REITs are capital hungry and small caps gain confidence: This week in capital markets

There was a distinct quietness in capital markets this week. $449m was raised via Placement a far cry from the $5.7b raised last week. One possible explanation is that money at the big end of town is running out. Most of the institutional market was sitting on a large pile of cash heading into the eye of the COVID-19 storm, but this has been quickly soaked up through the flurry of capital raises that took place in April.

We wonder if it could be the case that the active money in the market is starting to dry up. If so, what does this mean for companies that are still itching for capital injections? We think that there is always funding available at the right price. Discounted stock is hard to resist.

A few REITs have already made the trip to capital markets, we think there will be more.

It is no surprise that REITs have become popular candidates for raising capital. They are often leveraged, and will all be hard hit by the write-downs and revenue pressure currently affecting the commercial property sector.

There was another Charter Hall raise this week, this time for the Social Infrastructure trust (CQE) - think property used for childcare, education, health and transport services. The market was told that the $100m in new funds were to shore up the balance sheet. To appease existing holders there was also an attaching UPP (same concept as a Share Purchase Plan, but for Units in the trust) to raise $15m which had had a very interesting pricing structure. In the standard placement + SPP combo pricing is the same for both offers, but participants in the placement receive shares earlier.

For this raise, CQE guaranteed a favourable entry price for their existing holders by setting the UPP price at the lower of - the placement price, 2 % discount to 5 day VWAP before closing date or 2% discount to on the closing date. Although the pricing is well considered it is worth noting that $15m equates to roughly $2.5k per existing shareholder in CQE.

National Storage REIT (NSR) also raised this week, another JP Morgan REIT raise. It was a $300m placement conducted at an eerily similar discount to Charter Hall (7.1% vs. 7.56%), maybe this a magic number for JPM? There was an equally small $30m SPP to follow but fixed at the same price as the placement.

Green shoots are emerging at the smaller end of the market.

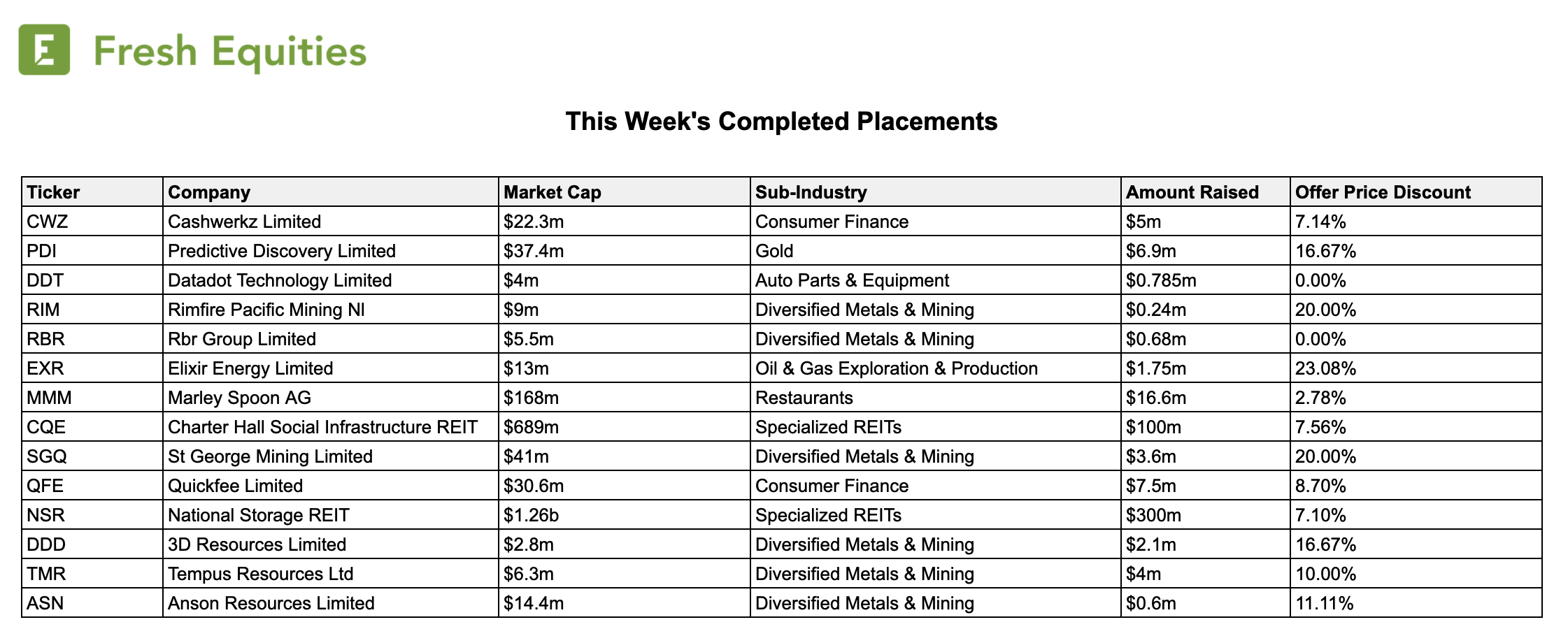

Few small caps would dare to head to investors for funding 4-6 weeks ago, but as quickly as the interest dried up it appears to have returned. In April there was an extraordinary level of capital raising activity amongst the ASX 200, now small caps are back in vogue. Of the 14 placements that completed this week, 12 were for small caps.

A great example of this confidence was the placement completed by St George Mining (SGQ). This was their 3rd trip to equity markets this financial year, raising $3.6m with a small $1.6m SPP to follow. One would imagine that a company asking for funding 3 times in an 8 month period would struggle to secure support, but the deal closed oversubscribed.

Gold explorer Predictive Discovery (PDI) was another favourite, raising $6.9m on the back of some well-received results and a 590% share price appreciation this year. Investors were told that existing holders were to receive preferential allocation.

Small cap vs. large cap pricing structures.

Placement shares are usually at a discount to the last traded price in order to entice new investment and defray risk. Since COVID we have observed a higher average discount in placements as companies try to account for the new downside risk.

This is more of an issue in smaller companies, who are generally more reliant on continued growth and funding. The average discount this week for small cap raises was 11.3% vs. an average of 7.3% for the large caps. Small caps aren't for everyone, but the deals are plentiful and they are getting filled.

3 topics

14 stocks mentioned