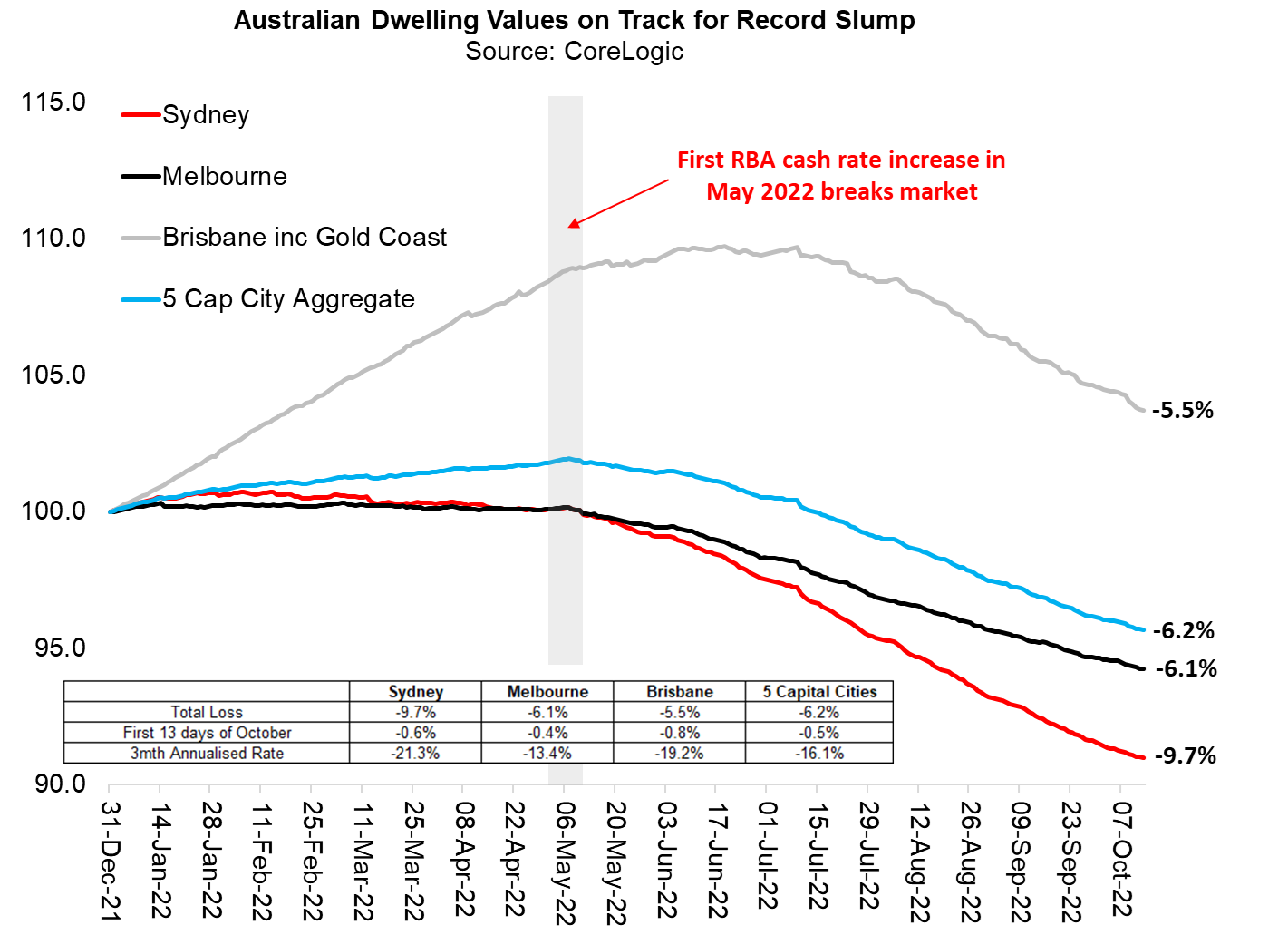

Sydney house prices have now fallen 10%, national prices on track for >15% loss

The great Aussie housing crash continues to unfold as the charts below highlight, which are updated to 13 October 2021. In Sydney, home values have now lost more than 9.7 per cent and are depreciating at more than a 21 per cent annual rate based on the last three months of data from CoreLogic.

Brisbane is not far behind with a similarly savage three-month annualised loss north of 19 per cent. In the first 13 days of October, Brisbane has actually overtaken Sydney as Australia’s worst performing capital city, retrenching 0.82% compared to Sydney's 0.60% loss. The 5 capital city index has shrunk 0.49% over the first 13 days of the month, and is down 6.2% since its recent May peak.

The losses in Melbourne are more modest, melting at a lower, 13 per cent annual rate (and by 0.44% in October so far). There is certainly zero evidence that the bottom is in sight for what will be the Aussie housing market’s biggest-ever decline.

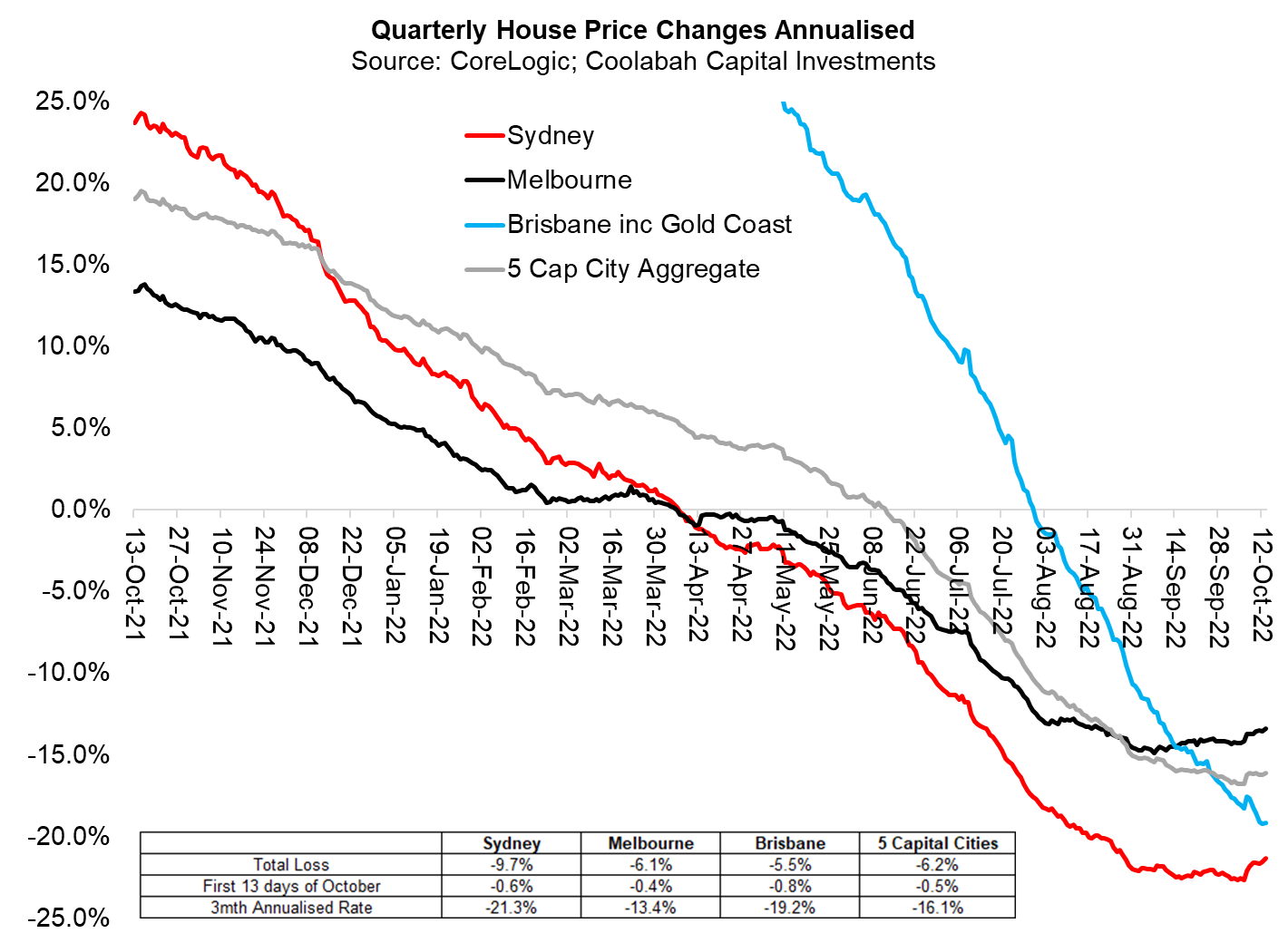

The most positive thing one can say currently is that the rate at which house prices are falling nationally seems to have stabilised at a circa 16 per cent annual loss. Observe how the red line (Sydney), grey line (5 capital city index) and black line (Melbourne) in the chart immediately above have started drifting sideways. It is possible that this implies the worst monthly losses are behind us. Alternatively, it may just reflect some seasonal strength over the Spring buying/selling season. We may face more difficult months ahead as borrowers eat north of 300 basis points worth of RBA rate hikes, and mortgage defaults inevitably climb.

It's worth remembering that borrowers have yet to be hit with all the RBA’s interest rate increases, which are being only gradually passed on by banks. And Martin Place is signaling that there are more hikes to come, which will only exacerbate the damage.

Given benign wage growth combined with our analysis showing a record immigration boom at the same time as the housing market experiences its biggest-ever losses, the RBA might be minded to pause its hikes later this year or early next year. That would be certainly welcome news for borrowers...

Access Coolabah's intellectual edge

With the biggest team in investment-grade Australian fixed-income and over $7 billion in FUM, Coolabah Capital Investments publishes unique insights and research on markets and macroeconomics from around the world overlaid leveraging its 14 analysts and 5 portfolio managers.

3 topics