“Sorry mate, we’re full” – Odds of a V-shaped recovery rising

In the past few days, I visited shopping centres in North-West Sydney. Relishing my favourite burrito and treating myself to retail therapy aside, I wanted to gauge whether consumers are truly cowering at home out of caution of contracting coronavirus in public places.

Turns out, these malls and some of their stores are busier than ever. So much so that a few of my favourite food venues didn’t even have space for two even from 1 June, when restaurants and cafes can admit up to 50 patrons in NSW.

I spent hours talking to store managers and making notes about how their business has been performing and whether foot traffic is rebounding. I relay some of my conversations below, overlay some data insights and get an economist's take on what it means for Australia’s prospects. Turns out, the odds a V-shaped recovery are increasing.

The perspective of an Area Manager for Nike stores...

“Since we reopened most of our Sydney stores in late May we’ve had lines outside, not just because of maximum occupancy limits, but because demand has been so high. While online sales have boomed, there are a heap of people eager to come in to try and buy new Nike products as well. Sales are nearly back to pre-COVID levels – our trouble is getting enough fresh stock in. We’ve recalled all our store staff back and are off JobKeeper payments.”

a NIKE STORE IN north-west sydney

The perspective of a Store Manager at Just Jeans (a Premier Investments-owned brand)...

“I've definitely felt foot traffic is going up around here - people are free again. Our sales have hit records on some days after we opened up again, and we haven’t been able to cope with demand. While there is all this talk about online shopping booming, what we’ve found is a lot of people want to come into the store and try out clothes before buying. We’ve had a lot of people who ordered online from us and then come to the store to change sizes or for change of mind returns because it didn’t look or feel as they expected. ”

The perspective of a Store Assistant at Mad Mex...

“Our sales never really took much of a hit as people came in to get takeaway. But now with lockdowns easing I’d say for us and the mall, we’re even busier than before COVID on some days.”

the courtyard of a mall in rouse hill

The perspective of a Cafe Owner at Winston Hills...

“Sorry mate, we’re full. I’d suggest making a booking for later this week. Looks like people are keen to come back and enjoy being in cafes again.”

A CAFE IN WINSTON HILLS (1 June)

3 charts to show Australians are moving about again

Of course, anecdotal evidence from two malls in Sydney does not reflect all of Australia. But given I suffered through traffic jams to get to the mall (and again to find parking), it got me thinking. So I looked at Apple and Google mobility data for various activities; clearly, the trend is up.

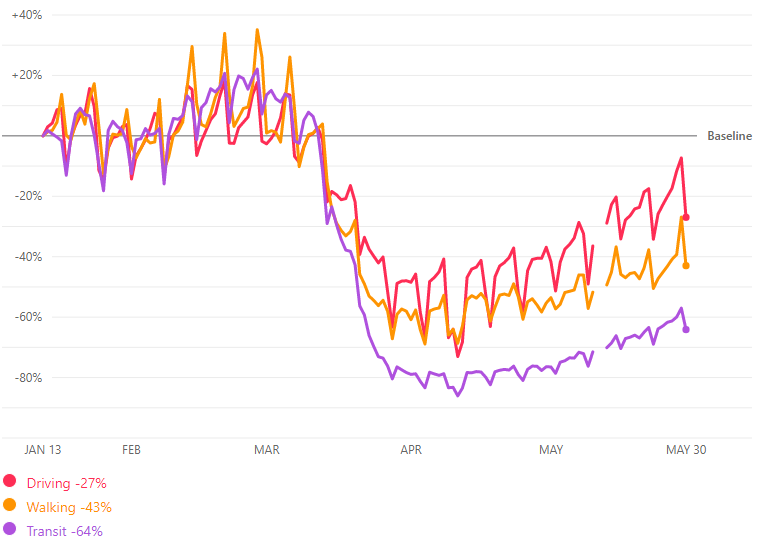

Chart 1: Requests for directions on Apple Maps across Australia (driving, walking and public transport)

source: Apple

Chart 2: Requests for directions on Google Maps to get to restaurants, malls, parks, museums and libraries across Australia

source: google

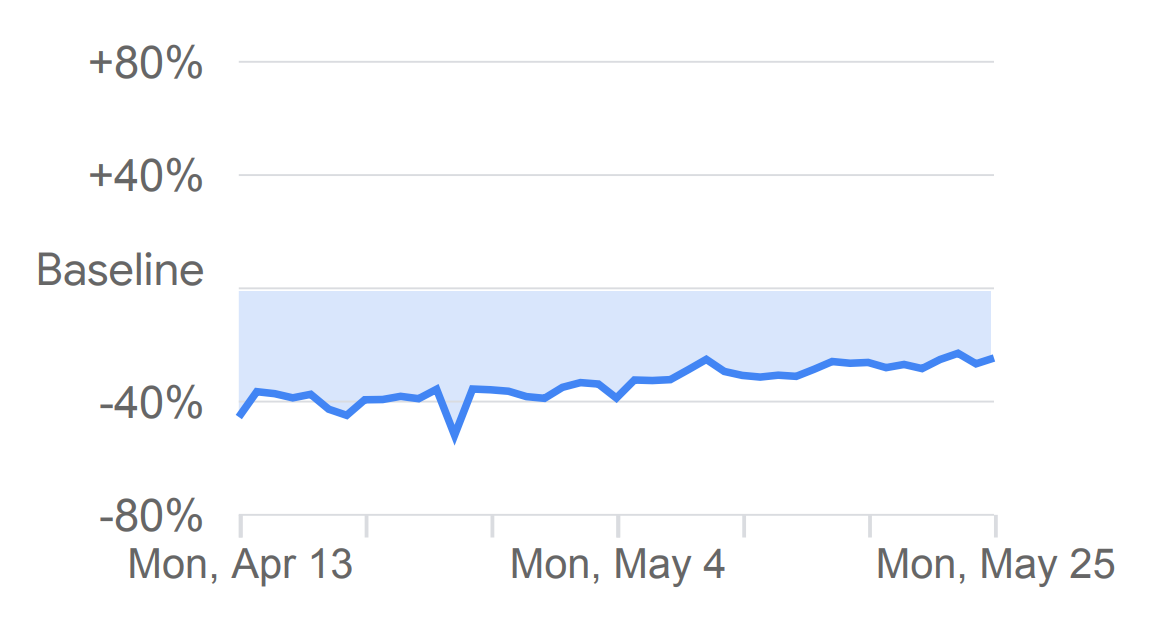

Chart 3: Requests for directions on Google Maps to get to offices across Australia

source: google

Domestic travel looks promising

Additionally, according to data from popular accommodation source Airbnb, Australians are driving a resurgence in domestic tourism with new data showing a surge in bookings, particularly in regional areas.

Following the easing of travel restrictions in New South Wales, intrastate bookings jumped, up 488% month-on-month and 15% compared with the same in 2019. Australia-wide bookings in New South Wales are reaching pre-COVID-19 levels, with Airbnb seeing almost 90% of bookings in the same week last year.

Airbnb's country manager for Australia, Susan Wheeldon said

“Just as it has driven economic growth in the past, domestic tourism will play an enormous role in driving economic recovery, especially in the regions.”

Early signs of economic momentum

While people are on the move again, are they spending? Are businesses bringing staff back? The following proprietary Australia Economic Activity Tracker from AMP Capital blends data points including credit card transactions, energy usage, job ads and restaurant performance. It suggests the recovery has been gaining traction for six consecutive weeks.

AMP Capital's Shane Oliver, who previously provided his optimistic outlook says the data suggests Australia is capitalising on its “Lucky Country” moment as lockdowns ease. He's found the same challenges in his daily/weekly routines: battling traffic jams, difficulty in finding car parking at his local shopping centre and being turned away from restaurants.

“If you look at the anecdotal evidence along with the data, it certainly suggests that the odds of a V-shaped recovery are increasing. The downside risks are diminishing at an even surprisingly faster rate than we were expecting.”

While AMP's base case is for a small fall in March quarter GDP, the AMP team thinks there is a slight chance that we could eke out an increase and thereby avoid a technical recession. He adds while there’s no doubt some businesses and sectors like travel will suffer as they pull all stops to get to the other side, the current consumption data along with factors such as iron ore prices powering through US$100 per tonne suggest that – in totality – things are looking up for the economy. That means domestic asset prices including the Australian Dollar and shares are looking good on a 12 month-basis, according to Oliver.

"It’s a close call and we may just sneak into positive territory which would pave the way for Australia to retain its record run without a technical recession. The Lucky Country might ride again!"

- With assistance from Bella Kidman

2 topics

1 contributor mentioned