Shovels in a gold rush (the 21st century equivalent)

When most investors think about investing in technology leaders, it's the FAANG's, Tesla and other disruptors currently exciting the market. But there's a lesser-known group of businesses critical to next generation technology.

Like selling shovels in a gold rush, leading-edge semiconductor manufacturers provide the hardware big tech (and its big aspirations) can't go without.

Powering the next digital revolution

Our consumption of data has increased at a phenomenal rate over the past two decades and now 5G technology and next-generation Wi-Fi is about to propel a new era of connectivity.

5G will allow us to send and receive more data at a faster pace - we’ll be streaming more content than we ever have, gaming experiences will improve, there'll be more augmented and virtual reality experiences.

At the industrial level, this technology will see profound changes to communities - smart cities, smart factories, degrees of autonomous driving.

As we produce and consume more data, the key to processing, storing and analysing this data is semiconductor chips.

We covered this topic in-depth during our latest podcast episode. You can listen here or continue reading below.

Semiconductors are silicon substrates that house many millions of microscopic electrical connections (transistors) that are able to perform a set of instructions determined by the system and software in which they are housed (say a smartphone). The smaller the size of these connections, the greater the number of connections that can be housed on the substrate, and therefore the greater the number of tasks that can be performed by the chip. This drives a constant need to shrink the tiny circuit connections. In fact, the most advanced semiconductors in the market today have over 50 billion transistors, crammed onto a piece of silicon measuring just 5x5cm. These advances are at the heart of the ongoing computing revolution.

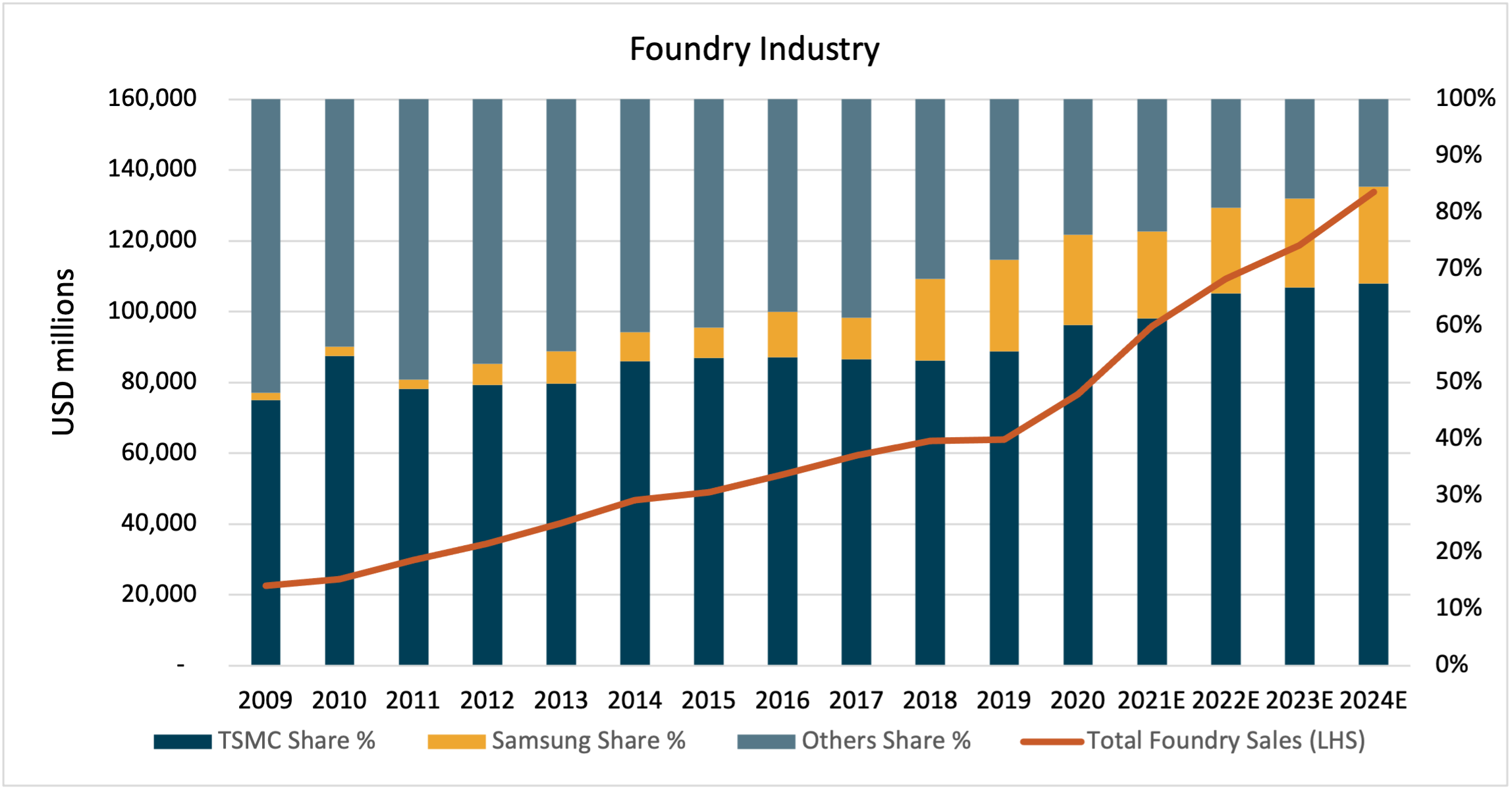

Following the deep 2002 industry downturn, large tech companies began to embrace outsourced manufacturing of leading-edge semiconductors. This allowed them to focus research dollars on designing semiconductors, while leaving the capital-intensive part of the process (the fabrication) to specialist foundries. Since then, we’ve seen a growing dependence on these specialist foundries. Foundry’s share of the semiconductor industry has grown from around 15% to 40% over the last 15 years.

Incredibly, with Intel largely bowing out of the competition in 2020, there are now just two companies that can manufacture leading-edge chips for technology companies globally; Taiwan Semiconductor Manufacturing Company (TSMC) and Samsung Electronics.

In our global portfolio these companies have a combined weight of around 6%.

Taiwan Semiconductor Manufacturing Company

TSMC is the world's leading semiconductor manufacturer. Its share of the foundry industry today is around 55%. This is a result of cumulative knowledge built up over 25 years of being dedicated to the task. It manufactures chips for all the leading companies such as Apple, Qualcomm and Nvidia, just to name a few.

To paint a picture of the company’s dominance, 100% of Apple’s chip production for the iPhone and the Mac are manufactured by TSMC. Further, the company offers the only independent leading-edge foundry given Samsung is a competitor to some of the largest foundry customers (such as Apple and Qualcomm).

TSMC’s sales have grown around 14% p.a. for the last 15 years – three times faster than the overall industry – and as such the company has consistently grown its share of the foundry industry, illustrated below.

Source: Factset, Antipodes

Samsung Electronics

Samsung today remains a business where profit cycles are dominated by semiconductor memory, where it is the world leader and a low-cost producer. After years of capital destruction, the memory industry has arrived at a place where returns are rising on a through cycle basis.

As we enter 2021 we are emerging from a three year down cycle. The additional functionality that will come with 5G handsets - faster modems, higher spec cameras and displays – drives greater semiconductor content per device. More memory is required to execute these processes; flagship devices today are coming to market with 50% to 100% more memory per phone than leading 4G devices. Samsung’s business should perform very well against that backdrop. It’s worth remembering, however, that the industry is prone to overbuild, so supply needs to be closely monitored.

Additionally, Samsung will continue to develop its capabilities in foundry, transporting its leading-edge manufacturing processes to external customers where, as we’ve noted, there is a role for a strong number two player to TSMC.

Value and structural growth

This structural growth opportunity has begun playing out with Antipodes having had exposure to the sector for several years already. Over the last year, semiconductors have outperformed the broader tech complex by more than 20%, and our holdings in TSMC and Samsung have performed well. But we believe there’s still a long runway ahead. The great wave of connectivity that is sweeping the world will result in the exponential growth in data – data which needs to be processed and stored.

TSMC and Samsung Electronics are key in enabling this to happen.

We expect both companies to continue to outgrow the broader industry with top line growth accelerating versus historic levels over the next several years as the confluence of connectivity and artificial intelligence drive a wave of investment in compute requirements.

What's great about investing in these businesses is you’re making a longer-term play on the ongoing digitisation of modern economies as opposed to taking a bet on which individual semiconductor companies will be future market share winners.

Looking forward over the next one to two years, we see TSMC valued at around 20x earnings, but where the business is compounding those earnings at over 20% p.a. Likewise with Samsung Electronics, a growing appreciation for the foundry opportunity and the inflection in memory prices can drive the multiple higher than where it is today.

As many investors chase aspirational growth at any price, the ‘shovels’ of next generation tech offers strong growth at a sensible price

Discover more about pragmatic value opportunities

Click the contact button below to speak to the Antipodes Partners team or visit the Antipodes website.

2 topics

1 contributor mentioned

.jpg)

.jpg)