Tapping into the rich vein of growth opportunities outside the top 20

Note: This interview was recorded on 20 May 2025.

While Australia’s top 20 companies dominate headlines and market cap, they’re not always where the best long-term growth opportunities lie. That’s the view of Dushko Bajic, Head of Australian Equities Growth at First Sentier Investors.

In this edition of Fund in Focus, Bajic explains how the First Sentier ex-20 Australian Share Fund is built to capture quiet compounders - businesses with strong fundamentals, long runways, and the ability to scale over time without being tethered to index weightings.

“There’s an inefficiency in the market where there’s a handover from small cap portfolios into large cap portfolios," he says.

"Whereas if you’ve got an ex-20 mandate, you can potentially own the stock from its small cap life all the way until it’s knocking on the door of the top 20.”

Bajic also shares why enterprise software is one of Australia’s most globally competitive sectors, how his team filters a universe of over 500 stocks, and why doing the hard work during a panic led to a high-conviction bet on ResMed that’s already paid off.

.jpg)

Why the ex-20?

An astonishing 57% of the market cap of the ASX 300 is comprised of the top 20 companies, making it a heavily top-weighted index.

An ex-20 mandate allows managers to look beyond these giants; avoiding both the concentration risk and mature earnings profile that often comes with large caps.

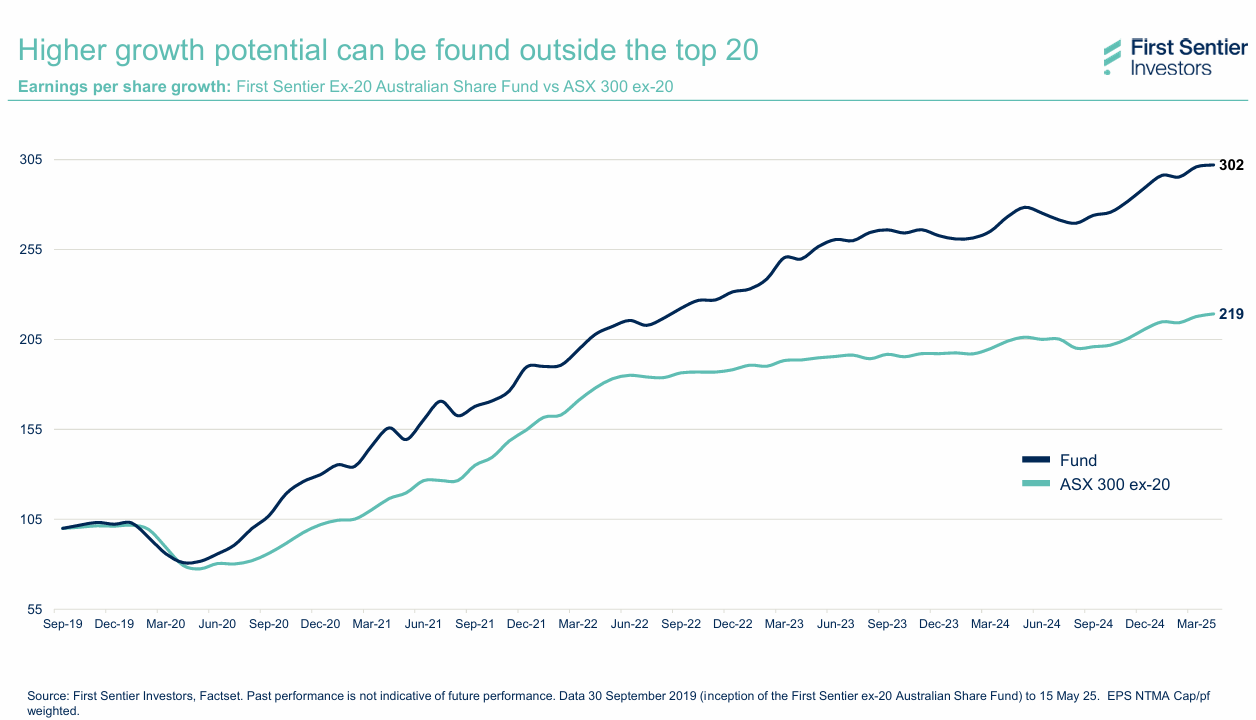

Instead, it opens the door to companies with greater potential to scale, reinvest, and accelerate earnings over time, as shown below.

“For an active fund manager, it enables you to put more of your best ideas in there without having to think about your index weightings and your relative index positions on the big stocks. It's a passion project of mine,” Bajic says.

He adds that an ex-20 mandate also removes the structural constraints that can force managers to exit a great business just because it grows too large for a small-cap portfolio.

The hidden research gap

One of the unique advantages of an ex-20 strategy is its ability to exploit moments of institutional neglect.

When a stock graduates from the small-cap index into the mid or large-cap space, it can find itself in no-man’s land; no longer covered in depth by small-cap analysts, and not yet picked up by large-cap teams.

Because investment firms often have siloed research teams for different market segments, the handover isn’t always seamless. That gap in research coverage creates pricing inefficiencies, particularly for companies with strong fundamentals that temporarily slip under the radar.

“There’s this spot of missed research and an opportunity for companies that get mispriced in that time period," he says.

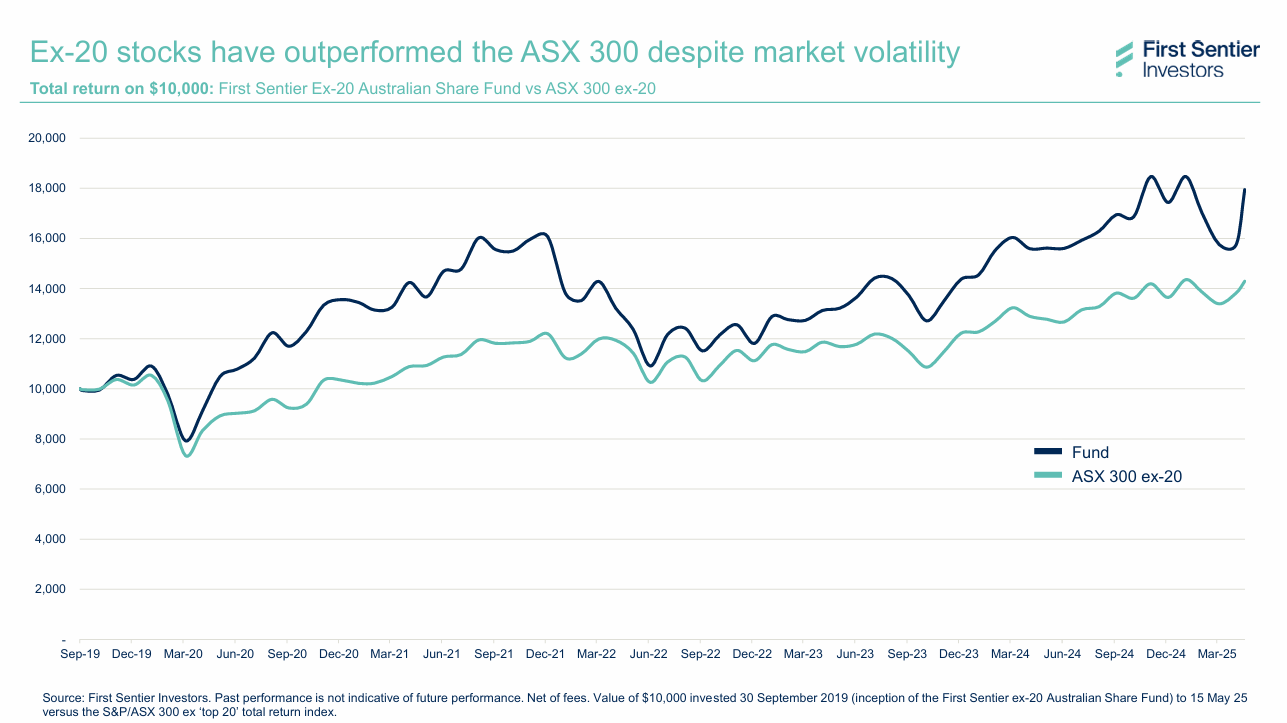

And exploiting that mispricing is a big reason the First Sentier Ex-20 Australian Share Fund has beaten the broader market.

Where Australia leads in growth

Although many investors turn to the U.S. for innovation, Bajic believes Australia holds its own in enterprise software.

"Australia does have a pretty compelling competitive advantage in the enterprise software part of the market where we really do have some global leaders," he says.

"Whether it's Pro Medicus in terms of radiology image viewing, Wisetech for freight forwarding and logistics supplies where it's a global leading product, or Xero the great accounting software, great payroll and payments functionality."

Bajic says the key to finding great companies like these early boils down to a robust process.

The investment process

First Sentier Investors team begins by screening over 500 Australian stocks, narrowing the focus to around 200 that are modelled in detail. These models incorporate profit and loss analysis, balance sheet strength, future cash flow forecasts, and valuation using a consistent discounted cash flow (DCF) framework.

Each analyst is required to stack-rank their coverage, assigning ratings from strong buy to strong sell, which enforces discipline and clarity across the team’s research.

“Automatically we’ve narrowed the universe down to 40% of stocks that we can invest in,” Bajic says.

From there, portfolio managers construct concentrated portfolios using only the stocks rated as strong buys or buys, ensuring every position reflects the team’s highest conviction.

But investing isn’t just about finding great companies and leaving them be. It’s also about regularly checking in to make sure the thesis still holds up. That’s where tools like AlphaSense come in.

Take Xero, for example. Analyst call transcripts show it’s gaining ground in the U.S. small business market through acquisitions and partnerships, targeting key needs like payroll and inventory tracking, a sign it’s expanding its total addressable market.

When markets panic, do the work

In 2023, ResMed’s share price plunged by 35% in just six weeks as investors worried that GLP-1 weight-loss drugs like Ozempic could shrink its addressable market.

Instead of reacting emotionally, Bajic’s team went deep on the numbers and determined the likely long-term earnings impact was only around 6%.

“We went away and did the work… yet we had a 35% fall in share price," he says.

Their research-driven conviction paid off, with the stock rebounding strongly.

Timecodes

0:00 – Intro

0:23 – About First Sentier Investors and its investment philosophy

1:23 – Why the ex-20?

3:15 – Where Australia leads in growth (Mentions: Pro Medicus, WiseTech, Xero)

5:11 – Filtering 500 stocks down to investable ideas

6:49 – Case study: ResMed

8:36 – Managing risks in the portfolio

Uncovering world-class companies across the ASX

Dushko and his team actively target Australia’s growth engine – high-quality, growing companies listed on the ASX – to create portfolios with potential to outperform the market. Find out more via the fund profile below or visit the First Sentier Investors website.

4 topics

3 stocks mentioned

1 fund mentioned

1 contributor mentioned