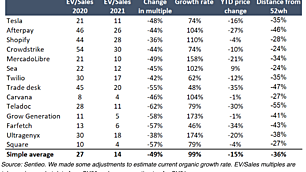

Six companies with explosive growth

My previous article described why, with stocks down, fundamentals up, and mass institutional selling, now was the time to allocate to growth. In this article, I'll provide six examples of companies we like.

MercadoLibre (NASDAQ:MELI)

Mercado Libre is an Argentine company that operates online marketplaces dedicated to e-commerce and online auctions. Despite being down 32% from recent highs, they reported net revenues in the first quarter of 2021 of $1.4b, a year-over-year increase of 158%. They have now experienced three consecutive quarters of sales growth over 140%.

On an EV/Sales basis, this is as cheap as the company has traded in a year.

We added to MercadoLibre over the past week and it is now one of our largest positions at ~6%.

Negative price momentum but positive operational momentum is something of a sweet spot for us.

Roblox (NASDAQ:RBLX)

Roblox is a global video game developer based in the US, and is down 10% from recent highs. It is a recent IPO we invested in, and in a sharp contrast to first-time SPAC reporters, smashed expectations recording $387m in first quarter revenue, an increase of 140% year on year.

Bookings were up 160% and free cash flow was up over 4x year-on-year. These kind of growth rates in a US$40 billion dollar company are precisely where we focus our fund.

Daily active users are growing at 79%, but more impressively, spend per customer grew at 48%, showing the firm is getting better and better at monetising their enormous user base and justifying their serious free cash flow investment in user acquisition.

Square (NYSE:SQ)

Square is one of the largest growing digital payments system companies out of the US, and is down 27% from recent highs. Over reporting season, they reported over 200% growth, but this includes bitcoin, so perhaps a better metric is growth in gross profit, which grew 79% year-on-year.

Our thesis here is that Square is one of only a handful of players that can create a closed payment loop between merchant and customer networks.

Square, of course, started with merchants but has invested heavily in its consumer offering. There are now over 36 million people transacting through Square’s app:

This is precisely the return on investment and profile we look for in portfolio companies:

We are in these companies for the long term.

Moderna (NASDAQ:MRNA)

The pharmaceutical company, down 19% from its recent highs, finally reaped the rare financial rewards of years of hard scientific work and risk, recording quarterly revenue of $1.9 billion and net income of $1.2 billion. 102 million doses were shipped, suggesting an average dose price of around $19. The firm expects to ship 1 billion doses this year, and 2 billion doses next year.

Multiply those numbers by the average selling price and you can see why we think the current $60 billion market cap still represents good value.

The real value, of course, is that $15-$20 can vaccinate against a disease that resulted in trillions of dollars of spending. It was great to see the Australian Government finally spending up and purchasing 20 million doses from Moderna, a trivial amount relative to the fortunes spent on JobKeeper and JobSeeker, and equivalent programs around the world.

The company has signed Advance Purchase Agreements for $19.2 billion over the next 12 months, and has $8.2 billion cash already on its balance sheet. So far the vaccine seems to work against new variants from around the world, and in any case, can easily be amended.

The red dots below mark the changes of different variants in the spike protein (B117 is a UK variant, B1351 is a South African variant, and P1 seems to have come from Brazil - usual caveats apply).

Moderna plans to target mutations in three ways: by developing vaccines for specific variants, by delivering a multivalent vaccine, and by offering third booster shots of their existing vaccine or the second generation equivalent.

As we have discussed at length, Moderna’s approach is likely to be effective for a variety of other viruses from herpes to influenza, and a host of otherwise untreatable rare genetic diseases. Lower respiratory infections still consist of one of the leading causes of death globally, far ahead of most cancers.

Those working at Moderna and firms like it are the true heroes of the modern era, despite being under fairly vicious attack in 2020 from short sellers, and today from politicians and various celebrities.

Carvana (NYSE:CVNA)

We first wrote about Carvana (down 30% from recent highs) in early 2019. The company has advanced over 6x since then.

Carvana is an online dealership where cars can be bought on an app and delivered days later. The firm can handle every part of the process from insurance, to trading in your old vehicle.

In addition to convenience, the customer experience is vastly ahead of that of visiting a dealership. Carvana offers a nationwide inventory rather than the several hundred vehicles that just so happen to be on the lot, and by saving on sales commissions they underprice the market by ~$1,000/car. Customers can return the car after a week for no cost - effectively a 7 day test-drive, and receive a 100 day warranty.

This quarter they recorded $2.2b in revenue, an increase of 104%, with gross profit increasing 145% to $338m year-on-year. Things remain on track, and despite all their progress, the firm has a minuscule market share.

Alnylam (NASDAQ:ALNY)

Alnylam (down 25% from recent highs) has much in common with Moderna. It has proven platform technology, only instead of mRNA they own key technology around RNAi - the i standing for interference. Like Moderna, they’ve generated an extensive pipeline across genetic medicines, cardio-metabolic diseases, infectious diseases, and those of the eye and central nervous system.

And like Moderna, the company has already proved it can execute. Net product revenues for Q1 2021 were $136m, a 89% increase year-on-year. They have forecast 40% revenue growth to 2025, which unlike less scrupulous management forecasts, we think they can easily achieve.

The firm is targeting over 4 Investigational New Drug applications each per year.

Learn more

Stay up to date with all our latest Livewire insights by clicking the follow button below, or visit our website for more information.

Related article:

4 topics