Retirees need to dial down risk and focus on income

It has been hard to keep up with financial news lately. As Howard Marks aptly put it, “the world’s economy has been shaken like a snow globe.” Trump’s tariffs initially caused steep sharemarket declines, then they rebounded on news of the 90-day pause, and markets have been yo-yoing ever since.

We appear to be in a period of great global change which Ray Dalio has called a ‘once in a lifetime breakdown in the global order’. The only consistent thing with the Trump presidency so far is inconsistency, and it seems clear we are in for more volatility.

For long-term investors in their 30s and 40s this period of volatility will probably end up as a funny story and one of many bumpy patches on a long road. But for investors approaching retirement age, it couldn’t have come at a worse time. For investors who are about to retire, or who have just retired, any big losses now could have a severe impact on their future quality of life.

Investment losses around retirement age can severely reduce your future quality of life

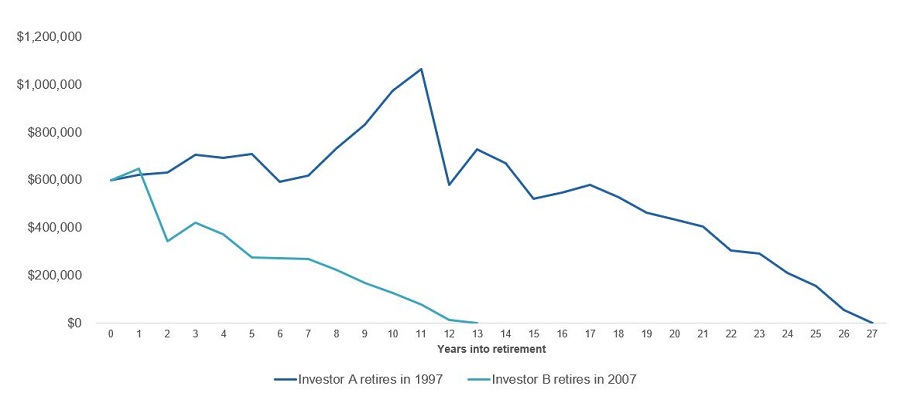

While investment losses at any time hurt, the impact can be much more pronounced when they occur at or near retirement, leaving investors with insufficient time to recover. The technical term for this is sequencing risk – the risk that the ‘sequence’ of returns has a negative impact on an investor’s total savings. The chart below shows two people who retire at 67 in line with the Association of Superannuation Funds of Australia (ASFA)’s 2025 guidance on what are likely to need for a ‘comfortable retirement’. They both have ASFA’s recommended balance of $595,000, invest the full amount in the ASX 300, and withdraw the amounts ASFA suggests people need to be comfortable. The only difference is that Investor A retires in 1997, and Investor B retires in 2007.

Source: IML

Investor B was very unlucky, retiring just before the GFC, so incurring a major investment loss shortly after retirement and running out of money by the time they reached 79 years old. Whereas Investor A’s money lasted until they were well into their 90s as no major investment losses occurred shortly after retirement.

The outcome is so stark because making withdrawals from your savings at low points in the market means that you lock in your losses and then aren’t able to make up lost ground when the market bounces. While a major event like the GFC obviously has a severe impact on your investments, you don’t need a GFC-type event to be impacted by sequencing risk. Market volatility can steadily erode your capital over time if you are in the drawdown phase as a retiree as you can become a forced seller of dips – so locking in your losses.

Investment strategies which include greater levels of downside protection are particularly valuable for investors in, or approaching, retirement. Also, a greater focus on income reduces the likelihood that retirees will need to use their investment capital to fund their lifestyles during times of poor investment performance.

Consistent income can smooth out returns and better maintain capital

There are many different ways of generating income from investments including rental properties, coupons from fixed income, interest from term deposits and dividends from equities. All have their advantages and disadvantages but offer important diversification, and greater income for investment portfolios.

While equities, particularly Australian equities, deliver solid income returns (more than half of the returns from the ASX200 over the past 20 years come from dividend income(i)) equities are more volatile than many other asset classes. Dividends are inherently less volatile than share prices though, as dividends are paid based on the underlying profitability of the company, whereas share prices fluctuate depending on the whims of the market. Investors can also reduce the volatility of equities by focusing on higher-quality companies, and increase income by investing in companies that pay consistent dividends.

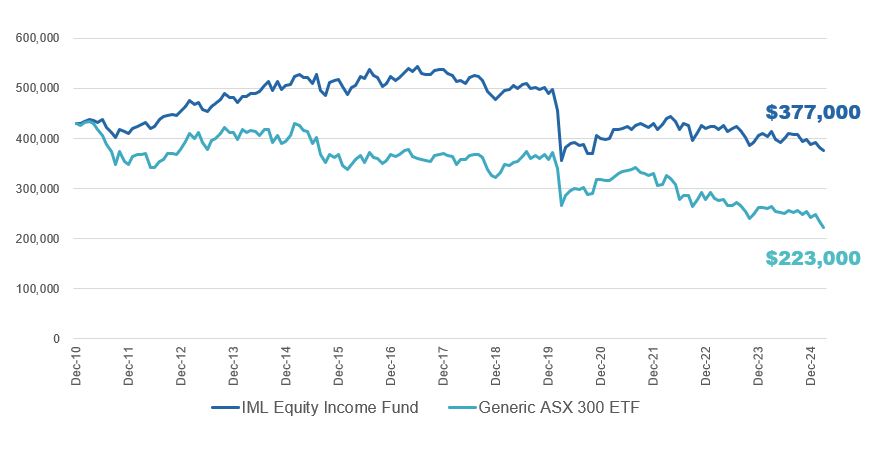

To show the impact higher income can have let’s look at a hypothetical scenario where someone retires at the end of 2010 with a lump sum of $430,000, the amount ASFA recommended at the time for a ‘comfortable retirement’, and invests the entire amount in either:

- An income-focused equity fund (EIF)

- Or a generic passive ETF(ii) which replicates the ASX 300, with quarterly distributions

The total return for both funds is very similar (7.8% for EIF and 7.7% for the generic ETF), so if no withdrawals are made then the investment performance is very similar. At the end of March 2025

- Investors in the generic ASX 300 ETF end up with $1.468 million

- And investors in EIF end up with $1.5 million

However, if you add in monthly withdrawals to pay for a ‘comfortable lifestyle’ in line with ASFA’s guidance (starting at $3,275 per month in January 2011 and rising with inflation), things change significantly.

Cumulative value of income versus growth investment with monthly withdrawals

Source: IML, Factset as of 31 March, 2025. Lump sum and monthly withdrawals based on ASFA’s Retirement Standard for a ‘comfortable’ life for a single person. Returns calculated after fees and including franking (iii). Past performance is not a reliable indicator of future performance.

At the end of March this year the amount invested in EIF would have been worth $377,000, whereas the amount invested in the generic ETF would have fallen to $223,000 – around 40% less.

The main reason for this stark difference, despite similar investment performance, is the higher and more consistent income, which is distributed quarterly. This regular income gives investors money to live on, making it less likely they will be forced to sell shares for living expenses when performance is poor, and so lock in losses and permanently deplete their investment capital.

To be clear: we would never recommend someone invests their entire portfolio in one investment option – diversification is a critical component of successful long-term investing. There are also many differences between the products investors should be aware of before considering investing, including the higher fees of EIF compared to the passive ETFs, and the different risk profiles of each fund. See below for fuller explanation*. This is not meant as a broad comparison between the funds, it is simply intended to show the difference income and capital growth ratios can make for long-term investments.

Steady income gives you better long-term outcomes if you are making withdrawals

When you’re investing it’s easy to get very focused on the total return you expect to make from an investment, but what’s even more important for retirees is how much money they will be able to spend to fund their lifestyle and pay for any unexpected expenses. For retirees who need to live off their savings it’s important to generate enough income from their investments to stay ahead of inflation, then they are more likely to be able to enjoy their retirement and less likely to be worrying about their finances.

1 topic

1 fund mentioned