SD-WAN and the future of 5G: What it is, how to get exposure

It’s easy to see why so many investors are caught up in the hype of 5th generation wireless technology. We hear of 5G powering a new age of technology, transforming global connectivity, even enabling the 4th industrial revolution.

There is no doubt 5G’s extraordinary speed and low latency will have a significant impact across nearly every industry globally, but this doesn’t simplify the challenge for equity investors – separating the 5G winners from the pretenders.

The global microcap space offers an abundance of opportunity when searching for real 5G beneficiaries. Unconstrained by geographic boundaries we do find companies offering 5G aspirational hyperbole, but also real businesses with strong fundamentals, poised to benefit from this technology.

Looking beyond the large cap 5G providers (the telcos) and 5G enablers (infrastructure and component builders), we have a range of 5G users offering compelling opportunities.

The opportunity in SD-WAN

While the likes of AI, autonomous driving and factory automation steal the headlines, the provision of wireless networks is one of the lesser-discussed areas at the forefront of the 5G shift.

SD-WAN stands for Software-Defined Wide Area Network. While this is most likely not part of your household vocabulary, the underlying technological framework is all around you.

A wide area network (WAN) is a computer network that extends over a large geographic area. They are used by businesses, schools, and government entities to securely transmit data between devices on the network.

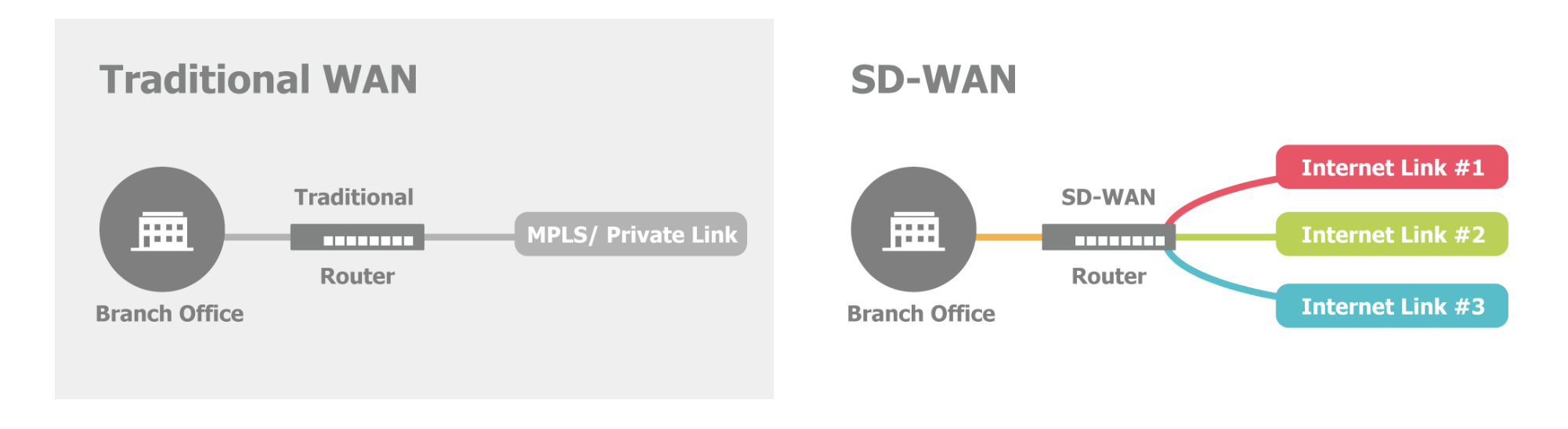

Traditional WANs are entirely hardware based and were never designed for the cloud, where massive amounts of data need to be moved around thousands of connected devices.

SD-WAN simplifies the operations of a wide-area network.

It uses a centralised control function to securely and intelligently direct traffic across a WAN. This lowers cost, increases speed and efficiency, and allows IT teams to rapidly scale up networks and set policies from a remote location, all without sacrificing security and data privacy.

The SD-WAN model was designed to fully support on-premise data centres, public and private clouds, and SaaS services such as Salesforce, Workday and Office365. Wireless SD-WAN takes this concept a step further, incorporating wireless technology into SD-WAN routers.

This can be used in conjunction with wired connections to improve speed, latency, and reliability. Or for purely wireless applications such as emergency services, public transport, maritime, broadcasting, robotics, and of increasing importance, remote working.

Wireless networks are almost always “metered”, where the cost is associated with data usage, while hardline networks are typically “un-metered”, and charged at a fixed price. This has acted as a barrier preventing a lot of organisations from deploying wireless solutions in the past. This is where 5G comes into play.

Data costs on 5G networks will be substantially lower than on previous generation networks. Businesses are beginning to deploy more hybrid networks to improve speed and reliability in critical fixed locations, as well as purely wireless networks for their workforces to work remotely. This doesn’t just apply to work-from-home scenarios, it also includes branch networks that need to move frequently or are in remote and ad-hoc locations.

For locations currently relying on previous generation wireless SD-WAN, there will be a multi-year upgrade cycle to 5G for better speed and lower latency. Applications such as surveillance cameras, Wi-Fi hotspots on public transport, live video streaming, and fixed network failover will create strong demand for 5G wireless SD-WAN routers.

Given the high-growth nature of the SD-WAN space, finding companies in the global microcap space at a reasonable price is a challenge. Spheria’s screening process identified a Hong Kong-based microcap that stands out from the pack with its high return on capital, strong balance sheet, and its consistent growth over time.

Plover Bay (HK:1523)

Plover Bay is an asset-light developer of both wired and wireless SD-WAN hardware and software. It’s a small company in the grand scheme of SD-WAN, however, it predicted the shift to wireless well ahead of the competition and has secured its spot as one of the dominant players in the wireless space. We estimate its global market share at approximately 16%.

Its patented SpeedFusion technology can combine networks (fixed lines, wireless 4G, wireless 5G) from multiple service providers to form fast and highly reliable network connections from any location, with multiple fail-overs. It refers to this as “unbreakable connectivity”.

Plover Bay counts Google as a key client. When Google wanted to upgrade its commuter transport network to include secure Wi-Fi for its employees, it turned to Plover Bay.

Plover Bay generates up-front revenue from the sale of SD-WAN routers, as well as recurring revenue from software and services. It recently rolled out a subscription model, providing routers, data connectivity, support services, and access to its cloud management platform, in exchange for a monthly fee based on data consumption.

This provides an attractive proposition to smaller businesses that want to avoid the upfront costs of setting up a wireless SD-WAN network, while creating another recurring revenue stream for the business. It currently derives 76% of its revenue from wireless, which has grown at a compound annual growth rate of 25% over the past 5 years.

Plover Bay is the stereotypical stock the Spheria team searches for. It’s currently under the radar of most investors, only covered by a single local broker, and is a dominant player in a niche area of a growing industry.

It’s highly cash generative, has a net cash balance sheet, trades on 11x forward EBIT, and at its current price, pays a dividend yield of 7%.

Amongst the 5G hype, we see plenty of upside potential for this hidden microcap gem.

Micrcocap opportunities beyond our shores. Gain exposure to some of the world's most robust, profitable and innovative microcap companies.

To learn more about the Spheria Global Microcap Fund, visit the Spheria website, or click the 'contact' button below to make a direct enquiry.

4 topics