Screening the globe for small caps

Smaller companies have had a stellar run since the COVID sell-off, with the MSCI World Small Cap Index managing to outperform even the NASDAQ since the market’s bottom – up more than 45% at the time of writing. While it’s tempting to assume that the rally has taken all the opportunities from the market, the breadth of the market means that there’s always something of value on offer. Mettler-Toledo, for example, produces a similar return on capital to Cochlear, and has better long-term EPS growth, PE ratio less than half that of Cochlear.

In this wire, Ned Bell from Bell Asset Management and Kirsty Desson from Aberdeen Asset Management share insights into how they screen ideas down for further research, how some Australian companies stack up against their overseas counterparts, and some of the opportunities on offer today in global small caps.

Narrowing down the field

Depending how you define the sector, global small caps can include anywhere from 5,000 companies up to ~50,000. Naturally, with such a large universe, even the most well resourced of investment teams can’t cover everything. At Aberdeen, they’ve been developing a proprietary screening tool since the early 90s called Matrix. This allows them to screen their universe of 6,000 companies down to a more manageable size.

“In our opinion it is effectively impossible to cover the vast investable universe of some 6,000 companies from a purely bottom-up basis. So, a sophisticated screening tool is essential to uncover the most compelling research opportunities,” Desson said.

Matrix focuses on 13 factors spread across four categories – quality, growth, momentum, and value. These include changes in 12-month and 24-month EPS forecasts, EPS revisions ratio (EPS upgrades vs EPS downgrades), forecast EPS growth, forecast P/E, price momentum and Piotroski scores.

But Desson stresses that passing these screens alone is not enough. This is just the first stage of the investment journey, with the team undertaking significant further research before including a company in the portfolio.

“As effective a tool as the MATRIX is, it will never be able to take account of some investment criteria: good management team, strong environment, social and governance (ESG) credentials, sustainable competitive advantage, operating in an area of structural growth and resilient earnings stream. These are all aspects that we factor in during our research,” she said.

Desson cites the example of Chegg, an American education technology company. Before the company was highlighted by Matrix, it was completely unknown to the team. She highlights the relevance of the company now in the wake of COVID-19 as the shift to online education accelerates.

“Subscriber growth accelerated to +35% in the first quarter, and forward guidance is for a further uplift to +45% in the second quarter. Whilst this is likely to slow once lockdown is lifted, we believe it has driven a step change in adoption that won’t reverse,” Desson told us.

Ned Bell takes a slightly different approach however, applying a broader screen to bring his investable universe down to just 460 companies. To make it into this list, a company must have a market cap in excess of $1 billion, three consecutive years of profitability and an average daily traded value in excess of $5 million.

Filtering this down further to arrive at a short list would mean looking for metrics that imply a mix of profitability, growth, financial strength, liquidity and valuation support. For example:

- Return on Capital > 20%

- Net Debt / EBITDA < 2.5x

- Long Term EPS Growth > 5% p.a.

- Sales Growth (5yr historical) > 5% p.a.

- Free Cash Flow Yield > 4%

Bell says that such a filter would produce a list of just 10 names that pass, of which four are current inclusions in their portfolios - Arista Networks, ICON Plc, Moncler and Partners Group.

A healthy range of opportunities

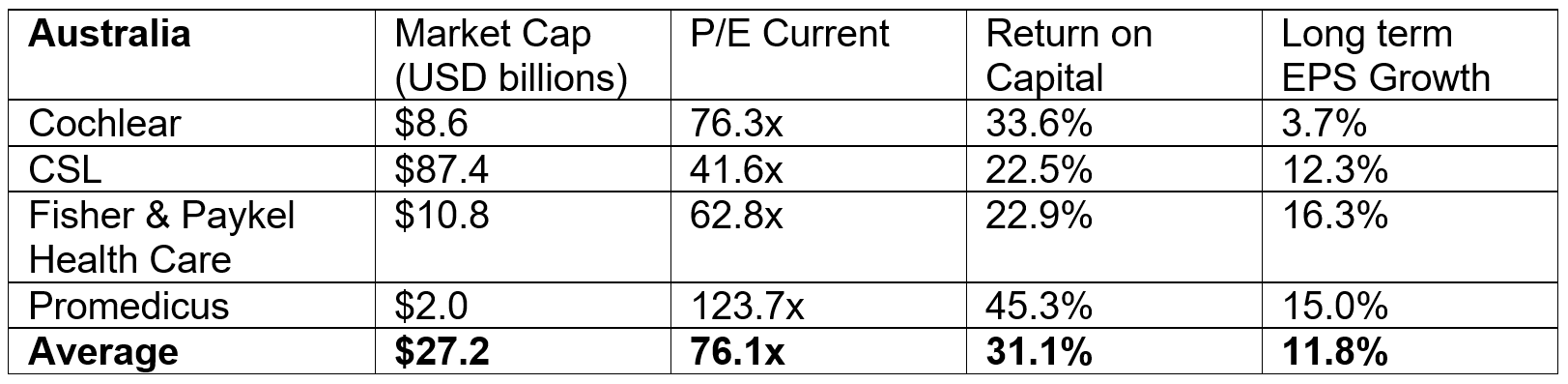

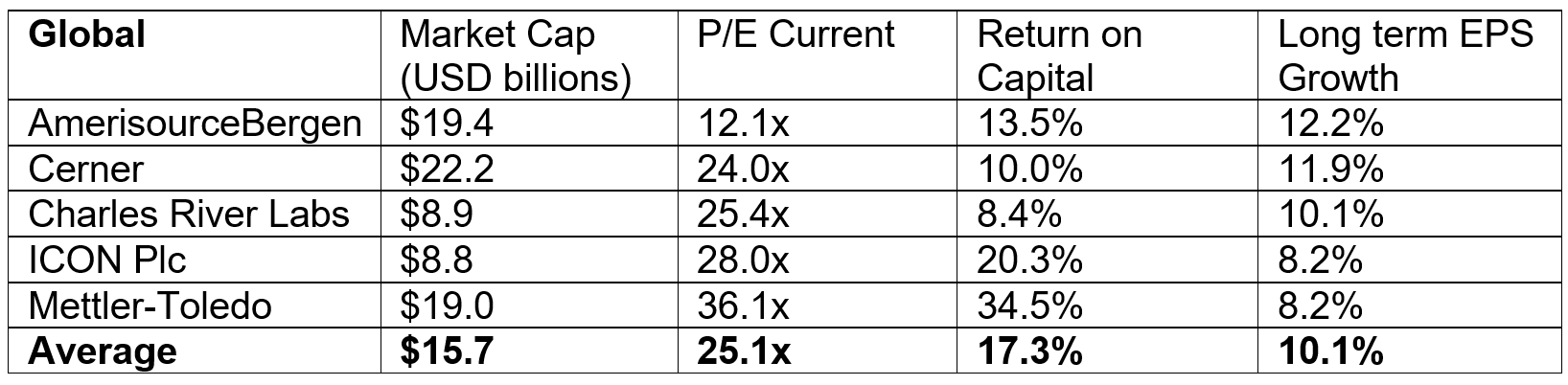

Due to the broad range of opportunities available, it’s often possible to find global small caps that are cheaper and/or higher quality than their ASX equivalents. While Bell is clear that their process specifically excludes looking for ASX equivalents, he does note that in some sectors, the relative value proposition is more attractive overseas. In particular, he argues that the global speciality healthcare stocks are “materially more attractively valued” than their Australian counterparts.

Relative value of Australian and Global health care companies

“While they aren’t exact like for likes, collectively they represent specialty health care names with comparable long term EPS growth outlooks – yet the global peers trade on a material discount to the Australian peers,” Bell said.

Desson also pointed to healthcare as an area where global peers looked more attractive. Using their Matrix screening tool, they identified earlier this year that US aged care providers, Amedisys and Chemed offered the quality, growth, and momentum characteristics they look for. Meanwhile, Australian providers, Estia Health and Regis Healthcare did not score as well.

“Amedisys and Chemed were benefitting from positive share price momentum, earnings upgrades, strong earnings growth and quality balance sheets, leading to strong overall scores. By contrast, the Australian firms showed underperformance and earnings declines and carried plenty of debt, resulting in negative scores. We decided to look more closely at Amedisys and Chemed, while dropping the Australian names.”

Further research identified three key tailwinds for these companies:

- Regulatory changes driving increased demand

- Industry changes driving efficiencies and cost savings

- A fragmented industry that’s beginning to consolidate, benefiting the larger players and allowing them to gain market share.

“We concluded that Chemed and Amedisys were quality businesses enjoying healthy growth and positive momentum. On the understanding that these are sustainable trends, we took positions in both stocks. While we have avoided the Australian care providers for now, we will continue to monitor the Matrix for any change in outlook,” she said.

Wrapping it all up

Screening can be a useful tool to narrow down a large universe to a list of candidates for further research. This is particularly pronounced in the global small cap sector, where a huge number of investable stocks are often covered by fairly small investment teams, making efficiency key. Screening is not enough on its own though, further detailed research is required to identify the most attractive candidates.

Learn more about global small caps

In part one of this series, Ned Bell and Kirsty Desson discussed the key themes to watch coming out of COVID-19. In the second part, they each shared a recent addition to their portfolio. To be notified when they post a wire, click on their name in the sentence above and hit the 'Follow' button.

Not already a Livewire member? Sign up today to get free access to investment ideas and strategies from Australia's leading investors.

1 topic

2 stocks mentioned

1 contributor mentioned