemployment rate and increasing inflation even though the cash rate is constrained by ”.

“Different tools can be used to affect different channels of transmission,” the authors wrote. “A range of policies deployed in unison lowers the unemployment rate further and increases inflation in a way that closely replicates the channels of a conventional cash rate cut.”

“Without these alternative monetary policies, and a range of other policies including fiscal stimulus, economic outcomes would be more varied and adverse.” One would be hard pressed to find a stronger endorsement of the RBA’s ability to use purchases of longer-dated assets, known as “quantitative easing”, to cushion the biggest shock since the great depression.

A remaining opportunity canvassed by analysts and journalists has been the disconnect between the cost of borrowing that the RBA has bequeathed banks, which is set at just 0.25 per cent for 3 year money, and that paid by state governments to fund their fiscal policies. Here the RBA has pointedly highlighted that the latter actually have a greater impact on economic outcomes than the commonwealth’s fiscal policy.

Our research shows that the biggest state, NSW, with the highest-possible AAA rating, currently pays materially more for its 3 year funding than BBB-rated institutions like ME Bank does via the RBA.

In practice, state governments prefer longer-term funding of between 3 years and 15 years to match the investments required to build infrastructure projects. And the longer the tenor, the more they have to pay.

When we look at the price of 5 year and 10 year money, it jumps to more than 0.53 per cent and 1.31 per cent annually for NSW. What is even more odd is that NSW has the most expensive cost of capital of all the major state governments (paying more to raise money than Queensland, Victoria, and Western Australia).

In his submissions to parliament, Lowe has encouraged the states to spend more. “I think preserving the credit ratings is not particularly important; what's important is that we use the public balance sheet in a time of crisis to create jobs for people,” Lowe counselled.

“I have no concerns at all about the state governments being able to borrow more money at low interest rates. The Reserve Bank is making sure that's the case. The priority for us is to create jobs, and the state governments have an important role there, and I think, over time, they can do more.”

The RBA has ameliorated state borrowing costs from their March spike by purchasing both commonwealth government bonds and those AA and AAA rated securities issued by the states.

The RBA’s $200 billion Term Funding Facility also incentivizes deposit-takers to park excess cash that they cannot lend to households and businesses in high-yielding state government bonds, which should put downward pressure on yields.

And the AFR’s John Kehoe has revealed that the RBA and APRA are considering shrinking the size of the banks’ $223 billion Committed Liquidity Facility (CLF), which would materially relieve the states’ funding pressures.

The CLF is an undrawn line of credit that the RBA extends to banks, which they can tap in a crisis. It is secured by assets banks hold in their CLF liquidity portfolios, which they must pledge to the RBA in return for borrowing CLF money.

CBA estimates that 71 per cent of the banks’ CLF portfolios are made-up of “self-securitised” (or internal) home loans, which it describes as “free money” because they are existing loans the banks have already funded (ie, they don’t need to go and buy new assets to back the CLF).

This contrasts with global best practice whereby banks are normally required to hold more marketable third-party government bonds in their liquidity portfolios, which can be sold by the central bank if it lends to a distressed institution that goes bust

A second Bulletin paper highlighted that these difficult-to-value and illiquid “self-securitised” loans could load the RBA’s balance-sheet up with significant “wrong-way” risk. Rather than the RBA lending money to a distressed bank that has pledged safe government bonds that can be divested if the bank defaults, it is taking the banks’ own idiosyncratic assets as security, which could be of questionable quality. They might therefore impose unnecessary losses on the RBA or leave it holding illiquid collateral.

In practice, the RBA tries its best to mitigate these risks by only lending against about 73 per cent of the value of a bank’s self-securitised loans.

A better approach would be ensuring banks hold more liquid, third-party assets, such as commonwealth and state government bonds. The RBA developed the globally-unique CLF solution because Australian’s government bond market was not big enough to supply banks with sufficient liquid assets at the time. The explosion in government debt since has rendered the need for a $223 billion CLF redundant.

Replacing the CLF’s self-securitised loans with government bonds at a time when the states are issuing record volumes would simultaneously solve two problems.

Not already a Livewire member?

Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

2 topics