Signal or Noise: Was the RBA's May rate hike the right decision?

Before the COVID-19 pandemic, the Reserve Bank of Australia was considered one of the leading lights in the global central banking circuit. For a large part of the last 30 years, inflation has been within the Bank's 2-3% target and the broader economy has not been in a technical recession once thanks in large part to strong monetary policy settings.

When the pandemic arrived, the cash rate was just 0.75%. It was quickly cut to 0.1% and Governor Philip Lowe strenuously argued that the nominal interest rate would not be taken below zero (unlike in Japan or Europe).

What happened afterwards is undoubtedly a series of mistakes - forward guidance, yield curve control, and a lack of consistent communication chief among them. The combined frustration from investors, economists, and the general public has thrust the RBA's credibility into a spotlight it never wanted to have.

Now, 30 years on since its last major operational review, Australia's central bank will likely have to contend with some humongous changes. And all this before we find out if the Governor gets to keep his job for another three-year term.

To discuss the Reserve Bank Review and what it means for investors, Livewire's Signal or Noise is back with an all-new episode. Joining me and permanent panellist Diana Mousina of AMP are:

- Kerry Craig, global markets strategist at J.P.Morgan Asset Management

- Warren Hogan, chief economics advisor to Judo Bank

Note: This episode was taped on Wednesday 3 May 2023. You can watch the video, read our edited transcript, or listen to the podcast.

EDITED SUMMARY

If you had to give the RBA Review a score out of 5, what would you give it and why?

Diana: 3/5 Diana is more concerned that the Review actually went too far and will dilute the impact that the RBA has in its monetary policy setting.

Kerry: 2/5 Too many things were left out in Kerry's view, including some serious broader topics that needed to be addressed including inflation targeting. But on the plus side, at least they didn't mention house prices.

Warren: 2.5/5 Warren thinks ChatGPT could have written the RBA Review. The central bank was already operating under a best practice model but the Review itself leaves out two very important issues - the Australian Dollar and the lack of involvement with APRA.

Topic 1: Does the RBA Review go far enough?

Diana: NOISE - If the Review is just a copycat of other central banks, is that really a better idea?

Kerry: NOISE - The effort was not groundbreaking enough and it doesn't reveal anything new in the immediate future for investors.

Warren: NOISE - A modernisation of the governance structures is a good signal but in terms of monetary policy, how can you do better than the best which is what already exists?

What are some actionable things investors can do to start preparing for these changes?

Diana noted that the new Board and new appointments don't mean much if we cannot work out who is voting for what particular monetary policy action. Kerry argues the outstanding question is still whether the RBA will be given more tools to make its core jobs easier. The J.P. Morgan house view is that yields and rates will remain higher for longer. Warren thinks Australians need to get ready for higher for longer inflation given the opportunity to crystallise a specific inflation target was not taken up.

Topic 2: Are two boards better than one?

Kerry: NOISE - There may be some positives around the separation of boards but will it mean much to the average investor? Probably not.

Warren: SIGNAL - He believes this is the right way to go, primarily because it serves an important governance function. But it all still comes down to who actually sits on the Board.

Diana: SIGNAL - Ultimately, you will have two different sets of experts who will now focus on one central job and that's a good outcome for investors.

How many mistakes could have been avoided if this Review came earlier?

Warren believes there was only one heinous crime in the last 30 years. The Board's use of forward guidance led everyday people to assume rates would not go up until 2024 without exception. In his view, someone on the Board should have stood up and said something to stop it!

Was this a missed opportunity to add more outside expert opinion?

Yes, in short. More market economists on the Board would have made sense because it increases the RBA's reaction function.

Topic 3: The May RBA rate decision

Warren: SIGNAL - The rate hike was much needed in his view. The bigger question for him is why rates traders had priced such a little chance of a rate hike when the meeting was probably more live than most people expected.

Diana: NOISE - AMP did not expect the RBA's May rate hike and argues this has purely come down to varied communication. In her conversations with money managers, she has found that they can't read the RBA.

Kerry: NOISE - J.P. Morgan also didn't expect the May rate hike (although he did expect one in June). In his view, credibility has now been severely tarnished and the narrow focus on inflation has become too narrow. He is not expecting any more rate hikes here and in most jurisdictions around the world.

Kerry's Market Strategy

The shift in market dynamics over the last 12 months has created an environment for higher for longer rates. Kerry and the team are leaning much more towards fixed income and the returns that can be gleaned in that field.

The Charts to Watch

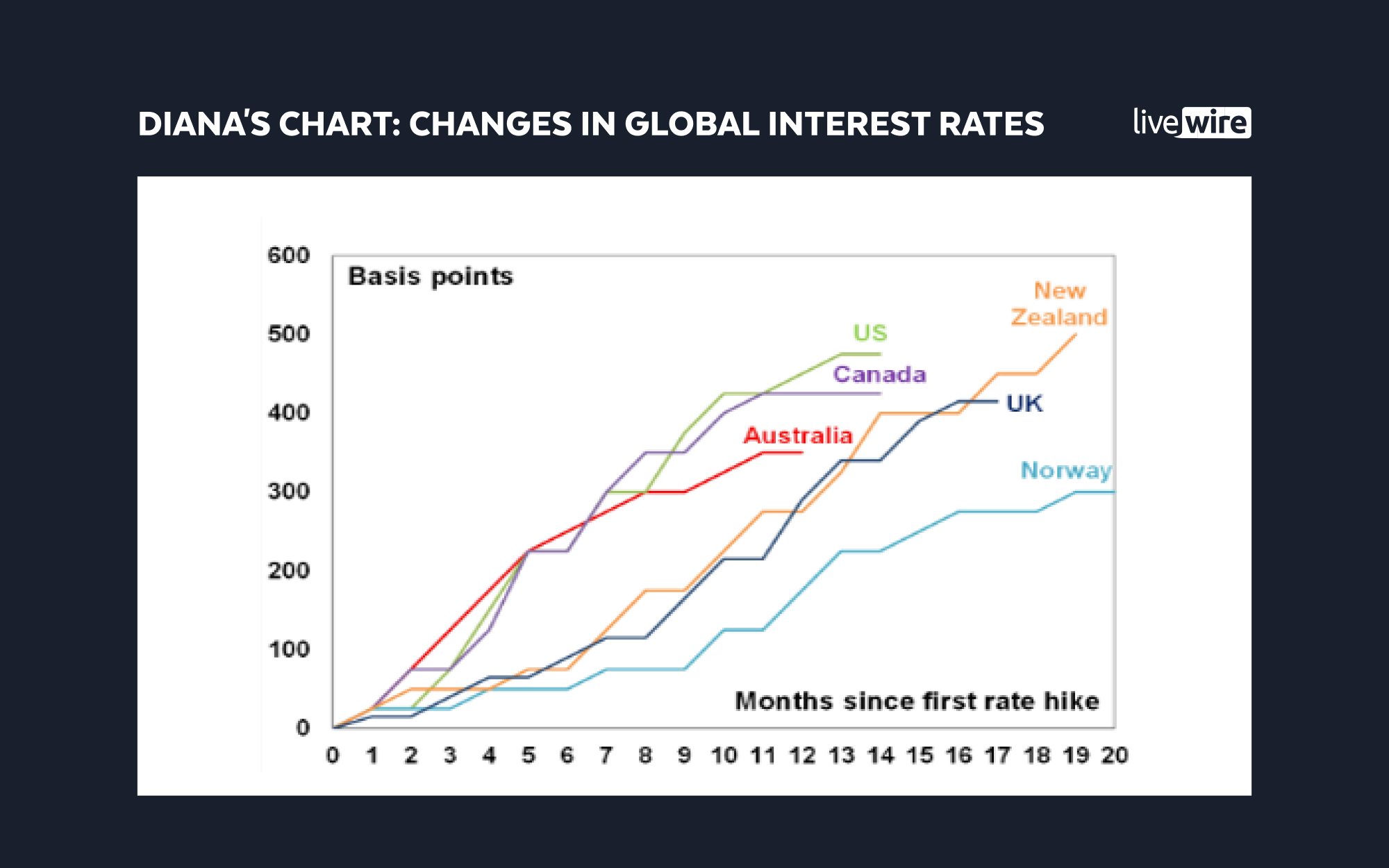

Diana: The massive rise in global interest rates since 2021

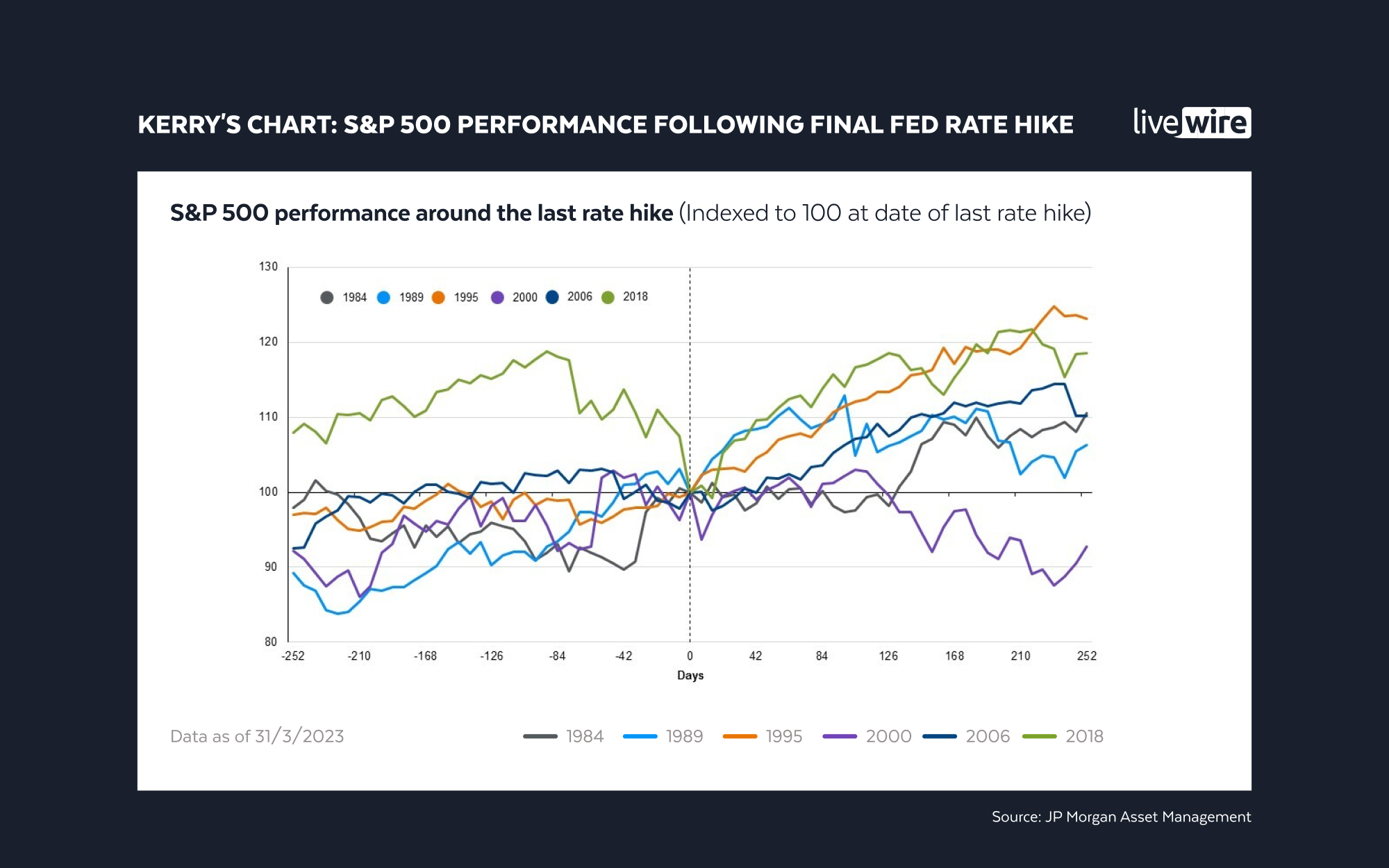

Kerry: S&P 500 performance after the last rate hike

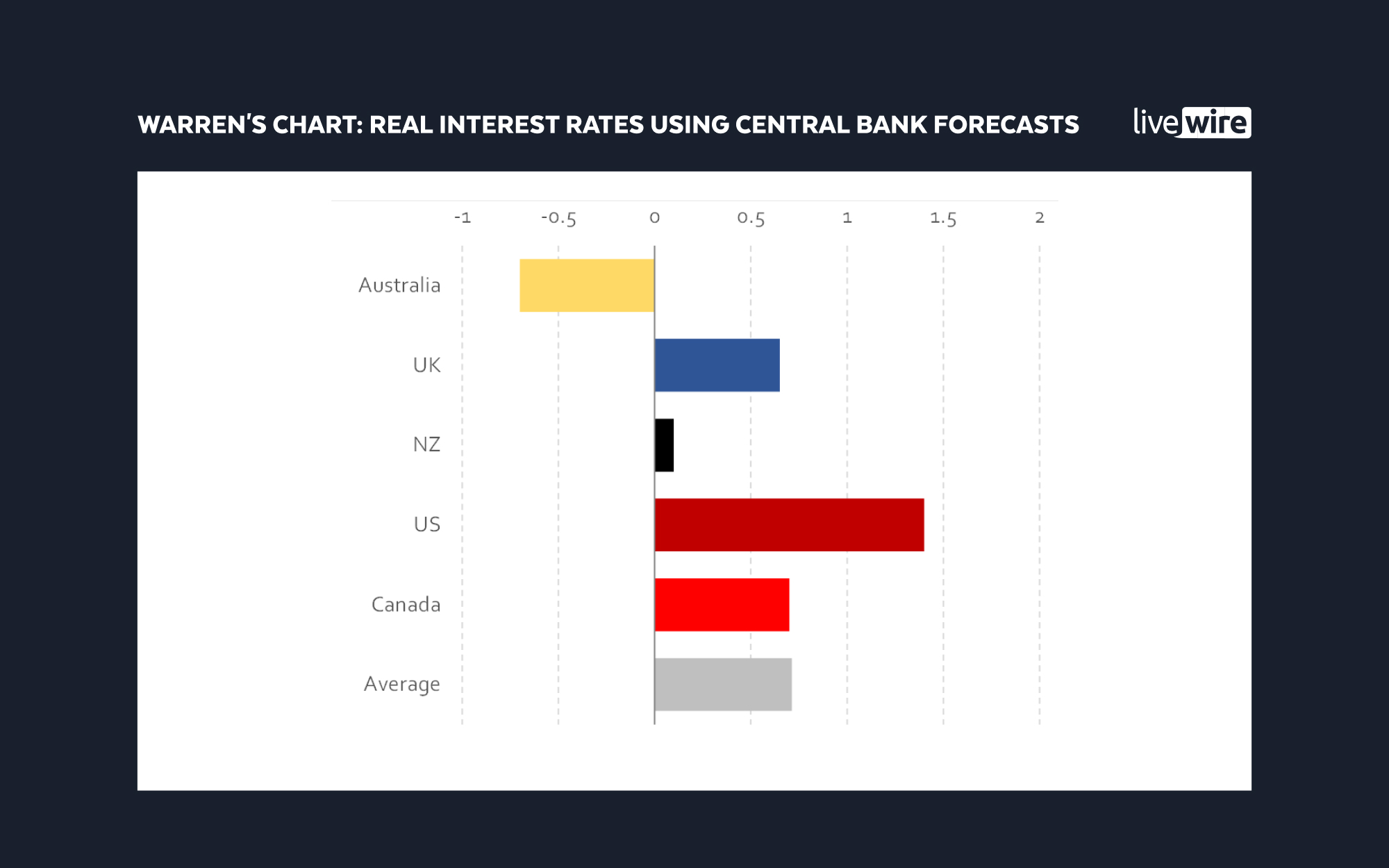

Warren: Real interest rates with the addition of central bank inflation forecasts

Do you think the RBA Review goes far enough? Should Governor Philip Lowe keep his job for another term? Let us know in the comments.

4 topics

2 contributors mentioned