Signal or Noise: Is this the start of a second Global Financial Crisis?

Banking is a game of confidence. When the public loses faith in its financial institutions, the whole system crumbles. Film buffs will know the bank run scene from the classic film It's a Wonderful Life. Investors with long memories can simply tell you about the drama that unfolded in 2008 when Lehman Brothers collapsed and how rivals like Fannie Mae and Freddie Mac had to be bailed out by the federal government.

Well, they say history doesn't repeat itself but it often does rhyme. If the last month is anything to go by, then banks certainly have a way of repeating previous mistakes.

The primary cause of the 2008 banking meltdown and the unfolding crisis in 2023 is eerily similar - excessive risk-taking at a time when the macro picture looked so good.

The difference this time is that two Global Systematically Important Banks (also known as the "too big to fail" club) have merged with UBS buying out long-time rival Credit Suisse for a fraction of its once-huge value. The deal caused shockwaves throughout global markets with some investors even speculating on the future of European compatriot Deutsche Bank. All this before we even consider the collapses of Silicon Valley Bank, Signature Bank, and Silvergate Capital stateside.

So will 2023 be a repeat of 2008? Or is this just a case of poorly managed risk in individual situations?

This month's episode of Signal or Noise probes those exact questions and how the fallout from the global banking crisis is impacting the decisions of investors.

Joining yours truly are:

- Diana Mousina, AMP Deputy Chief Economist and series regular

- David Cassidy, Head of Investment Strategy at WILSONS

- Daniel Siluk, Portfolio Manager at Kapstream Capital

Note: This episode was taped on Wednesday April 5 2023. You can watch the show, listen to our new podcast, or read our edited transcript.

EDITED TRANSCRIPT

Are we at the start of a second Global Financial Crisis?

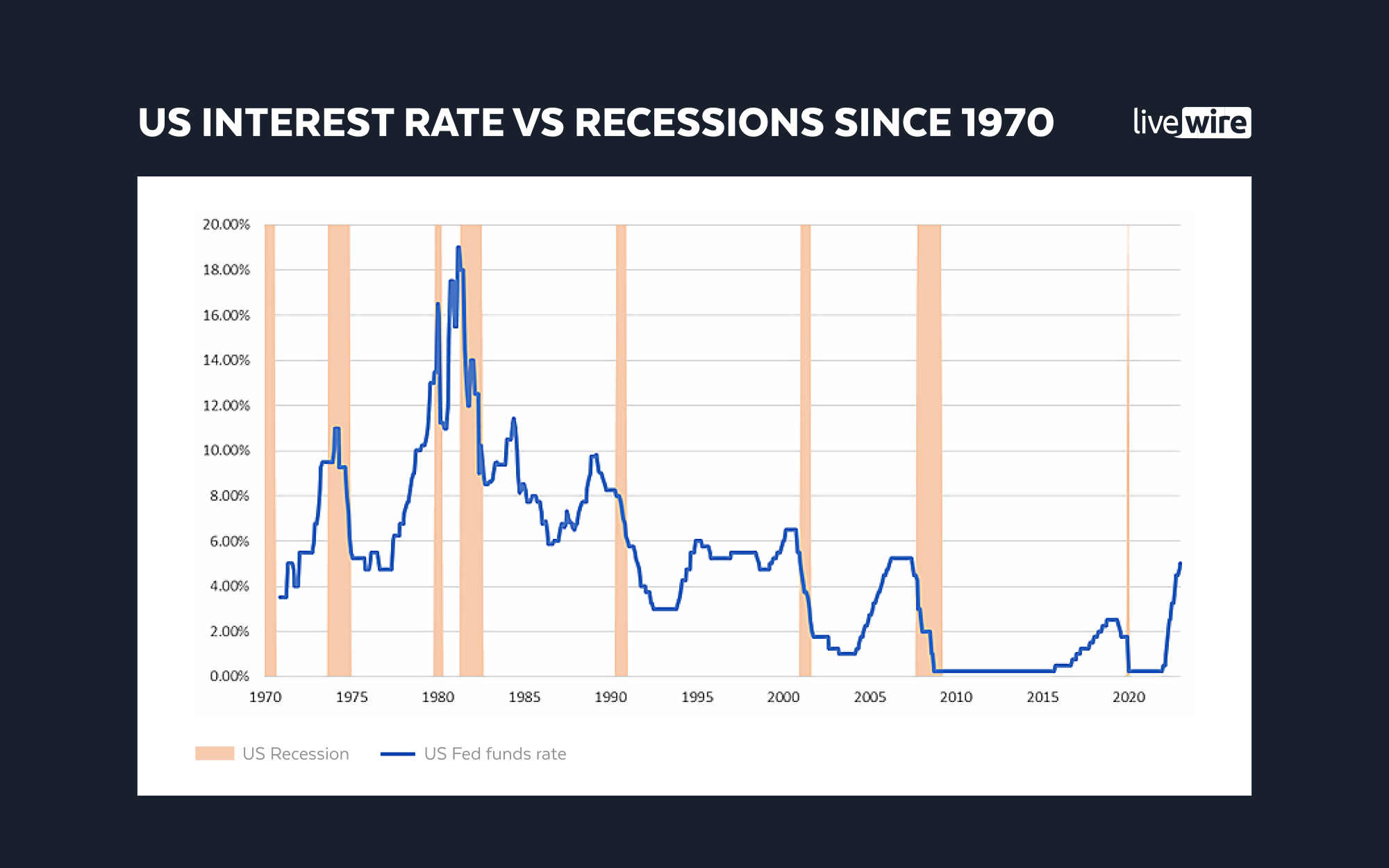

Diana: Something was always going to break because of the massive rate hikes from central banks. We have yet to see the full impact of this crisis play out, and the next shoe to drop might be commercial real estate.

David: It's unlikely at this stage and stress indicators are nowhere near where they were in the 2008 GFC.

Daniel: This isn't the start of a second Global Financial Crisis but several idiosyncratic cracks have appeared.

Topic 1: Is a global credit crunch coming?

Diana: SIGNAL - There is more to come even if regulation is now better than it was in 2008. Further pockets of high stress, especially in the US, cannot be ruled out. The good news is that Australian banks are in a much better shape than stateside. The bad news is that Australian institutions are not immune to confidence crises even if these start overseas.

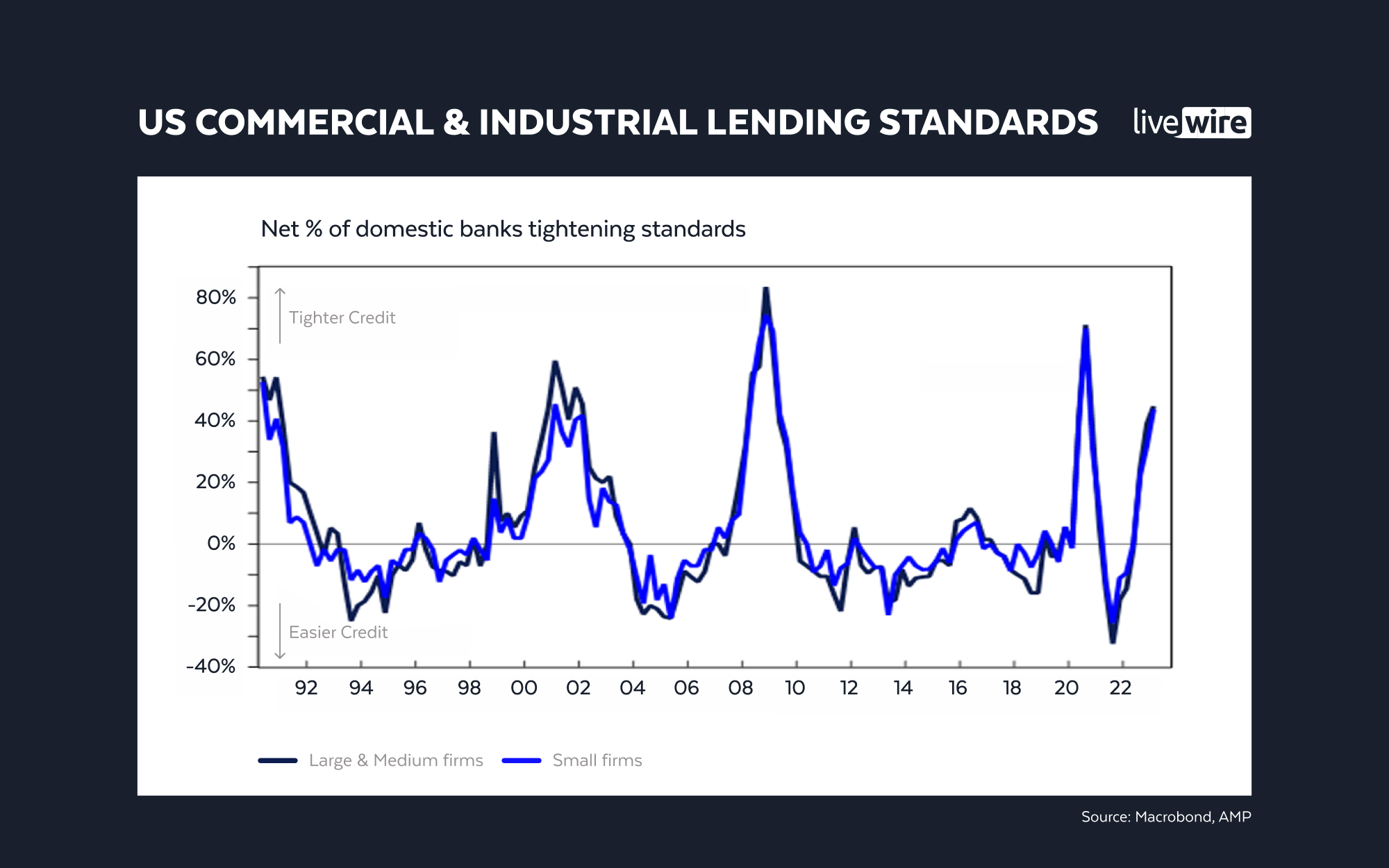

David: NOISE - While tighter lending standards are a definite signal, a credit crunch in and of itself is not likely to happen. Having said this, the bond market is certainly sending warning signals.

Daniel: NOISE - Credit spreads in 2023 are nowhere near 2008 levels (in some cases, 2023's levels are just one-fifth of 2008's levels). Australian banks have even lower beta than US banks, making our institutions even safer from a fundamental perspective.

Topic 2: Is the new NASDAQ bull market sustainable?

David: SIGNAL - The signal only applies to profitable tech companies, where they could even act as defence in an economic slowdown.

Daniel: NOISE - The differentiation will become clear over coming months between good quality growth and unprofitable growth. Daniel also believes the markets could trade sideways in coming months as investors digest what is coming.

Diana: NOISE - If US recession risks re-emerge in 2024, then the tech sector could rally again. But for now, it's been too far too soon.

Topic 3: Historic volatility in the bond market

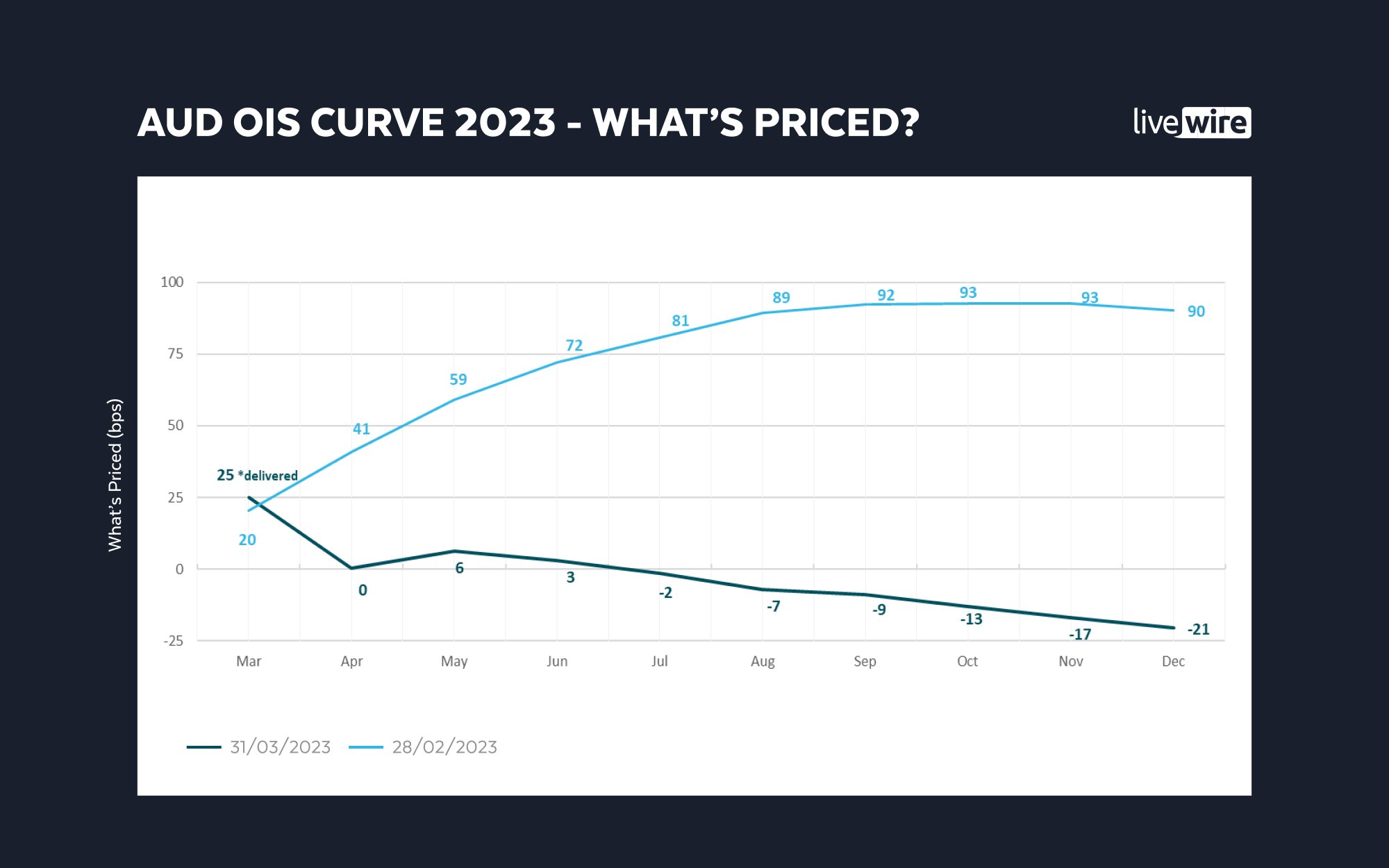

Daniel: SIGNAL - Heightened uncertainty and a delayed reactive function from central banks have made this period different (and more challenging) for investors. Central banks also cannot wave the victory flag on inflation just yet.

Diana: NOISE - All the economic indicators are coming down, growth and inflation are slowing throughout the world. And if central banks are really near or at the end of their hiking cycles, the rates market look accurately priced.

David: NOISE - The bond market is sending warning signals but it's not a reason to become massively bearish.

The Charts to Watch

Diana: US lending standards

David: Is a soft landing coming?

Daniel: Changes in the ASX OIS Curve

Do you think we are at the beginning of another major financial downturn? How are you positioned for the next few months? Let us know in the comments below.

3 topics

3 contributors mentioned