Return of the memes, and other signs we could be near the top

The COVID pandemic was one of the strangest periods in financial market history.

As the virus spread around the world, the global economy came to an almost overnight halt.

Borders were closed. Many governments imposed some form of lockdown on their populations. Businesses, especially those in the travel, tourism, hospitality and bricks and mortar retail industries, were forced to lay off employees leading to a spike in unemployment. GDP growth plummeted.

With this as a backdrop, it wasn’t a surprise that equity markets crashed, which they did in March 2020.

However, despite no improvement in the economic situation, and no sign of the pandemic improving, something strange happened. Share prices started soaring.

With interest rates low and government stimulus in hand, a surge of speculation took hold from retail investors that befuddled experienced investors and “Wall Street”.

One of the more infamous events during this time, the popularity of meme stocks, now appears to be back.

It is yet another sign that equity markets could be overheating.

If at first, you don’t succeed

Earlier this month, Roundhill Investments, announced that they are relaunching the Roundhill Meme ETF (NYSE: MEME).

In an interview with CNBC, Roundhill Investments CEO, Dave Mazza, said:

“The meme ETF allows investors to actually tap into the power of retail”.

That power might be more myth than reality though, at least in regard to this strategy.

During its first iteration, when it was released at the peak of the meme stock craze in December 2021, it coincided just as the NASDAQ Composite Index was hitting its peak. Between the time the Meme ETF launched and when it was finally shut down in late 2023, the NASDAQ fell by almost 10%.

The few who invested in the Meme ETF -- the ETF was rumoured to only have around US$2.7 million in net assets -- fared much worse. At the time the ETF closed, investors were down by approximately 57%.

This echoes the investment performance of other “meme” products -- such as “meme coins”, cryptocurrency coins that are launched by celebrities or around internet culture -- many of which quickly lose more than 90% of its value.

The fact that Roundhill has resurrected this relic from the pandemic points to the animal spirits and attitude to risk that is currently gripping the market, particularly amongst retail investors whose activity, according to JP Morgan Chase, now rivals that of the pandemic peak.

The first Meme ETF coincided with the top of its market. Could its reemergence again signify the top?

The new gold rush

The relaunch of the Meme ETF is not the only sign of a financial market frenzy.

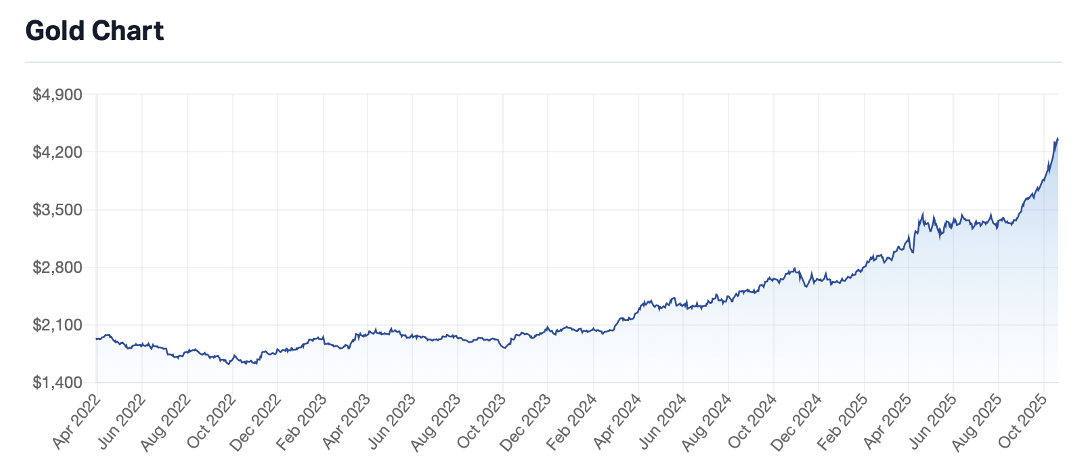

There appears to be a new gold rush.

However, rather than speculators migrating to Ballarat or Bathurst, this gold rush sees a slightly different behaviour – most notably the queuing up outside gold retailers in major Australian cities every morning in the hope of buying the commodity.

Such behaviour is not normal and is often the result of an asset price flying so high that it leads to the fear of missing out (or FOMO).

It is also usually a precursor to that asset falling as we saw in the early 2000’s during the dotcom boom.

Cockroaches in credit

So, with equity markets booming, leading to new ETFs set around retail investor exuberance, and gold bugs lining Martin Place in Sydney, what about credit?

That’s surely safe, isn’t it?

Not according to Jamie Dimon, chief executive officer of JPMorgan.

“I probably shouldn’t say this, but when you see one cockroach, there are probably more, and so everyone should be forewarned of this one.”

This was in relation to the recent collapse of two US firms, First Brands and Tricolor, which involved private credit. Tricolor, a subprime auto lender, led to Dimon’s firm writing off US$170 million.

The collapse of these two firms has raised questions on lending standards in private credit, which is today one of the fastest growing asset classes.

Dimon isn’t the only one concerned either. Kristalina Georgieva, the head of the International Monetary Fund, has urged more attention be placed on non-bank financial institutions and that the sector “keeps her awake at night”.

Of course, every private credit lender will tout the robustness of their lending processes, but it is also worth remembering that Enron also had a code of ethics.

If there are more cockroaches, as Dimon believes, there could be more pain to come.

Waving the warning flag?

Investing is often an act of merging the quantitative and the qualitative.

On the quantitative side, we have equity and bond markets that are both at all-time highs, both on an absolute level and regarding PE multiples and credit spreads.

Regarding the ASX 200, you’d have to go back to the pandemic, where earnings multiples were artificially depressed, to find a time where the markets price-to-earnings multiple was as high as it has been recently.

The above examples also highlight that qualitative signals are also starting to emerge, and frighteningly, emerging across different asset classes.

The lights are not necessarily flashing red yet.

Published research still points to certain sectors of the market as providing opportunity -- such as Andrew Tang who recently published Morgan's preferred sectors and Bell Potter who recently published their list of top small cap ideas.

But the signs are starting to mount up that investors at least need to start taking a more active approach to managing their portfolios rather than just betting that the market will keep going up.

5 topics

1 stock mentioned