Three ultimate value-compounding machines

Clime Investment Management

In April 2007, coincidentally around the same time that I joined Clime, markets were rollicking and the pricing of risk seemed a forgotten investment principle. What a time to raise capital. In a sign of the times, one of the largest public offers of shares that Australia had ever seen was underway. Global drilling services contractor Boart Longyear (ASX: BLY) hit the ASX boards amongst a wave of optimism typical of the pre-GFC largesse washing across global markets.

In the first few months of trade, BLY traded solidly at or around its listing price. Then the GFC hit, exposing a weak business model backed by an even weaker balance sheet. The ~$3bn of 2007 market value has since receded to about $45m of market value, representing one of the greatest destructions of shareholder capital seen over the past decade.

While there could be a multitude of learnings to be gleaned from this review, the point I’d like to highlight today is the power of a self-funding business model.

At one end of the spectrum, we have capital destroyers; companies that continually suck up investor capital and generate little, no or negative returns on the vast amounts of capital raised. At the other end of the spectrum, we have ultimate compounding machines; companies that raise a relatively small amount from investors, make a profit and subsequently retain some or all of its earnings to reinvest in its business. Then, critically, repeat this process for many years. In doing so, the wonders of compounding ensure substantial returns for long term investors.

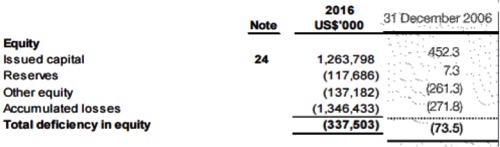

Unfortunately for long suffering BLY investors, this company represents one of the starkest examples of capital destruction seen in recent years. As at 31 December 2016, BLY had raised a total of US$1.26bn of equity from shareholders. Since listing, BLY has generated a compound annual return of -43%. As it stands, despite raising over a billion dollars from shareholders and before the proposed debt for equity recapitalisation, BLY has negative equity!

Figure 1: BLY Balance Sheet Equity 2006 vs 2016

Source: BLY Annual Report 2016 & PDS

The above tale of woe highlights how serial capital raisers can destroy millions of investor capital. On the flipside, what if we could find those companies that have the ability to reinvest retained profits and compound growth over many years?

What if we could take $3.4m of issued capital and turn it into $600m of market value? How about turning $10.0m of issued capital into $4.1bn of market value? Perhaps we could raise $43.2m of capital, reinvest profits over many years and turn this into $4.5bn of market value?

While the above may sound fanciful, these figures directly represent three high quality ASX listed companies that have self-funded their way to incredible growth. Shareholders that have stayed the course with these companies have enjoyed many years of market beating returns.

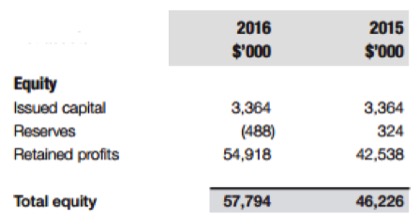

The first example comes from the pristine balance sheet of Nick Scali (ASX: NCK). Founded in 1962 by Nick Scali and listed on the ASX in 2004, NCK has issued capital of just $3.36m. Today, NCK’s market cap is $600m – and that’s after paying out tens of millions worth of fully franked dividends.

Figure 2: NCK Balance Sheet Equity

Source: NCK 1H2017 Report

When NCK listed on the ASX, the company had 81 million shares on issue. Today, NCK has … 81 million shares on issue. Ultimately, NCK has epitomized what we look for when it comes to sensible capital management and self-funding growth. The 10-year total shareholder return (TSR) has been 17.4% per annum.

The second example is that of Reece Limited (ASX: REH). Established almost one hundred years ago in 1919, and subsequently listed on the ASX in 1954, REH is Australia’s leading supplier of plumbing and bathroom products. REH’s network now encompasses nearly 600 branches across Australia and New Zealand, while the business employs in excess of 4,000 staff and stocks thousands of specialty products.

Much of REH’s success can be attributed to the Wilson family, who first became involved with the business in 1969. The Wilsons, represented on the board by Alan, Peter, Bruce and John and whose tenures span an aggregate of 144 years, remain highly influential as majority owners and long-term managers of the company.

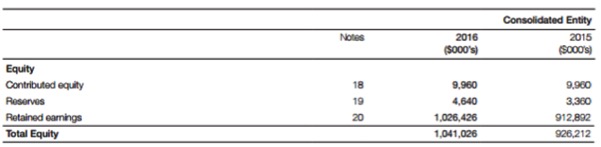

REH management have always played the long game; investing through the cycle while maintaining a strong balance sheet and a generally conservative payout ratio. REH’s aggregated contributed equity amounts to just $9.96m, yet the company’s market capitalisation now exceeds $4bn.

Figure 3: REH Balance Sheet Equity

Source: 2016 Annual Report

As the above would suggest, REH has consistently retained and sensibly reinvested a good portion of earnings over many years. The result: REH has been a 500+ bagger over the past 40 years.

Figure 4: REH Share price 1978 to 2017

Source: Iress

The final example in today’s analyst opinion piece is that of Washington H. Soul Pattinson (ASX: SOL). With origins dating back to the 19th century, SOL is one of Australia’s oldest and most respected public companies.

SOL has been listed on the ASX since 1903 and in this time, has never failed to pay a dividend to shareholders. While SOL’s origins are in owning and operating Australian pharmacies, the group’s operations have since expanded considerably. SOL’s portfolio now encompasses investments in natural resources, building materials, telecommunications, retail, agriculture, property equity, investments and corporate advisory.

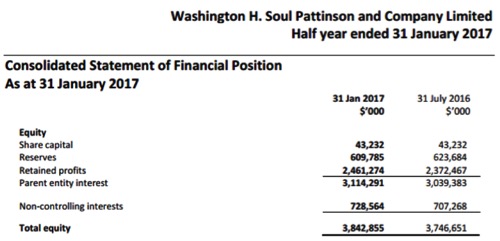

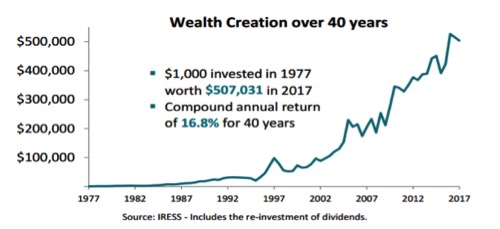

With a firm view on the long-term horizon and a track record spanning decades, SOL management have seen off the various challenges that have come its way in recent years. As highlighted below, long-term investors have been handsomely rewarded, as SOL has effectively taken issued capital of $43.2m to build a multi-pillar investment house now worth over $4.5bn. In anyone’s book, this represents a remarkable result and again proves the power of patience, sensible capital management and ultimately, compounding.

Figure 5: SOL Balance Sheet Equity

Source: 1H 2017 Report

Figure 6: SOL 40 Year TSR

Source: 1H 2017 Report.

While scores of investors focus almost exclusively on the profit figures produced by listed companies, we would suggest that this is best reviewed in tandem with a range of other important figures, such as:

· The amount of equity required to produce the reported profit: This provides investors with insight into the return on equity of the given business. In general, those companies that can reinvest retained profits whilst sustaining a high ROE will build business value at above average rates,

· The source of that equity: Self-funding businesses generally build per share value at attractive rates, and

· The level of operating cash flow: Ideally cash flow should match or exceed reported profit

Clime owns shares in NCK and REH.

Original blog available here: (VIEW LINK)

3 topics

4 stocks mentioned

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.

Expertise

The Clime Group is a respected and independent Australian Financial Services Company, which seeks to deliver excellent service and strong risk-adjusted total returns, closely aligned with the objectives of our clients.